Information exhibits merchants have arrange contemporary Bitcoin positions on the perpetual futures market throughout the previous day, and the Funding Charge suggests they’re lengthy bets.

Bitcoin Open Curiosity Has Witnessed An Uptick

Based on information from on-chain analytics agency Glassnode, the surge Bitcoin has seen to kick off Monday has come alongside a spike within the Bitcoin perpetual futures Open Curiosity.

The “Open Interest” refers to an indicator that retains monitor of the whole quantity of BTC perpetual futures positions which can be at the moment open on all derivatives exchanges.

When the worth of this metric rises, it means the buyers are opening up contemporary positions in the marketplace. Since such a development normally accompanies a rise in leverage for the sector, it will possibly result in extra volatility for the asset.

However, the indicator taking place implies buyers are both pulling again on danger or getting liquidated by their platform. This type of development can lead to the cryptocurrency’s value behaving in a extra steady method.

Now, here’s a chart that exhibits the development within the Bitcoin Open Curiosity over the past couple of weeks:

As displayed within the above graph, the Bitcoin Open Curiosity rose from 304,000 BTC to 310,000 BTC because the cryptocurrency noticed a restoration surge to $90,000 throughout the previous day.

This represents a rise of about 2%, which isn’t a lot, however nonetheless alerts that the rally inspired merchants to open up new positions on the perpetual futures market.

The Open Curiosity consists of each kinds of positions when calculating its worth, so it incorporates no details about whether or not positions have a bias towards shorts or longs. One other metric referred to as the Funding Rate can be utilized to find out that as a substitute.

This indicator measures the quantity of periodic price that perpetual futures merchants are exchanging between one another. A optimistic worth implies lengthy buyers are paying a premium to the shorts so as to maintain onto their positions, whereas a damaging one implies bearish bets are dominant.

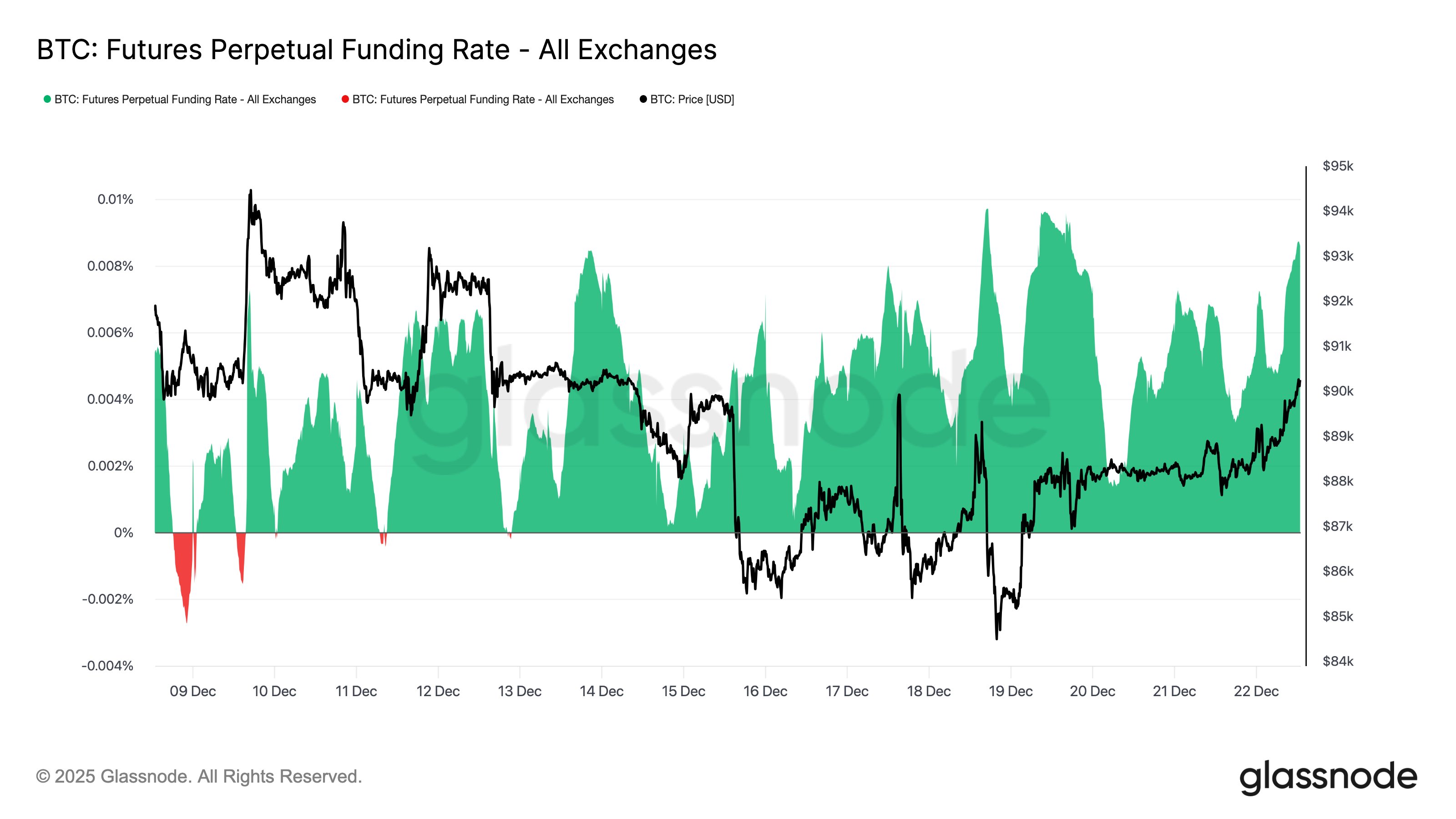

Because the under chart exhibits, the Bitcoin Funding Charge has been optimistic for a lot of the final two weeks, indicating {that a} bullish sentiment has been shared by the vast majority of perpetual futures merchants.

This metric additionally famous an uptick alongside the rise within the Open Curiosity, going from 0.04% to 0.09%. “This mix alerts a renewed buildup in leveraged lengthy positioning, as perpetual merchants place for a possible year-end transfer,” famous Glassnode.

BTC Value

Bitcoin has seen a little bit of a pullback since its surge above $90,000 as its value is now again at $89,500.