Bitcoin Worth Weekly Outlook

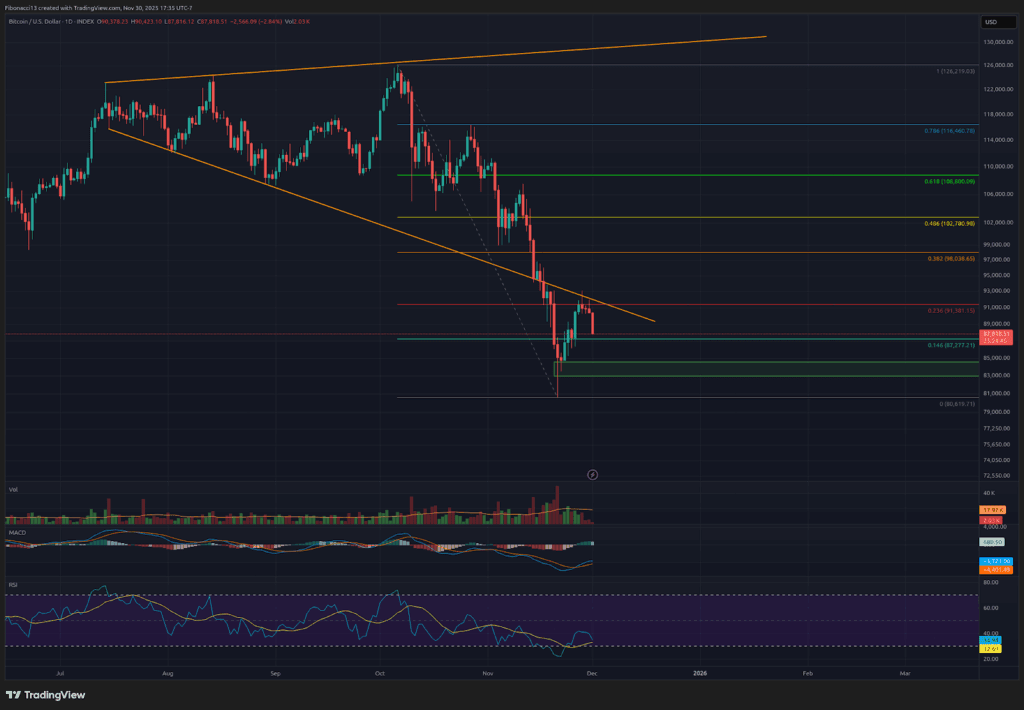

Bitcoin worth managed to place in a inexperienced candle on the weekly shut, lastly, however it wasn’t sufficient to carry off the bears as the worth dropped sharply proper after the weekly and month-to-month shut on Sunday night time. The week and month closed at $90,385, nonetheless nicely beneath the closest resistance stage at $91,400. Bears will seemingly look to benefit from this weak shut heading into this week, and doubtlessly push the worth down beneath the $84,000 assist stage.

Key Assist and Resistance Ranges Now

Bulls managed to check preliminary resistance final week at $91,400, however bought off closely after hitting $93,000, in need of the subsequent resistance at $94,000. Above right here, we should always see sturdy resistance at $98,000 all the way in which as much as $103,000. Increased resistance ranges had been lined in final week’s evaluation, so we’ll reopen that subject if bulls can handle to get near $100,000 after the top of this week.

$84,000 Assist held agency this previous week, however bulls didn’t muster a lot of a bounce. This assist stage will probably be below stress heading into this week. Initially, bulls will look to carry the 0.146 Fibonacci retracement at $87,000, nevertheless. Beneath $84,000, bulls might look to defend $75,000. Beneath right here, the $72,000 to $69,000 space ought to present sturdy assist and not less than a bounce or two from this zone. If this space sees heavy promoting stress, although, it could ultimately crack and usher in a take a look at of the 0.618 Fibonacci retracement at $57,700.

Outlook For This Week

With the worth closing beneath resistance on Sunday, the bears jumped on this weak point and pushed the worth right down to $87,000 assist. Search for bulls to defend this stage early, however whether it is misplaced, bulls know they need to maintain the road at $84,000 to keep away from dropping to new lows and testing $75,000 this week. So, we might even see some range-bound motion this week as bears should still want a little bit of a relaxation earlier than taking out this assist stage. If bulls can maintain them off, they are going to once more try to overcome $91,400 and doubtlessly $94,000 this week, however I wouldn’t count on any sturdy strikes up this week.

The following few weeks

Sunday night time introduced us the month-to-month candle shut for November as nicely. November closed as an enormous purple bearish candle, taking out the April, Might and June inexperienced closes in a single fell swoop. Worth did rally to shut above the month-to-month 21-EMA, which is an effective signal, however December must attempt to put in some reversal candles to maintain the bulls’ hopes alive. Probably the most bearish side of November’s shut is that it confirmed a bearish cross on the MACD oscillator. That is to be taken severely on such a excessive timeframe and will maintain the worth subdued for not less than the approaching two to a few months. This sign is one more signal that the 4-year cycle high is probably going in.

Terminology Information:

Bulls/Bullish: Consumers or buyers anticipating the worth to go increased.

Bears/Bearish: Sellers or buyers anticipating the worth to go decrease.

Assist or assist stage: A stage at which the worth ought to maintain for the asset, not less than initially. The extra touches on assist, the weaker it will get and the extra seemingly it’s to fail to carry the worth.

Resistance or resistance stage: Reverse of assist. The extent that’s more likely to reject the worth, not less than initially. The extra touches at resistance, the weaker it will get and the extra seemingly it’s to fail to carry again the worth.

EMA: Exponential Shifting Common. A transferring common that applies extra weight to latest costs than earlier costs, decreasing the lag of the transferring common.

Fibonacci Retracements and Extensions: Ratios based mostly on what is named the golden ratio, a common ratio pertaining to progress and decay cycles in nature. The golden ratio relies on the constants Phi (1.618) and phi (0.618).

Oscillators: Technical indicators that fluctuate over time, however usually stay inside a band between set ranges. Thus, they oscillate between a low stage (usually representing oversold situations) and a excessive stage (usually representing overbought situations). E.G., Relative Power Index (RSI) and Shifting Common Convergence-Divergence (MACD).

MACD Oscillator: Shifting Common Convergence-Divergence is a momentum oscillator that subtracts the distinction between 2 transferring averages to point development in addition to momentum.