Monetary Occasions reported in the present day that Cantor Fitzgerald, LP is near a $4 billion SPAC deal that may goal to amass billions of {dollars} value of bitcoin, signaling one of many largest bitcoin and different crypto purchases ever made by a Wall Avenue linked agency.

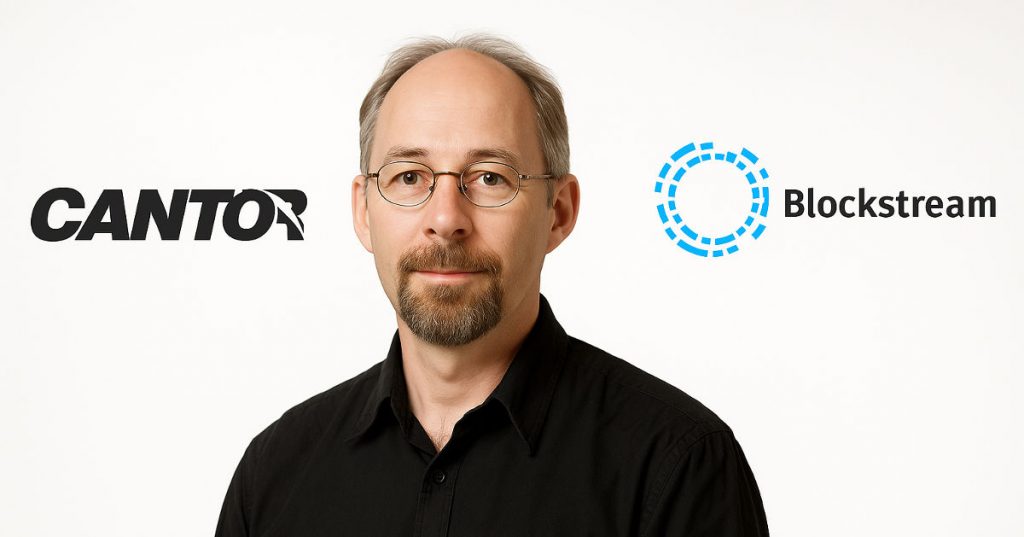

The deal entails Cantor Fairness Companions 1, a clean cheque car that raised $200 million in January, and Adam Again, founding father of Blockstream. Again, a pioneer within the business and whose Hashcash proof-of-work system is foundational to securing the Bitcoin blockchain, is predicted to contribute as much as 30,000 Bitcoin to the Cantor Fairness Companions 1, valued at over $3 billion.

The car additionally plans to boost as much as $800 million in exterior capital to develop bitcoin purchases, bringing the whole deal worth to greater than $4 billion. In trade for the Bitcoin, Again and Blockstream Capital would obtain shares within the Cantor Car, which will likely be renamed BSTR Holdings.

“A deal might come as early as this week, stated the folks, who cautioned that phrases might nonetheless change,” Monetary Occasions reported. “If accomplished within the coming days, it will come throughout what Republican lawmakers have dubbed “crypto week” as they debate laws tied to digital currencies.”

This may be Cantor’s second main bitcoin acquisition this yr, following a $3.6 billion enterprise with SoftBank and Tether in April. Mixed, Cantor’s complete bitcoin and different crypto acquisitions this yr might attain practically $10 billion via BSTR Holdings and Twenty One Capital.

The agency is aggressively positioning itself as a number one institutional bitcoin and crypto purchaser underneath the management of Brandon Lutnick, who was appointed chairman in February after his father, Howard Lutnick, grew to become US Commerce Secretary.

“The Cantor deal would mark the most recent in a collection of high-profile offers the place particular objective acquisition firms are used as autos to purchase bitcoin, as traders search to emulate billionaire bitcoin evangelist Michael Saylor’s firm, known as Technique, in hoarding the digital forex,” Monetary Occasions acknowledged.

Again, who co-founded Blockstream in 2014 with backing from Khosla Ventures and Baillie Gifford, has additionally made current private investments in bitcoin companies throughout Europe. These embody a €5 million fairness funding in France’s The Blockchain Group and a $15 million convertible bond for Swedish well being tech and Bitcoin treasury agency H100 Group.