XRP Ledger whale exercise spiked sharply at first of the week, with on-chain knowledge supplier Santiment flagging a surge in large-value transfers that pushed the community to its highest $100,000+ transaction rely in roughly three months, a setup the agency says sometimes coincides with elevated volatility.

XRP Whales Are Waking Up Once more

“XRP Ledger has seen a serious enhance in whale transactions (moved valued at $100K or extra on the community),” Santiment wrote in a submit on Wednesday through X alongside a Sanbase chart. “Monday noticed 2,170 of them, and yesterday shot all the way in which as much as 2,802 (a 3-month excessive). Volatility needs to be greater than normal.”

The chart, labeled “XRP $1M+ & $100K+ Whale Transactions Per Day,” highlights two particular knowledge factors for the $100K+ threshold: 2,170 transactions on Jan. 5, 2026 and a couple of,802 transactions on Jan. 6, 2026. The Jan. 6 print is marked because the native peak and, per Santiment’s commentary, the strongest studying in roughly three months, the best proven for the reason that notorious October 10 liquidation event.

Associated Studying

Whereas Santiment’s submit spotlights $100K+ transfers, the chart additionally tracks $1 million-plus whale transactions. That sequence suggests large-holder exercise picked up throughout a number of dimension bands into the early-January transfer, with $1 million transactions pushing to a one-month excessive, the strongest studying since early December.

The bounce stands out as a result of $1 million-plus exercise seems to have been comparatively muted via most of December, particularly when set towards the mid-October to November stretch, when the chart exhibits more frequent days with greater counts.

Associated Studying

In sensible market phrases, merchants have a tendency to look at bursts in massive on-chain transfers for what they may symbolize moderately than treating the uncooked counts as a directional sign. Spikes can mirror accumulation or distribution, inner treasury actions by massive entities, exchange-related transfers, or positioning round liquidity occasions. What they typically share is mechanical affect: when massive holders transfer dimension, the likelihood of sharper intraday swings tends to extend, notably if that exercise persists over a number of classes.

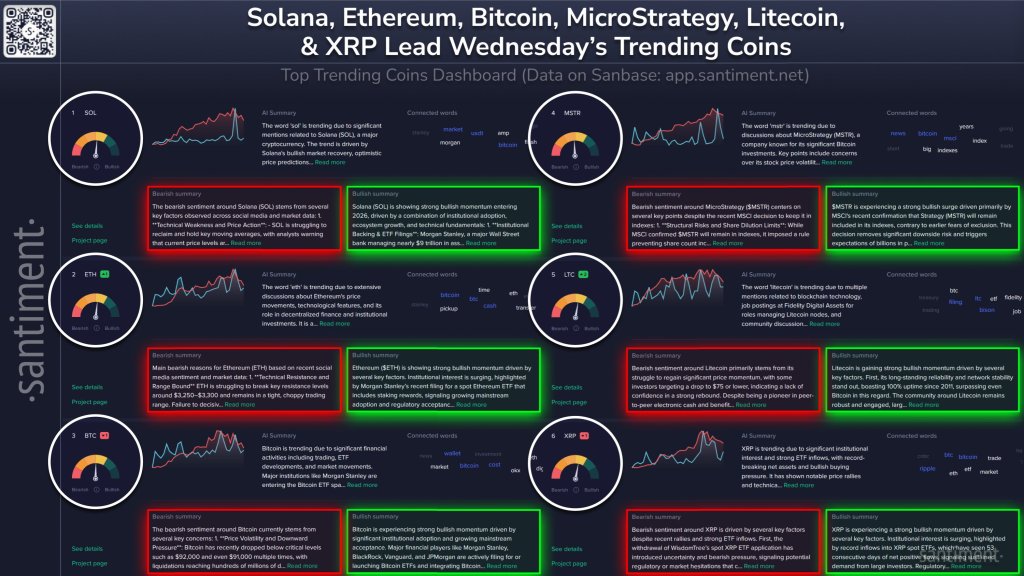

XRP Additionally Re-Enters The Social ‘Trending’ Set

The whale-transaction alert landed alongside a separate Santiment replace that positioned XRP among the many property seeing the largest jumps in discussion across social channels. In that submit, Santiment grouped XRP with Solana, Ethereum, Bitcoin, MicroStrategy, and Litecoin because the day’s high “trending” tickers by adjustments in dialog quantity for Wednesday.

For XRP particularly, Santiment mentioned the dialogue combine leaned closely institutional in tone: ETF flows, “record-breaking internet property,” and the concept of XRP as a high-beta commerce into 2025–2026 narratives whereas additionally referencing perceived regulatory readability after the SEC case decision and use instances akin to bridge exercise for stablecoins and tokenized real-world property. These claims had been offered as themes circulating in social chatter moderately than as independently verified developments within the submit itself.

At press time, XRP traded at $2.127.

Featured picture created with DALL.E, chart from TradingView.com