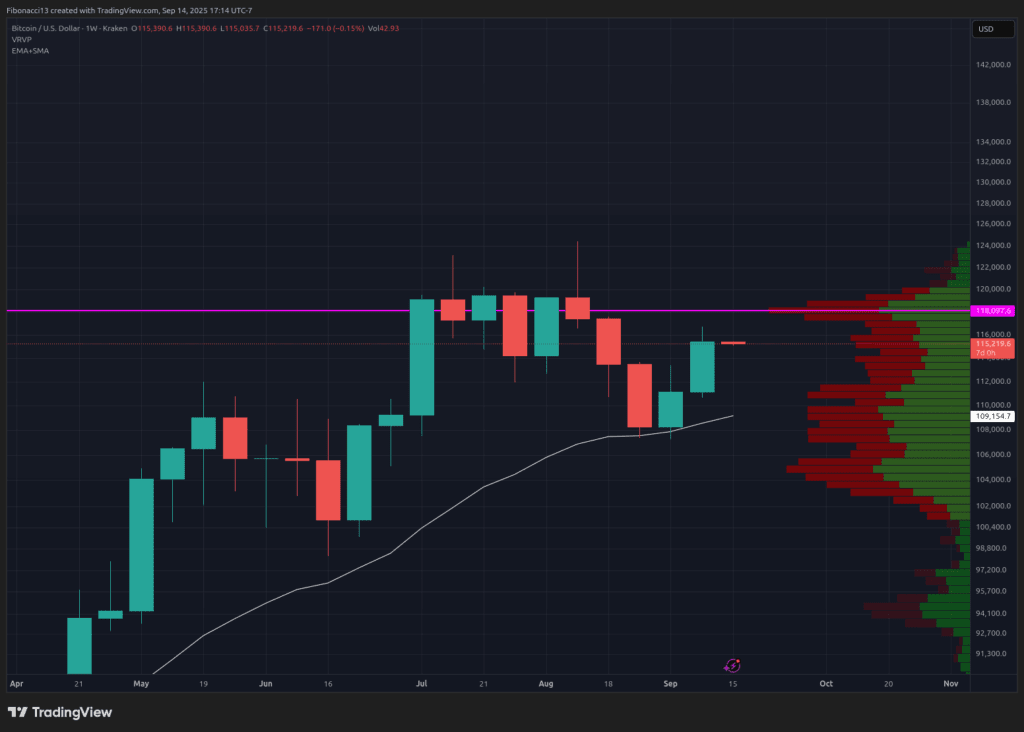

Bitcoin Value closed final week at $115,390, briefly breaching the $115,500 resistance degree because it pushed into the weekend, solely to dip again down and shut the week out just under it. Final week produced a robust inexperienced candle for the bulls, sustaining upward momentum into this week. The U.S. Producer Value Index got here in nicely under expectations on Wednesday morning final week, giving market bulls hope for the approaching fee lower choice by the Federal Reserve. U.S. inflation knowledge the next morning was lukewarm, nonetheless, because it registered at 2.9%, as anticipated, however greater than the earlier month’s studying of two.7%. The Federal Reserve can have its work lower out for it this week at Wednesday’s FOMC Assembly, the place it should weigh the advantages and downsides of reducing or not. The market is totally anticipating a 0.25% interest rate cut (as seen in Polymarket), so any hesitation now by the Fed will probably result in a market correction.

Key Assist and Resistance Ranges Now

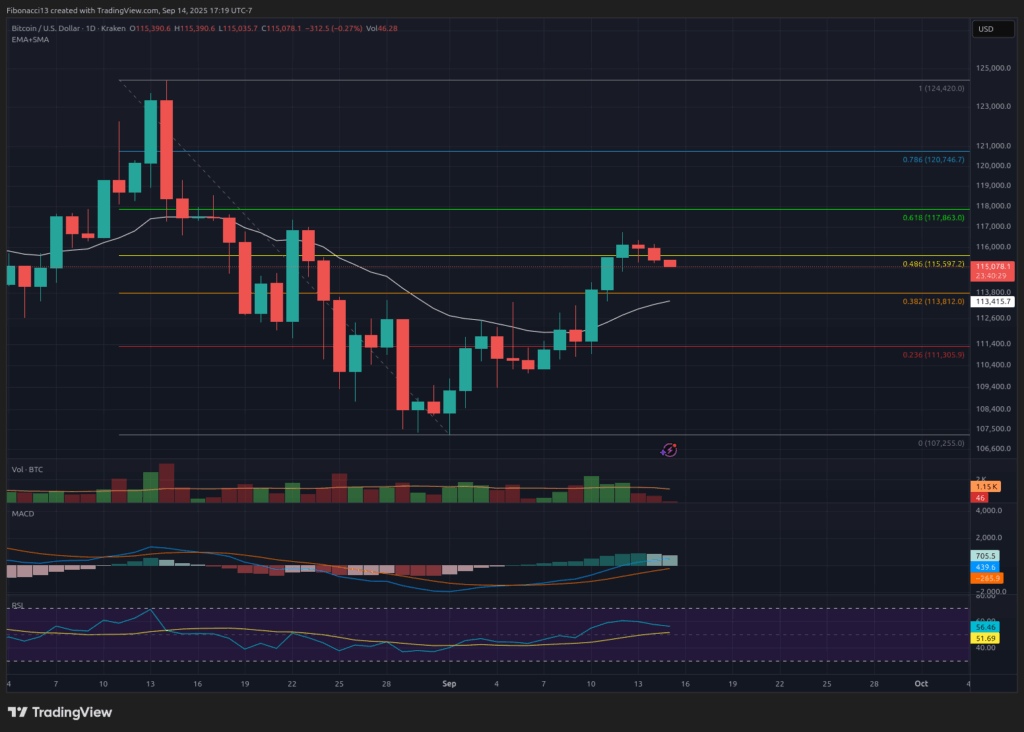

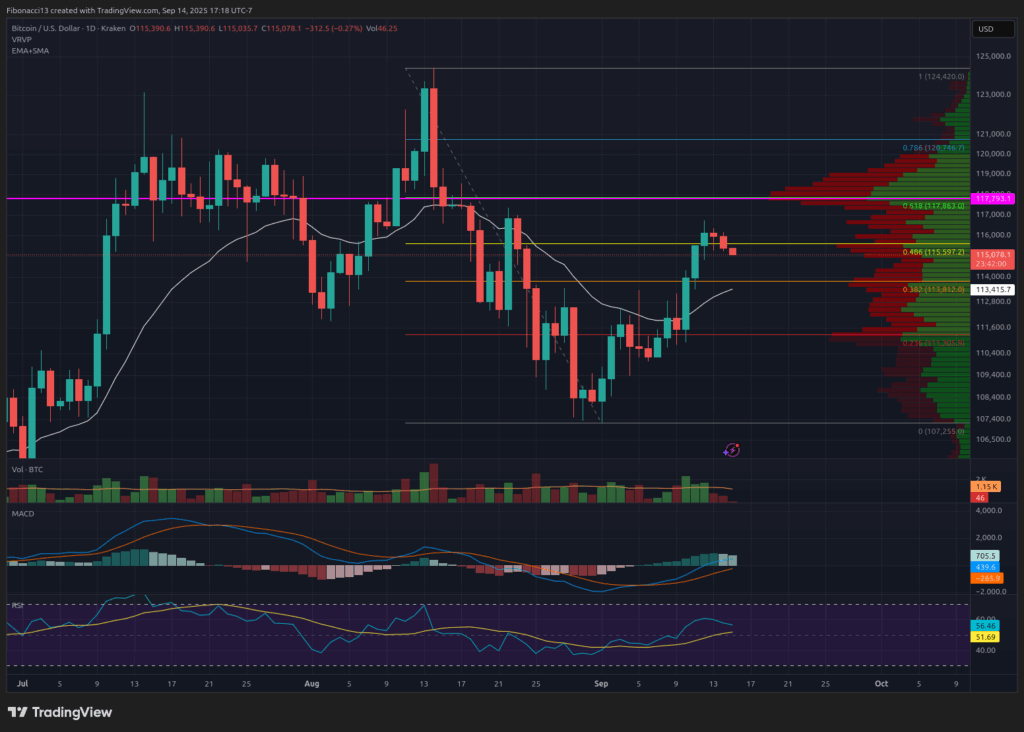

Getting into this week, the $115,500 degree is the following resistance degree bitcoin shall be seeking to shut above. $118,000 shall be standing in the way in which above right here, nonetheless. If bitcoin places in one other sturdy week, it’s doable the worth pushes above the $118,000 degree intraweek solely to shut again under it on Sunday. We must always count on sellers to step in strongly there and stress bulls to present again some floor.

If bitcoin sees any weak spot this week, or a rejection from the $118,000 degree, we should always look all the way down to the $113,800 degree for short-term assist. Under there, we have now weekly assist sitting at $111,000. Closing under there would probably problem the $107,000 low.

Outlook For This Week

Zooming into the each day chart, bias is simply barely bearish as of Sunday’s shut, after rejecting from $116,700 final Friday. This might shortly return to a bullish bias, although, if Monday’s US inventory market worth motion resumes its bullish development as nicely. The MACD is presently making an attempt to carry above the zero line and re-establish it as assist for bullish momentum to renew. In the meantime, the RSI is dipping however stays in a bullish posture. It can look to the 13 SMA for assist if promoting intensifies into Tuesday.

All eyes shall be on Chairman Powell and the Federal Reserve on Wednesday as he speaks at 2:30 PM Jap. With something aside from a 0.25% fee lower announcement at 2:00 PM prone to trigger vital market volatility that may certainly spill over into bitcoin.

Market temper: Bullish, after two inexperienced weekly candles in a row — anticipating the $118,000 degree to be examined this week.

The following few weeks

Sustaining momentum above $118,000 shall be key within the coming weeks if bitcoin can leap over this impending hurdle within the close to future. I’d count on bitcoin to proceed into the $130,000s if it may possibly set up $118,000 as assist as soon as once more.

Assuming the Fed lowers charges this week, the market will then sit up for October for an extra rate of interest lower. Due to this fact, supportive market knowledge and continued cuts shall be essential to bitcoin’s worth path going ahead, fueling a bullish continuation to new highs.

On the flip aspect, any vital bearish occasions, or the Fed shocking everybody with a choice to not lower on Wednesday, will certainly ship the bitcoin worth again down to check assist ranges.

Terminology Information:

Bulls/Bullish: Patrons or traders anticipating the worth to go greater.

Bears/Bearish: Sellers or traders anticipating the worth to go decrease.

Assist or assist degree: A degree at which the worth ought to maintain for the asset, not less than initially. The extra touches on assist, the weaker it will get and the extra probably it’s to fail to carry the worth.

Resistance or resistance degree: Reverse of assist. The extent that’s prone to reject the worth, not less than initially. The extra touches at resistance, the weaker it will get and the extra probably it’s to fail to carry again the worth.

SMA: Easy Shifting Common. Common worth primarily based on closing costs over the required interval. Within the case of RSI, it’s the common power index worth over the required interval.

Oscillators: Technical indicators that change over time, however usually stay inside a band between set ranges. Thus, they oscillate between a low degree (usually representing oversold situations) and a excessive degree (usually representing overbought situations). E.G., Relative Energy Index (RSI) and Shifting Common Convergence-Divergence (MACD).

MACD Oscillator: Shifting Common Convergence-Divergence is a momentum oscillator that subtracts the distinction between 2 transferring averages to point development in addition to momentum.

RSI Oscillator: The Relative Energy Index is a momentum oscillator that strikes between 0 and 100. It measures the velocity of the worth and modifications within the velocity of the worth actions. When RSI is over 70, it’s thought of to be overbought. When RSI is under 30, it’s thought of to be oversold.