Async Payjoin is the perfect hope for sturdy privateness in Bitcoin. Modeled after HTTPS, which enabled safe funds for the net, the Payjoin foundation has been quietly increase this privateness toolkit, which have to be adopted by a lot of Bitcoin wallets, to ship privateness at scale.

Modeled after the Bitcoin and Lightning dev kits — which have develop into fairly standard amongst pockets builders — and constructed with the identical cryptographic primitives already in Bitcoin core, such that it may be simply built-in into the primary Bitcoin implementation, Async Payjoin is designed from the underside up for mass adoption.

Following within the footsteps of Let’s Encrypt, which within the 2010s led the mass adoption of HTTPS on the internet through open supply, free software program tooling, Async Payjoin appears to be like to resolve Bitcoin’s largest privateness ache factors via an open privateness normal. In contrast to particular privacy-focused wallets like Samourai Pockets and Wasabi, Async Payjoin is a software program library that any bitcoin funds app can combine, becoming a member of an open normal of privateness, just like HTTPS on the internet.

Async Payjoin can be known as Payjoin V2 by the Basis, because it differs from V1, an older implementation that requires each customers to be on-line whereas they transact for the Payjoin to work. A rising record of Bitcoin wallets help the Payjoin Basis’s V1 and V2 requirements as we speak, together with:

Async Payjoin is backwards suitable, such that customers with wallets that don’t help the usual but can nonetheless ship to Payjoin addresses and QR codes with out friction to the customers. Followers of Bitcoin privateness ought to ask their favourite pockets suppliers to combine this open supply normal, which builders can discover a technical reference for at Bip 77, alongside their plug-and-play dev kit on GitHub.

The PayJoin Basis Group

The nonprofit PayJoin Basis, launched in August 2025 to maintain open-source privateness improvement, receives funding from OpenSats and Cake Pockets, whereas Spiral, Human Rights Basis, Maelstrom, and Brink have supported lots of the open-source builders who contributed to the undertaking. Their GitHub exhibits 37 contributors simply on the Rust implementation of Async Payjoin.

Growth of the Async Payjoin protocol, also called Payjoin V2 through Bip 77, is spearheaded by Dan Gould, government director of the Payjoin Basis and lead maintainer of the Payjoin DevKit. Dan has pioneered Bitcoin privateness instruments because the TumbleBit period, forked Wasabi Pockets for cellular use, and co-authored BIP 77 with Yuval Kogman, advisory board member and Spiral Bitcoin Wizard with over twenty years of programming expertise. Kogman has accomplished in depth work within the Bitcoin privateness subject, corresponding to growing WabiSabi DoS protections and whistleblowing vulnerabilities in numerous CoinJoin implementations.

Armin Sabouri has additionally joined the staff as R&D lead with prior roles as CTO at Botanix and engineer at Casa, co-winner of the 2021 MIT Bitcoin Hackathon by getting Bip 78 CoinJoin engaged on Mac OS via Tor, and is a co-author of BIP 347 (OP_CAT).

Gould instructed Bitcoin Journal that they’re at all times fundraising and that “none of this work is feasible with out the funders.” He additionally went into element about why they determined to begin a Payjoin basis reasonably than a for-profit entity, saying that “Bitcoin privateness — for-profits have principally been killed.”

In response to Gould, a nonprofit is extra sustainable to resolve the issue as a result of it aligns the incentives; “I believe the for-profits have an incentive to promote one thing that doesn’t essentially assure privateness as a result of in the event that they make a sale, they earn revenue. And we’ve seen on the web that it was tried. Phil Zimmerman began an organization that developed PGP. However HTTPS was a decentralized nonprofit effort, as was Tor”. Gould says the Payjoin Basis has utilized for 501 (c) (3) standing, which is pending approval. Donors can contact him at donate@payjoin.org.

How does Payjoin work?

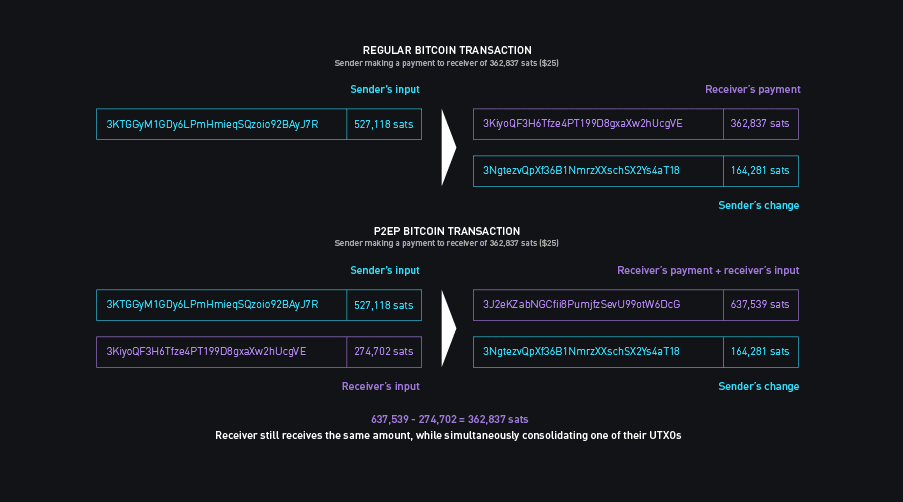

Payjoin gives privateness to Bitcoin by breaking a standard sample of regular transactions, the place the sender has one enter that will get cut up up into two to make a fee. Of the ensuing outputs, one is more likely to be the fee and the opposite the change again to the sender.

Customers usually have a number of UTXOs (unspent transaction outputs), that are like pockets of cash. If a transaction tries to ship greater than is in a single UTXO, it’s going to pull from one other, linking two of those pockets of cash, which up till that time may need had no connection to one another on the chain. This reduces the privateness of customers within the eyes of blockchain analysts, who can assume the 2 UTXO packets belong to the identical entity.

Payjoin dissolves the usual enter heuristic by facilitating coordination between the sender and the receiver, leading to transactions that seem to have two inputs and two outputs, the place one of many inputs is from the receiver. The receiver will get the identical quantity he’s anticipating; each events merely coordinate on the quantities and co-create the transaction. In consequence, what would have been a single-input, two-output transaction now has two inputs and two outputs, complicated on-chain analysts. The extra transactions of this kind exist, the much less dependable the single-input heuristic turns into, leading to extra privateness for all customers, because the core assumption of on-chain evaluation breaks down.

This course of is totally non custodial, with full management over quantities signed and despatched by each events, it’s atomic, if each events don’t agree, the transaction will not be legitimate.

Gould cautioned about how a lot data is leaked with regular bitcoin transactions as we speak, referring to organizations like Chain Evaluation, which may, in some circumstances, get entry to change consumer information to attempt to determine house owners of a given UTXO, “when you eavesdrop on that, you possibly can see who you’ve transferred cash to up to now. You may see who somebody transfers cash to sooner or later. You may see how a lot cash somebody has. You may see how a lot cash somebody makes.”

Enhancements to Bitcoin privateness of this kind are essential to the success of Bitcoin as they implement the fungibility of the asset, an vital high quality of sound cash. Fungibility implies that all cash are thought-about equal and interchangeable; one will not be completely different from the opposite primarily based on its historical past.

Cryptocurrencies that target maximizing on-chain privateness, like Zcash or Monero, provide increased default levels of on-chain privateness by encrypting the quantities transferred amongst events. This, nevertheless, comes at a excessive value; validation of the overall provide of cash in these various cryptocurrencies is far more sophisticated. In consequence, bugs within the associated cryptography may result in inflation bugs which are undetectable, a danger which undermines shortage, one other important high quality of sound cash.

Payjoin in flip gives Bitcoin a better diploma of on-chain privateness with out encrypting the quantities transferred between events, respecting the shortage of Bitcoin whereas enhancing fungibility. The principle trade-off is that it can’t be a protocol-level change; it wants pockets adoption and thus consumer engagement.

It’s additionally vital to notice that fiat-level privateness already protects customers from third-party evaluation by being a closed personal system, or tries to anyway. Authorities companies and executives working at banks have a lot larger visibility into consumer balances, however organized crime doesn’t. There are additionally many legal guidelines in international locations all through the world defending consumer monetary privateness, which Async Payjoin is seeking to elevate Bitcoin to.

Community privateness and the client-server V2 mannequin, the Async a part of the protocol.

One of many challenges traditionally with conventional Payjoin is that it required each events to be on-line to coordinate the creation of the transaction. To resolve this, Payjoin V2 introduces a blinded listing server to supply asynchronous Payjoin coordination amongst events, utilizing the well-known Web normal, Oblivious HTTP.

Gould instructed Bitcoin Journal that “the cool factor is the protocol has the listing server blinded. The listing server is barely reachable by oblivious HTTP, which is principally a pressured proxy. So the IP addresses (of customers) are by no means leaked to the listing server.” Including that, “the payload (pre-signed transaction) is definitely end-to-end encrypted between the sender and the receiver anyway. So the listing simply will get an 8-kilobyte uniform encrypted blob. They don’t see something.”

The truth is, Gould in contrast using OHTTP to Tor, explaining that “The explanation we used it’s as a result of it’s an online normal. So it’s gone via the rigorous evaluation course of. OHTTP is actually supported within the iOS working system. It’s utilized in browsers.” including that “OHTTP it’s type of just like the minimal viable product of Tor the place Tor layers encryption and does a number of hops and that is simply probably the most minimal model the place you simply have one hop. You simply have one layer of encryption.” Related multi-hop community encryption is used within the Lightning community to guard consumer privateness.

The Payjoin V2 servers present no monetary reward to those that run them, just like Tor exit nodes, which have sustained these privateness networks on a volunteer foundation for many years.

What about compliance?

Regulators and, because of this, change operators usually have issues about Bitcoin privateness applied sciences, as they’re perceived to be in battle with matters of compliance. Gould considers this a false impression, saying that “the fact is {that a} compliance regime is completely impartial from the character of the chain. If an change desires to gather your child’s identify, know the place you reside, your cellphone quantity, and what supply of funds, having privateness by default doesn’t cease them from doing that. Doesn’t cease them from asking for it so as to do enterprise with the consumer.” Including that “It simply doesn’t give them full perception into your entire pockets, previous, current, and future. So it places the facility to consent to disclose the details about your cash in your personal palms.”