A warning sign is flashing on the charts, with market analysts predicting that the Bitcoin worth might collapse again soon. In keeping with technical evaluation, if BTC fails to proceed its uptrend, it might repeat the bear-market crash from previous cycles, probably dragging its worth down by double-digit percentages.

Bitcoin Worth To Repeat 2022 Bear Market Crash?

Crypto analyst Tyrex believes that Bitcoin could also be approaching a important turning level if the present uptrend fails to carry. In his newest BTC worth outlook on X, he compares the present market construction to the April 2022 cycle, when Bitcoin made an ATH after which crashed exhausting for weeks.

Associated Studying

Tyrex disclosed that Bitcoin dropped roughly 45% from its all-time excessive in 2022 earlier than coming into an prolonged consolidation part that lasted almost 4 months. The accompanying chart exhibits that in that interval, costs revered clear horizontal boundaries, making a false sense of energy and stability, all whereas underlying weakness continued to construct.

That consolidation ultimately led to an upside fakeout, with the Bitcoin worth briefly breaking resistance earlier than reversing sharply. Sadly, the rejection triggered a continuation of the broader downtrend that 12 months, leading to one other aggressive worth crash that worn out remaining bullish confidence.

In keeping with Tyrex, BTC’s present chart construction carefully mirrors the identical historical setup from 2022. Bitcoin has as soon as once more pulled again sharply after reaching an all-time high of over $126,000. Moreover, the cryptocurrency has spent roughly two months consolidating inside an outlined vary, repeatedly stalling at resistance ranges.

Tyrex warns that Bitcoin is barely holding above $95,000, which aligns with the resistance zone proven on the chart. If worth fails to recuperate and continues to stall close to this degree, the transfer greater might change into a fakeout, probably main to a different sharp dump— simply because it did in 2022. The red-shaded space on the chart exhibits how far BTC might crash if the uptrend breaks, with the analyst projecting an 11.04% drop to the $86,000-$84,000 vary.

Bitcoin Set For March ATH And Could Flash Crash

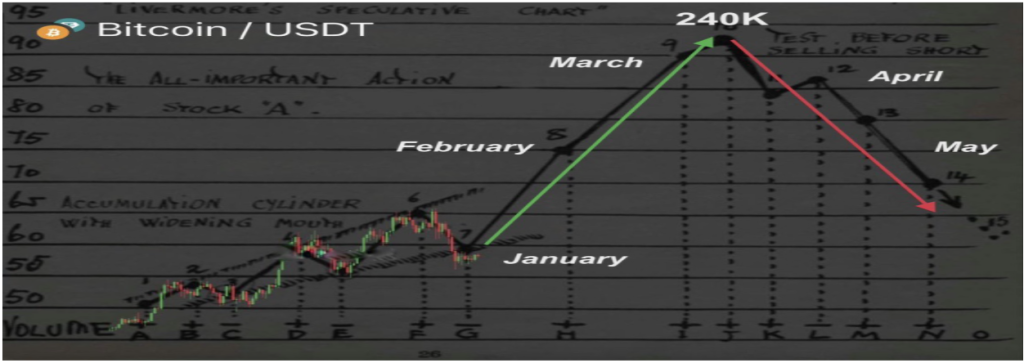

One other forecast from market skilled CryptoXLarge outlines the place Bitcoin may very well be headed over the subsequent 4 months. The analyst bases the outlook on historic market conduct, suggesting the present cycle could also be replicating previous cycle peaks.

CryptoXLarge factors to January 2026 as a part of quiet accumulation with managed worth motion and muted volatility. February is anticipated to carry a robust rally as momentum builds quickly and consumers push the BTC worth greater. This surge might set the stage for Bitcoin to reach a new all-time high round $240,000 in March.

Associated Studying

After this projected peak, April will possible be a bull lure the place the value seems robust however fails to maintain upward momentum. The forecast concludes with a warning of a flash crash in Could 2026, throughout which costs might pull again to recent lows.

Featured picture from Unsplash, chart from TradingView