Bitcoin worth slipped under $104,000 on Tuesday, however Wednesday has seen a protection above $103,500. In the meantime, Arthur Hayes says it’s too early to name the top of the market’s momentum.

The Maelstrom chief funding officer noted in a Tuesday put up that the Bitcoin worth has fallen 27% over the previous month. Even so, he believes the Federal Reserve might nonetheless pave the way in which for one more rally.

Hayes mentioned the following chapter for Bitcoin might begin when the Fed begins what he calls “stealth quantitative easing,” a quiet return of liquidity disguised as cautious coverage.

For now, he mentioned, markets are feeling the pressure from a liquidity squeeze tied to the continuing US authorities shutdown.

Hayes additionally admitted there’s no solution to know when that shift will arrive. Fed Chair Jerome Powell has mentioned quantitative tightening will finish by Dec. 1, although there’s no assure of one other charge lower subsequent month.

Why Are Lengthy-Time period Bitcoin Holders Promoting?

The CME FedWatch device puts the percentages of one other charge lower at about 72%. Nonetheless, analysts say the shortage of readability is affecting threat urge for food throughout markets.

That warning is exhibiting up within the Bitcoin worth. The asset has fallen about 10% previously week. Spot Bitcoin ETFs additionally saw almost $1Bn go away the market throughout the identical stretch, an indication of weak sentiment.

Hayes urged traders to safeguard capital and put together for risky buying and selling till the shutdown ends. He has beforehand mentioned Bitcoin might attain a minimum of $200,000 earlier than the top of the 12 months.

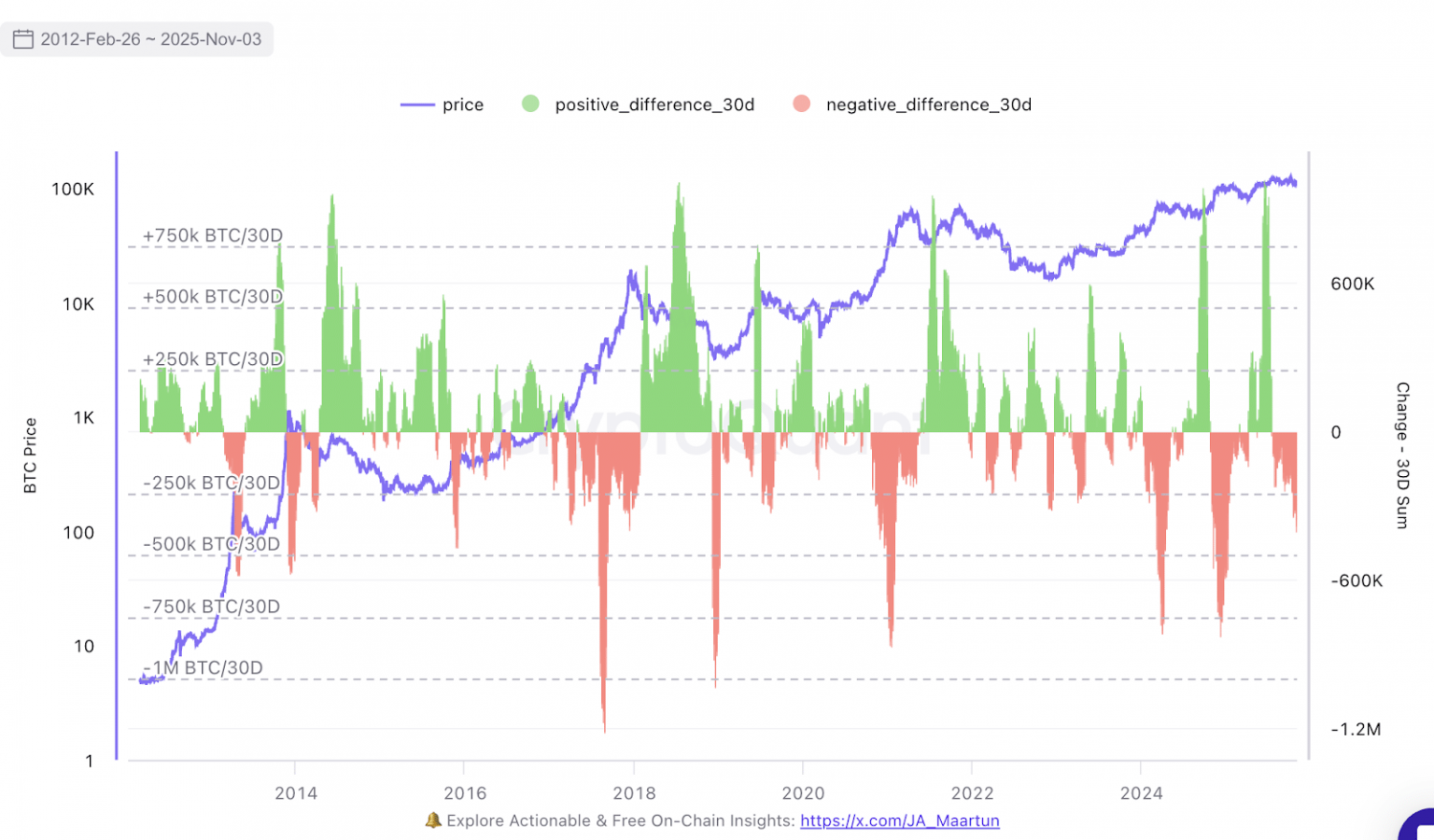

CryptoQuant data present long-term holders offered greater than 827,000 BTC over the previous month, price roughly $86Bn.

That quantity is near 4% of Bitcoin’s complete provide and marks the steepest month-to-month decline since July.

EXPLORE: 20+ Next Crypto to Explode in 2025

Bitcoin Worth Prediction: Does A Break Under The Oct. 10 Low Sign Extra Draw back?

Bitcoin slipped towards the $101,000–$102,000 zone on Monday, testing a assist stage that has held since early October.

Analyst Ali Martinez mentioned the realm might act as a short-term ground. He famous that the value has touched a historic demand zone, which beforehand helped stabilize the market.

Bitcoin $BTC might rebound right here to a minimum of $106,500 or $112,000. pic.twitter.com/BaWBJ7VCTx

— Ali (@ali_charts) November 4, 2025

His chart factors to a doable bounce towards $106,500, and if momentum builds, the transfer might stretch to about $112,000. He additionally expects the market to maneuver sideways for a bit earlier than any clear restoration.

A second analyst supplied a extra cautious view. He mentioned Bitcoin has already fallen under its Oct. 10 low, flagging a break in construction that might deepen strain in the marketplace.

He famous that that is the final main assist earlier than Bitcoin slips towards the $98,000 space a worth final touched throughout the sell-off linked to June’s Center East tensions.

The chart reveals repeated sweeps close to present lows, hinting at fading power and regular promoting strain.

$BTC Now broke under its tenth of October low.

That is the final main stage earlier than the $98K low from the center jap warfare fud again in June. pic.twitter.com/41Lzflq7db

— Daan Crypto Trades (@DaanCrypto) November 4, 2025

Each charts present a fast drop from the $114,000–$116,000 zone in late October, adopted by sharp liquidations.

The market is now at a important level. Patrons want to carry this vary or threat a deeper slide.

If Bitcoin can not transfer again above close by resistance quickly, worth might drift towards the skinny liquidity space close to $98,000. That will assist a darker outlook for the market.

EXPLORE: Best New Cryptocurrencies to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The put up Arthur Hayes Claims Bull Market Still In Play: Monetary Policy Locks In Extended BTC Price Growth appeared first on 99Bitcoins.