Bitcoin Value Weekly Outlook

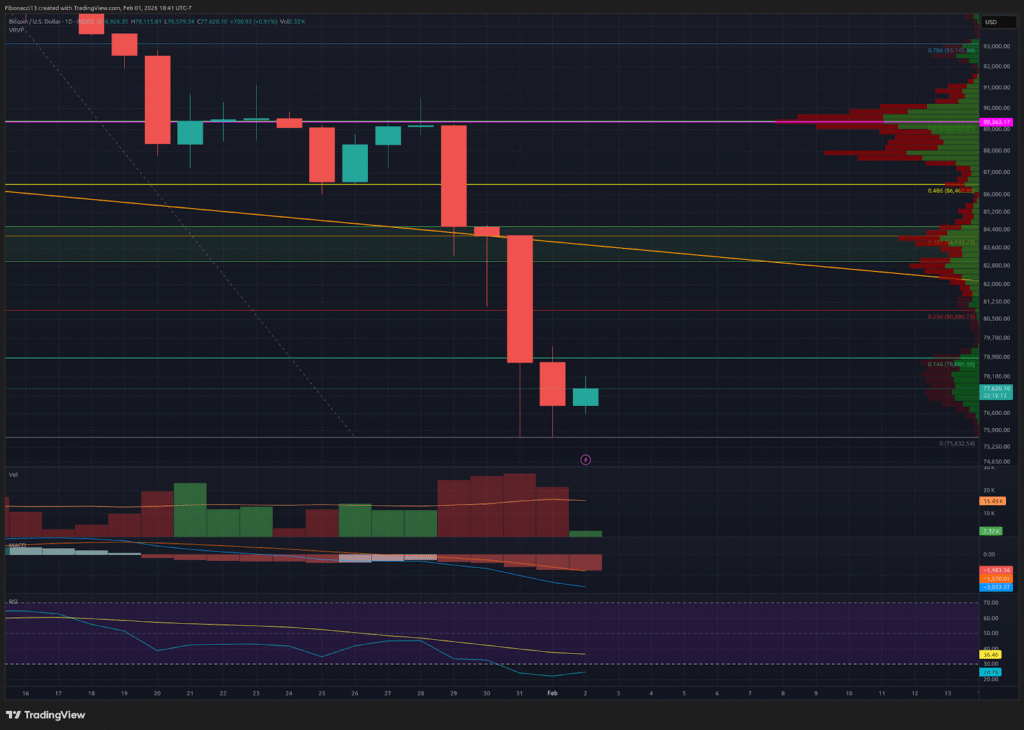

Final week, we have been anticipating the crucial $84,000 assist stage to interrupt, and to the bulls’ dismay, it did. Bitcoin had a small bounce after the prior week’s shut, then proceeded to dump down by the $84,000 assist stage all the best way right down to $75,600 on Saturday, earlier than shifting up somewhat to shut the week out at $76,919. Bitcoin dropped 13% final week, so we might even see a bounce early this week again to $80,000 or so, however continuation downwards needs to be anticipated earlier than too lengthy.

Key Assist and Resistance Ranges Now

The bulls are reeling this week after shedding that key $84,000 assist stage. We’re seeing somewhat little bit of a bounce early on right here, however the bulls can be hard-pressed to regain a lot floor. $79,000 ought to function resistance early on right here, with $81,000 sitting as the following resistance above. Now that $84,000 has damaged as assist, it needs to be sturdy resistance on the best way again up. $87,600 on the POC on the quantity profile needs to be a brick wall of resistance if the bitcoin value can handle to wick above $84,000.

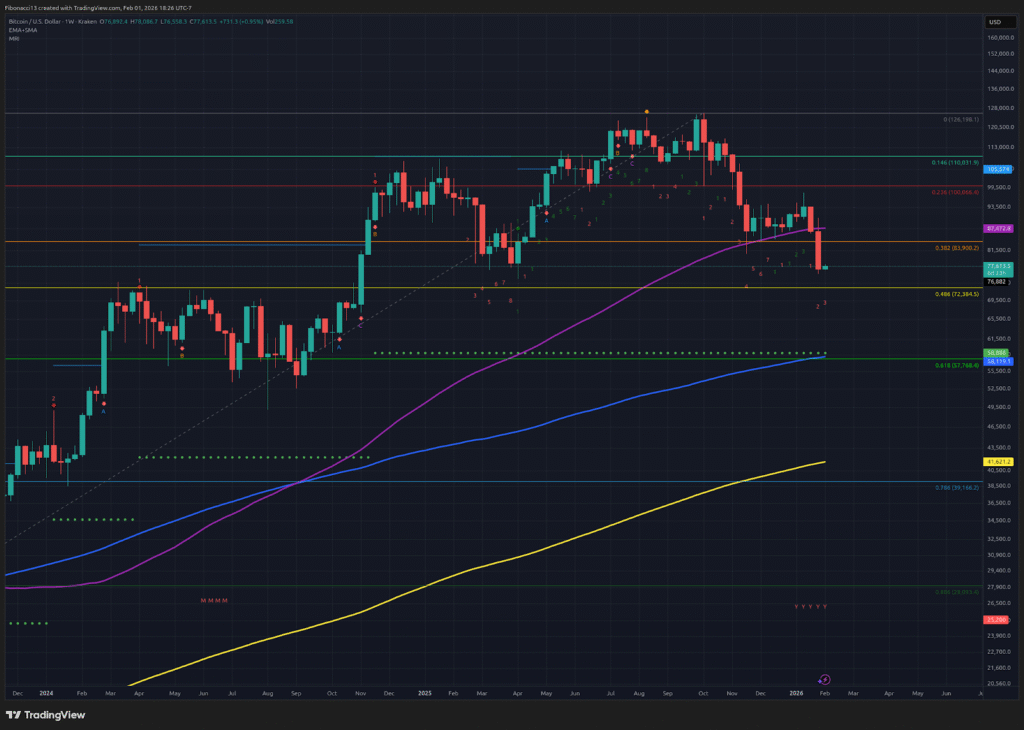

The bears at the moment are sitting comfortably in management. The value bounced from $75,600, so we’ll look to this stage initially as assist, however don’t anticipate it to carry up if below strain. Beneath $75,000, we’ll have a look at $72,000 all the best way right down to $68,000 as a assist zone. A stable bounce from this stage is warranted with all the quantity that constructed up there within the 2024 consolidation interval. Shedding $67,000 beneath this assist opens up the door to $58,000 on the 0.618 Fibonacci retracement. $42,000 sits as assist beneath right here, however don’t anticipate to see it anytime quickly.

Outlook For This Week

Zooming into the day by day chart, we see that the RSI has hit oversold ranges over the previous few days. The bulls ought to attempt to muster a small push again up quickly. Bitcoin value will doubtless look to proceed the push right down to no less than $72,000 right here earlier than mustering a bounce. When and if the bounce comes, it ought to attempt to tag the $79,000 resistance no less than, and presumably even $81,000, however don’t anticipate greater than that.

Market temper: Extraordinarily Bearish – The bears lastly busted down the door on the $84,000 assist stage. They may look to hold this momentum ahead because the bewildered bulls hunt down the place to make their stand.

The subsequent few weeks

At this level, even essentially the most cussed of bulls should concede that we’re certainly in a long-term bear market. Shedding the 100-week SMA, which had been assist for a number of weeks, was a giant signal of energy for the bears. Count on the bitcoin value to stay beneath $87,600 till a long run backside is in place right here. There’s a excessive quantity node from $68,000 right down to $60,000, so anticipate the value to take its time shifting round this space if $68,000 is misplaced as assist.

Terminology Information: Bitcoin Value Weekly Outlook

Bulls/Bullish: Consumers or traders anticipating the value to go larger.

Bears/Bearish: Sellers or traders anticipating the value to go decrease.

Assist or assist stage: A stage at which the value ought to maintain for the asset, no less than initially. The extra touches on assist, the weaker it will get and the extra doubtless it’s to fail to carry the value.

Resistance or resistance stage: Reverse of assist. The extent that’s prone to reject the value, no less than initially. The extra touches at resistance, the weaker it will get and the extra doubtless it’s to fail to carry again the value.

SMA: Easy Shifting Common. Common value based mostly on closing costs over the required interval. Within the case of RSI, it’s the common energy index worth over the required interval.

Oscillators: Technical indicators that adjust over time, however usually stay inside a band between set ranges. Thus, they oscillate between a low stage (usually representing oversold circumstances) and a excessive stage (usually representing overbought circumstances). E.G., Relative Power Index (RSI) and Shifting Common Convergence-Divergence (MACD).

RSI Oscillator: The Relative Power Index is a momentum oscillator that strikes between 0 and 100. It measures the velocity of the value and modifications within the velocity of the value actions. When RSI is over 70, it’s thought-about to be overbought. When RSI is beneath 30, it’s thought-about to be oversold.

Quantity Profile: An indicator that shows the full quantity of buys and sells at particular value ranges. The purpose of management (or POC) is a horizontal line on this indicator that reveals us the value stage at which the very best quantity of transactions occurred.

Excessive Quantity Node: An space within the value the place a considerable amount of shopping for and promoting occurred. These are value areas which have had a excessive quantity of transactions and we’d anticipate them to behave as assist when value is above and resistance when value is beneath.

Fibonacci Retracements and Extensions: Ratios based mostly on what is called the golden ratio, a common ratio pertaining to development and decay cycles in nature. The golden ratio is predicated on the constants Phi (1.618) and phi (0.618).