On-chain information exhibits the Ethereum Day by day Lively Addresses metric has shot up not too long ago. Right here’s what this might imply for the cryptocurrency.

Ethereum Day by day Lively Addresses Close to Highest Stage In 2 Years

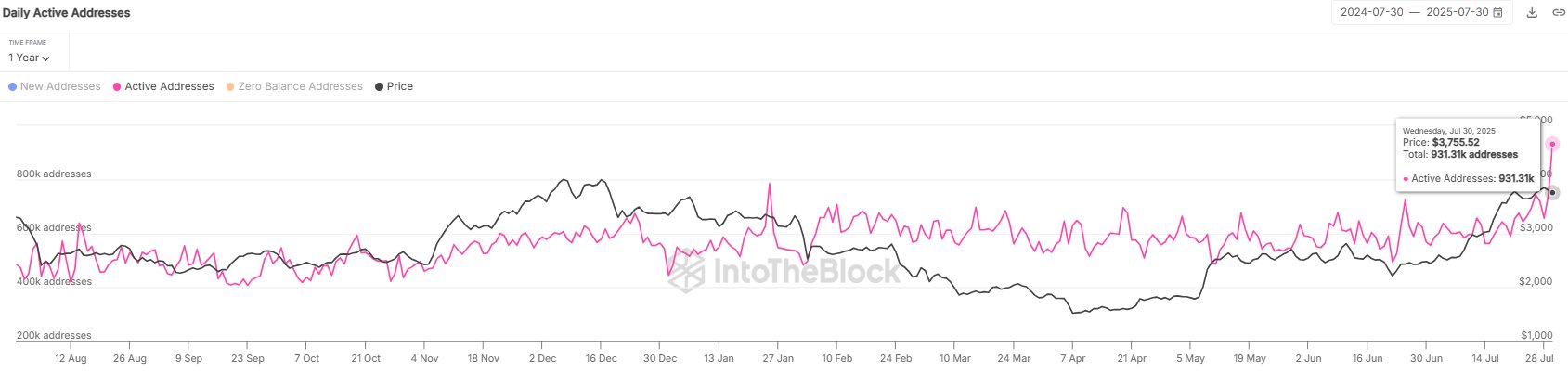

Based on information from institutional DeFi options supplier Sentora, the Ethereum blockchain has seen exercise mild up not too long ago. The “Daily Active Addresses” is an on-chain indicator that retains observe of the entire variety of ETH addresses which might be collaborating in some form of switch exercise day by day.

When the worth of this metric rises, it means a larger variety of customers are making strikes on the community. Such a pattern implies the buying and selling curiosity within the cryptocurrency could also be going up.

However, the indicator observing a drop suggests investor exercise goes down on the blockchain. This sort of pattern generally is a potential signal that spotlight is shifting away from the asset.

Now, here’s a chart that exhibits the pattern within the Day by day Lively Addresses for Ethereum over the previous 12 months:

The worth of the metric seems to have shot up in current days | Supply: Sentora on X

As displayed within the above graph, the Ethereum Day by day Lively Addresses noticed deviation above its current consolidation stage of 600,000 with the newest rally, implying the worth motion introduced curiosity within the asset.

Curiously, the pattern has accelerated in the previous couple of days, with the indicator registering a pointy spike. This fast improve has taken its worth to 931,310, which is the best every day stage in virtually two years.

Traditionally, excessive transaction exercise from the customers has usually been a precursor to volatility. Any worth motion rising out of the buying and selling can, in idea, go both approach, because the Day by day Lively Addresses comprises no details about whether or not shopping for or promoting is dominant, simply that the traders are making strikes.

It might seem that the spike within the Ethereum Day by day Lively Addresses could have led into volatility this time as nicely, because the cryptocurrency’s worth has plunged because it has appeared.

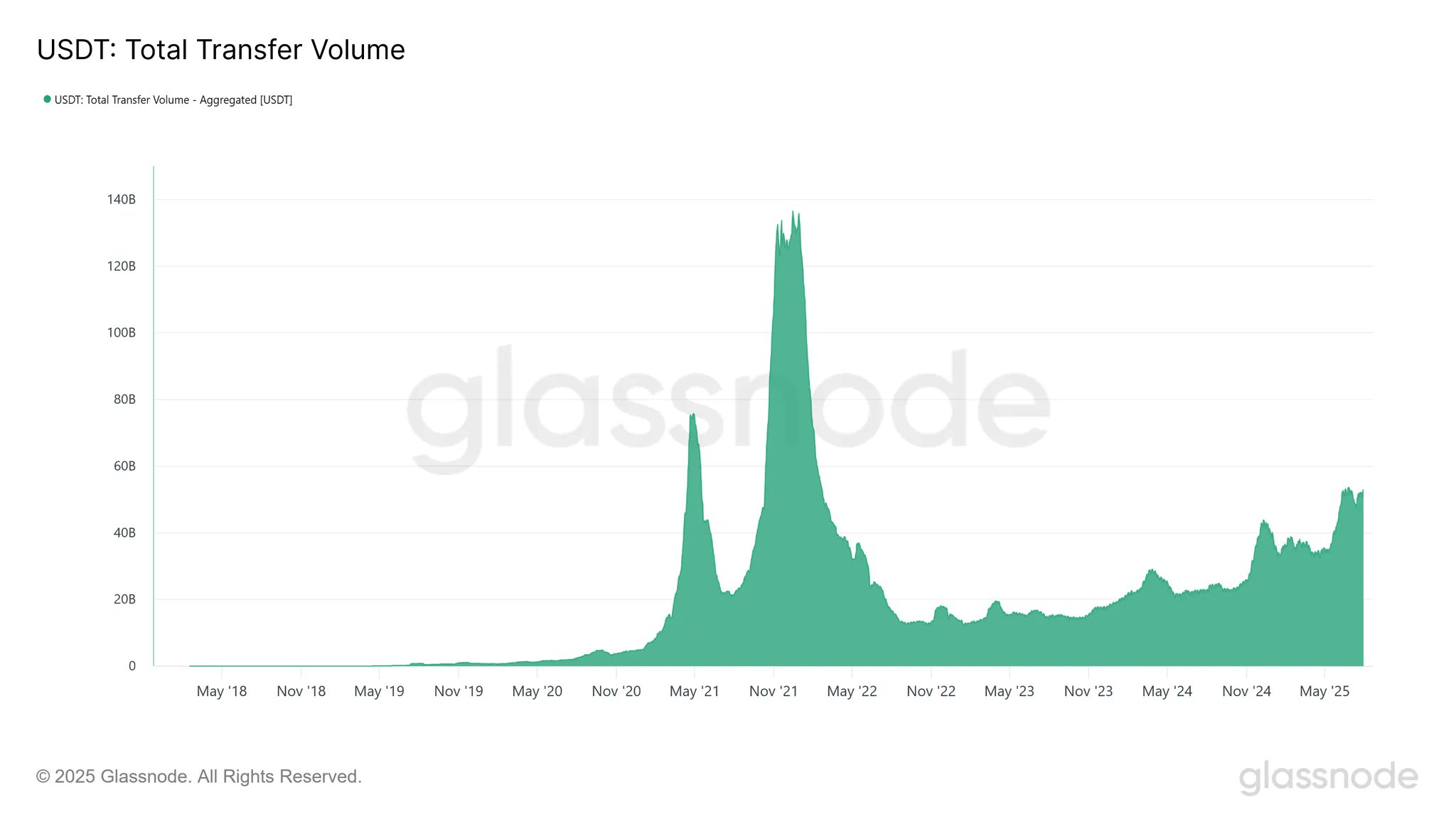

In another information, stablecoin USDT has seen its 30-day transferring common (MA) transfer volume recuperate to the $52.9 billion mark not too long ago, as on-chain analytics agency Glassnode has defined in an X post.

The pattern within the USDT switch quantity over the previous couple of years | Supply: Glassnode on X

As displayed within the above graph, the USDT switch quantity has steadily been recovering because the 2022 crash. “This gradual climb displays a gradual however constant restoration in stablecoin velocity and market exercise,” notes Glassnode.

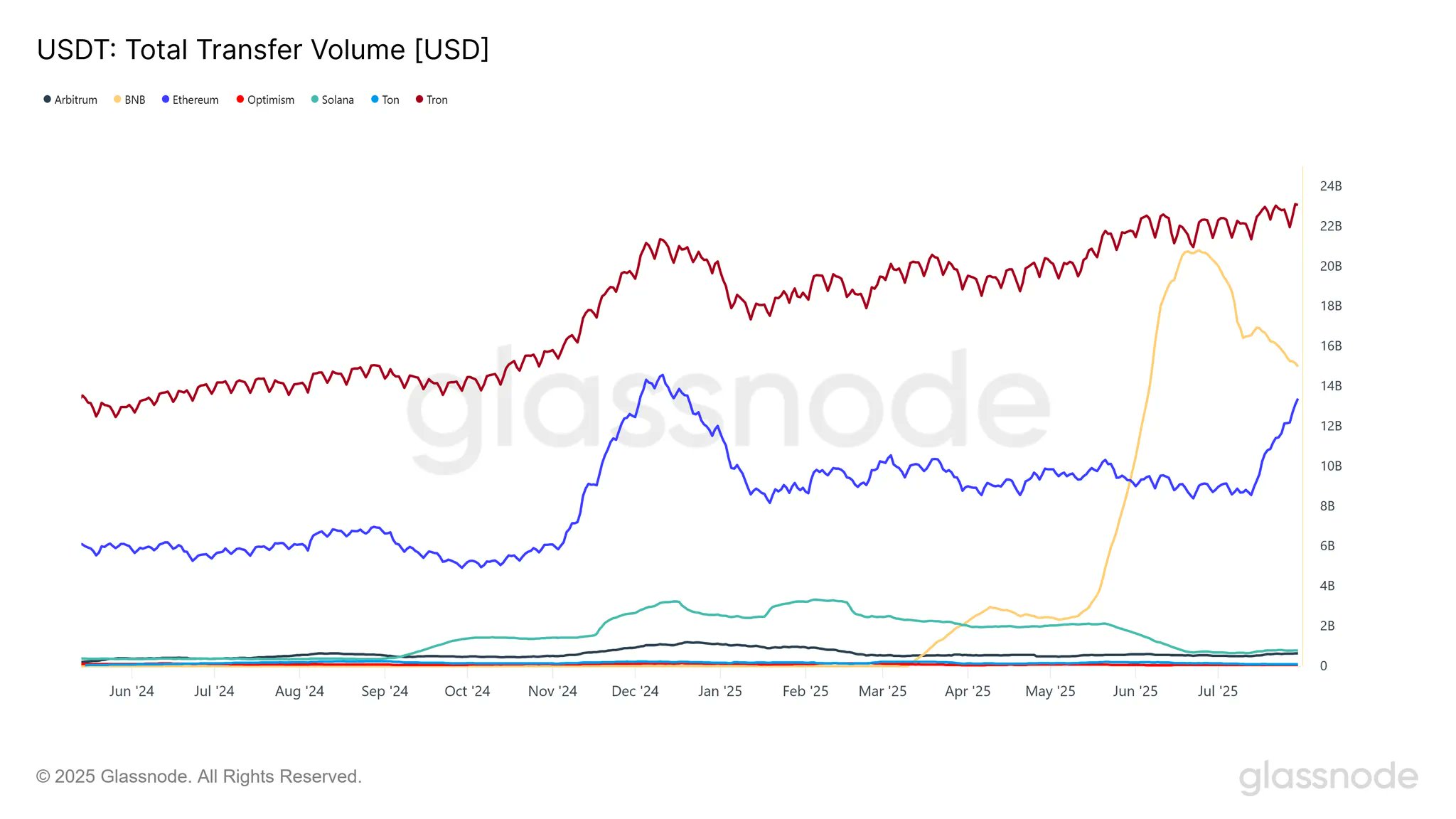

Curiously, Ethereum has not even been among the many high two networks that occupy the most important share of the steady’s quantity.

The information of the USDT Switch Quantity throughout main networks | Supply: Glassnode on X

Tron and BNB are the 2 networks main in USDT quantity, with the metric sitting at $23 billion and $14.9 billion, respectively.

ETH Worth

On the time of writing, Ethereum is buying and selling round $3,650, down round 3.5% within the final 24 hours.

Seems to be like ETH has simply taken a success | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, IntoTheBlock.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.