“B*tch higher have my cash..”; it’s a catchy tune most pop lovers would possibly know by coronary heart. Sadly, for Berachain, that’s precisely what they hear each time BERA crypto ticks decrease.

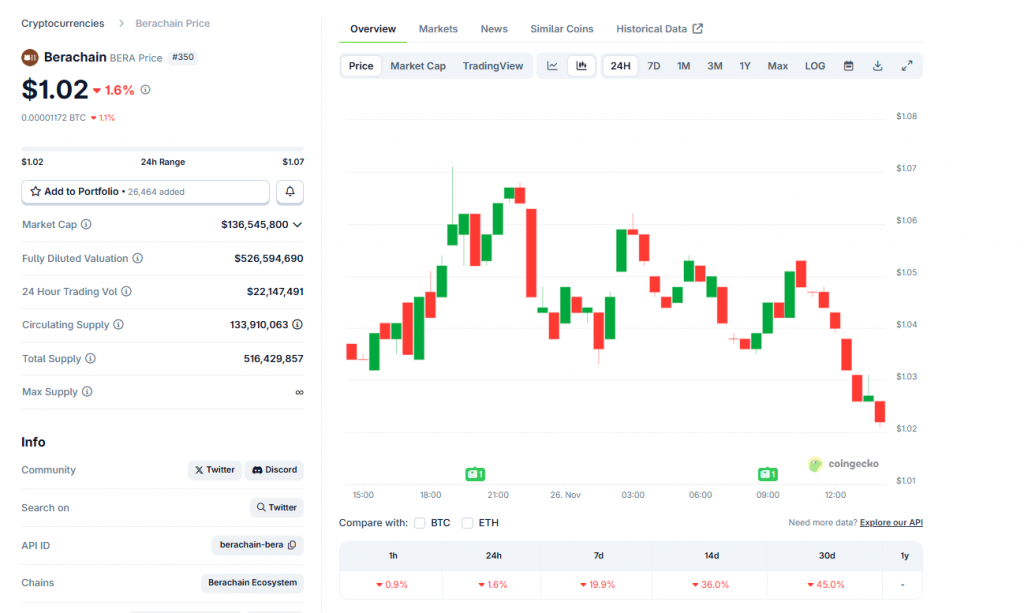

After flying to all-time highs in February 2025, BERA USDT has been dumping laborious. To place it in numbers, BERA crypto is down -92% from all-time highs, and on November 22, it plunged to all-time lows.

Previously month of buying and selling, BERA crypto has sunk -45%, dropping almost -20% within the final week of buying and selling. The downtrend has been punishing HOLDers, however it might worsen if Brevan and Nova have their approach.

(Supply: Coingecko)

DISCOVER: Best New Cryptocurrencies to Invest in 2025

What’s Berachain? What’s Particular About This DeFi-Targeted Undertaking?

Berachain is a layer-1, much like Solana, which hosts among the top meme coins.

It’s also Ethereum-compatible and scalable, aiming to handle among the key challenges DeFi protocols face when deploying on the primary sensible contract platforms: fragmented liquidity, excessive and unpredictable charges, and inefficient capital allocation.

By way of this Proof-of-Liquidity, the platform changed the proof-of-stake system by rewarding customers every time they provide liquidity to DeFi protocols, quite than staking, thereby locking away tokens.

BERA is used for paying fuel charges and staking for PoL validators, however there are different tokens, together with BGT, which is earned everytime you provide liquidity, and HONEY, the native stablecoin backed by different stablecoins like USDC and USDT.

Berachain launched in early February 2025, when the preliminary demand drove BERA to as excessive as $14 earlier than promoting off.

Alongside the way in which, there have been airdrops, together with one in February, throughout which +15.8% of the BERA provide was distributed to testnet customers and lively neighborhood members.

Additionally they rolled out PoL model 2, which enabled BEAR staking with rewards as much as +300%.

On the twenty first day, they stated "Let there be PoL V2". And there was PoL V2. pic.twitter.com/zJIhsiC9NL

— Berachain Basis

(@berachain) July 21, 2025

DISCOVER: 10+ Next Crypto to 100X In 2025

Why Is BERA Crypto Then Falling? Nova Has A Particular Insurance coverage Coverage

First off, when Balancer was hacked in early November, DeFi protocols confronted it tough, and although Berachain didn’t lose funds, like different DeFi tokens, BERA prolonged losses.

Affected secure swimming pools on the BEX have been positioned into emergency withdrawal mode, following greatest steering from the Balancer workforce.

This permits current LPs to securely withdraw their funds, although the swimming pools will not be lively, and deposits will not be enabled. Noting that the Balancer…

— Berachain Basis

(@berachain) November 12, 2025

Nevertheless, for impartial observers eager on how Berachain evolves, the controversy surrounding its traders might break BERA costs.

Yesterday, Unchained’s investigations revealed a facet settlement between Berachain and Nova Digital Grasp Alternatives Fund Restricted, a subsidiary of Brevan Howard Digital, a hedge fund. Brevan participated in Berachain’s Sequence B funding, providing $25M.

(Supply: whosknave, X)

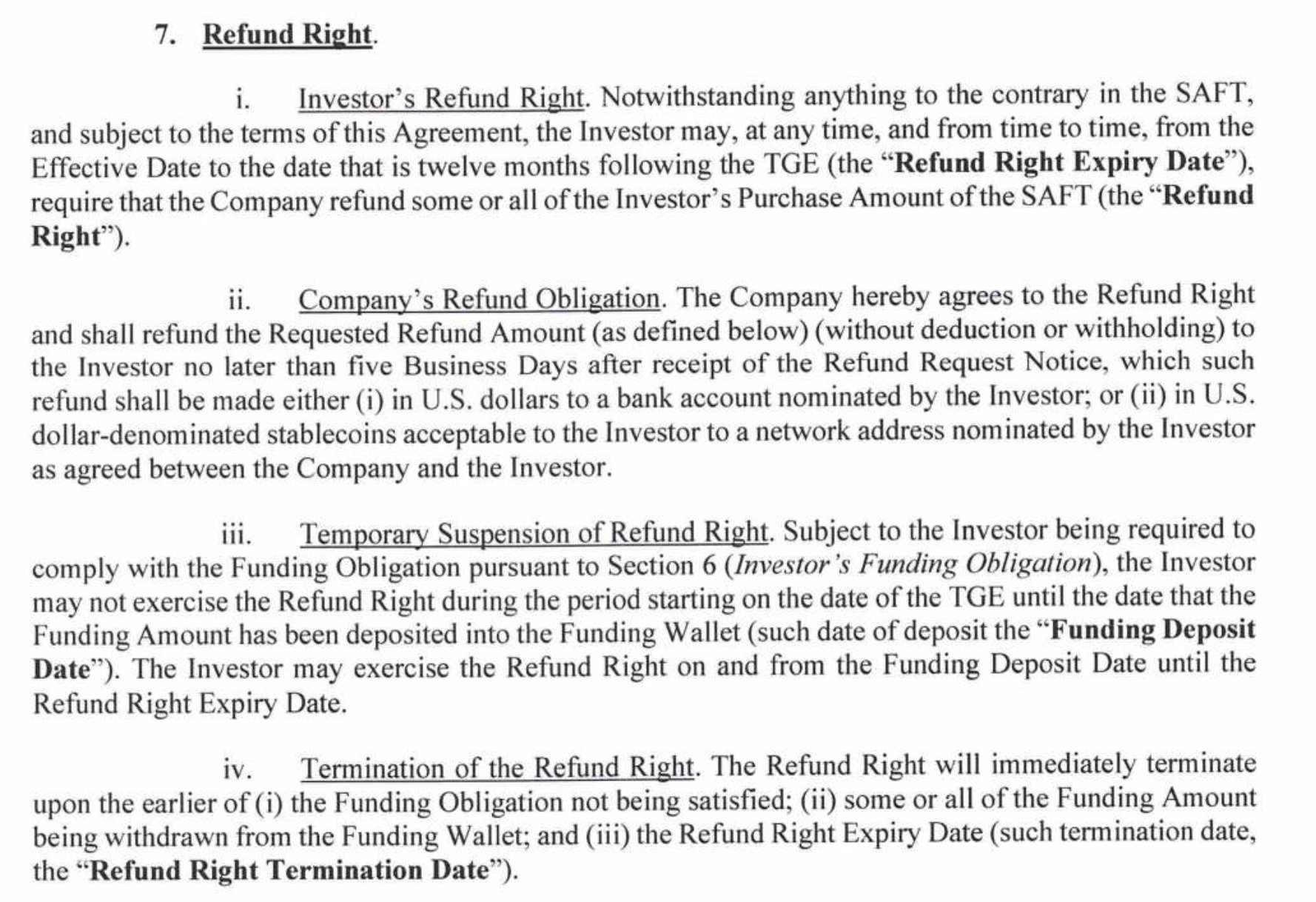

Nevertheless, as a part of the deal, there was a clause signed by Berachain’s lawyer, Jonathan LP, that completely offers Nova the best to demand repayments of some or all its principal in money at any time as much as one yr after the BERA TGE occasion.

The TGE was on February 6, 2025, and till early February 2026, the hedge fund has the best to demand compensation from Berachain as insurance coverage ought to BERA costs proceed ticking decrease. In essence, the clause was Brevan’s and Nova’s insurance coverage in opposition to a value dump, and the one approach they may recoup their funds was if BERA surged, printing larger highs solely.

To set off this refund, Nova needed to deposit $5M into a chosen Berachain pockets by March 8. This fund acted as collateral or a liquidity dedication.

For now, it stays to be seen whether or not the clause was exercised, and if Berachain needed to repay Nova and Brevan in money, it might clarify why BERA USDT has been promoting off steadily after peaking in February.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Berachain VC Troubles: Is This Why BERA Crypto is Down -92%?

- Berachain is DeFi-focused.

- BERA crypto down -92% from all-time highs.

- Nova has a proper to demand a refund from Berachain

- Will BERA USDT proceed falling?

The publish Berachain VC Troubles: Is This Why BERA Crypto Is Down -92%? appeared first on 99Bitcoins.