Bitcoin has just lately set new all-time highs, but most of the main Bitcoin treasury corporations have been underperforming considerably. Regardless of Bitcoin itself just lately pushing nicely above $120,000, the share costs of companies reminiscent of (Micro)Technique stay removed from their peaks. Are these corporations more likely to see a sustained restoration, or has their interval of outperformance already handed?

Bitcoin Treasury Corporations: Huge BTC Holdings in 2025

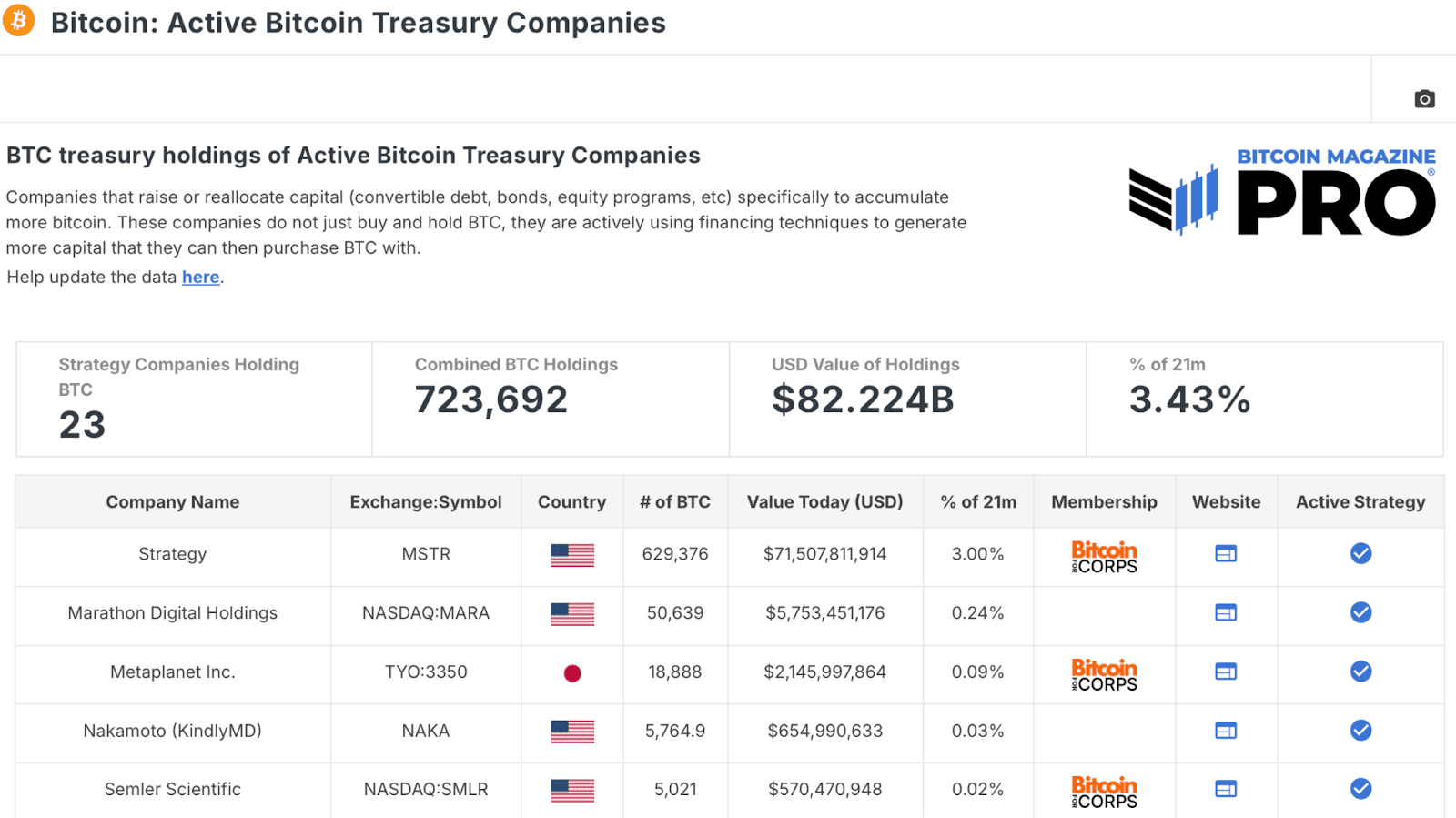

Analyzing the desk of Top Public Bitcoin Treasury Companies reveals a complete of 79 public corporations maintain no less than 100 BTC, amounting to nearly 1,000,000 Bitcoin, valued at over $110 billion. A monumental quantity, contemplating a majority of those corporations solely began accumulating previously couple of years!

Of those, twenty-three corporations are Active Bitcoin Treasury Companies, these which can be actively utilizing financing methods to generate extra capital for BTC accumulation, holding a mixed 723,000 BTC and rising quickly. Unsurprisingly, (Micro)Technique dominates this group with the most important allocation of near 630,000 BTC.

This huge stage of institutional accumulation highlights the rising significance of Bitcoin on company steadiness sheets. Nonetheless, buyers have begun to query whether or not the once-explosive inventory efficiency of those corporations can proceed.

Why Bitcoin Treasury Corporations Are Underperforming in 2025

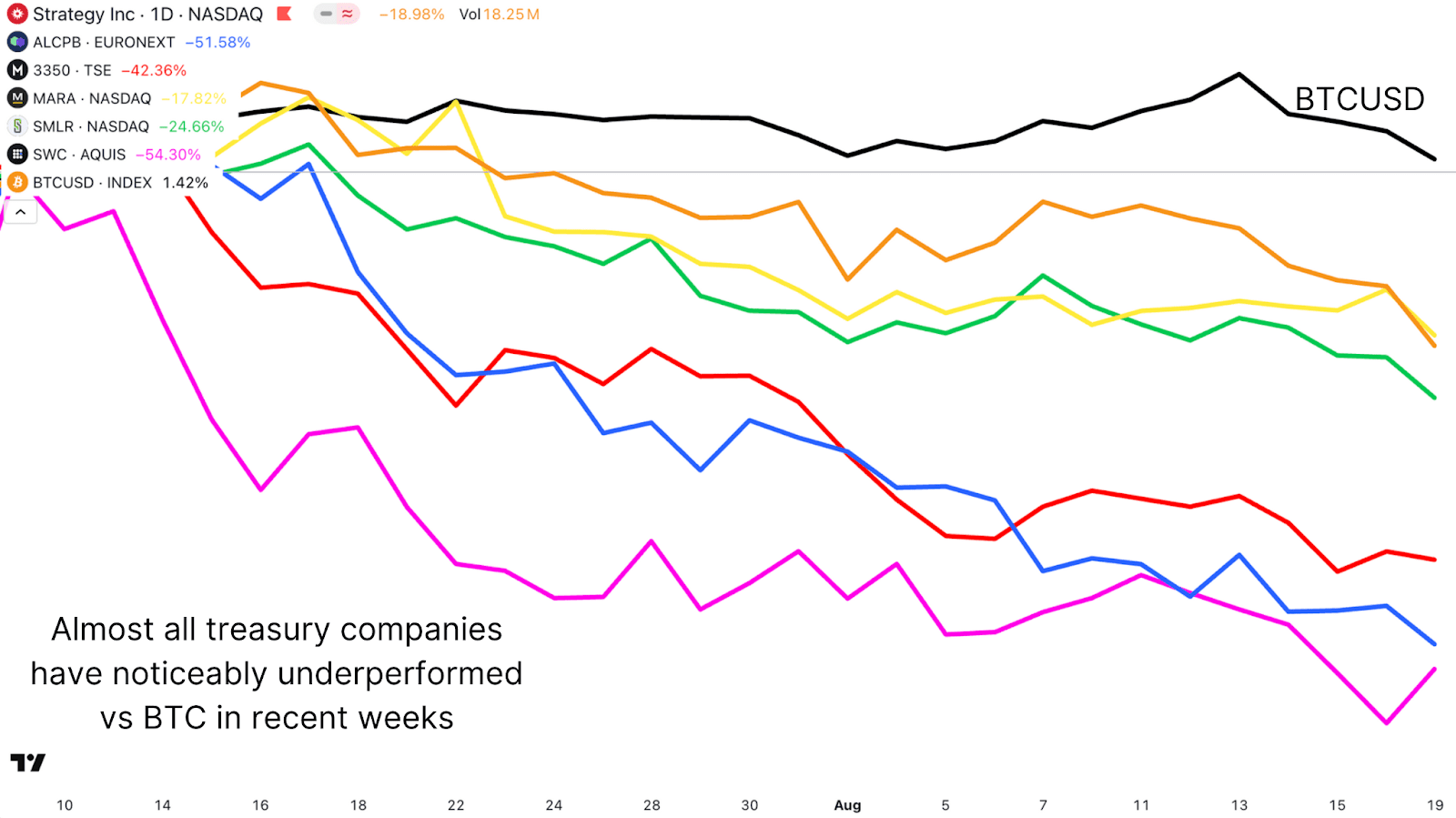

(Micro)Technique has been the flagship Bitcoin treasury firm, however its inventory value has not mirrored Bitcoin’s power in current months. Whereas BTC surged previous $124,000 earlier than its current retracement, MSTR’s share value has languished to as little as $330 just lately, nicely under its $543 highs. In current weeks, nearly all of those treasury corporations have considerably underperformed compared to Bitcoin.

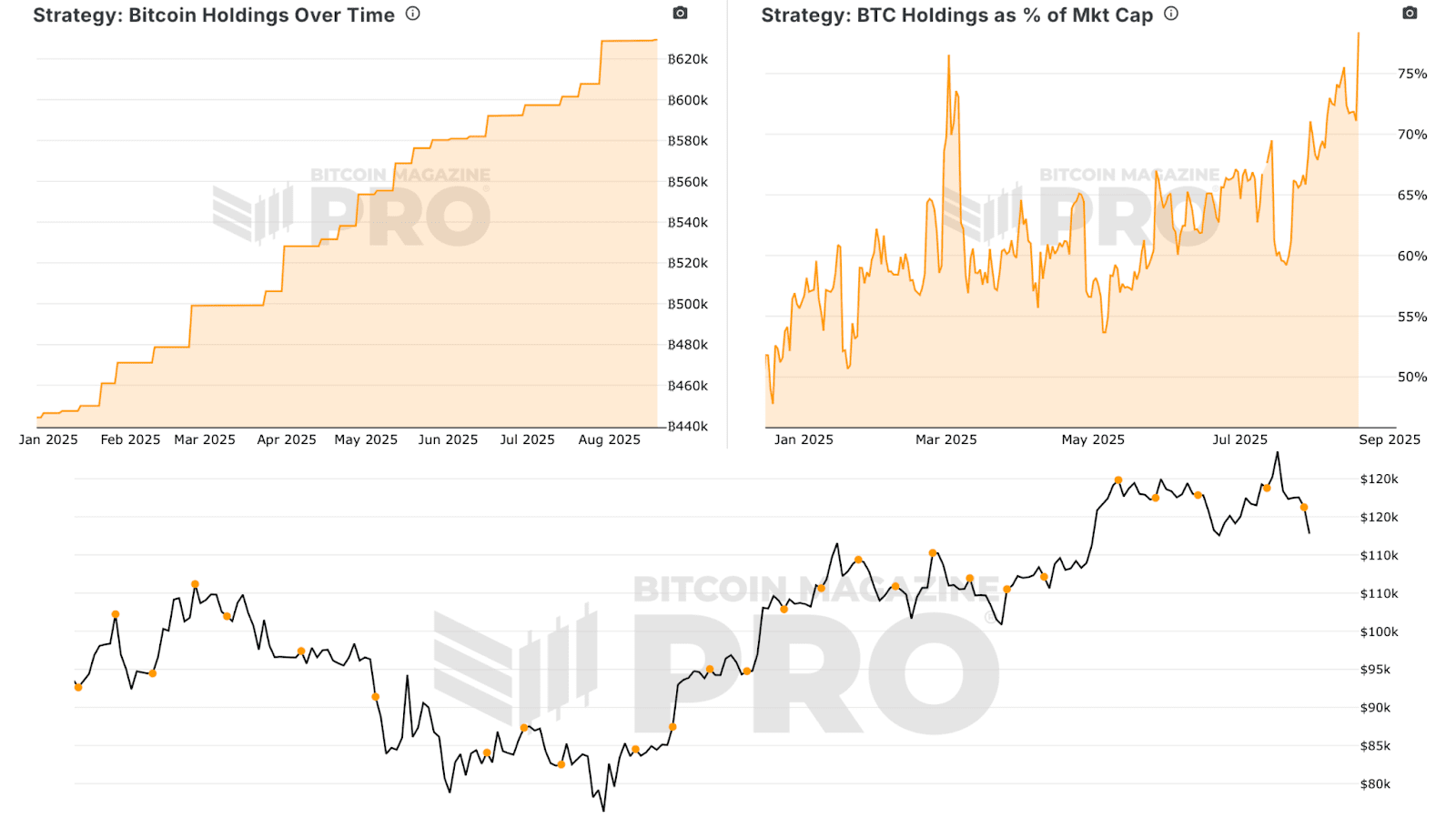

A key motive is the slowing accumulation. Whereas (Micro)Technique made a big buy in July 2025, we are able to see from their Bitcoin Holdings Over Time that the tempo has noticeably tailed off in comparison with its aggressive shopping for in prior years. With out steady and vital accumulation, buyers could also be much less prepared to pay a premium for shares.

Share Dilution’s Influence on Bitcoin Treasury Corporations’ Inventory Costs

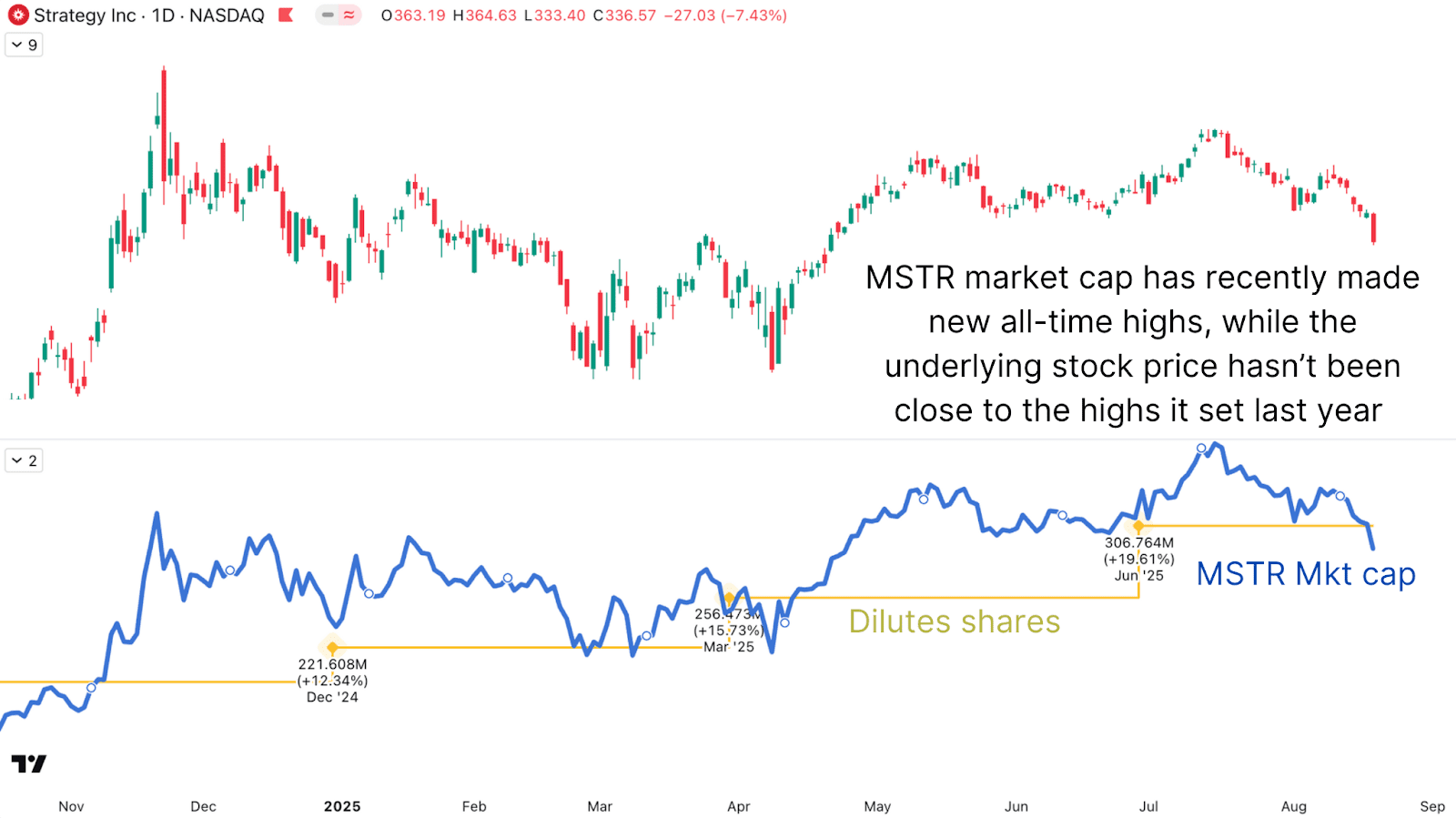

(Micro)Technique ceaselessly points new shares to lift capital for Bitcoin purchases. Whereas this will increase complete holdings, it dilutes present shareholders and weighs on the inventory value. From 2020 to 2025, (Micro)Technique’s diluted share depend rose from round 97 million to over 300 million, reflecting the dimensions of capital elevating for Bitcoin purchases. Whereas this technique has succeeded in amassing monumental BTC reserves, it has additionally capped share value appreciation.

Wanting on the firm’s market cap fairly than its share value paints a unique image. Market capitalization, which accounts for excellent shares, really reached new highs in July 2025, intently monitoring Bitcoin’s rise. The share value alone tells a extra destructive story due to this heavy dilution.

Bitcoin Treasury Corporations: NAV Premiums and Valuations in 2025

The web asset worth (NAV) premium, the premium buyers pay for shares in comparison with their Bitcoin per-share worth, has fallen significantly. Traditionally, (Micro)Technique commanded a major NAV premium as one of many solely methods for buyers to achieve leveraged Bitcoin publicity. Now, with dozens of treasury corporations and ETFs obtainable, that “first mover” benefit has diminished. As extra corporations undertake Bitcoin as a reserve asset, the NAV premium throughout the sector will seemingly pattern towards one.

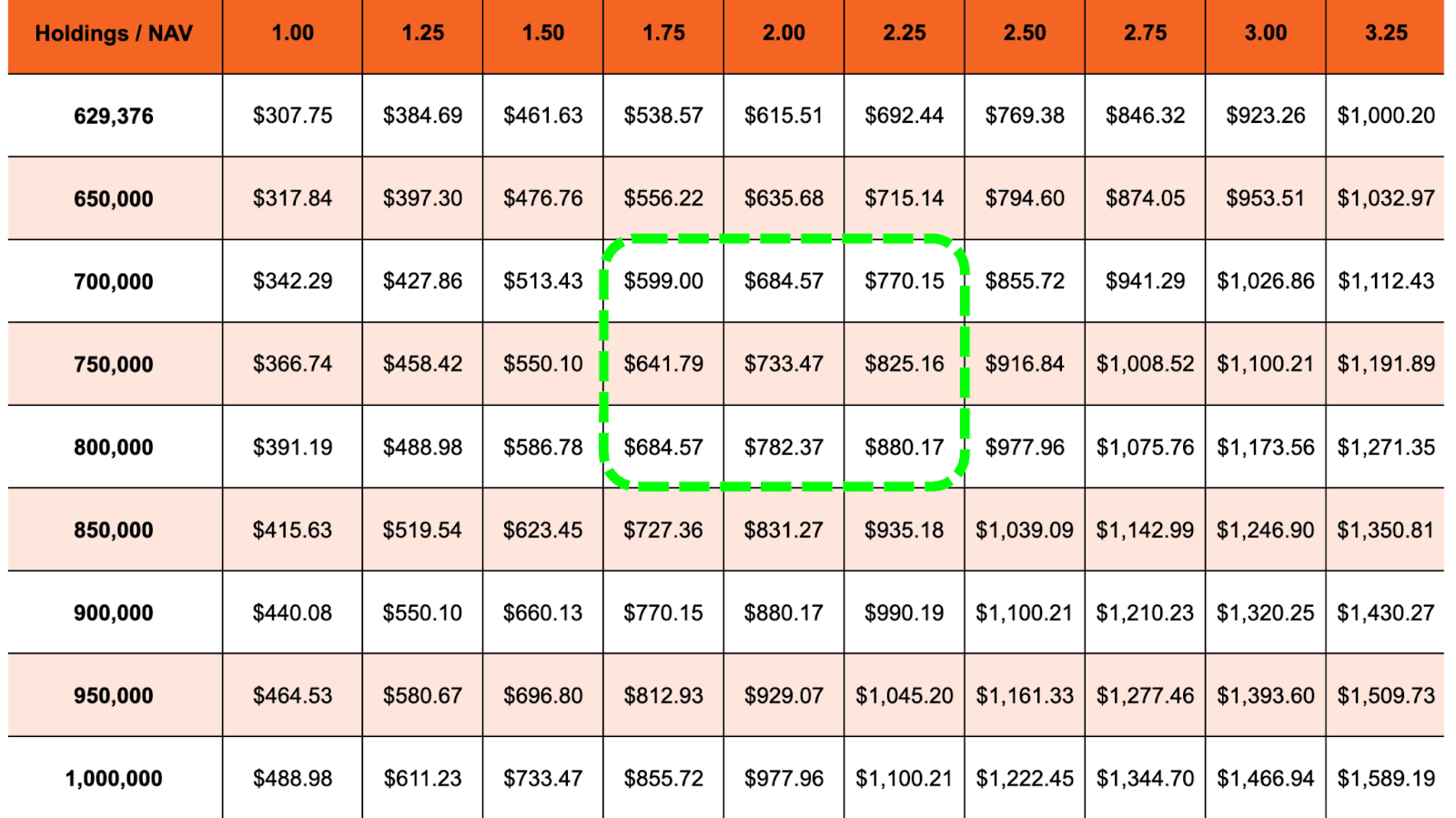

Treasury Corporations and their mNAV can have increase/bust cycles, as all markets all the time have. If Bitcoin reaches $150,000, (Micro)Technique’s personal end-of-year prediction, primarily based solely on its present holdings and assuming no extra accumulation or share issuance, its honest worth, with a 1.00x NAV, would sit round $308 per share. With continued accumulation (doubtlessly reaching between 700,000 – 800,000 BTC) and a modest NAV premium of 1.75–2.25x, share costs might attain the $600–$880 vary. This nonetheless appears to be a sensible chance, particularly if we see an S&P 500 inclusion within the coming months alongside a extra sustained BTC upside transfer.

Bitcoin Treasury Corporations’ Future: Funding Outlook for 2025

Bitcoin treasury corporations like (Micro)Technique have confronted a tough interval of underperformance regardless of Bitcoin’s surge to new highs. Dilution, slowing accumulation, and elevated competitors have weighed closely on share costs. Nonetheless, their elementary position in locking up huge quantities of Bitcoin makes them strategically essential, and in sure market phases, they could nonetheless provide leveraged upside relative to BTC.

The uneven alternative stays, however buyers ought to mood expectations: the “simple outperformance” of the early (Micro)Technique days has seemingly handed, changed by a extra mature and aggressive panorama.

Beloved this deep dive into bitcoin value dynamics? Subscribe to Bitcoin Magazine Pro on YouTube for extra skilled market insights and evaluation!

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to skilled evaluation, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. All the time do your individual analysis earlier than making any funding choices.