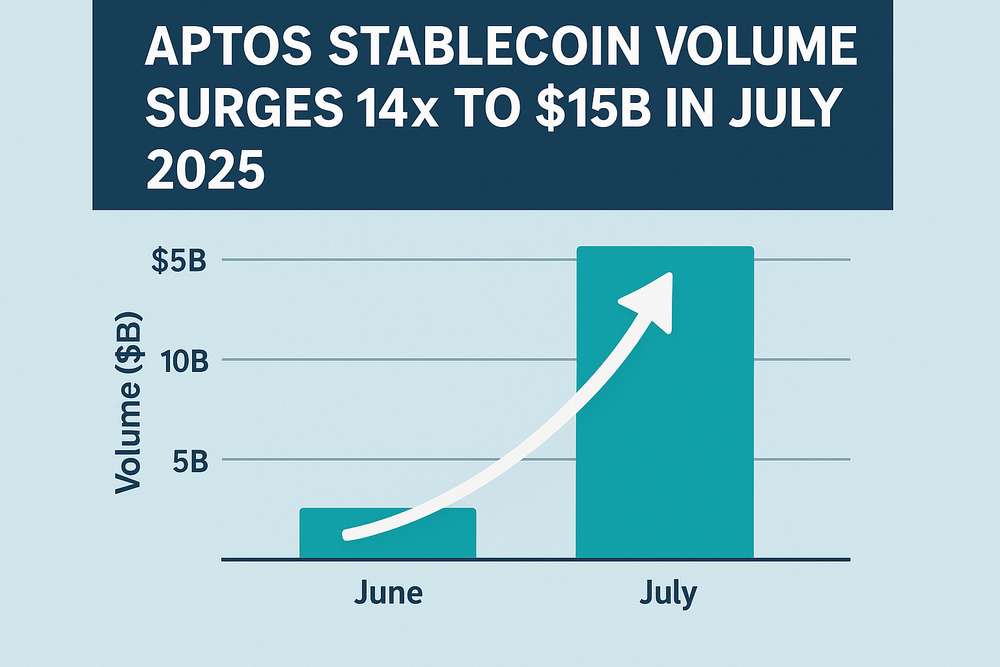

Aptos has seen a dramatic surge in stablecoin switch quantity, with a neighborhood proposal highlighting a 14x enhance from ~$1B in January to $15B in July 2025. This progress, reported in a discussion board submit by person 0xham3d, underscores the blockchain’s fast adoption as a stablecoin hub. The surge coincides with Aptos’ growth of native stablecoin choices and strategic partnerships, positioning it as a serious participant in decentralized finance (DeFi) and cross-border funds.

The Aptos ecosystem has turn into a hotspot for stablecoin exercise, supporting three main stablecoins: USDT, USDC, and USDe. These tokens have collectively pushed over $30 billion in native stablecoin quantity, with Aptos rating second in USDT exercise throughout all blockchains. The community’s means to course of over 11,000 transactions per second (TPS) with near-zero gasoline charges (beneath $0.0008) has attracted customers searching for low-cost, high-speed transactions.

Transaction exercise on Aptos has grown by 36% up to now 30 days, with the community processing over 172 million transactions throughout this era. This momentum builds on Q1 2025 efficiency, the place Aptos dealt with 412 million transactions and surpassed 2.5 billion whole transactions cumulatively. The blockchain’s person base has additionally expanded considerably, with month-to-month energetic customers (MAUs) nearing 15 million and each day energetic wallets approaching 1 million.

Aptos Ecosystem Growth

Aptos’ stablecoin dominance is fueled by its help for USDT, USDC, and USDe, which collectively characterize over $1 billion in market capitalization on the community. This multi-stablecoin technique has attracted liquidity suppliers and merchants, driving decentralized change (DEX) volumes to $13.2 billion+ in Q1 2025 alone. The blockchain’s low charges and excessive throughput have made it notably interesting for retail customers in rising markets, the place cost-effective transactions are important.

Key metrics highlighting Aptos’ progress embody:

| Metric | Q1 2025 | July 2025 |

|---|---|---|

| Whole Transactions | 412 million | 172 million (30 days) |

| Month-to-month Lively Customers | 36.26 million | 15 million (approaching) |

| TVL | $1 billion+ | $1 billion+ |

| DEX Quantity (Q1) | $13.2 billion+ | $100 million+ weekly |

Yellow Card Partnership Boosts Cross-Border Funds

Aptos’ latest partnership with Yellow Card, a number one African crypto change, has additional accelerated its adoption. The collaboration allows prompt, fee-free transfers of USDT and USDC throughout borders, concentrating on mobile-first markets like Sub-Saharan Africa, the place 54 million digital asset customers reside. This integration leverages Aptos’ sub-second settlement capabilities, making it ideally suited for each day funds and remittances.

The partnership aligns with Aptos’ concentrate on rising markets, the place stablecoins function a hedge in opposition to inflation and forex volatility. By eliminating gasoline charges for Yellow Card customers, Aptos goals to onboard tens of millions of recent customers, notably in areas with restricted entry to conventional banking infrastructure.

Aptos Basis’s $200M DeFi Funding

The Aptos Basis has dedicated over $200 million in grants and investments to develop its DeFi ecosystem, concentrating on protocols like Aries Markets, Echelon, and Superposition. These lending platforms have collectively attracted ~$550 million in whole worth locked (TVL), driving liquidity into the community. The inspiration’s technique consists of funding AMMs, CLMMs, and spot markets to deepen DeFi utility.

DeFi exercise on Aptos has surged, with TVL rising from $100 million to over $1 billion in Q1 2025—a 10x enhance year-over-year. This progress is supported by the community’s low charges and excessive scalability, which allow advanced monetary devices to function effectively. The inspiration’s investments goal to maintain this momentum, making certain Aptos stays a high contender within the DeFi house.

Set up Coin Push cell app to get worthwhile crypto alerts. Coin Push sends well timed notifications – so that you don’t miss any main market actions.

Market Influence

Regardless of the surge in stablecoin exercise, Aptos’ native token APT has confronted volatility. On the time of writing, APT trades at $4.54, down 5.2% from its July 3 excessive of $4.84. Analysts attribute this dip to broader market corrections, although the blockchain’s fundamentals stay sturdy. The $15 billion stablecoin milestone and Yellow Card partnership might drive renewed investor curiosity, probably reversing the short-term downtrend.

Glossary

- TVL (Whole Worth Locked)

- Whole worth of belongings deposited into DeFi protocols. Aptos’ TVL surpassed $1 billion in Q1 2025, pushed by lending and buying and selling exercise.

- TPS (Transactions Per Second)

- Measure of a blockchain’s processing pace. Aptos achieves over 11,000 TPS, enabling real-time transaction finality.

- MAUs (Month-to-month Lively Customers)

- Customers interacting with a blockchain month-to-month. Aptos reported 36.26 million MAUs in Q1 2025, rating among the many high blockchains.

- DEX (Decentralized Trade)

- Platform for peer-to-peer buying and selling. Aptos DEXs noticed $13.2 billion+ in quantity throughout Q1 2025.

- CLMM (Fixed Leverage Market Maker)

- DeFi protocol kind. Aptos’ CLMMs, like Aries Markets, have attracted vital liquidity.

- AMM (Automated Market Maker)

- Algorithmic buying and selling protocol. Aptos Basis funds AMMs to boost liquidity provision.

This text is for informational functions solely and doesn’t represent monetary recommendation. Please conduct your personal analysis earlier than making any funding choices.

Be at liberty to “borrow” this text — simply don’t overlook to hyperlink again to the unique.

Editor-in-Chief / Coin Push Dean is a crypto fanatic based mostly in Amsterdam, the place he follows each twist and switch on the planet of cryptocurrencies and Web3.