Bitcoin had a child! Ethereum was born! And the Ethereum value is lastly rebounding, up 3.9% during the last week.

Furthermore,

.cwp-coin-chart svg path {

stroke-width: 0.65 !necessary;

}

.cwp-coin-widget-container .cwp-graph-container.optimistic svg path:nth-of-type(2) {

stroke: #008868 !necessary;

}

.cwp-coin-widget-container .cwp-coin-trend.optimistic {

shade: #008868 !necessary;

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.optimistic {

border: 1px stable #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.optimistic::earlier than {

border-bottom: 4px stable #008868 !necessary;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-graph-container.unfavorable svg path:nth-of-type(2) {

stroke: #A90C0C !necessary;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.unfavorable {

border: 1px stable #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.unfavorable {

shade: #A90C0C !necessary;

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-coin-trend.unfavorable::earlier than {

border-top: 4px stable #A90C0C !necessary;

}

Ethereum

0.22%

Ethereum

ETH

Worth

$2,929.19

0.22% /24h

Quantity in 24h

$10.69B

<!–

?

–>

Worth 7d

// Make SVG responsive

jQuery(doc).prepared(perform($) {

var svg = $(‘.cwp-graph-container svg’).final();

if (svg.size) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘top’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘top’);

svg.css({‘width’: ‘100%’, ‘top’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

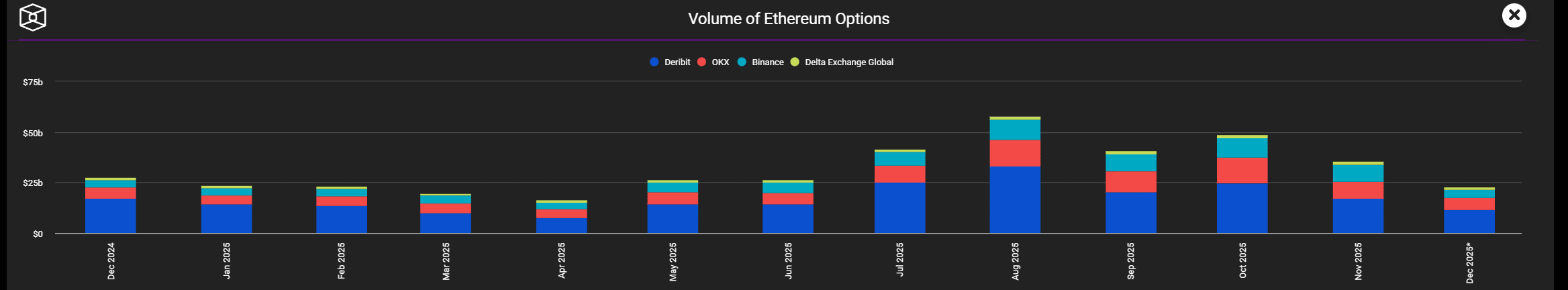

year-end destiny is about to be determined by derivatives, not headlines. Roughly $6 Bn in ETH choices expire Friday, and regardless of name choices outnumbering places by greater than 2.2 instances, the construction nonetheless favors bears until value can reclaim key ranges quick. Right here’s what to know:

Ether’s $6B Choices Expiry Places Bulls on a Brief Leash

ETH has failed to carry above $3,400 for greater than 40 days, a stretch that has steadily drained bullish conviction. Most calls have been positioned between $3,500 and $5,000, reflecting expectations that Ether would close 2025 near $4,000 earlier than the 28% November drawdown shattered that thesis.

Because of this, greater than $4.1 Bn in name choices at the moment are susceptible to expiring nugatory.

DISCOVER: Top 20 Crypto to Buy in 2025

Historical past doesn't repeat, however it typically rhymes. $Ethereum is printing an an identical fractal

we’re at present within the 'Ultimate Loading Zone' earlier than the $5K+ enlargement. pic.twitter.com/Mw8yn75cGJ

— 𝐊𝐚𝐦𝐫𝐚𝐧 𝐀𝐬𝐠𝐡𝐚𝐫 (@Karman_1s) December 24, 2025

Put positioning is extra grounded. Bears clustered safety between $2,200 and $2,900 ranges. If ETH settles between $2,700 and $2,900, places win by roughly $580 Mn.

Even a $2,901 to $3,000 shut nonetheless favors bears by $440 Mn. Bulls solely attain parity above $3,100, with a modest $150 Mn benefit rising above $3,200.

Derivatives flows clarify the chop for the Ethereum value. ETH has hovered round $3,000 whereas sellers hedge publicity, holding spot pinned inside a slim band. If value holds above $2,950, greater than 60% of $1.9 Bn in places expire nugatory, easing draw back strain however not flipping the pattern outright.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Why the Market Is Bracing for Later, Not Now

Crypto Concern and Greed Chart

1y

1m

1w

24h

Ethereum choices exercise exhibits merchants rolling publicity into late-2025 and 2026 expiries moderately than loading up on shorts for this week. Related positioning appeared in mid-2023 and early 2024 earlier than delayed breakouts materialized.

Macro stress is including warning. Moreover, weak spot in US semiconductor manufacturing and softer AI-linked optimism have pushed merchants towards hedges like bear put spreads and bear name spreads after repeated failures at $3,400.

The upshot is that this: you’re the Christmas miracle, Anon. You’re a gorgeous and caring individual and you’ve got individuals who love you. Oh, and this week can be massive for the ETH value; count on volatility.

EXPLORE: Singapore Denies Do Kwon’s $14M Refund Demand For ‘Stolen’ Penthouse

Key Takeaways

- ETH has failed to carry above $3,400 for greater than 40 days, a stretch that has steadily drained bullish conviction.

- If value holds above $2,950, greater than 60% of $1.9 billion in places expire nugatory.

The publish $6B Options Expiry Weighs on Ethereum Price appeared first on 99Bitcoins.