Bitcoin Value Weekly Outlook

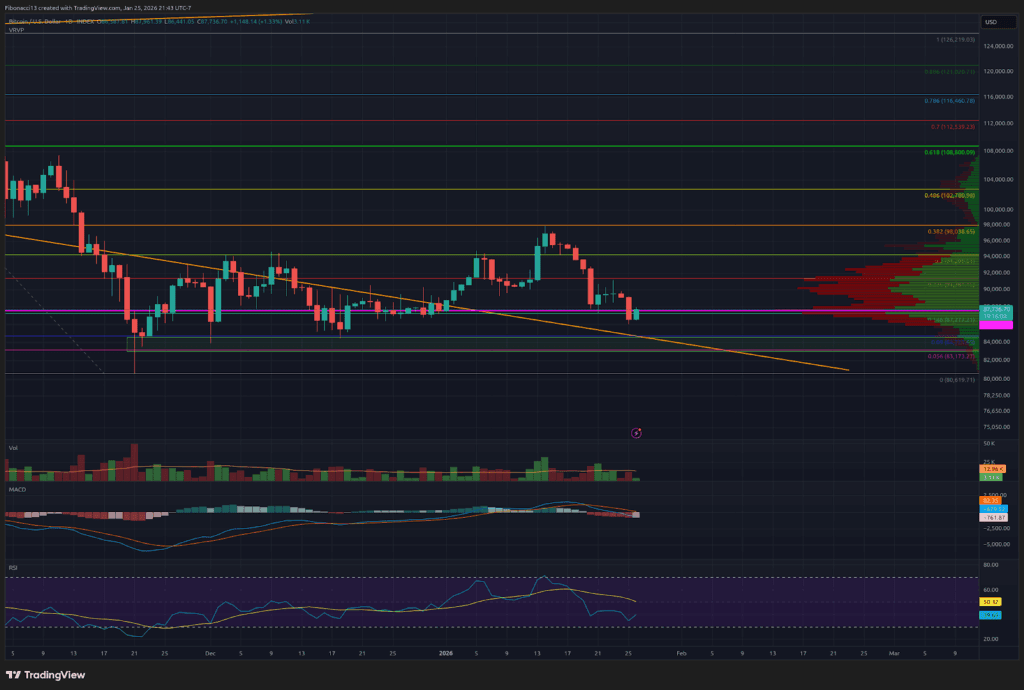

What a disastrous weekly shut for Bitcoin, that about sums it up. After tapping $98,000 resistance the week prior, the bitcoin worth simply went straight down final week to shut close to the lows at $86,588. The bulls have been corralled again into their pens and can want a whole lot of assist to interrupt out as soon as once more. The bears will look to proceed their momentum into this week to interrupt down the $84,000 assist stage as soon as and for all, and take the value all the way down to the low $70,000 space. Bulls should defend $84,000 like by no means earlier than to keep away from a breakdown this week.

Key Assist and Resistance Ranges Now

The bears are again on the town. $87,000 assist has been misplaced, and $84,000 might not maintain one other take a look at. If the bears can handle to get a each day shut or two beneath $84,000, the value ought to speed up all the way down to the $72,000 to $68,000 assist zone. We doubtless see a bounce from down there, but when it will definitely provides wa,y we are going to look to the 0.618 Fibonacci retracement stage at $58,000.

After grinding above a number of resistance ranges not too long ago, the bulls are again the place they began. Bulls should reclaim $88,000 initially. From there, they’ll look to get above $91,400, then $94,000 as soon as once more. $98,000 has confirmed itself as robust resistance above right here. Within the unlikely occasion the bulls can push above $98,000, it ought to be a gradual go as much as $103,500.

Outlook For This Week

This week is make-or-break for the bulls. Failure to defend $84,000 this week will doubtless ship the value all the way down to new lows. There’s a massive slate of massive firms reporting earnings this week, so if the outcomes are very robust, it may assist buoy the bitcoin worth to maintain main assist ranges. Though correlations to shares have been weak currently, there are not any ensures that bitcoin will profit from any upward market motion. Odds are within the bears’ favor for a breakdown this week.

Market temper: Bearish – The bulls confirmed some energy within the prior week for a slight benefit, however the bears took full management final week, driving the value proper again all the way down to the lows.

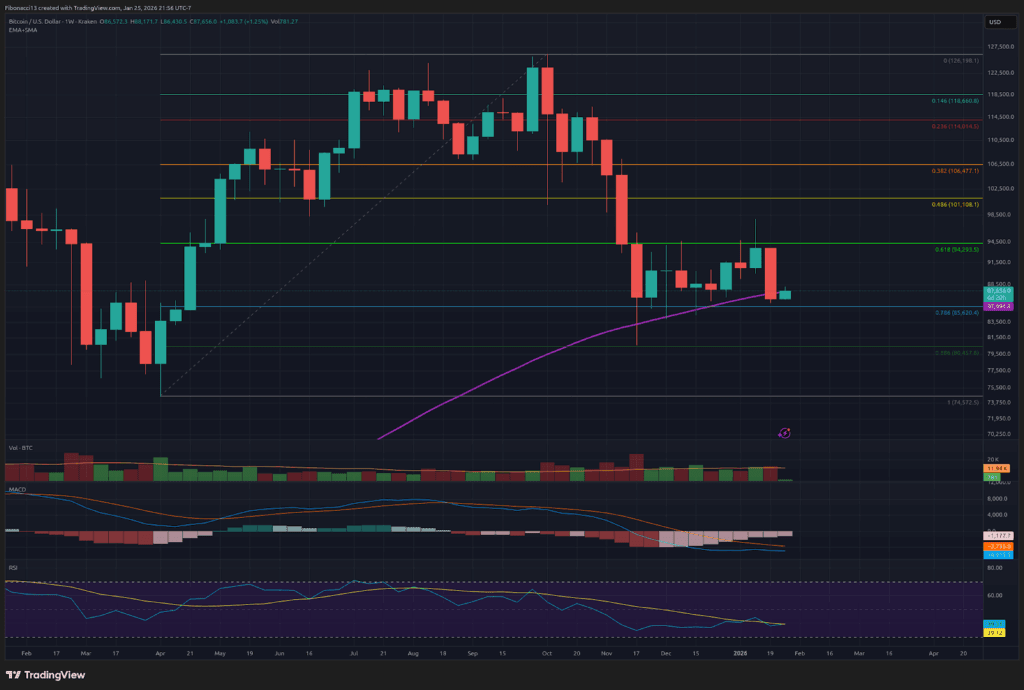

The following few weeks

The weekly chart was on the lookout for a bounce not too long ago, and it received one. The worth motion this previous week, nonetheless, has put in a robust indication that this bounce could also be over and new lows could also be on the horizon as the value closed beneath the 100-week SMA. The MACD oscillator is firmly in bearish territory, and whereas it seemed like it might see a bullish cross final week, the bears got here out in drive and prevented that bullish cross from going down. The relative energy index has crossed again down beneath the 13 SMA and sits in a bearish posture as soon as once more.

Terminology Information

Bulls/Bullish: Consumers or traders anticipating the value to go larger.

Bears/Bearish: Sellers or traders anticipating the value to go decrease.

Assist or assist stage: A stage at which the value ought to maintain for the asset, not less than initially. The extra touches on assist, the weaker it will get and the extra doubtless it’s to fail to carry the value.

Resistance or resistance stage: Reverse of assist. The extent that’s more likely to reject the value, not less than initially. The extra touches at resistance, the weaker it will get and the extra doubtless it’s to fail to carry again the value.

SMA: Easy Shifting Common. Common worth based mostly on closing costs over the required interval. Within the case of RSI, it’s the common energy index worth over the required interval.

Oscillators: Technical indicators that change over time, however usually stay inside a band between set ranges. Thus, they oscillate between a low stage (usually representing oversold situations) and a excessive stage (usually representing overbought situations). E.G., Relative Energy Index (RSI) and Shifting Common Convergence-Divergence (MACD).

RSI Oscillator: The Relative Energy Index is a momentum oscillator that strikes between 0 and 100. It measures the pace of the value and modifications within the pace of the value actions. When RSI is over 70, it’s thought-about to be overbought. When RSI is beneath 30, it’s thought-about to be oversold.

MACD Oscillator: Shifting Common Convergence-Divergence is a momentum oscillator that subtracts the distinction between 2 transferring averages to point pattern in addition to momentum.

Fibonacci Retracements and Extensions: Ratios based mostly on what is called the golden ratio, a common ratio pertaining to development and decay cycles in nature. The golden ratio is predicated on the constants Phi (1.618) and phi (0.618).