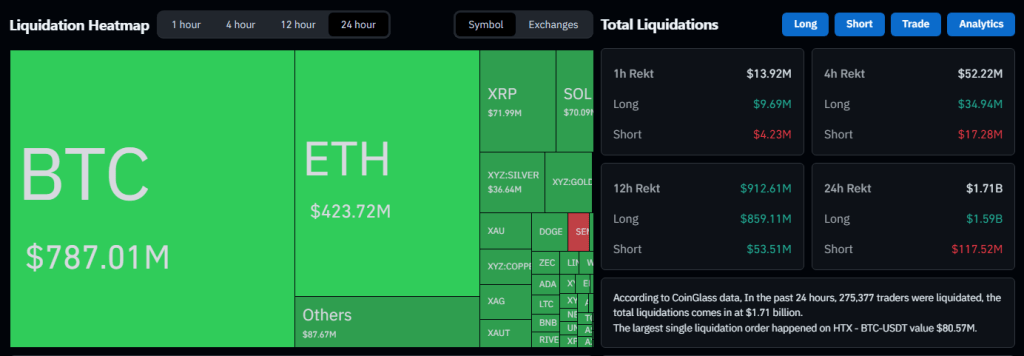

Bitcoin slid sharply this week, hitting simply above $82,000 in early US buying and selling and triggering a large purge of crowded positions. Primarily based on data from Coinglass, roughly 270,000 accounts had been worn out throughout exchanges prior to now day, and near $1.70 billion in whole liquidations was recorded. Most of the losses got here from merchants who had wager that costs would hold rising.

Liquidations And Market Shock

The transfer was quick. Lengthy bets had been the toughest hit. Experiences say over 90% of the liquidated contracts had been lengthy positions, largely in Bitcoin and Ether.

The market was shaken shortly as cease orders had been pulled and margin calls had been compelled. Value gaps confirmed up on some platforms and volatility spiked. This sort of clearing occasion can depart costs unstable for a bit, even after merchants relax.

Geopolitics And Coverage Strain

Experiences observe heightened tensions within the Center East added gasoline to the selloff. A US warship deployment and renewed public statements from US President Donald Trump put threat belongings on edge.

On the similar time, an govt motion linked to tariffs on items tied to sure oil offers raised recent concern amongst world merchants. Threat urge for food cooled as buyers mulled how these strikes may have an effect on vitality flows and commerce.

Tech Earnings And Investor Temper

Microsoft’s earnings miss was one other observe within the combine. Some large tech names fell arduous after outcomes that confirmed rising prices and slower progress in cloud companies.

That made buyers query the near-term outlook for AI-driven progress tales. With confidence wobbling in each shares and crypto, many diminished publicity. The market ambiance turned cautious and shopping for dried up in minutes.

Bitcoin price action, threat aversion and volatility amid battle headlines had been each feeding into the promoting. Information feeds had been filled with sharp alerts. Merchants who observe headlines carefully discovered themselves adjusting positions shortly.

Help Check And Wider Market Drops

Bitcoin is buying and selling close to a higher-timeframe help space that mattered in current months. Weekly closes have been caged between roughly $94,000 and $84,000 for a number of weeks, and that construction faces one other take a look at now.

If consumers don’t step in, deeper weak point might observe. Experiences say the broader crypto market misplaced round $200 billion in worth throughout tokens through the worst of the transfer.

What Merchants Are Saying

Some analysts known as the response overblown and famous that costs had already been falling since October. Others warned {that a} longer correction might be in play if macro pressures persist.

Benjamin Cowen warned that Bitcoin could proceed to behave weak in contrast with shares, suggesting any hoped-for fast flip from gold or silver into crypto may not occur quick.

Based on Buying and selling Economics, gold and silver have climbed to file ranges, with gold reaching $5,608 per ounce and silver rising to $121.60.

Featured picture from Unsplash, chart from TradingView