The Financial institution of England’s Stablecoin regulatory framework for so-called systemic stablecoins was launched right now (November 10) in a session paper outlining its proposal.

There was immediate debate throughout Crypto Twitter over the precise remit of those so-called ‘systemic stablecoins’, which many have highlighted as deliberately vaguely worded – with the press launch itself solely referencing ‘UK stablecoins’.

One interpretation would see the time period ‘systemic stablecoins’ as any listed to be used on UK monetary merchandise similar to exchanges, custodians, and DeFi protocols, or any stablecoin used within the cost of products, companies, or earnings to UK residents.

The second interpretation attracts on a single doc headline that refers to ‘GBP-denominated stablecoins’. Though this isn’t clarified once more within the doc, which defers to a distinct group, HM Treasury, to label ‘systemic stablecoins’, this implies it attracts the road at GBP-backed stablecoins.

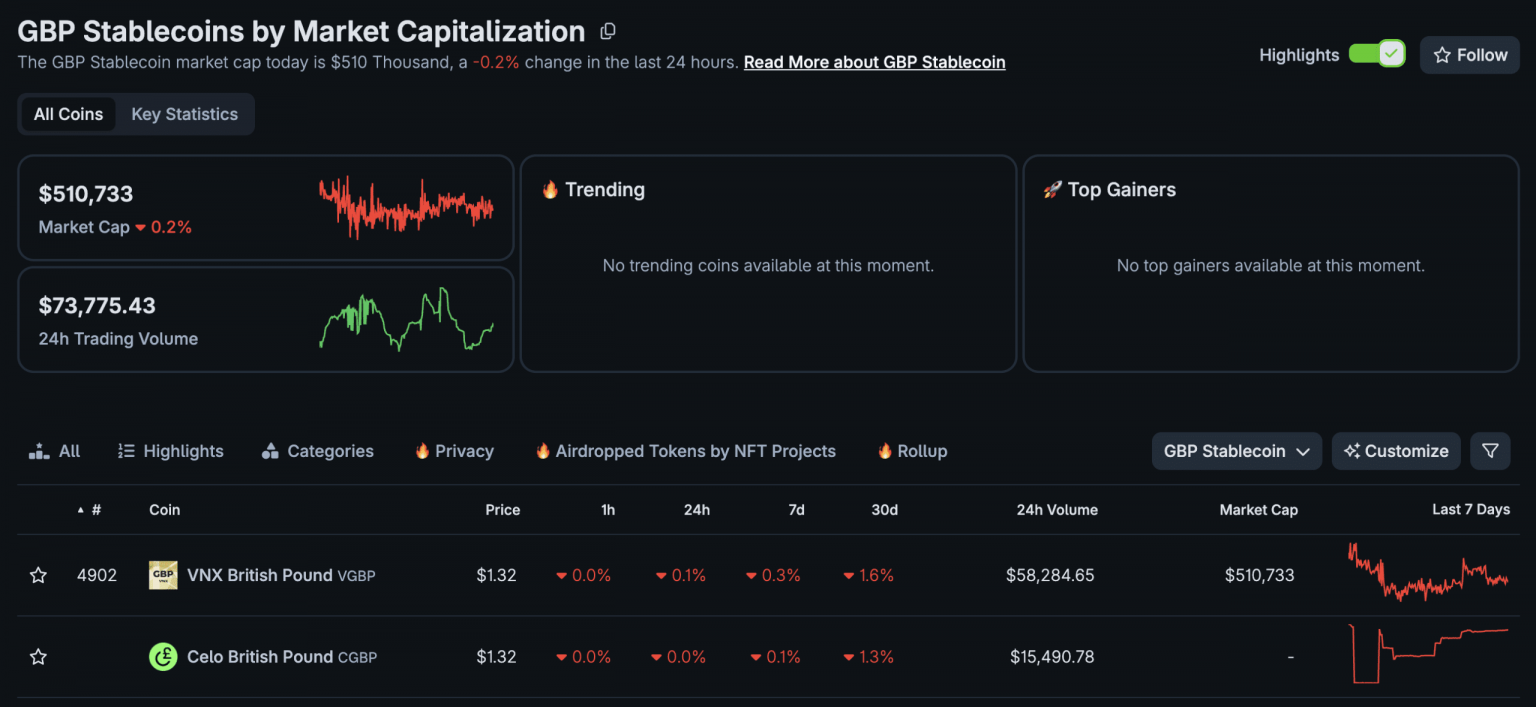

Hilariously, there are presently two GBP-backed stablecoins, VGBP and CGBP, which maintain a mixed worth of $500,000, with a every day buying and selling quantity of simply $10,000 between the 2 – which illuminates an even bigger query: has the Financial institution of England actually spent 3 years investigating a market with a half-million market cap, or is that this a soft-entry for a wider stablecoin regime?

The proposals are constructed upon suggestions from the November 2023 Dialogue Paper. Whereas the BoE states that it’s a dedication to public belief in cash as cost improvements evolve, a UK stablecoin restrict of £20,000 per particular person tells a distinct story, as Kier Starmer and the UK Authorities proceed to hinder the nation’s FinTech innovation.

In its press release, the BoE notes that the proposed framework is not going to cowl stablecoins used for non-systemic functions, and that non-systemic stablecoin issuers shall be regulated by the FCA.

If recognised as systemic by HM Treasury (HMT), they are going to transition into the Financial institution’s regime and shall be collectively regulated, with the Financial institution overseeing prudential and monetary stability dangers, and the FCA persevering with to oversee conduct and shopper safety.

Key Coverage Proposals Outlined within the Financial institution of England Paper: A Delicate Entry Through Intentional Vagueness?

So what does systemic stablecoin imply?

The Bank of England paper clarifies that ‘systemic stablecoins’ are these broadly utilized in funds, and are deemed to pose a danger to UK monetary stability by HM Treasury.

Critically, the definition doesn’t point out the GBP denomination; the truth is, the one threshold required by this authorized definition is {that a} stablecoin is utilized in funds within the UK.

The cynical view can be that this acts as a ‘soft-entry’ for a wider clamp-down on stablecoins, granting HM Treasury powers to categorise, providing an simply extendible company seize underneath the masks of the restricted scope of the GBP stablecoin market.

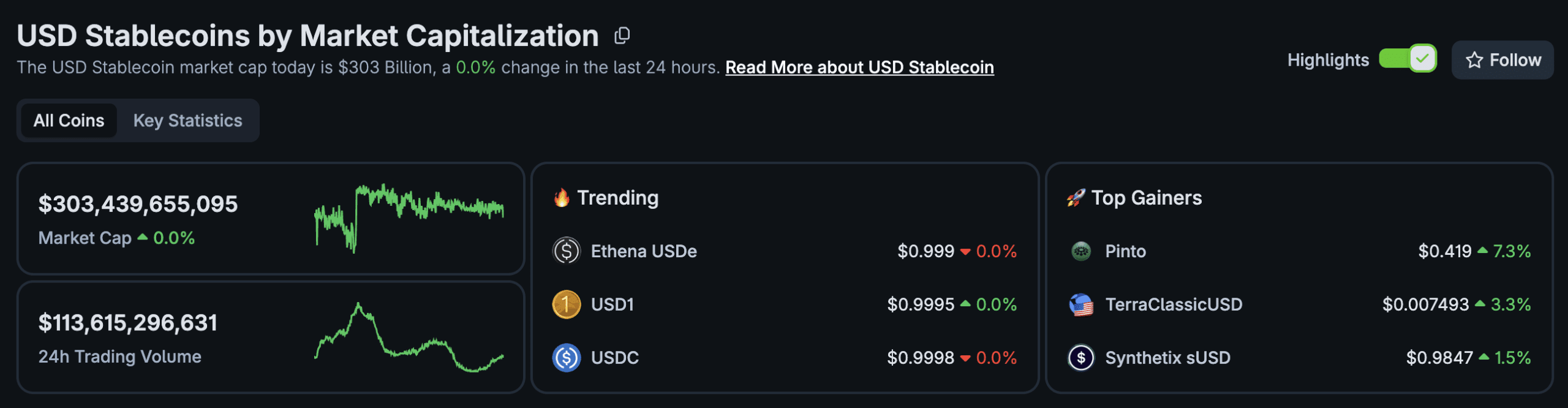

In spite of everything, USD-denominated stablecoins dominate exercise in UK crypto finance, serving as the first buying and selling pair on British exchanges and because the premier technique of cost/settlement for the UK’s crypto natives.

And certainly, the British authorities isn’t new to this. Police within the UK have seized cryptocurrency, together with stablecoin assets USDT and USDC, for years, so that they’re effectively conscious of the extent of USD-stablecoin proliferation.

Is The Financial institution of England Gunning For Your Crypto? Or Are UK Crypto Regulators Making ready for a Digital Shockwave?

In response to suggestions, the BoE has acknowledged that systemic stablecoin issuers shall be allowed to carry as much as 60% of their backing property in short-term UK authorities debt. For the remaining 40%, the Financial institution will present issuers with unremunerated accounts on the Financial institution of England, guaranteeing sturdy redemption and public confidence, even throughout annoying situations.

Moreover, issuers thought of systemic at launch, or these transitioning from the FCA regime, will initially be permitted to carry as much as 95% of their backing property in short-term UK authorities debt to assist their viability as they develop. Because of this any agency making a GBP-backed stablecoin underneath this framework should abide by the above ruleset.

In a brand new proposal, the Financial institution of England can be contemplating central financial institution liquidity preparations to help systemic stablecoin issuers throughout instances of volatility. These preparations would improve monetary stability by offering a security internet in case systemic issuers are unable to monetize their backing property in non-public markets.

No, the Financial institution of England hasn’t set a £20,000 restrict.

It’s a brief proposal inside its new session (revealed right now) on systemic stablecoins, designed to handle dangers from massive outflows of financial institution deposits as digital cash adoption grows.

The priority is that if an excessive amount of…

— CryptoUK

(@CryptoUKAssoc) November 10, 2025

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

£20,000 Holding Restrict: The True Centerpiece of the Financial institution of England Stablecoin Paper

The Financial institution of England has acknowledged that the £20,000 holding restrict per systemic GBP-backed stablecoin is meant to “Guarantee continued entry to credit score because the monetary system step by step adapts to new types of digital cash.”

A £10M holding restrict has been proposed for companies (with an exemption course of to permit bigger corporations to carry extra if obligatory). These limits will reportedly be eliminated as soon as the transition not poses dangers to the supply of finance to the actual financial system. Moreover, these limits is not going to apply to stablecoins used for settling wholesale monetary market transactions within the Financial institution and FCA’s Digital Securities Sandbox.

Whereas the BoE has some fairly phrases for these holding limits, it’s additional proof of the iron grip the UK is placing on its individuals, wrapping future GBP-backed stablecoins in crimson tape and restrictions that shut them off as severe funding autos to the common individual.

Coupled with the proposed digital ID playing cards, the UK is rolling full steam forward in its bid for self-destruction by stifling FinTech innovation and concurrently eradicating extra of its individuals’s freedoms.

financial institution of england proposing a £20k cap on pound stablecoins is like placing a pace restrict on unicycles, no-one is utilizing them anyway

pic.twitter.com/3tL2aae5jU

— Ye Olde Intern (@blockscribbler) November 10, 2025

Good Play to Keep away from the Financial institution of England and Its Suffocating Stablecoin Restrictions

Fairly merely, all one must do to keep away from the Financial institution of England and its ridiculous £20,000 holding restrict is to refuse outright to commerce or maintain any declared ‘systemic stablecoins’.

Why would anybody select to carry a GBP-backed stablecoin, or if prolonged, a longtime USD-backed token, similar to Tether’s USDT or Circle’s USDC, when the UK is taking steps to cut back entry by outdated approaches to the adoption of digital property?

With such an unlimited stablecoin trade, it appears probably that for years to come back, there shall be a plethora of freely accessible and liquid stablecoins not-yet declared ‘systemic’ to HODL wealth in (*cough* DAI *cough*).

For Brits, it’s clear to see that the UK Authorities and the Financial institution of England are doing nothing to entice buyers away from stablecoins; if something, they’re driving individuals deeper into the clutches of the obscure USD-denominated cash, prematurely killing any prospect of a digital GBP market.

The UK has a variety of catching as much as do, because the mixed USD-backed stablecoin market cap exceeds $300Bn, with a every day buying and selling quantity of over $113Bn. These numbers are anticipated to proceed rising at a speedy tempo because the US Authorities rolls out its GENIUS Act, which is anticipated to convey readability and widespread adoption to its stablecoin sector.

EXPLORE: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The publish Bank of England Restrict Stablecoin Limits to £20K: What is a ‘Systemic Stablecoin’? appeared first on 99Bitcoins.