Ethereum is holding regular above the $4,400 mark after a weekend surge that briefly carried it to recent all-time highs. The rally, fueled by sturdy institutional demand and broader market optimism, has been tempered over the previous two days as the worth retraced to check decrease ranges. Regardless of the pullback, ETH stays some of the carefully watched belongings available in the market, with bulls and bears each eyeing the subsequent decisive transfer.

Analysts are divided. Some argue that ETH’s capacity to take care of help above $4,400 indicators resilience and a possible setup for one more rally towards $5,000. Others, nevertheless, see warning indicators of shopping for exhaustion and lift considerations of a deeper correction if market sentiment shifts.

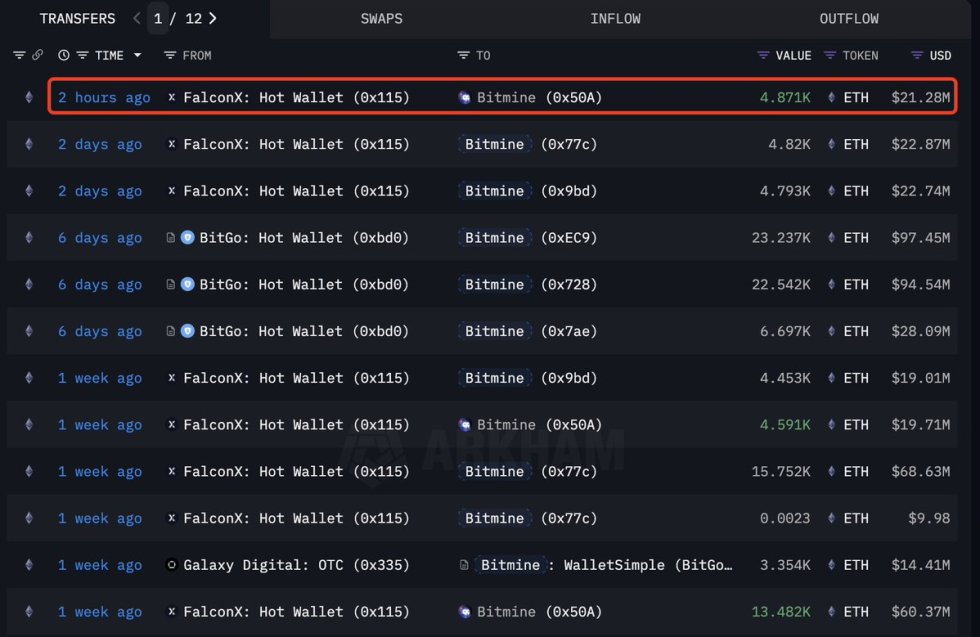

Including to the intrigue, blockchain analytics agency Lookonchain revealed that Bitmine, Ethereum’s largest company holder, purchased one other 4,871 ETH value $21.28M simply 12 hours in the past. This brings Bitmine’s complete holdings to staggering ranges, reaffirming the narrative of large-scale institutional accumulation.

The mix of sturdy whale exercise, heightened institutional demand, and unstable short-term value swings underscores the pivotal second Ethereum faces. Whether or not ETH breaks increased into uncharted territory or succumbs to correction pressures might be a defining issue for the broader altcoin market.

Ethereum Whale Accumulation Strengthens Bullish Outlook

Based on Lookonchain, Bitmine at the moment holds 1,718,770 ETH valued at $7.65 billion, making it one of many largest company holders of Ethereum. This accumulation trend has turn into a defining function of the present market cycle, with different firms equivalent to Sharplink Gaming and Bit Digital additionally increasing their ETH positions. Such large-scale institutional shopping for reinforces the bullish continuation narrative and units Ethereum aside because the main altcoin for long-term development.

Past accumulation, macro circumstances and authorized readability within the US are enjoying a significant function in Ethereum’s outlook. The clearer regulatory setting is attracting extra establishments, which now see ETH not solely as a key participant in decentralized finance but additionally as an asset with rising legitimacy. This shift in sentiment is fueling expectations for Ethereum to outperform within the coming months.

On the similar time, liquidity dynamics are tightening. Exchanges are reporting declining ETH balances, whereas OTC desks equivalent to Wintermute spotlight a fast-paced decline in reserves. This means that provide is more and more being absorbed by establishments and long-term holders, leaving fewer cash obtainable on the open market.

The mix of institutional demand, regulatory readability, and shrinking provide creates a robust backdrop for Ethereum. Whereas short-term volatility might persist, the underlying fundamentals level to a market primed for continuation towards new milestones.

Weekly Chart Indicators Power

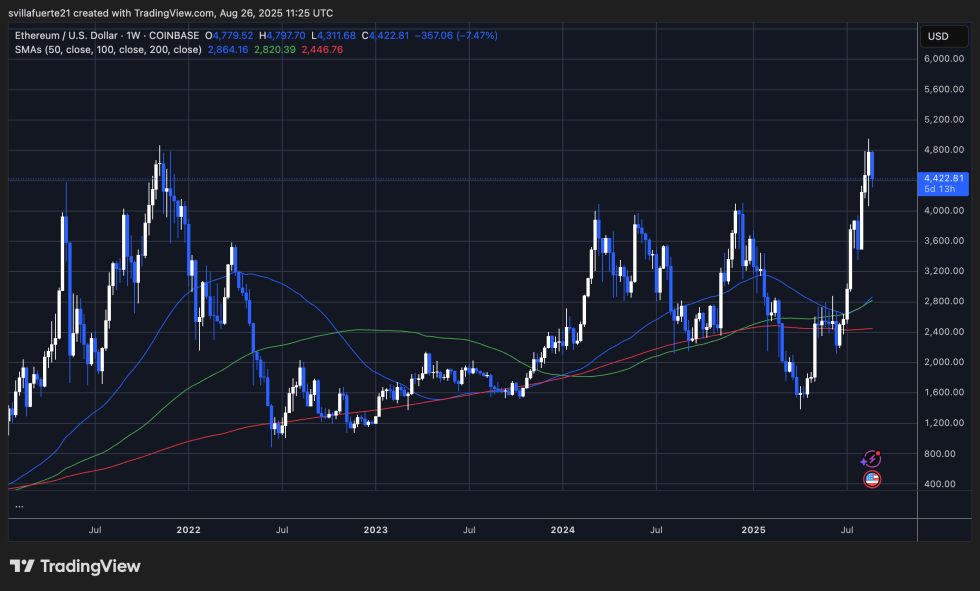

Ethereum’s weekly chart exhibits that the asset is in the course of a major check after its surge to new highs above $4,800. Following that rally, ETH retraced sharply, now buying and selling round $4,422, reflecting a unstable however wholesome correction after weeks of steep good points. Regardless of this drop, the chart nonetheless exhibits ETH sustaining its broader bullish construction.

The 50-week transferring common (blue line) is curving upwards, signaling renewed momentum after months of consolidation earlier this 12 months. In the meantime, the 100-week (inexperienced) and 200-week (purple) transferring averages stay properly beneath the present value, reinforcing that ETH continues to be in a powerful macro uptrend. The retracement appears to be discovering help across the breakout zone of $4,200–$4,400, which may act as a brand new base if bulls defend it.

Essentially the most notable takeaway is how ETH has damaged free from its lengthy consolidation between 2022 and early 2025, the place the worth struggled below $3,000. That multi-year resistance zone has now flipped into sturdy help, suggesting the potential for Ethereum to maintain increased ranges within the months forward.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.