There are a number of approaches to valuing bitcoin they usually can differ from conventional, institutional asset class valuations. The reason being that bitcoin could be considered a foreign money, a commodity, or a financial fee community — on the identical time. Bitcoin has many various traits which is why many various valuation approaches could be utilized.

From a pure funding perspective, bitcoin has been one of many best-performing “store-of-value” investments of the previous 10+ years, outperforming conventional property like U.S. equities or gold by a really broad margin.

Why Adoption — Together with Institutional Adoption — Will Improve Over Time

With respect to the adoption of bitcoin as a superior financial expertise, there are completely different segments of society that might be formed in numerous methods. Take into consideration the next:

- People

Pervasive shopper value inflation has led to an erosion of buying energy over the previous a long time, particularly because the introduction of the fiat customary in 1971. Shoppers have seen their purchasing power erode, particularly in housing.

As this erosion continues, people who undertake bitcoin as their major retailer of worth will see their purchasing power increase over time, particularly relative to their social circle.

This may encourage others to repeat this conduct to “sustain with the Joneses” (a Schelling Level in behavioral economics).

It’s a focus that people use to information their selections when attempting to foretell what others will do. Bitcoin will function that Schelling Level.

- Asset managers

It’s broadly identified that solely a small portfolio allocation to bitcoin can have already got very vital results on general portfolio efficiency with out a vital improve in portfolio volatility. In different phrases, a small bitcoin allocation can improve risk-adjusted returns of your portfolio, letting asset managers construct extra environment friendly portfolios.

In 2024, bitcoin was by far the best-performing main asset with a return of 121%, outperforming the S&P 500 but additionally the highest hedge funds on the planet.

Actually, bitcoin has been the best-performing main asset since 2011 in all years besides 2014, 2018, and 2022.

The asset managers who added bitcoin to their multi-asset portfolio had been capable of outperform their friends each on an absolute and risk-adjusted foundation. They are going to more than likely win tomorrow’s Morningstar or Lipper Fund awards for outperforming their friends and exhibiting superior efficiency metrics.

Social and financial strain exerted by purchasers and superiors will finally improve for these asset managers who don’t add bitcoin to their multi-asset portfolios.

With a purpose to sustain with those that do, the one viable long-term answer might be so as to add bitcoin to their multi-asset portfolio, resulting in rising institutional adoption over time.

- Firms

The financial motive so as to add bitcoin to company stability sheets is just like that of people: to protect the company money balances in opposition to erosions of buying energy over time, which is suboptimal for its shareholders.

Furthermore, firms might be incentivized economically so as to add bitcoin to their stability sheet, as a result of those that have outperformed their friends by a really broad margin.

Take Metaplanet in Japan, for instance.

Metaplanet and its CEO Simon Gerovich had been comparatively unknown in Japan in the beginning of 2024. With a market capitalization of simply JPY 1.95 billion (USD 14.5 million) in the beginning of 2024, Metaplanet was within the backside 500 Japanese firms on the Topix, which tracks round 2,000 firms listed on the Tokyo Inventory Alternate.

Metaplanet, usually engaged in diversified companies reminiscent of finance, buying and selling and actual property, publicly introduced in early April 2024 that it might undertake a bitcoin customary and purchase BTC because the core asset of its treasury, committing an preliminary funding of 1 billion JPY (roughly 6.5 million USD).

This strategic transfer was impressed by MicroStrategy’s method to bitcoin adoption. The corporate accomplished its first bitcoin buy on April 22, 2024, buying 97.85 BTC for 1 billion JPY.

By the top of October 2024, Metaplanet had develop into the biggest company bitcoin holder in Asia, surpassing rivals reminiscent of Nexon and Meitu.

Because of this, its share value outperformed each single inventory within the Topix and MSCI World in 2024, boasting a whopping +2,629% return.

Metaplanet is now among the many top-5 largest company bitcoin holders on the planet, with over 16,000 BTC on its stability sheet, in line with the newest information from bitcointreasuries.internet.

Metaplanet’s transfer is emblematic of the rising world urge for food for bitcoin as a part of company treasury technique.

What’s extra is that it has very vital implications for different firms:

It’s only a matter of time earlier than not adopting bitcoin may lead to a major drawback for shareholders, as firms that do undertake bitcoin proceed to outperform non-adopters by a large margin.

As with asset managers, there might be rising social and financial strain on company boards and CEOs to undertake a bitcoin customary.

- Sovereigns

Sovereign adoption may need barely completely different mechanics than private-sector adoption of bitcoin however the incentives are, principally, of an financial nature as nicely.

El Salvador declared bitcoin authorized tender in September 2021 and formally adopted a bitcoin customary. It was the very first nation on the planet to announce such a transfer. Since then, the country’s treasury has been buying extra than 6,000 BTC.

Because of this, El Salvador’s credit standing has considerably improved from a composite issuer ranking of CCC+ in July 2021 to B- in line with information supplied by Bloomberg.

The development in credit standing was additionally as a consequence of a major enchancment in vacationer arrivals and general acceleration in GDP development, which had been additionally direct penalties of the transfer to undertake a bitcoin customary: It each fuelled home “animal spirits” and attracted extra worldwide guests.

Nonetheless, this instance goes a good distance in demonstrating the financial advantages, direct and oblique, of adopting a bitcoin customary for nation-states.

Actually, El Salvador’s 1-year sovereign default chance declined considerably from a excessive of round 20% in April 2021 to barely beneath 5% in March 2025, in line with information supplied by Bloomberg.

The decline in sovereign default chances can be usually useful for the nation’s trade price since there’s an inverse relationship between sovereign credit score default swaps and trade charges, particularly in emerging market countries.

To sum up, different sovereign nations will possible be incentivized to undertake bitcoin due to the next causes:

- Bolstering worldwide FX reserves

- Enchancment in fiscal debt scenario

- Decline in sovereign debt default chances

- Enchancment in credit score rankings

- Decline in sovereign yields = enchancment in monetary situations

- FX Stabilization = decline in import value inflation

- Oblique: improve in “animal spirits” and home GDP development

- Long run: enchancment in Web Worldwide Funding Place (IIP)

Social dynamics of Bitcoin adoption

There are a number of behavioral phenomena that would speed up the adoption of bitcoin: community results, the Lindy impact, and the Dunning-Kruger impact.

Community Results

Community results describe the phenomenon in economics the place the usefulness or worth {that a} consumer positive aspects from a services or products will increase with the variety of different customers utilising related items or providers. This impact, additionally known as community externality or demand-side economies of scale, normally ends in a product turning into extra helpful as extra individuals be a part of its community.

There are two sorts of community results: direct and oblique. Direct community results happen when the adoption of a product by numerous customers makes the product extra helpful to every consumer. That is completely different from advantages derived from value reductions as a consequence of elevated adoption. Examples of platforms exhibiting direct community results embrace social media websites like Twitter and Fb, in addition to providers like Airbnb, Uber and LinkedIn, together with telecommunication instruments reminiscent of telephones and prompt messaging providers.

Oblique (or cross-group) community results come up when there are a minimum of two distinct teams of consumers which are interdependent, and the utility for a minimum of one group will increase as the opposite group(s) develop. An instance of that is the elevated worth of {hardware} to shoppers with the provision of extra appropriate software program.

Thus, the unfold of expertise could be considerably influenced by community results, making adoption self-reinforcing.

- Within the context of bitcoin, the community impact implies that, because the Bitcoin community grows bigger, adoption may speed up as the scale of the community may reinforce additional adoption because of the increased utility that comes from utilizing the community.

- Bitcoin’s community results had been firstly mentioned in additional theoretical method by Trace Mayer in June 2015 as he outlined seven kinds of community results that happen within the bitcoin ecosystem: 1) hypothesis, 2) service provider adoption, 3) shopper adoption, 4) safety, 5) developer mindshare, 6) financialization and seven) adoption as a world reserve foreign money.

The Lindy Impact

The Lindy effect means that the long run life expectancy of nonperishable entities, like concepts or applied sciences, is straight proportional to their present age. Because of this the longer one thing has been round, the longer it’s more likely to proceed current. Longevity suggests a decrease chance of turning into out of date or being changed. Originating from observations made at Lindy’s Delicatessen in New York by comedians, the idea has been additional explored by mathematicians and statisticians.

This impact doesn’t apply to perishable entities, like people, whose life expectancy doesn’t improve with age. The Lindy impact is related to objects with out an inherent expiration date, indicating that the chance of a expertise being adopted will increase with its age.

- Within the context of Bitcoin, the Lindy impact implies that the chance that bitcoin will prevail will increase with daily the community has been working efficiently.

The Dunning-Kruger Impact

The Dunning-Kruger impact refers back to the phenomenon the place people with restricted data or ability in a selected space overestimate their competence. This cognitive bias demonstrates a scientific sample of incorrect considering or judgment. Biases are pervasive throughout varied eventualities, and tendencies spotlight particular patterns of thought or conduct noticed amongst teams of people, though not essentially manifested in each motion.

Within the context of expertise adoption, the Dunning-Kruger impact can initially decelerate the adoption course of as individuals may underestimate the capabilities of recent applied sciences and deem them irrelevant. Nevertheless, as people make investments time in understanding the expertise, this impact can finally result in an accelerated adoption price.

- Within the context of Bitcoin, the Dunning-Kruger impact implies that, firstly of the adoption cycle, a excessive quantity of (low-quality) critique and normal aversion might be extra possible than on the finish of the adoption cycle. A excessive quantity of unfounded critique ought to be considered as a sign of an early stage of the cycle.

Quantitative mannequin of Bitcoin adoption

“Persons are impinging on different individuals and adapting to different individuals. What individuals do impacts what different individuals do.” – Thomas Schelling

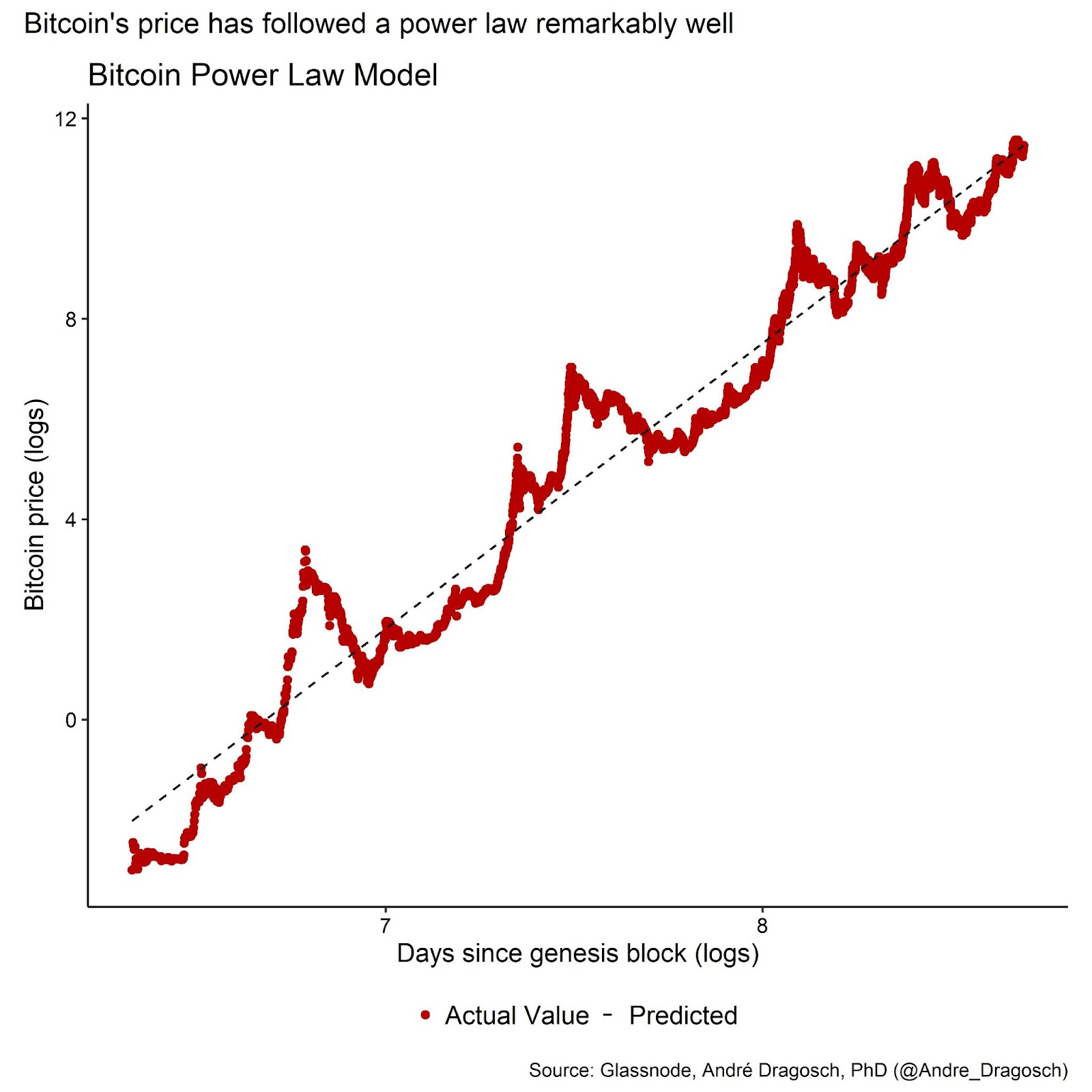

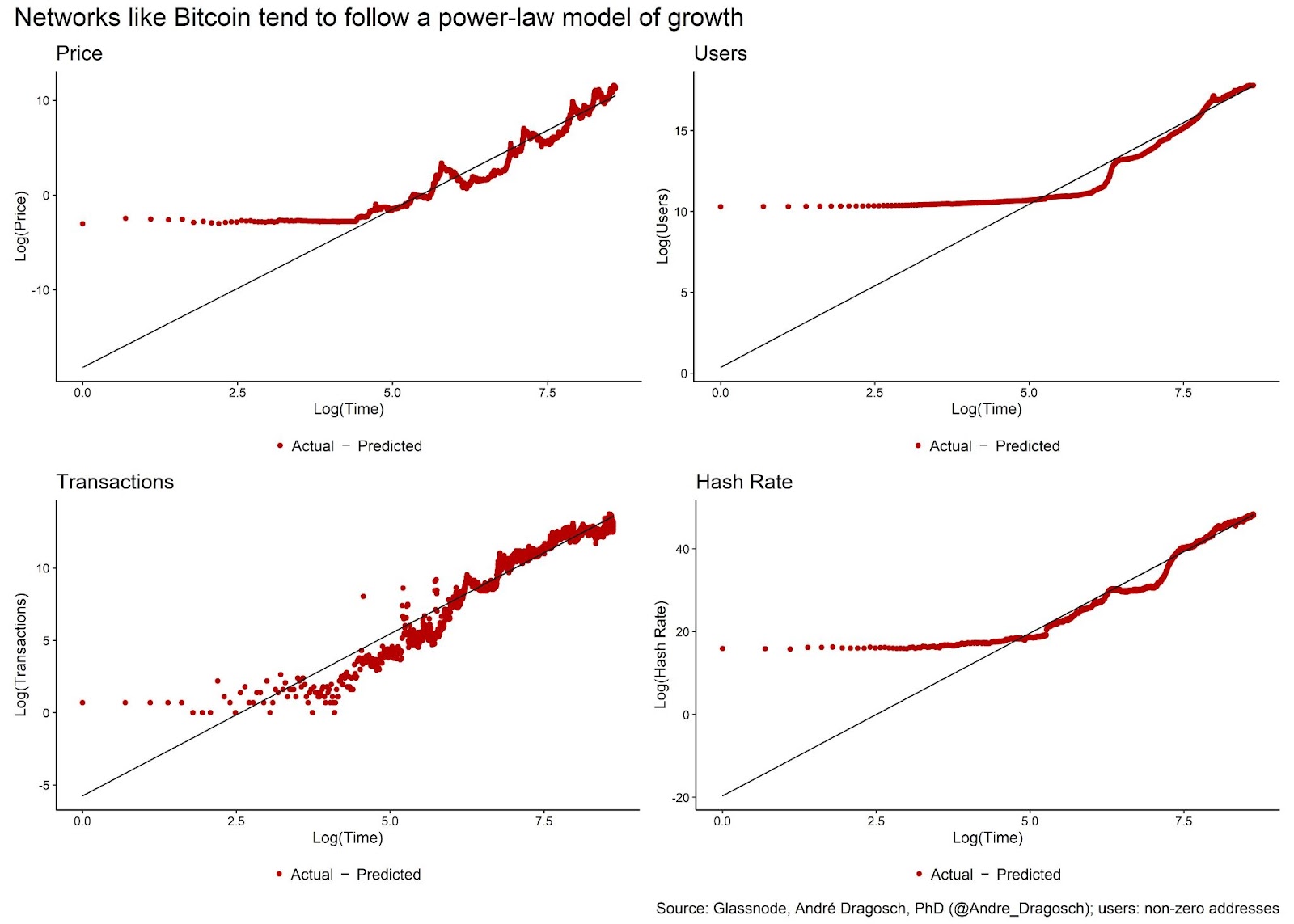

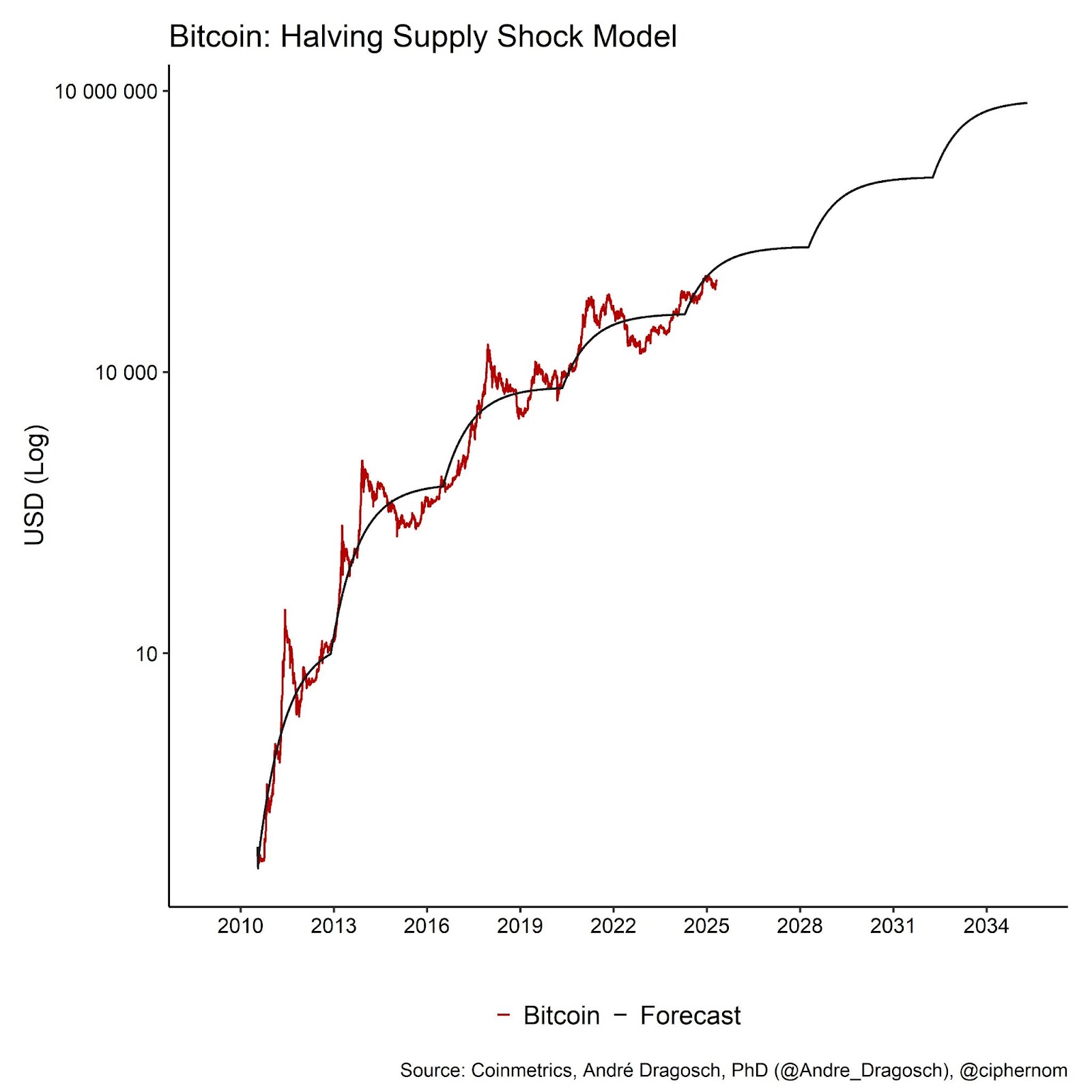

Some researchers have observed that bitcoin’s value efficiency has been following an influence regulation very carefully up to now.

Energy legal guidelines are significantly helpful in explaining phenomena during which minor occurrences happen steadily however main ones are unusual. Listed below are some frequent examples the place energy legal guidelines could be noticed:

Cities

An influence regulation can be utilized to characterize the distribution of metropolis sizes when analyzing the hyperlink between populations and cities. For instance, the variety of small cities and villages is much increased than that of huge cities (not to mention megacities like Tokyo and New York). Nonetheless, a disproportionately massive share of the inhabitants lives in these massive cities. Right here, the facility regulation means that, in line with a selected mathematical relationship, the frequency of cities declines as their dimension grows.

Giant Firms

An influence regulation may also be used to explain how completely different enterprise sizes are distributed inside organizations. There are much more small and medium-sized companies (SMEs) than there are main, world organizations with revenues higher than the GDPs of some nations. An influence regulation distribution is appropriate with the scale distribution of those corporations, which tends to be composed of many smaller firms and fewer massive ones primarily based on elements like market capitalization, variety of workers or income.

Viruses

Energy guidelines can be utilized to elucidate how viruses mutate or how epidemics unfold. The idea is that whereas the vast majority of adjustments might not have a lot of an impact, a small quantity may drastically change the conduct of the virus — making it extra virulent or transmissible, for instance. An influence regulation may also be used to explain the distribution of outbreak sizes, with most outbreaks being tiny, localized episodes, however a small quantity having the potential to broaden into broad pandemics that affect tens of millions of individuals.

There has certainly been some analysis that means that the adoption of bitcoin as a financial expertise was spreading “like a virus.”

Usually, the propagation of a virus tends to comply with an influence regulation depending on time handed because the first an infection.

Actually, a better have a look at the value evolution of bitcoin reveals that the log of value has been rising linearly with the log of time as expressed by way of days because the Genesis block (January 3, 2009).

What’s extra is that each the variety of energetic addresses/customers in addition to the hashrate of the Bitcoin community additionally adhere to this energy regulation as proven within the following charts:

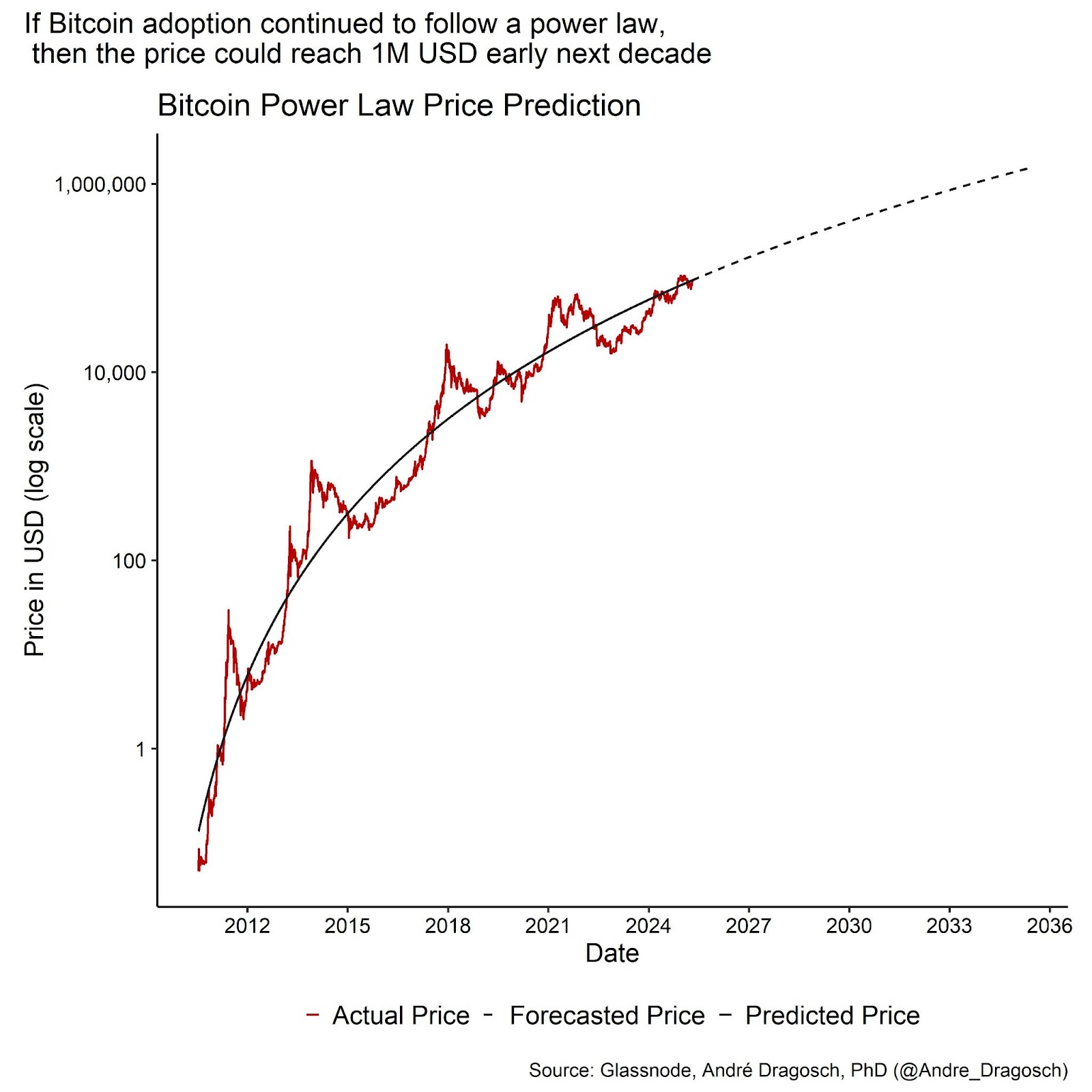

If we assume that bitcoin adoption would proceed to comply with such an influence regulation sooner or later, the following chart means that the value may attain $1 million per bitcoin over the following 10 years.

The implication of bitcoin following an influence regulation can be that returns will decline marginally over time with elevated adoption; finally, the adoption is “saturated.”

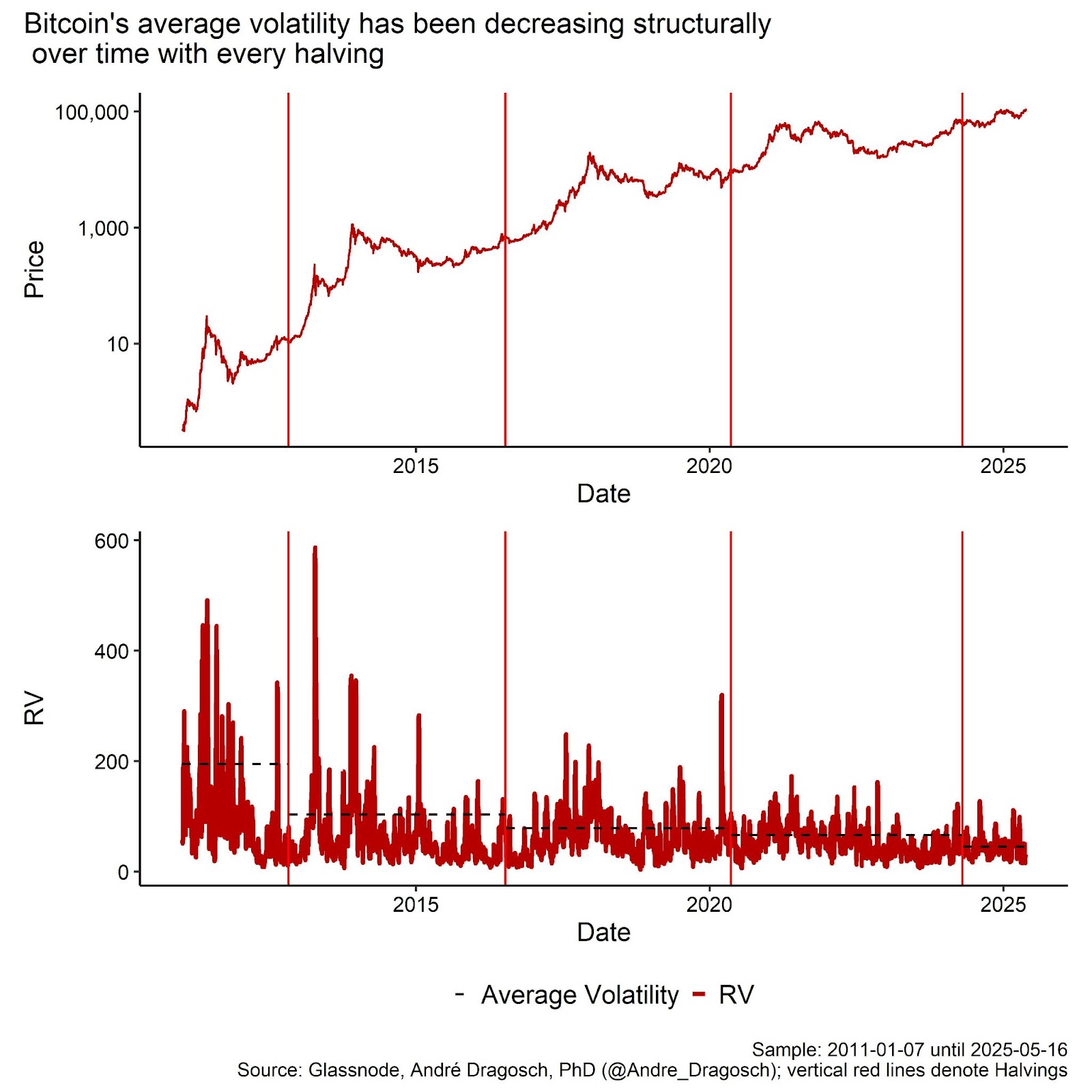

On a optimistic notice, this additionally implies that threat/volatility will have a tendency to say no over the long run.

Rising Institutional Adoption and the Fractal Market Speculation: A Case for Decrease Volatility

With rising adoption, it’s fairly possible that bitcoin’s threat and volatility may also decline structurally over time.

The reason being that as market contributors develop into extra heterogeneous over time, rising dissent amongst consumers and sellers is certain to have a stabilizing impact on market costs and volatility.

Think about a high-frequency dealer who may promote a place on account of a short-term buying and selling sign. In distinction, a longer-term buy-and-hold pension fund may see a short-term decline in value as a longer-term shopping for alternative; heterogeneity amongst buyers has stabilized the value.

In distinction, market instability normally happens in environments with rising consensus and homogeneity amongst buyers, e.g., many buyers promoting on the identical time on account of the identical sort of info can create value gaps/spikes.

That is additionally the logic of the so-called Fractal Market Hypothesis (FMH) put forth by Edgar Peters, usually thought of an antithesis to the dominant Efficient Market Hypothesis. The FMH assumes buyers to be heterogeneous, to have imperfect info and in addition completely different funding horizons.

With respect to bitcoin, rising heterogeneity by means of wider adoption additionally implies structurally decrease volatility over time.

The next chart reveals bitcoin’s value efficiency (higher panel) and its realized volatility (decrease panel) over time. The horizontal strains symbolize the dates of the Bitcoin Halvings.

As one can see, bitcoin’s volatility has been lowering structurally with each Halving.

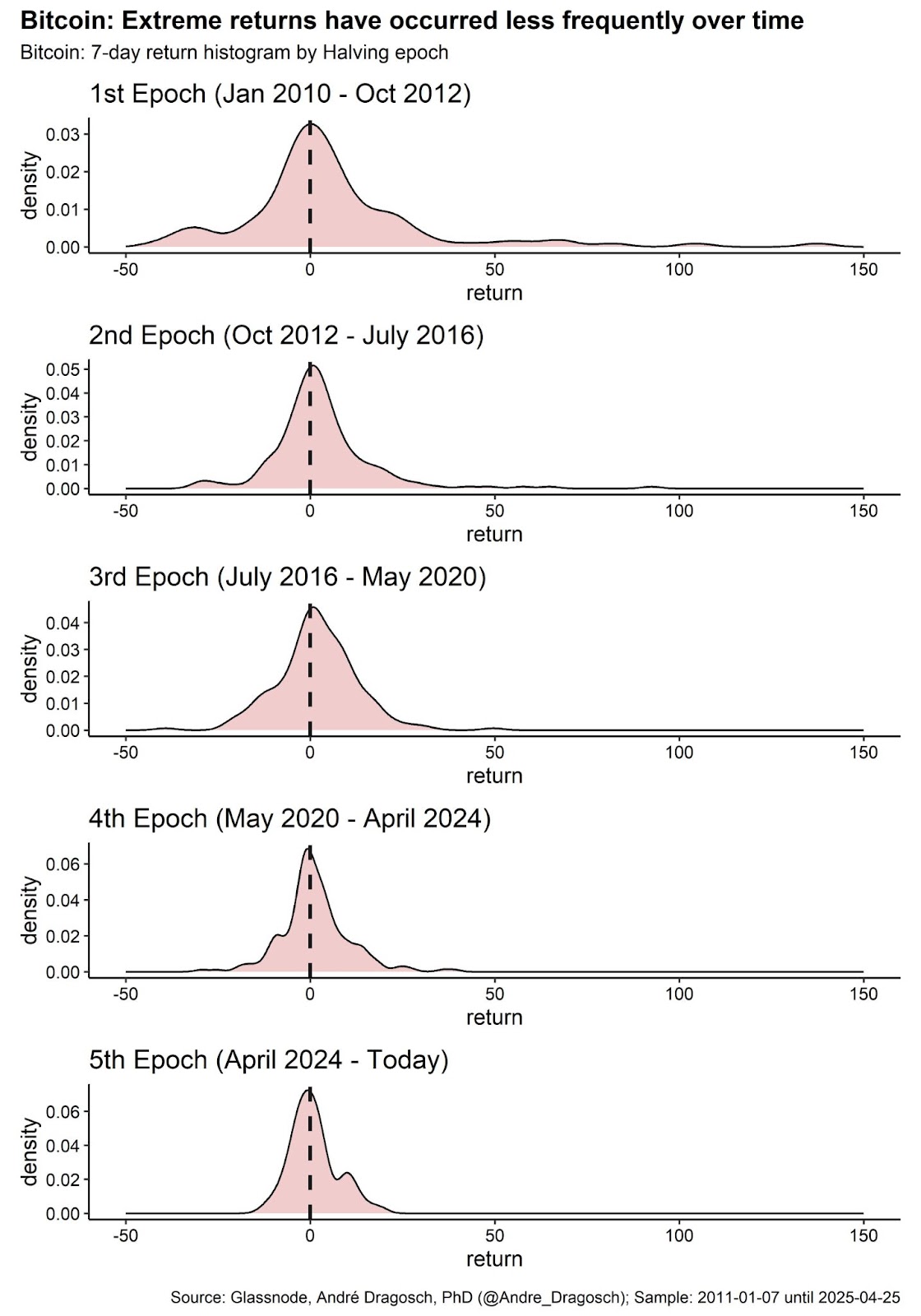

Furthermore, not solely has volatility decreased but additionally the incidence of utmost returns, each unfavorable and optimistic, has declined considerably with each Halving. In statistician’s parlance: The return distribution has develop into much less leptokurtic. That is proven within the following chart (every panel represents a single bitcoin epoch):

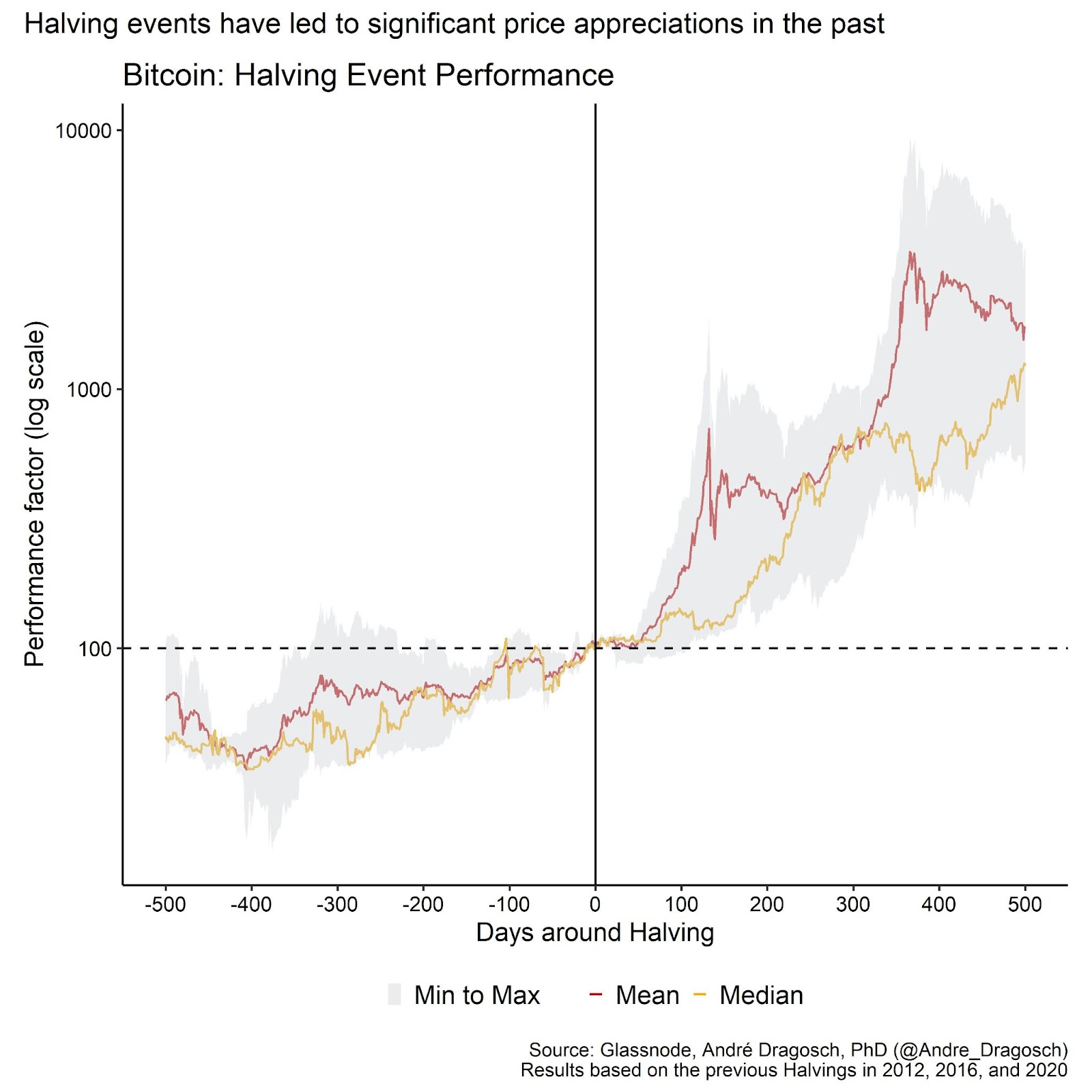

Bitcoin Halvings, which had been normally adopted by vital value appreciation up to now, may also be a major driver of adoption itself as adoption normally lags will increase in value.

The optimistic funding implication is that the danger traits of bitcoin will proceed to alter over time.

As adoption rises, bitcoin will possible evolve from a dangerous asset with excessive volatility to a safe-haven asset with low volatility.

The impact of these Halvings on bitcoin’s value efficiency might be analyzed within the following chapter.

Who Owns All of the Bitcoin?

So far as an in depth breakdown of the holders is anxious, though the Bitcoin blockchain is very clear, the semi-anonymous nature doesn’t enable for a direct identification of holders.

Moreover, the evaluation of holders is difficult by the truth that

- a single entity can management a number of pockets addresses (e.g., massive single holders)

- a number of entities could be behind a single pockets tackle (e.g., trade wallets)

Nonetheless, some firms have specialised in so-called “tackle tagging” and have created a separate database of identified bitcoin pockets addresses.

Moreover, skilled on-chain information suppliers like Glassnode present aggregations of information, e.g., for the variety of bitcoins held/managed by exchanges, miners or ETPs.

There are additionally different databases such because the one maintained on bitcointreasuries.internet which have compiled bitcoin holdings of firms, governments, ETPs and different entities primarily based on group entries and publicly accessible info. Though these information are usually incomplete and ought to be taken with a grain of salt, they supply the very best overview of approximate bitcoin holdings of the completely different teams.

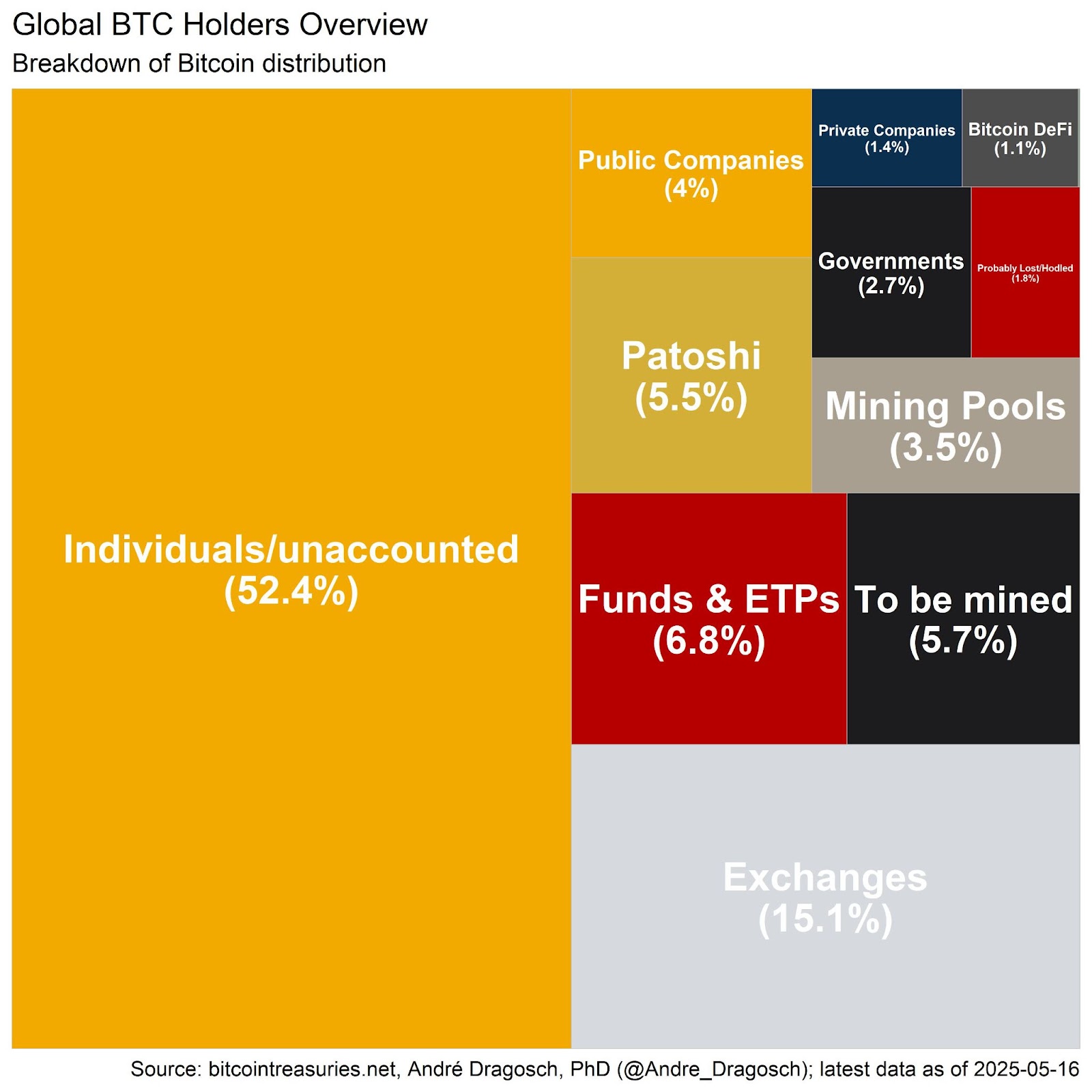

In response to the newest information, many of the bitcoin provide nonetheless stays unidentified. The belief is that these unidentified holdings are principally managed by people (52.4%).

The second-largest group of holders are exchanges like Coinbase or Binance who management round 15.1% of the availability of bitcoin. However behind these holdings are tens of millions of people (and companies) who’re the final word homeowners of these bitcoin. A rising group of holders lately have been funds and ETPs in addition to public firms (6.8% and 4.0%, respectively).

The so-called “Patoshi” holdings seek advice from the bitcoin holdings in wallets managed by the creator of Bitcoin — Satoshi Nakamoto. Nakamoto’s bitcoin initially got here from early mining efforts, which is why these holdings are sometimes aggregated with general miner holdings. They nonetheless symbolize a big a part of the prevailing bitcoin provide (5.5%) however specialists usually assume these holdings to be misplaced since they’ve by no means been moved. Most likely misplaced cash (1.8%) are additionally these bitcoin holdings which have usually been idle for greater than 10 years.

Though governments are nonetheless among the many smallest group of bitcoin holders (2.7%), it’s broadly anticipated that authorities entities, together with central banks and sovereign wealth funds, will improve their relative share of bitcoin’s provide over the approaching years, led by efforts by the U.S. authorities and others to ascertain strategic bitcoin reserves.

Modelling Bitcoin’s rising shortage over time

“The rationale that Bitcoin is magical is as a result of there’s solely 21 million. […] Bitcoin is a shortage. […] A shortage is one thing of which it’s completely capped” – Michael Saylor

The Bitcoin Halving stands out as essentially the most eagerly awaited incidence in cryptocurrency markets.

This occasion halves the block subsidy, which means the reward that miners get for securing the blockchain by discovering a legitimate nonce. Consequently, this results in a 50% discount within the price of recent bitcoin creation.

The Halving is a vital facet of Bitcoin’s design, selling a gradual lower within the price of recent provide and guaranteeing that the full variety of bitcoin won’t exceed 21 million. The Halving is hard-coded into the Bitcoin algorithm to happen each 210,000 blocks (round each 4 years).

As of this writing, the following Halving is anticipated to occur round March 2028. This upcoming occasion will see the block reward diminish additional to 1.5625 BTC, resulting in a every day output drop from roughly 450 BTC to about 225 BTC.

The Halving occasion is actually a supply shock to the system.

Ought to demand for bitcoin keep regular, the lower in bitcoin provide is predicted to push up its equilibrium value — the value should rise to stability the diminished provide.

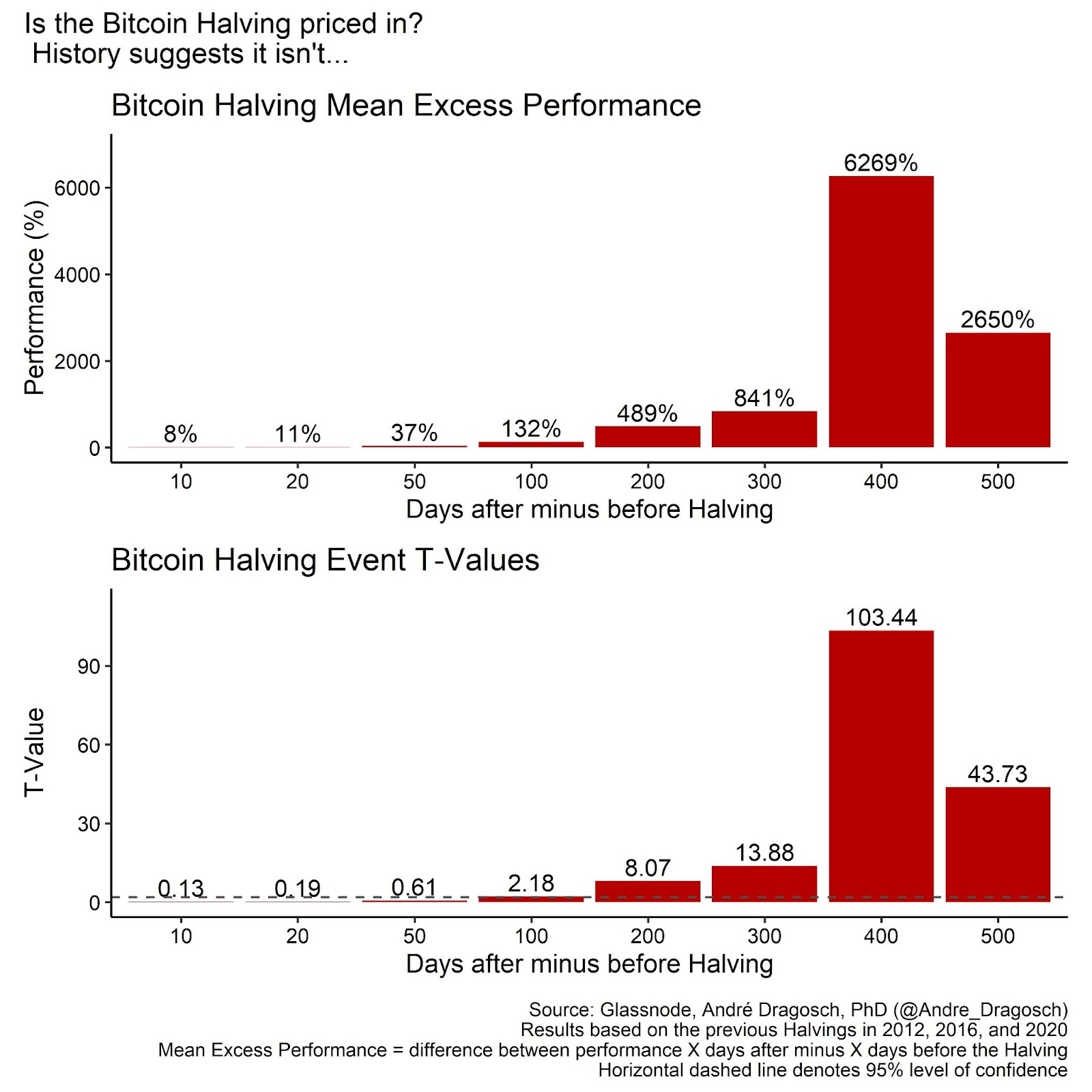

Historic precedents present that bitcoin’s value surged considerably within the months following previous Halvings. On common, bitcoin’s worth elevated roughly 17 occasions, or 1,800%, 500 days after the Halving, primarily based on the Halvings in 2012, 2016 and 2020.

Though customary theories of capital market pricing and knowledge concept counsel that this occasion ought to already be priced in, empirical findings point out that the very vital value efficiency that adopted the Halvings is unlikely to be random phenomena.

The reason being that post-Halving performances are considerably increased than pre-Halving performances.

General, it’s fairly possible that costs will pattern towards the next equilibrium worth within the years following 2024, influenced by the Halving’s optimistic affect and the following improve in shortage.

In response to my projections, bitcoin’s equilibrium value might rise to $172,000 by the top of 2025, and doubtlessly hit $215,000 by the fruits of the following cycle in 2028.

The evaluation right here additional means that the affect of the Halving will unfold progressively, as the availability shortfall created by the occasion step by step intensifies; it may be inferred that the market has not but absolutely integrated the Bitcoin Halving into its pricing.

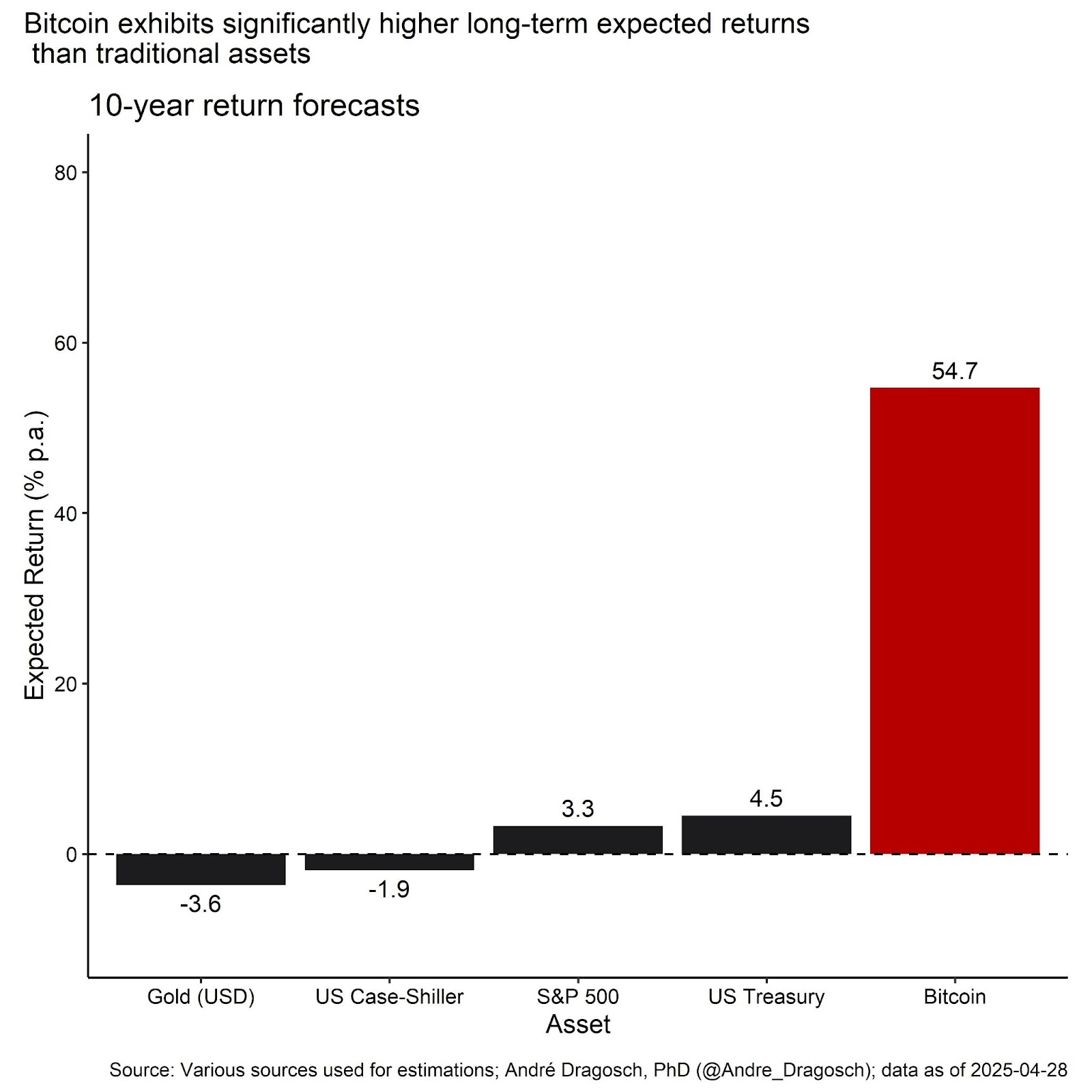

Primarily based on the above-mentioned mannequin for bitcoin’s rising shortage, bitcoin reveals considerably increased long-term anticipated returns than conventional property reminiscent of equities, bonds, gold or actual property:

Within the very long run, one ought to count on bitcoin to dematerialize traditional stores of value like gold and U.S. Treasuries on account of this rising shortage and supremacy as a financial asset.

Gold is more likely to be technologically disrupted as a retailer of worth due to the mix of Bitcoin’s spatial and temporal transferability not relevant to gold.

U.S. Treasuries, which have basically leapfrogged gold as a retailer of worth within the post-Bretton Woods fiat financial system, might be disrupted on account of the possible worsening fiscal scenario of the U.S. (traditionally resulting in monetary repression and loss in the actual worth of Treasuries).

The potential funding implication of such a situation for Bitcoin are huge. Hypothetically talking, if bitcoin disrupted gold as the first retailer of worth and achieved an analogous market cap as gold at present, this might indicate a theoretical value of near $1 million per bitcoin. If bitcoin disrupted U.S. Treasuries as the first retailer of worth and achieved an analogous market cap as at present, this might indicate a theoretical bitcoin value of roughly $1.4 million.

The completely different hypothetical costs are proven within the bar chart beneath.

This isn’t a far-fetched situation. As has been demonstrated beforehand, bitcoin will develop into nearly 10 occasions as scarce as gold by the 12 months 2032 (primarily based on the stock-to-flow ratio) and can proceed to develop into even scarcer over time sooner or later. One ought to count on this rising shortage of bitcoin to go hand in hand with an rising financial premium of bitcoin on the expense of different conventional shops of worth.

Usually, bitcoin will possible proceed to cannibalize the financial premium inherent in different conventional shops of worth, reminiscent of gold or real estate.

Is Bitcoin an Inflation Hedge?

Bitcoin is a scarce digital asset. The algorithm dictates not solely a gradual discount in price-inelastic provide development but additionally an final restrict of its circulating provide that may converge towards 21 million cash in the long term.

Absolutely the shortage of bitcoin, mixed with its disinflationary provide development schedule, makes it a possible candidate as a hedge in opposition to inflation.

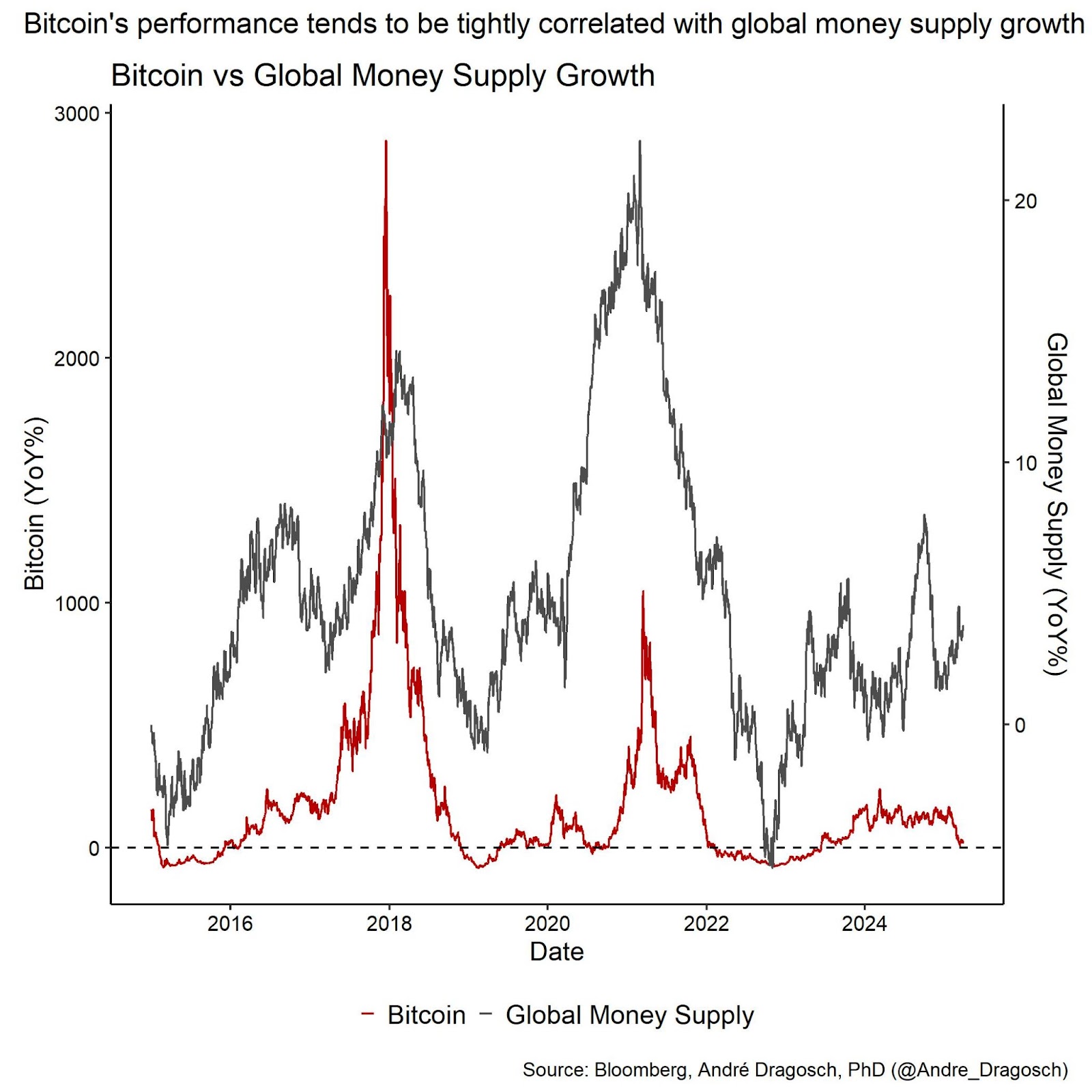

Actually, bitcoin’s efficiency has proven an in depth correlation to world cash provide development, i.e., world financial inflation over time.

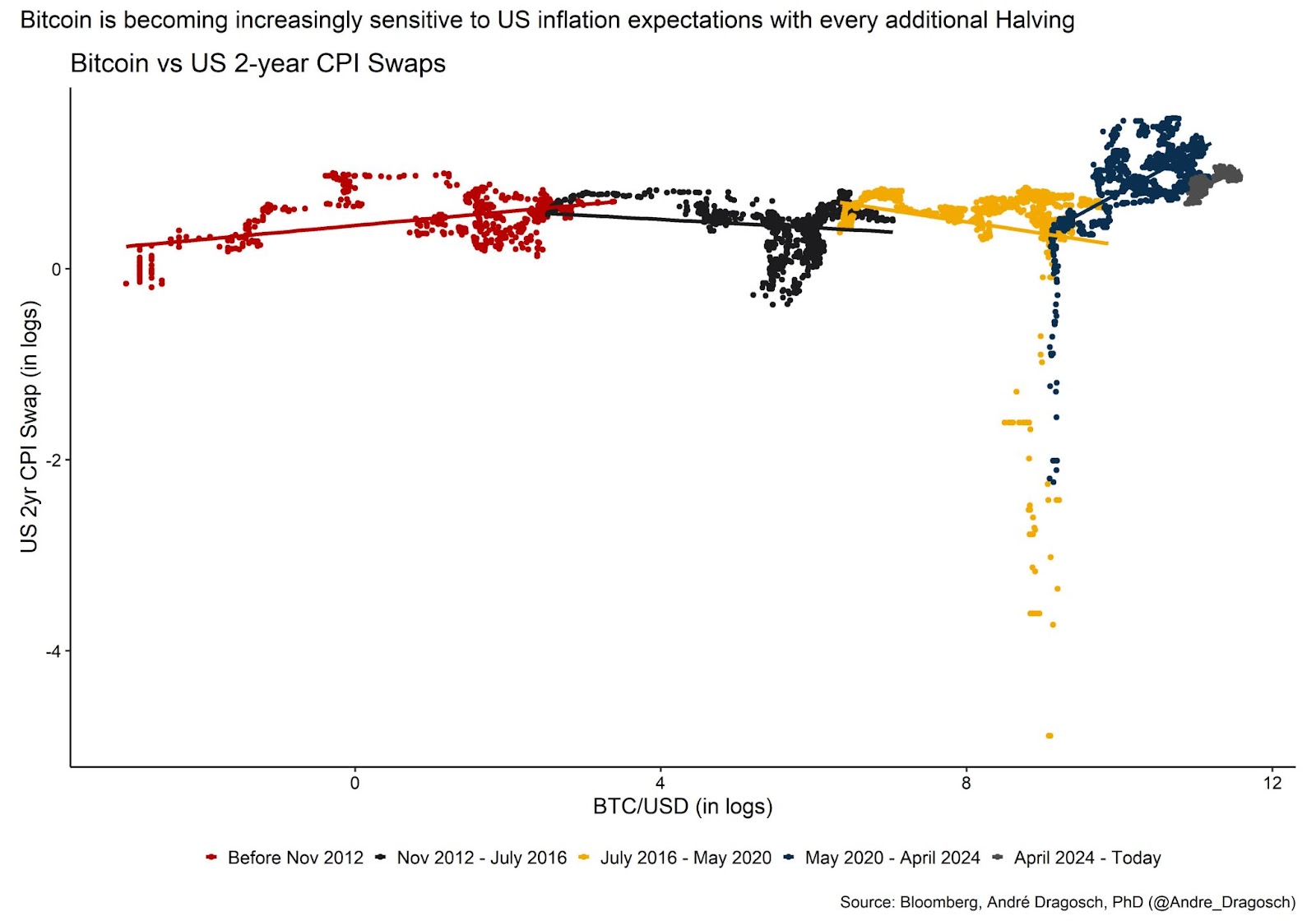

What’s extra is that bitcoin has proven an rising sensitivity to market-based inflation expectations reminiscent of medium-term U.S. CPI swap charges or U.S. TIPS breakeven charges.

On this context, you will need to notice that bitcoin has not at all times proven this shut correlation to inflation expectations: In the course of the earlier epochs of Bitcoin, i.e., from its inception in 2009 till round 2020, bitcoin’s value confirmed little correlation to market-based inflation expectations.

This has considerably modified because the Covid disaster and the ensuing financial and financial stimuli, which additionally coincided with the earlier Halving occasion in Might 2020.

It’s fairly possible that bitcoin’s sensitivity to market-based inflation expectations will improve even additional with an rising provide shortage going ahead.

On this context, easing U.S. financial coverage amid excessive U.S. fiscal deficits and rising inflation expectations may present a further tailwind for bitcoin going ahead.

The reason being that international locations with increased inflation charges are likely to see an elevated adoption of bitcoin as a store of value as well. Usually, international locations with excessive inflation have a tendency to point out increased charges of cryptoasset adoption as nicely. The highest adoption rates are typically noticed in rising markets which are likely to have structurally increased charges of shopper value inflation and cash provide development charges as nicely.

Is Bitcoin a Hedge In opposition to Sovereign Default?

In contrast to a centralized sovereign entity, Bitcoin is a decentralized world community. Transactions could be performed permissionless and should not topic to censorship by a government. This renders property held on the Bitcoin blockchain basically unconfiscatable and freed from counterparty threat. The fiscal scenario of main developed international locations just like the U.S. or U.Okay. has come underneath extra scrutiny lately as debt-to-GDP ratios proceed to be excessive whereas curiosity bills are rising quickly on account of the current tightening in financial coverage by the Fed and different main central banks.

So far as the U.S. is anxious, annualized curiosity bills have lately surpassed $1 trillion, which is greater than the annual navy spending or the expenditures associated to Medicaid. The Congressional Budget Office forecasts that (gross) curiosity expenditures will possible attain $3 trillion a 12 months by the top of this decade, whereas the annual funds deficit will proceed to widen. So, the chance of a sovereign default is probably going going to extend.

Central banks have lately admitted that even U.S. Treasuries, as soon as considered the final word safe-haven asset and foundation of the worldwide monetary system, should not as secure anymore as they was once. On this context, bitcoin could be considered as a gorgeous hedge in opposition to a possible sovereign default as a censorship-resistant and permissionless asset, freed from counterparty threat.

A modelling method on this regard was additionally put forth by Greg Foss. The overall thought is that bitcoin may act as a hedge in opposition to a basket of main sovereigns’ debt/bonds. Theoretically talking, if this had been the case, bitcoin’s market cap ought to be equal to the present market worth of this basket of sovereign debt multiplied by the weighted chance of default. In case of a cross default of all sovereign debt throughout the basket (100% default chance), bitcoin’s market cap ought to attain the identical stage because the market worth of sovereigns it tries to hedge in opposition to.

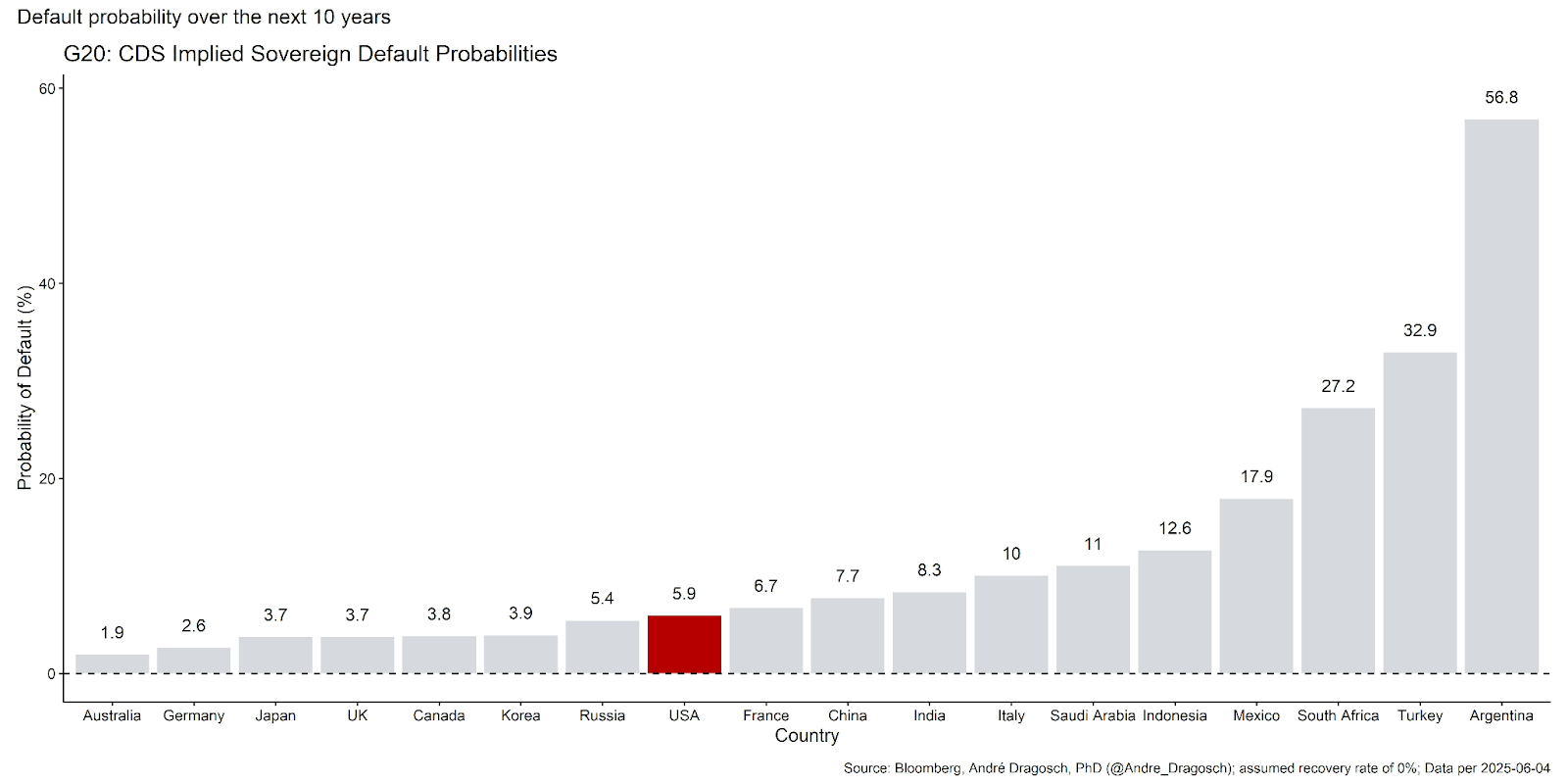

The next chart reveals the G20 sovereign’s default chance implied by their 10-year CDS spreads.

As an example, the market costs a default chance of round 5.0% for the U.S. over the following 10 years. (We assume a 0% restoration price, which tends to result in much more conservative estimates in our case.) If we multiply these chances by their respective market values of home and worldwide sovereign debt, we get the theoretical market worth of sovereign debt that’s “in danger” and for which bitcoin may function a hedge. After dividing this market worth by the variety of bitcoins in circulation you arrive on the “truthful worth” for a single bitcoin primarily based on this mannequin. Primarily based on this method, the present “truthful worth” of bitcoin can be round 232,000 USD per coin if it had been to hedge the implied market worth of G20 sovereign debt that’s in danger.

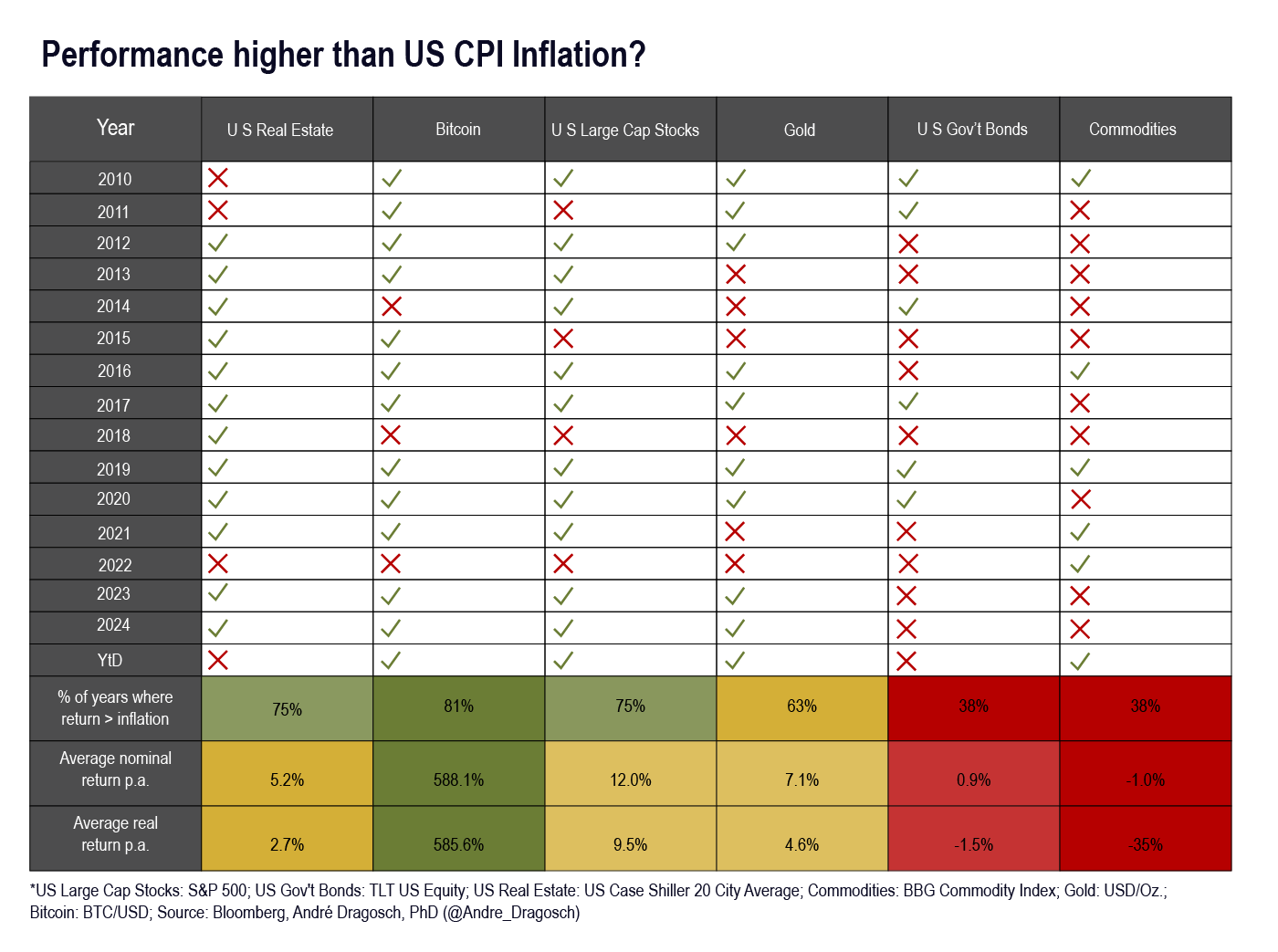

So far as the query whether or not bitcoin is an inflation hedge is anxious, it’s price taking a look at bitcoin’s efficiency in opposition to inflation relative to different main asset courses.

The thought behind this evaluation is to test whether or not bitcoin may protect buying energy and generate a optimistic actual/inflation-adjusted return in any given 12 months.

Actually, the desk beneath not solely reveals that bitcoin exhibited the very best common actual return since 2010 but additionally that bitcoin managed to outperform U.S. CPI inflation in additional than 80% of the years thought of.

Each U.S. actual property and U.S. large-cap equities (S&P 500) may equally beat U.S. inflation, though with considerably decrease nominal and actual returns.

In distinction, each U.S. authorities bonds and general commodities (BBG Commodity Index) have traditionally been dangerous at preserving buying energy. Gold seems to be an exception amongst commodities however its return can be not phenomenal.

Is the 4-year Bitcoin cycle “useless”?

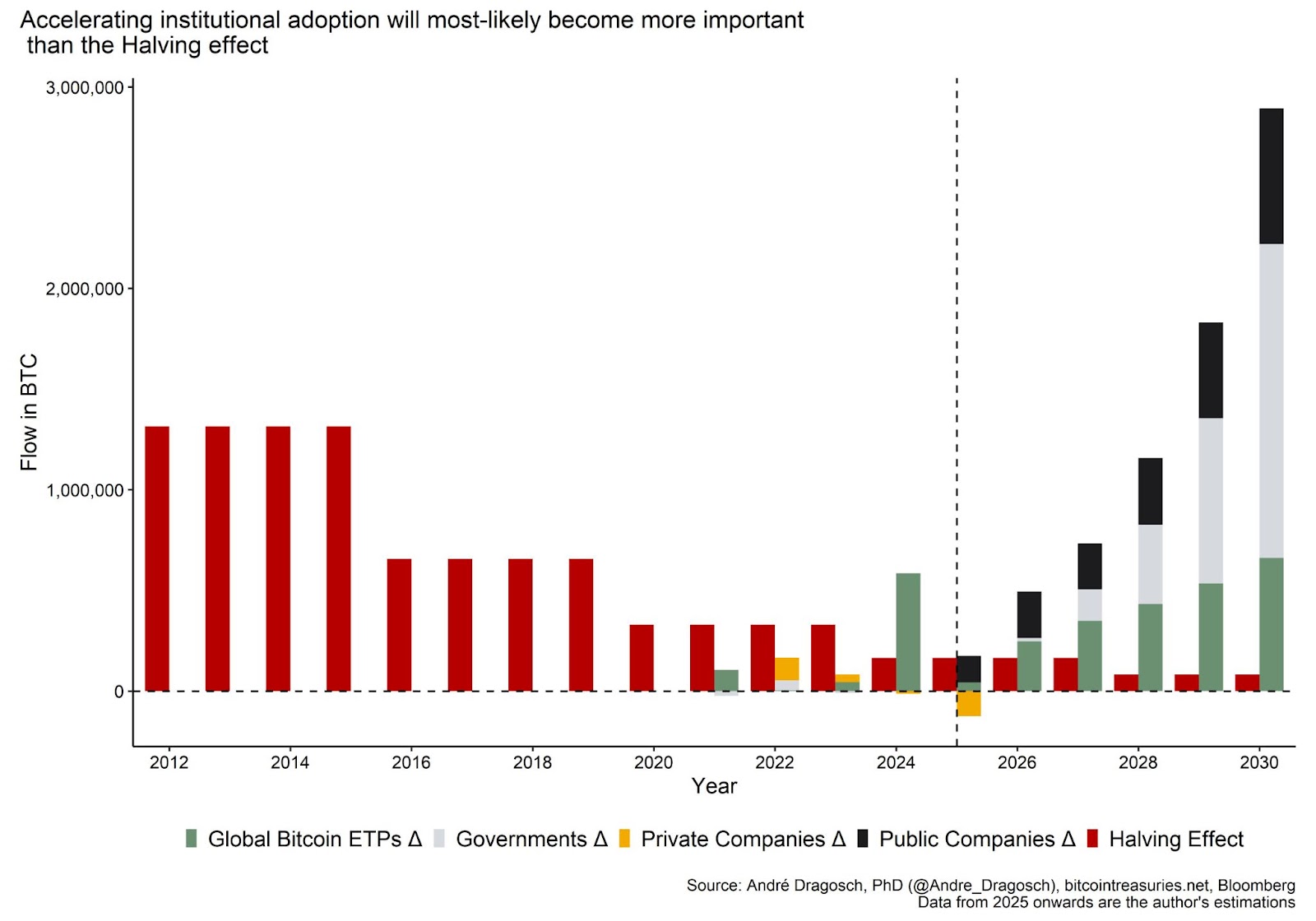

Some market observers have began to problem the historic sample of bitcoin to rally within the years across the Halving — which occurred in 2012, 2016, 2020, and 2024 thus far.

The reason being that the availability deficit induced by the Halving has develop into smaller over time in relation to the prevailing provide of bitcoin in circulation.

As an example, whereas the primary Halving in 2012 induced a provide deficit of 25 BTC per block each ~10 minutes (roughly 12.5% of the availability per 12 months), the newest Halving in 2024 has solely induced a provide deficit of three.125 BTC per block (roughly 0.83% of provide per 12 months).

This decline within the Halving impact is commonly seen as a purpose why bitcoin has been exhibiting diminishing returns with every new subsequent Halving cycle:

Nevertheless, the view that bitcoin will proceed to exhibit diminishing returns sooner or later is more and more being challenged.

The important thing purpose is that adoption seems to be accelerating globally and demand elements have gotten more and more extra vital than provide elements.

Actually, 2024 was the primary 12 months in bitcoin’s historical past the place demand from world bitcoin ETPs and different institutional sources have outweighed the Halving impact and this pattern is probably going going to proceed, particularly in the event you assume that institutional adoption by ETPs, firms and governments begins to develop exponentially — the idea underlying the mannequin of technological adoption by Rogers.

Such a situation would significantly problem the idea that bitcoin will proceed to stick to the 4-year cycle and in addition exhibit diminishing returns sooner or later.

Some fashions, just like the one offered by Rudd and Porter, have tried to estimate this exponential development trajectory as nicely. Their mannequin estimations conclude that bitcoin may already attain $1M per coin by January 2027 because of the vital improve in demand through elements like institutional and nation-state adoption.

This expectation additionally underpins the core speculation of this e-book: that bitcoin sits on the intersection of absolute shortage of provide and exponential demand development.

…therefore, the title of the e-book: Exponential Gold.

This view truly implies that common returns in every cycle ought to improve over the approaching years, particularly on account of the rising provide shortage on bitcoin exchanges. In response to the newest estimates by Glassnode, solely round 3 million bitcoin stay on exchanges (15.2% of the circulating provide).

It additionally implies that macro elements that affect demand reminiscent of world development expectations, cross-asset threat urge for food and financial coverage will develop into extra vital for bitcoin’s market cycles over time.

As belief within the established programs erode, trustless onerous property have develop into favorable once more. It’s no shock that each gold and bitcoin have been the best-performing property in 2024, and certain to repeat this feat in 2025.

Main firms are additionally establishing bitcoin as a corporate treasury asset with a view to mitigate the fixed erosion of buying energy of their money holdings, and maximize worth for his or her shareholders.

It’s fairly possible that we’re already at an inflection level with respect to world bitcoin adoption, as adoption development begins to speed up as soon as it crosses the chasm from the “early adopters” to the “early majority.”

André Dragosh is the top of analysis for Bitwise in Europe. He holds a Ph.D in monetary historical past from the College of Southampton. That is an extract from his e-book Exponential Gold: An Institutional Investor’s Guide to Bitcoin & Cryptoassets, self-published with help from the European e-book writer Konsensus Network on June 3, 2025. It’s re-published right here with the writer’s permission. (Full disclosure: Joakim Book edited the e-book and was remunerated for his providers by Konsensus.)