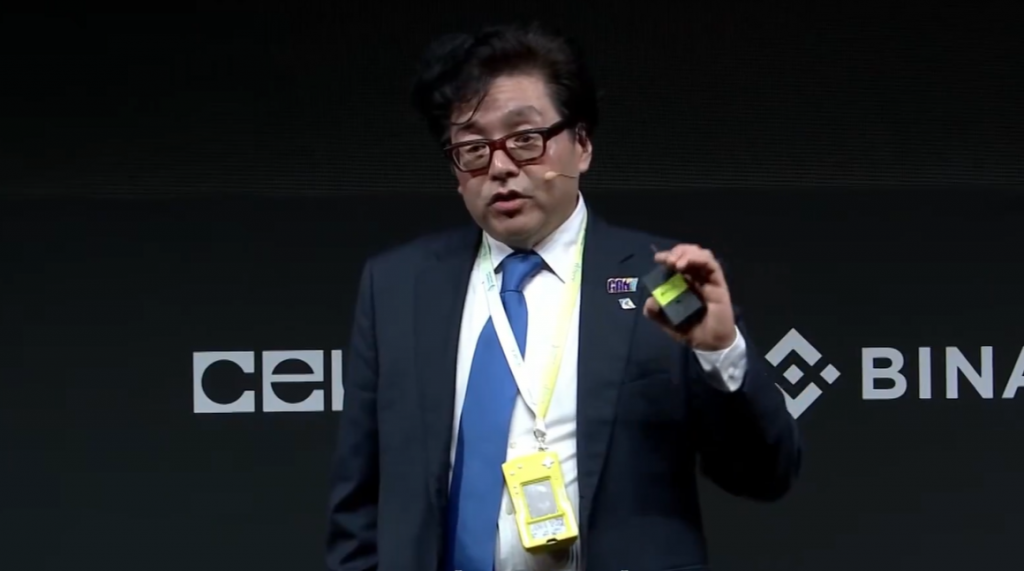

Tom Lee has reiterated one of the vital aggressive Ethereum targets out there, telling attendees at Binance Blockchain Week on 4 December that ETH might ultimately commerce at $62,000 because it turns into the core infrastructure for tokenized finance.

“Okay, so let me clarify to you why Ethereum, now that we’ve talked about crypto, […] is the way forward for finance,” Lee mentioned on stage. He framed 2025 as Ethereum’s “1971 moment,” drawing a direct analogy to when the US greenback left the gold normal and triggered a wave of monetary innovation.

Lee’s Thesis For Ethereum

“In 1971, the greenback went off the gold normal. And in 1971, it galvanized Wall Avenue to create monetary merchandise to ensure the greenback could be the reserve forex,” Lee argued. “Effectively, in 2025, we’re tokenizing everything. So it’s not simply the greenback that’s getting tokenized, however it’s shares, bonds, actual property.”

In his view, this shift positions ETH as the first settlement and execution layer for tokenized belongings. “Wall Avenue is, once more, going to make the most of that and create merchandise onto a wise contract platform. And the place they’re constructing that is on Ethereum,” he mentioned. Lee pointed to present real-world asset experiments as early proof, noting that “nearly all of this, the overwhelming majority, is being constructed on Ethereum,” and including that “Ethereum has received the sensible contract struggle.”

Lee additionally careworn that ETH’s market conduct has not but mirrored that structural function. “As you understand, ETH has been vary sure for 5 years, as I’ve shaded right here. However it’s begun to interrupt out,” he advised the viewers, explaining why he “obtained very concerned with Ethereum by turning Bitmine into an ETH treasury company, as a result of we noticed this breakout coming.”

The core of his valuation case is expressed by means of the ETH/BTC ratio. Lee expects Bitcoin to maneuver sharply increased within the close to time period: “I believe Bitcoin goes to get to $250,000 inside a couple of months.” From there, he derives two key ETH eventualities.

First, if the ETH/BTC worth relationship merely reverts to its historic imply, he sees substantial upside. “If ETH worth ratio to Bitcoin will get again to its eight 12 months common, that’s $12,000 for Ethereum,” he mentioned. Second, in a extra aggressive case the place ETH appreciates to 1 / 4 of Bitcoin’s worth, his long-standing $62,000 goal emerges: “If it will get to 0.25 relative to Bitcoin, that’s $62,000.”

🔥 TOM LEE CALLS FOR $62,000 $ETH

“I believe Ethereum’s going to turn out to be the way forward for finance, the cost rails of the long run and if it will get to .25 relative to Bitcoin that’s $62,000. Ethereum at $3,000 is grossly undervalued.” pic.twitter.com/VydvLou9IE

— CryptosRus (@CryptosR_Us) December 4, 2025

Lee hyperlinks these ratios on to the tokenization narrative. “If 2026 is about tokenization, which means Ether’s utility worth ought to be rising. Subsequently, you need to watch this ratio,” he advised the gang, arguing that valuation ought to observe rising demand for ETH blockspace and its function as “the cost rails of the long run.”

He concluded with a pointed evaluation of present ranges: “I believe Ethereum at $3,000, after all, is grossly undervalued.”

At press time, ETH traded at $3,128.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.