Earlier in the present day, Bitcoin (BTC) slipped beneath $115,000 for the primary time since August 6, elevating considerations that the cryptocurrency’s bullish momentum could also be fading. Towards this backdrop, the Binance Shopping for Energy Ratio means that demand for BTC may very well be weakening, probably setting the stage for a deeper value correction.

Binance Shopping for Energy Ratio Raises Alarms

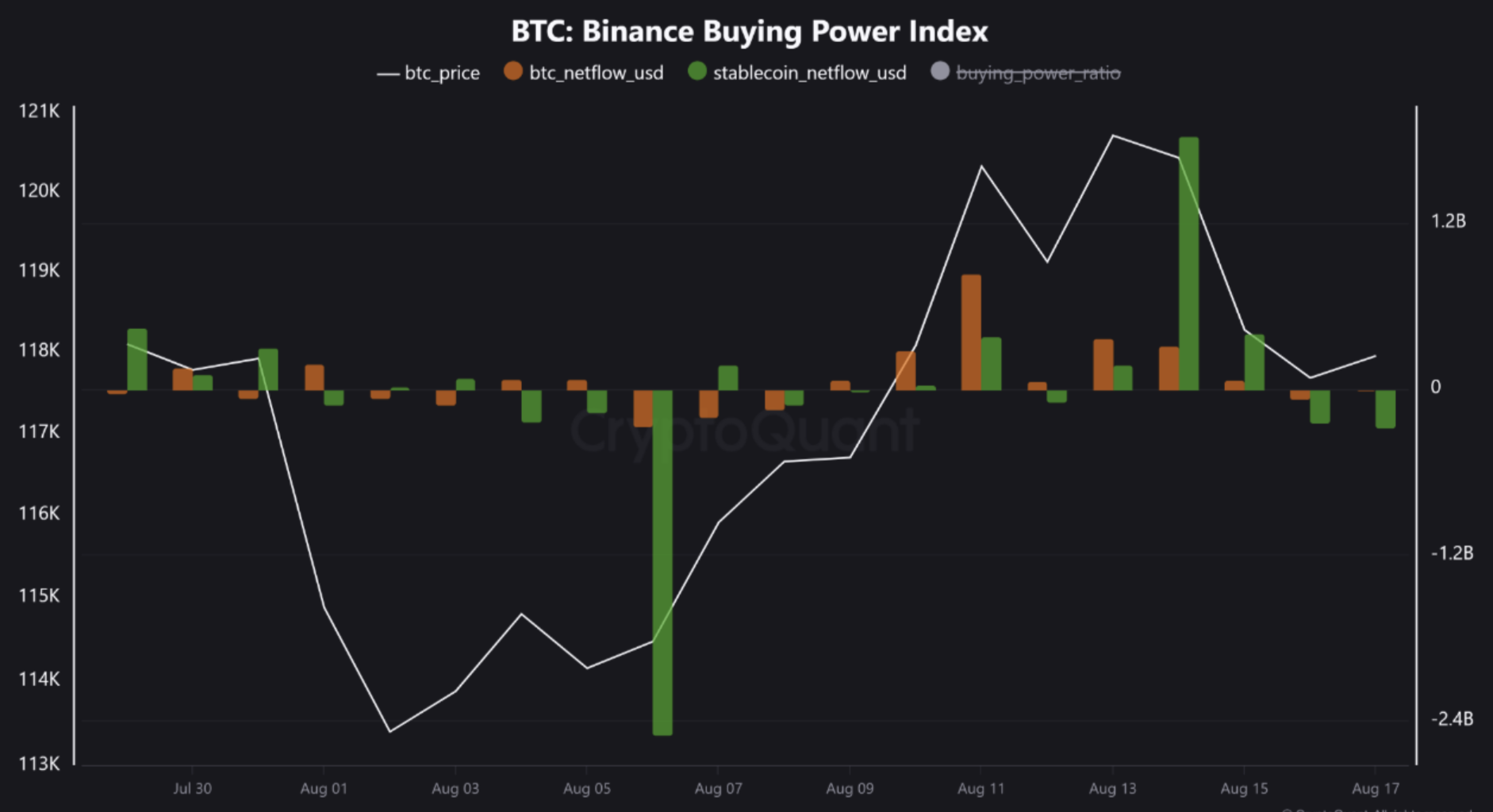

In line with a CryptoQuant Quicktake publish by contributor Crazzyblockk, the Binance Shopping for Energy Ratio serves as a dependable indicator of general market well being. The analyst defined that the present studying factors to a doable downturn for Bitcoin.

Associated Studying

To elucidate, the ratio measures stablecoin inflows towards Bitcoin outflows on Binance, primarily exhibiting how a lot new capital is in the stores BTC in comparison with how a lot is leaving the trade. A rising ratio displays robust shopping for energy and liquidity, whereas a pointy drop indicators weaker demand and a larger danger of correction.

Just lately, the ratio suffered a steep decline, issuing what the analyst known as a “textbook warning” simply earlier than BTC’s newest value drop. The correction noticed Bitcoin fall from as excessive as $124,474 on August 13 to a low of $114,786 earlier in the present day.

The analyst famous that the ratio peaked at 2.01 on August 14, exhibiting peak shopping for stress the place for each $1 of BTC shifting to chilly storage, greater than $2 in stablecoins entered the market.

Within the following days – from August 16 to 17 – the ratio witnessed a pointy reversal, crashing to -0.81 inside 48 hours. Consequently, extra shopping for energy left Binance than entered it, confirming that the BTC market’s main gasoline supply was exhausted.

Subsequently, BTC underwent a sustained value correction, falling 4.7% over the previous seven days. At the moment, the cryptocurrency is hovering barely beneath $115,000, whereas its subsequent main help lies across the $110,000 stage. Crazzyblockk concluded:

This evaluation proves that Binance is the market’s middle of gravity. Its capital flows are an early warning system. A falling Shopping for Energy Ratio indicators exhausted liquidity and excessive correction danger. For any severe analyst, monitoring Binance isn’t non-obligatory – it’s important.

How Will Bitcoin Carry out In September?

If Bitcoin avoids slipping beneath $110,000, the short-term holder value foundation mannequin suggests its subsequent main resistance lies round $127,000. A powerful breakout above this stage may ship BTC climbing towards $140,000.

Associated Studying

In a separate X publish, crypto analyst KillaXBT said BTC should maintain above $115,787 to focus on the $125,000 – $127,000 vary in September. Nevertheless, the analyst warned that even when Bitcoin opens the month with a recent all-time excessive, it could not guarantee sustained bullish momentum. At press time, BTC trades at $114,988, down 2.4% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com