Cardano (ADA) jumped about 7% in early Asian crypto buying and selling as 2026 kicked off, whereas Bitcoin and Ethereum posted smaller positive aspects. Bitcoin trades at $88 stage with about 1% acquire as Ethereum hovered above $3K with 1% rally, extending its gradual restoration from December lows. This all occurred as world inventory markets and even gold moved increased, signaling that traders really feel a bit braver about danger once more.

Cardano, Bitcoin, and Ethereum are three totally different crypto in the identical tech sector. In the present day, the entire sector is inexperienced, however one identify (ADA) stands out with a much bigger transfer. ADA outperformed main cash like Solana, XRP, and BNB, whilst analysts warned that this nonetheless doesn’t rely as a full “altcoin season.”

Why Is Cardano Crypto Leaping Whereas Bitcoin and Ethereum Simply Drift Increased? Altcoin Season?

An “altcoin season” is when a number of smaller cash rise a lot sooner than Bitcoin over a number of weeks. Proper now, that isn’t taking place. Analysts at B2BINPAY say cash nonetheless prefers the “massive, liquid” names like bitcoin and ether as traders begin the yr in “capital preservation mode.”

“Staking dangers are actual, however manageable with trusted suppliers.”

>Vitaliy Shtyrkin, CPO @B2BINPAY, by way of @nypost

Staking is not hype, it’s a long-term technique.

Learn extra: https://t.co/aFhQ5grCuq pic.twitter.com/kji6Lzh6hx

— B2BINPAY (@B2BINPAY) September 19, 2025

Cardano comes into this transfer after a brutal 2025. ADA dropped about 60% from its highs final yr, however nonetheless saved round 500 million ADA locked in its apps, which additionally reveals that many lengthy‑time period holders HODL-ing. In order for you a deeper have a look at that drawdown, we coated it intimately in our latest piece on Cardano’s 60% crash and 2026 outlook.

On the similar time, Bitcoin and Ethereum are doing their very own gradual grind. Now we have been monitoring this quick‑time period pattern in our each day market protection, together with Bitcoin near $90K and Ethereum reclaiming $3K, and our New Yr’s replace on BTC holding $87K with ETH just under $3K. Costs now sit barely above these ranges, which indicators that dip patrons quietly stepped again in after the vacation lull.

On‑chain and market reviews present ADA whales collected 150–180 million ADA throughout mid‑ to late‑2025, and establishments despatched about $73 million into ADA merchandise in 2025, with some analysis assigning about 75% odds of a Cardano ETF approval sooner or later.

DISCOVER: 16+ New and Upcoming Binance Listings in 2026

What Does This Imply for Us Taking a look at ADA, BTC, ETH, and SOL?

A 7% pop in ADA, whereas bitcoin and Ethereum transfer 1%, tells you merchants are taking selective danger. They aren’t throwing darts at each coin. They’re selecting tasks the place they see robust narratives in 2026.

For Cardano, these narratives embody main upgrades just like the Midnight privateness sidechain and the Ouroboros Leios improve, plus Hydra scaling work that goals to make the community sooner and cheaper. These upgrades help a “rebound” story for ADA in early 2026, although fundamentals like on‑chain exercise nonetheless look blended.

Charles Hoskinson on how Midnight can increase the $ADA ecosystem":If Midnight is like 25 cents, you could possibly be billions of {dollars} doubtlessly in TVL from that aspect of the home into the ecosystem, which is Cardano DeFi as properly."

[Source: @bigpeyYT] pic.twitter.com/k1KkwGwZPl— ALLINCRYPTO (@RealAllinCrypto) November 27, 2025

BTC and ETH, in the meantime, behave extra just like the “blue chips” of crypto. When analysts say flows favor “liquid majors,” they imply massive swimming pools of cash desire cash they’ll enter and exit rapidly with out transferring the value an excessive amount of. That is why many individuals begin with Bitcoin or Ethereum earlier than touching smaller altcoins.

Solana additionally joined at this time’s transfer increased, although with out ADA’s pop. If you wish to perceive how SOL generally trades out of sync with its rising utilization, verify our explainer on Solana’s price vs. network activity. We additionally just lately coated how ETF inflows interact with key Solana price levels, which supplies context for any SOL rallies you see this yr.

DISCOVER: 10+ Next Crypto to 100X In 2026

How Ought to You Assume Concerning the Dangers Behind In the present day’s Inexperienced Numbers?

ADA’s 7% transfer appears to be like thrilling on a each day chart. On a one‑yr chart, it nonetheless sits far beneath 2025 highs. Quick‑time period spikes typically replicate merchants reacting to skinny liquidity and vacation positioning, not a assured lengthy‑time period pattern.

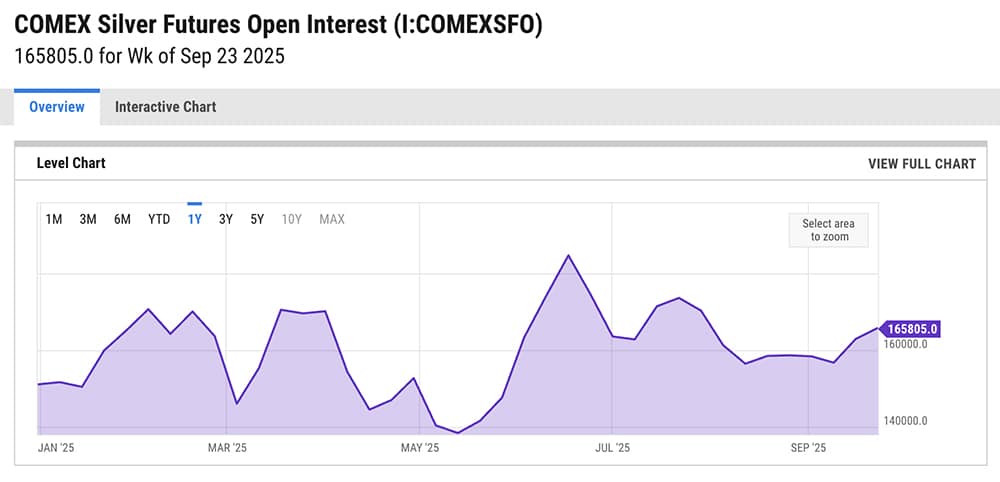

Analysts in conventional markets count on some close to‑time period promoting as massive funds rebalance after final yr’s rally in belongings like silver and gold. It’s reported that as a lot as 13% of open curiosity in Comex silver could exit within the coming weeks. When massive gamers reshuffle like this, it may possibly ripple into crypto as a result of many commerce shares, metals, and crypto as a part of one world danger bucket.

(supply – Ychart)

In case you are eager about shopping for ADA or some other coin due to at this time’s transfer, deal with this as a sign to analysis, not a inexperienced gentle to ape in. Excessive‑danger rule primary: by no means use hire cash, emergency financial savings, or borrowed funds to chase a each day pump. A 7% up day can flip right into a 15% down day simply as rapidly in altcoins.

The more healthy approach to method this: determine whether or not you need lengthy‑time period publicity to massive caps like BTC and ETH, then contemplate smaller positions in tasks like ADA or SOL solely after you perceive what they do, how upgrades like Midnight and Hydra matter, and the way a lot volatility you possibly can abdomen. If this quiet early‑2026 rally grows into one thing larger, affected person and educated patrons will really feel far more comfy than those that purchased on impulse.

For now, Bitcoin holding the excessive $80,000s and Ethereum sitting above $3,000 means that crypto patrons haven’t gone away, and selective curiosity in Cardano hints at an early return of danger urge for food. The following few weeks will present whether or not this stays a peaceful “majors and some alts” story or evolves right into a broader crypto run.

DISCOVER: Top 20 Crypto to Buy in 2026

Follow 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Every day Professional Market Evaluation.

The put up Cardano jumps 7% as 2026 Opens Its Crypto Chapter While BTC and ETH Quietly Grind Higher appeared first on 99Bitcoins.