After months of underperforming in comparison with BTC USD, Ethereum crypto is now in focus. Not solely has it been resilient, absorbing promoting strain, however after the frustration in H1 2025, the coin is on the cusp of breaking 2021 highs. At spot charges, ETH USD is buying and selling above $4,500 after surging to over $4,900 over the weekend. Though costs have been rejected and fell to present ranges, the uptrend stays.

From the each day chart, BTC USD has discovered key assist across the $110,000 degree. Notably, the drop seen prior to now few hours right this moment is a continuation of the sell-off posted on August 24, when bears fully reversed the beneficial properties of August 22. Technically, so long as BTC USD is capped under $118,000, bears are in management, and so they might pierce by way of $110,000 in a bear development continuation, confirming losses from August 14.

(Supply: TradingView)

In the meantime, ETH USD bulls are optimistic. Based mostly on Coingecko data, Ethereum crypto is up 22% prior to now month and a powerful 67% within the final yr of buying and selling. Regardless of the shakeout in Bitcoin over the weekend, ETHUSDT is up practically 8% within the final week of buying and selling.

Technically, the beneficial properties of August 22 outline the short-term worth motion. Consumers have the higher hand so long as costs development above $4,200, the low of August 22. As soon as $4,900 breaks, ETH USD will enter new territory, probably setting a stable basis for a leg as much as $10,000.

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

Bitcoin Bulls Dominate as Liquidity Dries Up

Whereas confidence is excessive amongst Ethereum holders, merchants must be cautious, contemplating Bitcoin’s high market dominance. As of August 25, Bitcoin controls 56% of the full crypto market, whereas ETH crypto has risen to 14%. This excessive market dominance implies that if Bitcoin drops under vital assist ranges, resembling $110,000, the percentages of BTC USD dragging different altcoins, together with a few of the top Solana meme coins, are excessive.

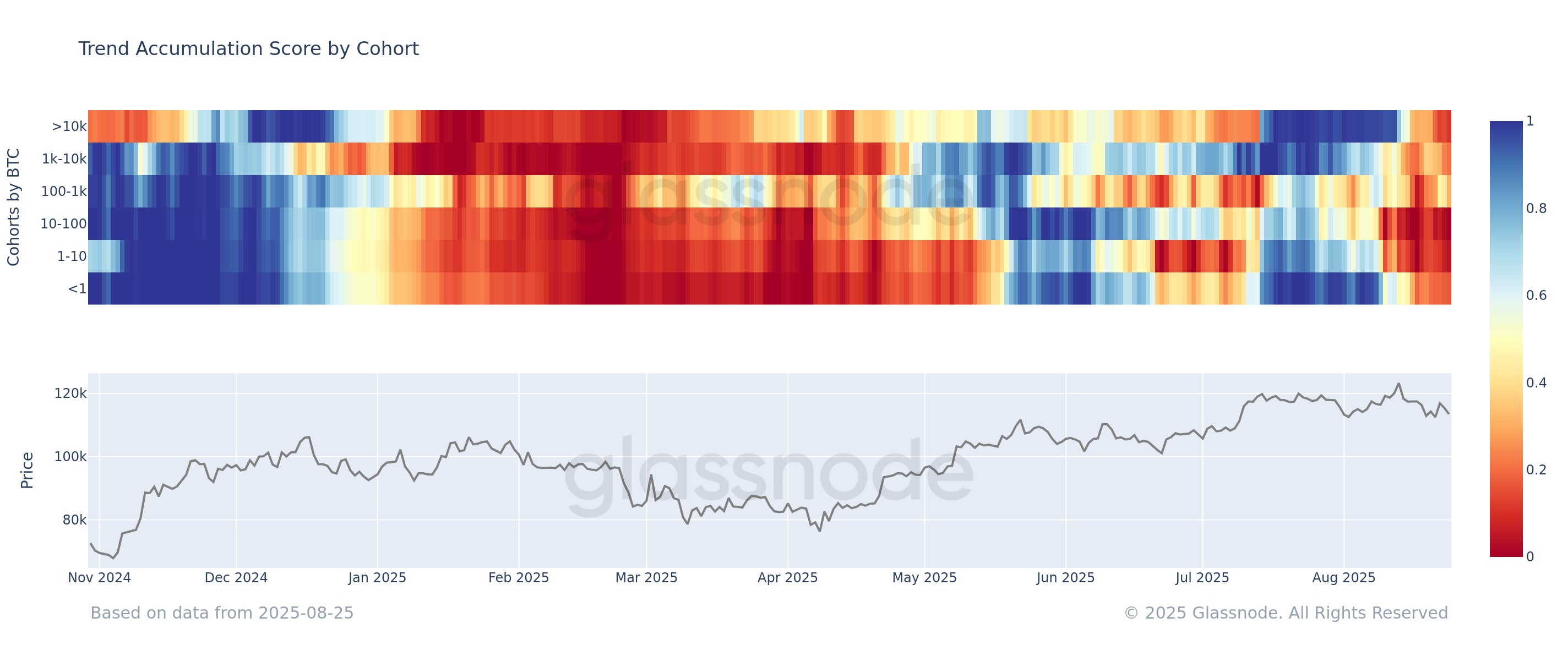

The percentages are stacking up in opposition to Bitcoin. In accordance with Glassnode, as of August 25, all Bitcoin cohorts, from small retail holders to whales, are in distribution mode, promoting or getting ready to promote. Analysts observe that these holding between 10 and 100 BTC are main the cost.

(Supply: Glassnode via X)

A number of elements, together with profit-taking after the latest surge to new all-time highs, may drive this broad sell-off. Macroeconomic uncertainties, resembling softening labor markets and rising inflation, are additionally concerns. Although the Federal Reserve may think about slashing charges in September, BTC USD may face immense promoting strain from holders within the brief time period.

As holders promote, onchain information reveals that Bitcoin liquidity can be falling. The Spent Quantity metric, which measures the full worth of BTC transacted each day, is shrinking, averaging 529,000 BTC within the final week. This drop means that draw back momentum might wane, although analysts advise merchants to proceed cautiously.

GM!

Spent Quantity (BTC)- the full quantity of cash spent per day. This metric displays liquidity stream, although it stays delicate to inner transfers by exchanges and providers. This week, its common worth dropped to a minimal of 529K BTC per day.

This means that the… pic.twitter.com/h390vBjFCj

— Axel

Adler Jr (@AxelAdlerJr) August 23, 2025

DISCOVER: 20+ Next Crypto to Explode in 2025

Institutional Shift to Ethereum: A Boon for ETH USD?

Apart from declining liquidity, massive sellers are lively throughout all main exchanges. One analyst observes that many of those sellers are unaware of time-weighted common worth (TWAP) methods, including to the volatility.

It’s a bit regarding that giant sellers are exhibiting up on exchanges who don’t appear to find out about TWAP.

Total, CEX Netflow remains to be inexperienced, however it’s getting near the purpose the place sellers will outnumber consumers.

Proper now could be the right time for Saylor & Co. to step up… pic.twitter.com/nOxmf8eVDw— Axel

Adler Jr (@AxelAdlerJr) August 25, 2025

Web stream to exchanges stays optimistic, which is bearish for BTC ▼-2.61% since extra cash parked at exchanges usually tend to be offered for money or blue-chip altcoins, primarily ETH and different best cryptos to buy.

That is taking place, as analysts observe that extra establishments are pivoting to ETH. Final week, Bitmine, the Ethereum Treasury Firm led by Tom Lee, a identified Bitcoin bull, bought $2.2 billion value of ETH. The agency now holds over 1.71 million ETH and 192 BTC.

NEW: Tom Lee explains how $6.6 billion in Ethereum generates over $200 million in internet earnings.

"Should you maintain $ETH and also you comply with stake it and validate transactions, you earn the staking charge, which is 3%."

He plans to make use of the earnings to pay BitMine holders a money dividend.… pic.twitter.com/DrLMAJ3Fgl

— CryptosRus (@CryptosR_Us) August 22, 2025

In accordance with Lee, due to this substantial stash, Bitmine generates over $200 million in internet income from staking.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

BTC USD Falls As Ethereum Surges: Will ETH USD Break $5K?

- BTC USD hovers round $110,000 assist

- ETH USD is up 22% in a month, buying and selling above $4,500

- Bitcoin holders trying to dump BTC

- Bitmine purchased $2.2 billion of ETH final week

The publish BTC USD Feels the Pressure as Big Players Shift to Ethereum: What’s Next? appeared first on 99Bitcoins.