Ethereum continues to battle to regain bullish momentum as apathy and protracted promoting stress dominate the broader crypto market. Value motion stays subdued, with ETH failing to maintain strikes above key resistance ranges, reinforcing the notion that traders are nonetheless cautious.

Many analysts argue that the market has but to totally reset, pointing to weak threat urge for food, declining liquidity, and a scarcity of robust spot demand. Consequently, Ethereum, like most main property, stays trapped in a consolidation section marked by hesitation relatively than conviction.

Regardless of this gloomy backdrop, a rising group of optimists believes Ethereum could possibly be approaching a cyclical backside. Their view relies much less on short-term worth motion and extra on structural and behavioral alerts that are inclined to emerge throughout late-stage bearish phases. Some of the notable developments comes from on-chain knowledge.

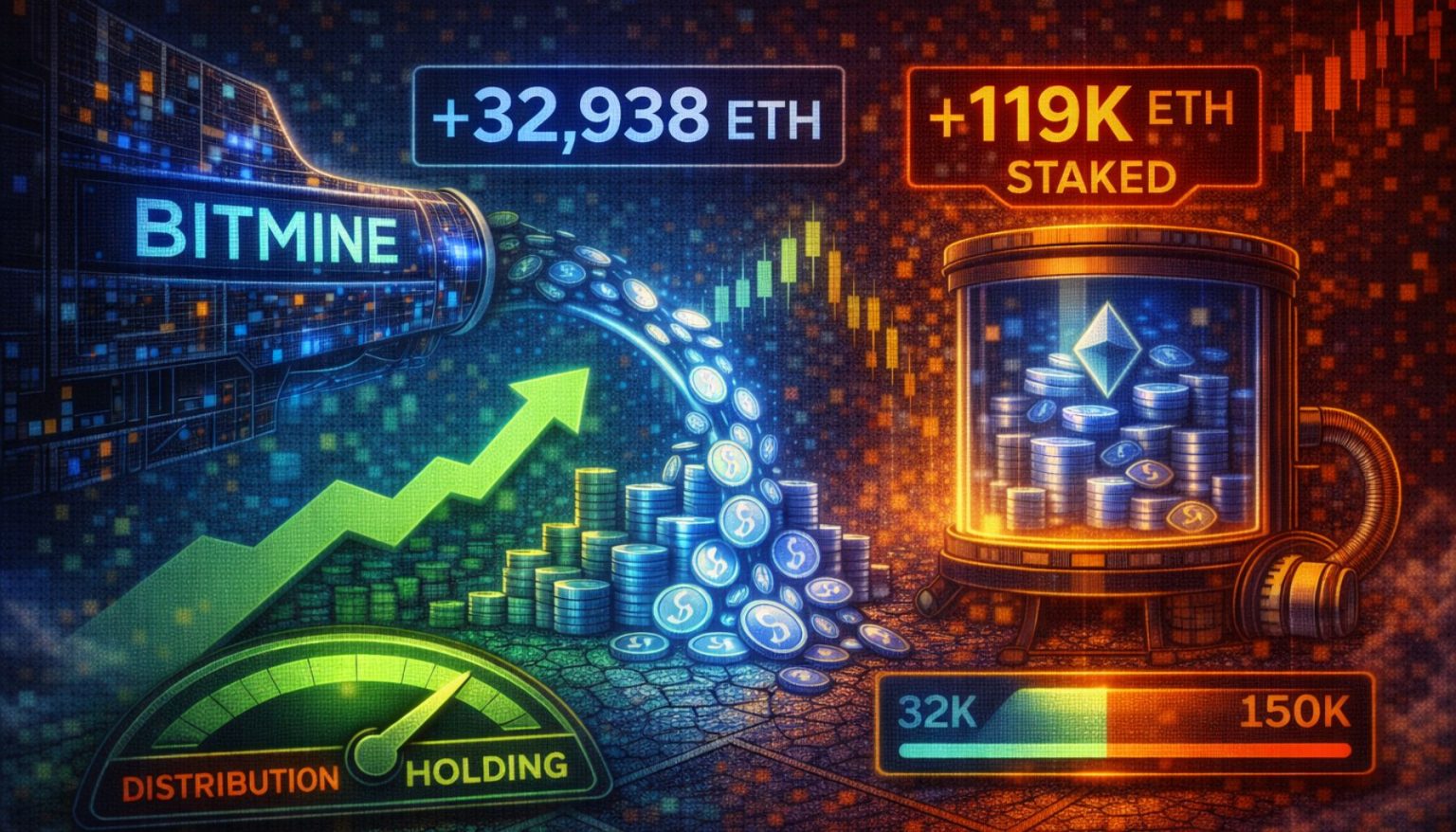

In accordance with knowledge from Arkham shared by Lookonchain, Bitmine acquired one other 32,938 ETH price roughly $97.6 million only a few hours in the past. Bitmine is a big institutional Ethereum-focused entity recognized for accumulating ETH at scale and deploying it throughout staking and long-term methods relatively than short-term buying and selling. With this newest buy, Bitmine now holds roughly 3.357 million ETH, valued at round $10 billion, making it one of many largest recognized Ethereum holders.

Bitmine Deepens Lengthy-Time period Dedication

Ethereum’s near-term worth motion stays fragile, however institutional habits continues to diverge from market sentiment. Over the previous few hours, Bitmine staked a further 118,944 ETH, price roughly $352.16 million, in line with data from Arkham reported by Lookonchain. This transfer follows Bitmine’s latest spot accumulation and reinforces its long-term positioning technique relatively than a short-term speculative strategy.

Staking at this scale successfully removes a big quantity of ETH from liquid circulation, tightening obtainable provide on exchanges. Not like transfers to centralized platforms, staking displays a high-conviction view that prioritizes yield era and long-term community participation over rapid liquidity.

For analysts monitoring structural provide dynamics, this habits contrasts sharply with the present worth pattern, which continues to indicate restricted bullish follow-through.

Regardless of these developments, the broader market stays unconvinced. Ethereum has struggled to reclaim key resistance ranges, and momentum indicators nonetheless level to weak point. Consequently, analysts are more and more divided when assessing the outlook for 2026.

Some interpret ongoing institutional accumulation and staking as early positioning forward of a longer-term restoration cycle. Others warning that macro uncertainty, muted demand, and protracted threat aversion might hold ETH range-bound or beneath stress for longer than anticipated.

On this context, Bitmine’s actions stand out as a sign of long-term confidence, however not essentially a right away catalyst. For now, Ethereum’s worth stays weak, whereas the strategic habits beneath the floor continues to quietly reshape the provision panorama.

Ethereum Stays Vary-Sure Under Key Resistance

Ethereum continues to commerce in a consolidation vary after failing to reclaim larger ranges, with worth hovering across the $3,000 zone. The chart exhibits ETH capped beneath the declining 100-day and 200-day transferring averages, which now act as dynamic resistance across the $3,400–$3,600 space. This alignment reinforces the broader bearish construction that has been in place because the November breakdown.

After peaking close to the $4,800 area earlier within the cycle, ETH entered a transparent downtrend, marked by decrease highs and increasing sell-side quantity throughout corrective phases. The sharp sell-off into late November pushed the value towards the $2,800 space, the place patrons stepped in to defend help. Since then, Ethereum has stabilized however didn’t generate sustained upside momentum, suggesting demand stays cautious relatively than aggressive.

Quantity has declined noticeably throughout latest rebounds, indicating a scarcity of robust conviction from patrons. This habits is typical of late-stage corrective phases, the place worth compresses whereas market individuals look forward to clearer alerts. So long as ETH stays beneath the 200-day transferring common, upside makes an attempt are prone to face promoting stress.

On the draw back, the $2,800–$2,900 zone stands out as a key help space. A clear break beneath this vary would enhance the chance of a deeper retracement. Conversely, reclaiming $3,300 with robust quantity could be the primary signal that Ethereum is transitioning out of its present corrective construction.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.