Bitcoin stays caught in a tightening vary simply above the $80K mark. Regardless of the current bounce from sub-$85K ranges, the general market tone nonetheless leans cautious. There’s been no significant breakout, and sentiment hasn’t shifted bullish but.

BTC Technical Evaluation

By Shayan

The Day by day Chart

On the day by day timeframe, the value continues to be trapped contained in the broader descending channel that’s been lively over the previous couple of months. BTC just lately bounced from the $81K help zone and has since printed a sequence of upper lows. Nonetheless, every push has been capped at round $95K, proper under the channel’s increased boundary and the important thing bearish order block.

The asset is now buying and selling under each the 100-day and 200-day MAs, that are curving downward round $107K. This can be a clear signal that patrons are nonetheless combating the macro pattern. Until a robust day by day shut above $96K happens, the construction stays bearish to impartial.

The 4-Hour Chart

Zooming into the 4H chart, BTC is forming a transparent ascending triangle between $80K and $95K. This sort of construction usually resolves upward, however provided that quantity and momentum help the breakout. Proper now, the breakout makes an attempt close to $94K hold getting rejected.

There’s a tightening squeeze between the trendline help and horizontal resistance, and the value is nearing the apex. So a breakout or breakdown is probably going throughout the subsequent few classes.

Patrons would wish to see a clear breakout above $95K with quantity to focus on the $100K zone. Sellers, however, would look to a break under the ascending trendline, aiming for a retest of $85K and even the vital $80K space.

On-Chain Evaluation

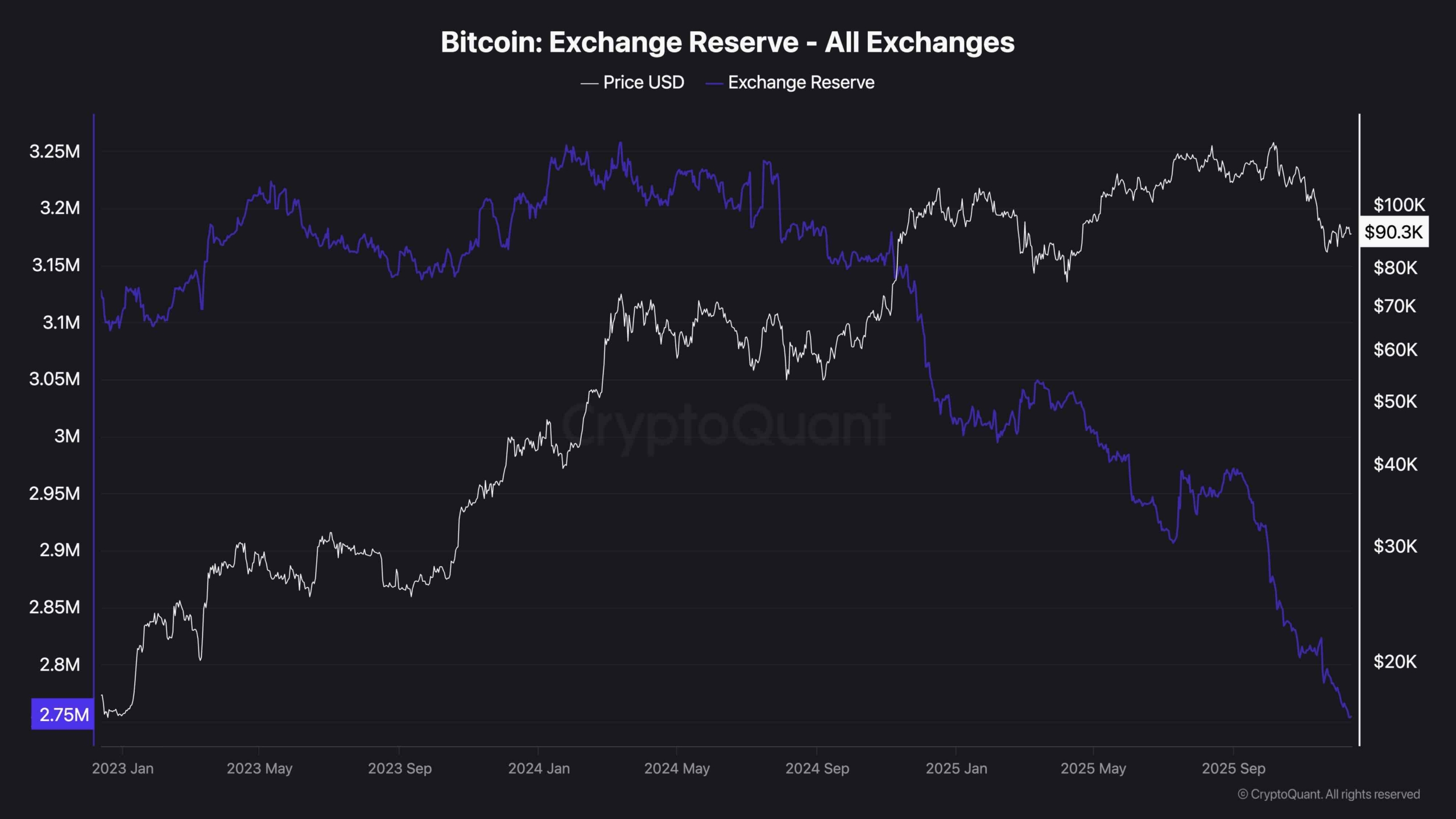

Bitcoin Alternate Reserve

Alternate reserve knowledge paints a extra fascinating image. BTC reserves on exchanges proceed to fall sharply, now hitting multi-year lows round 2.75M BTC. This sometimes suggests long-term holders are usually not interested by promoting, and provide is drying up.

Nonetheless, this hasn’t translated into value power but. The divergence between falling reserves and sideways value motion reveals one factor: demand continues to be not robust sufficient to push costs increased, regardless of low trade provide.

This could possibly be as a result of institutional flows and retail curiosity stay weak at present ranges, or as a result of capital is sitting on the sidelines ready for macro readability. Till spot demand kicks in, the falling reserves alone gained’t be sufficient to ignite a sustainable rally.

The submit Bitcoin Price Analysis: BTC’s Next Big Move Is Brewing – Breakout or Breakdown Ahead? appeared first on CryptoPotato.