We had excessive hopes for the bitcoin value in 2025. It was presupposed to be the crescendo of the four-year cycle, probably the most bullish setup in latest reminiscence. It was the yr after the halving, the ETFs had simply been authorised, a brand new president was elected, with the promise of the cash printer roaring again to life. All the things seemed primed for a This fall blow-off prime, and as an alternative of a brand new life in Monaco, all you bought was this awful article.

What follows is my interpretation of the occasions of 2025 and my outlook for 2026. I’m not a dealer, not an analyst, and such as you, I’ve been outperforming skilled funds for years, by merely stacking Sats, in fact. I’m extra of a “repair the cash, repair the world” kinda man, however like everybody else, it’s onerous to disregard Bitcoin’s price actions, which I consider as the sport of “Snakes and Ladders”.

Within the sport of Snakes and Ladders, momentum drives us ahead, however it will possibly additionally present a false sense of confidence. You will be one roll away from victory, solely to land on a snake that sends you sliding again ten locations. As a lot as hopium dictates that we pray for the worth to go ‘up and to the proper’, markets not often oblige. Switching from the board to the chart, value motion is performed on a board of world liquidity and market sentiment. When sentiment is low or liquidity dries up, no quantity of fine information can maintain momentum. We merely crab sideways or discover a snake that slides us down into additional despair.

Then again, when liquidity floods the system, we regularly discover the ladders that shoot us by way of resistance ranges. For many of 2025, we had been caught taking part in the previous, whereas dreaming of the “ladder”. So let’s take this time to overview 2025 from the attitude of hindsight, as foresight proved to be of little profit.

What Occurred To Our 2025 Bull Run?

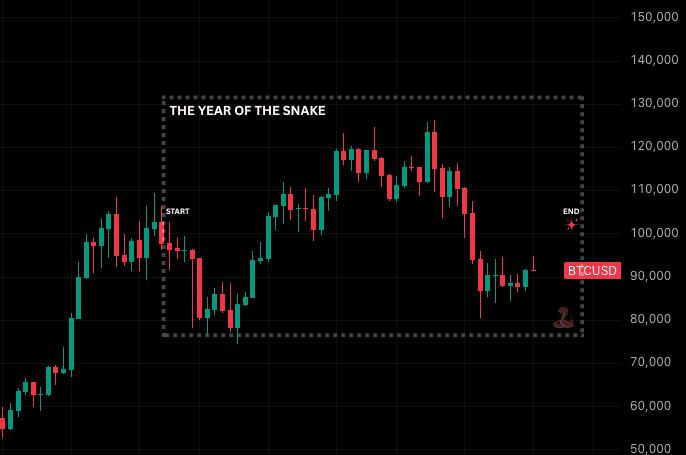

If there’s a phrase that defines the Bitcoin market of 2025, it’s precisely that: a 12 months of Snakes and valuable few ladders. Curiously, and unbeknownst to me, 2025 was certainly the yr of the snake in response to the 12-year Chinese language zodiac cycle, beginning January 29, 2025, and ending February 16, 2026.

We started the yr with the form of euphoria that often marks a cycle prime. The halving was behind us, and the political stars had aligned completely. Google tendencies confirmed search queries had been hovering. In actual fact, the yr kicked off with a quiet however huge victory earlier than the political fireworks even began: FASB truthful worth accounting guidelines took impact on January 1st, lastly permitting firms to report bitcoin earnings slightly than simply losses.

Then got here the primary occasion. We witnessed the inauguration of a “Bitcoin President.” Gary Gensler departed, abandoning a legacy that, in hindsight, was maybe much less villainous than we assumed, and Ross Ulbricht walked free inside 48 hours. With the brand new administration got here a number of allies: Paul Atkins took over the SEC and Mike Selig the CFTC, securing a pro-crypto cupboard.

The monetary plumbing was lastly accomplished. The ETFs had been absolutely operational, choices buying and selling on IBIT had been unleashed, and it rapidly grew to become clear that Michael Saylor was not about to let Larry Fink steal his thunder. MicroStrategy went on a $25 billion shopping for spree, 100x what they purchased in 2020, and the company treasury checklist exploded from 60 firms to almost 200.

By October, the engines had been nicely and really revving. We hit the All-Time Excessive on October sixth, able to punch the accelerator for the fantastic This fall end-of-cycle run. As a substitute, we shifted the gear into reverse and slid all the best way all the way down to $80,000.

First, we obtained our knickers in a twist over the “Knots vs. Core” drama. Then got here the Binance incident, the place the snake manifested itself as a “technical difficulty” at exactly the unsuitable time, and proper as Gold broke out. We primarily obtained rug-pulled by a glitch. The problem of October tenth probably created added promote strain by way of compelled liquidations, while additionally triggering the 4-year cycle sellers who’ve been educated to promote This fall of the 4th yr. Few understood the gravity of it on the time, although I tip my hat to Jesse Olson for calling it early.

Then the FUD machine was turned on. First, it focused MicroStrategy with threats of MSCI exclusion; it didn’t assist sentiment that its mNAV has been dropping all yr. Then it pivoted again to Bitcoin with the return of the “quantum assault” narrative.

Whereas the headlines swirled, the bitcoin value grew to become caught in purgatory, range-bound between $84,000 and $95,000 and trapped by choices merchants, regardless that {the handcuffs} had theoretically been taken off IBIT choices earlier within the yr. Bitcoin was having an Austin Powers second, whereas Peter Schiff loved his first time out within the solar since highschool. Bless him.

Is The Tide About to Flip?

Whereas some worry 2026 will deliver the hangover of a post-cycle bear market, I, like numerous different optimists consider in any other case. If 2025 was the yr of snakes, 2026 is the yr we lastly climb a number of ladders.

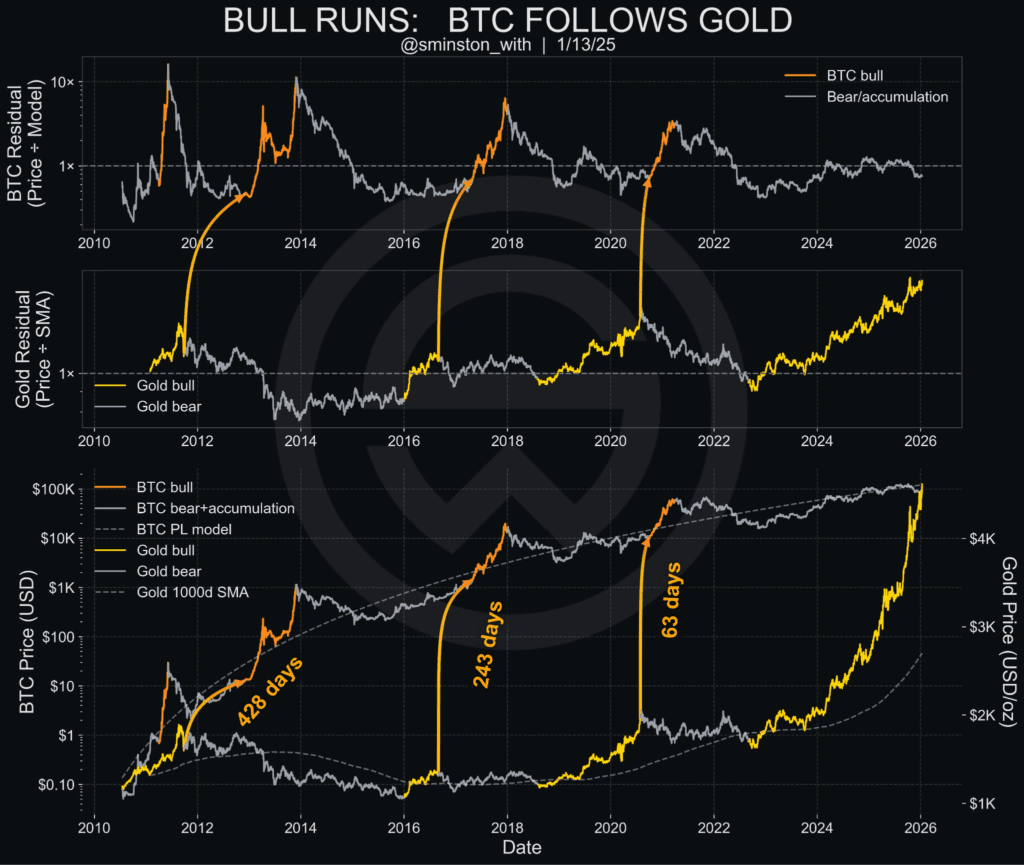

The setup is beneficial. Now we have a Bitcoin-ish president, who’s hungry to fireplace up the printing press, we’ve a growing multipolar world, the place the method of sport idea must be heating up, there’s a $7 trillion debt wall to be paid, the previous guard are positioned, the regulation stranglehold has been loosened, the cowboys (FTX, Terra-Luna, and so forth.) are gone, gold and silver have each had their runs, and Bitcoin’s presupposed to comply with subsequent, or so we hope.

Supply: Sminston With

To not point out, the tax yr is completed, and new budgets have been allotted to fund managers and companies alike. FASB truthful worth accounting is now dwell, smoothing the runway for company stability sheets. Michael Saylor continues to be shopping for with the relentless depth of a person who understands math higher than Archimedes. Even the “MSCI FUD” was defeated early, so credit score to George and the Bitcoin for Corporations staff for that victory.

On the cut-off date as the worth is starting to climb larger, the bears are lastly exhibiting indicators of exhaustion, that’s in response to James Check and numerous others. By far probably the most vital headwind Bitcoin confronted in 2025 was the relentless onslaught of cash bought by long-term holders. That strain appears to be like to lastly be ending. On November 1st, roughly 67% of the Realised Cap was invested above $95k. The final two months have seen an enormous provide redistribution happen, with that metric declining to 47%.

During the last 30 days, round 80% of the cash which have transacted got here from larger costs. That is the definition of capitulation. The weak arms who purchased the highest have flushed out, and new consumers have stepped in with a decrease and stronger value foundation.

By the way, the 12 months of the Snake formally ends on February 16, 2026, to be adopted by a horse, which as everyone knows has the flexibility to outrun any bull. This coincides virtually completely with the month-to-month CME Futures expiry on February twenty seventh. The shedding of a snake’s pores and skin occurs proper earlier than the expansion returns.

Is the 4-12 months Cycle Lifeless?

Actually, who can really say they know? What we do know is that the four-year cycle is now not linked to the halvings or the presidential cycles in the best way we as soon as thought, and the halvings are much less prone to have an impact going ahead, as the brand new cash distributed are a decrease share of provide, and the miners are supported by large funds which might help them climate any potential demise spiral.

Now we have not seen a Pi Cycle prime sign, the 200 week transferring common has not crossed the prior cycle prime, the MVRV score is just 1.3, the Puell multiple is simply .99, we’ve not had a substantial drawdown, and we’re nonetheless on the backside of the vary of just about each metric conceivable. For these of you who’re sufficiently old to recollect the KitKat ad from the 90’s, “the 4 yr cycle will not be lifeless, it was simply takin’ a break.”

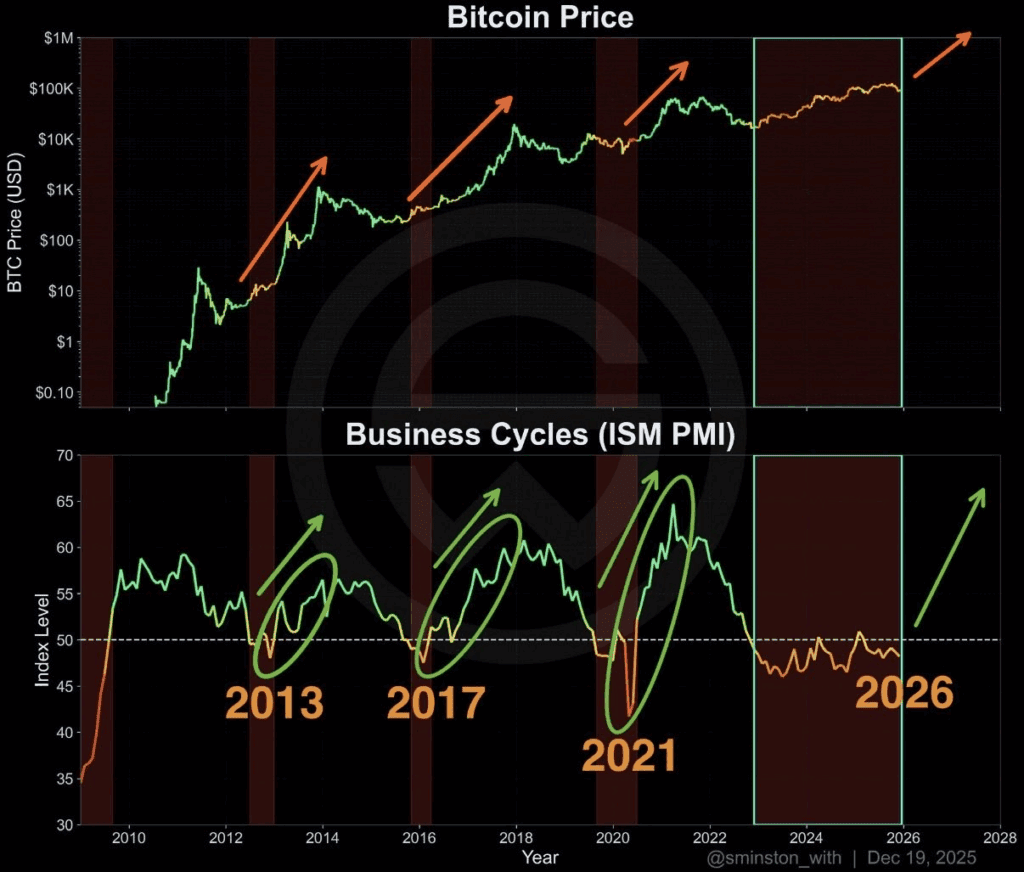

Because the 4-year cycle is a purely Liquidity Based mostly Cycle, it may be measured by proxy utilizing the ISM Manufacturing PMI, a qualitative index sourced from buying managers within the manufacturing business. I give credit to Raoul Pal for highlighting this metric; he was the primary I noticed to level out that bitcoin is a “Liquidity” asset slightly than a “Halving” asset. Bitcoin, because the highest-beta threat asset in existence, responds to shifts in international threat urge for food with better drive and velocity than another asset class. The PMI tracks the enterprise cycle, and it has been in contraction for practically two years. The present PMI at 47.9 indicators ongoing contraction, however ISM projections point out a 4.4% income progress for manufacturing in 2026, crossing 50 in Q2 as Trump’s policies kick in. The bitcoin value ought to comply with. When the ISM PMI is beneath 50, we’re usually in a bear market, and we’ve been that means for over two years now. The bull markets have traditionally topped out between 55 and 65. The query stays, when is the enterprise cycle going to see an upturn? TechDev is of the view that it’s happening very soon, because the bullish divergence reversal momentum is decidedly constructing.

Supply: Sminston With

The $9 Trillion Debt Query

The US authorities has to deal with the $9 trillion debt wall that’s due to mature this year. However the nuance is in how they do it. President Trump has made it clear he intends to construct a “Dream Navy” for 2027 and is pushing for a funds enhance to $1.5 trillion. Whenever you mix that with the $4.1 trillion of debt maturing in 2026 and the usual annual deficit, the US Treasury faces a $9 trillion liquidity hole, and a further $7.4 trillion before 2028.

Does the US need to print all $9 trillion? No. And thru this lens, the latest geopolitical strikes make sense. Trump didn’t solely seize Maduro for a photo-op; he has probably taken management over 303B barrels of reserves and is imposing USD oil gross sales, creating synthetic greenback demand and easing the liquidity hole by $2-3T yearly.

Can he cowl the hole by way of a mixture of tariffs (that People really pay for!), Petro-Greenback demand, and the inevitable monetization of the remainder by the Federal Reserve? I assume he’ll need to. With Jerome Powell anticipated to go away his chair in Might, the trail can be cleared to provide the printer engines a whir.

There’s one other $5 – $10 tr due globally in 2026, and the identical once more in 2027. So the fed chair received’t be with out firm.

My View: 2026–2027

The four-year cycle OGs could also be stepping apart, however the Liquidity Cycle is simply gearing up, and Bitcoin, as Raoul Pal has lengthy argued, stays the last word liquidity barometer.

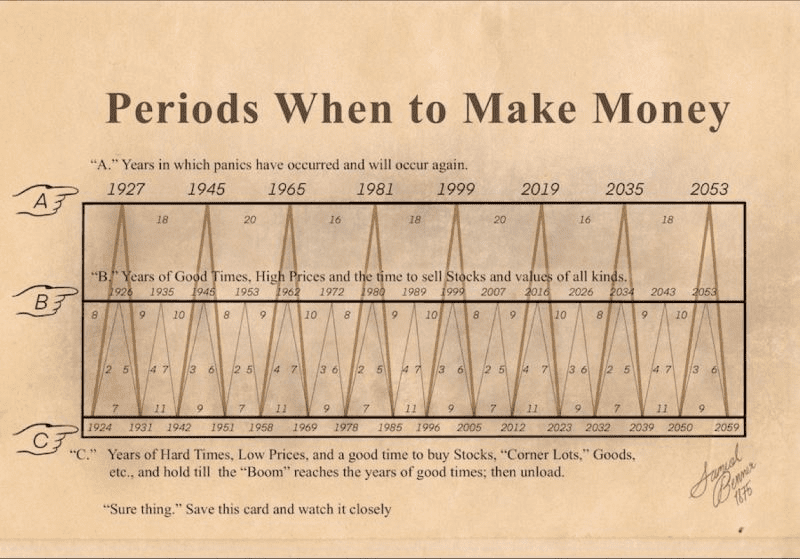

Samuel Benner’s well-known Nineteenth-century forecasting chart (first revealed in 1875), maps long-term cycles of panics (“A” years), booms/excessive costs (“B” years), and depressions/low costs (“C” years). Curiously, 2026 falls squarely in one among Benner’s “B” years, which is a interval of “Good Occasions, Excessive Costs and the time to promote Shares and values of all types.” The chart locations 2026 proper alongside earlier increase years like 2016, 2007, 1999, and 1989, suggesting we’re getting into a structurally favorable window for threat belongings.

How Lengthy Will The Subsequent Cash Printing Final?

Prediction: 18–24 months

Why: Historical past exhibits that when the dam gates open, it takes roughly two years to stabilize and reflate. If the official aggressive printing part begins in late 2025 (because the liquidity uptick and Benner timeline suggest, and as M2 shows), it’s going to probably run sturdy by way of mid-2027.

How A lot LIquidity Will Be Added?

Prediction: ~$9–$10 trillion within the U.S. Treasury debt is maturing in 2026 alone (about one-third of excellent marketable debt) and an extra $5 – $10 tr globally.

Why: As mentioned above, the maturity partitions for 2026 are practically double what we confronted in the course of the COVID disaster. Yellen prolonged the ache by leaning on short-term issuance again then, however come hell or excessive water, that debt must be paid or refinanced—the cash will arrive from someplace. Due to this, we are able to count on a brand new wave of inflation, the 70’s and 80’s have a narrative to inform about that!

How Excessive Will The Bitcoin Value Go?

Prediction: $250,000

Why: Throughout that $5 trillion COVID enlargement, BTC rallied roughly 20x from the $3k–$4k lows to $69k. With the potential for double that liquidity getting into the system this cycle, the upside is critical even when diminishing returns apply. From our $16k efficient low, a conservative 10x to 12x a number of lands us within the $160k to $200k vary as a base case. Nevertheless, fashions counsel we may push larger. PlanC’s quantile model factors towards $300k+ by the tip of 2026, and Giovanni Santostasi’s Energy Regulation tasks a peak doubtlessly round $210k early on, with room to stretch as excessive as $600k in outlier situations. However hey, I used to be anticipating +$200k final cycle too.

Oh, if the Strategic Bitcoin Reserve Act strikes out of the committee, and if the U.S. Treasury formally begins side-stacking alongside MicroStrategy, all bets are off the desk.

When Will The Value Prime Out?

Prediction: Late 2026 to mid-2027

The Logic: Bitcoin traditionally tops out 12–18 months after the liquidity enlargement enters its “mania” part. If the ISM Manufacturing PMI crosses again above 50 in early 2026, the proper storm ought to unfold all through 2026, organising a blow-off prime, doubtlessly in the primary half of 2027.

Bitcoin is unlikely to go straight up, nothing ever does. We’ll virtually definitely encounter a number of snakes alongside the best way: sharp corrections, regulatory noise, profit-taking, or some type of shenanigans. However the ladders are constructed, prepared and ready. The 12 months of the Snake is coming to an finish, simply forward of the February 27 CME futures expiry, our potential ignition level, proper earlier than the anticipated PMI uptick in Q2.

2025 was a yr of snakes and sideways ache, with long-term holders lastly capitulated and weak arms flushed out. Now, with a wall of liquidity heading our means, 2026 appears to be like just like the ladder we’ve been ready for. The horse yr is coming, so stack and safe accordingly.

Good luck.