In keeping with Sharplink co-CEO Joseph Chalom, Ethereum may see a serious leap in whole worth locked (TVL) subsequent 12 months if sure onchain tendencies decide up.

Chalom put a daring quantity on it: 10X TVL in 2026. That declare ties collectively rising stablecoin use, greater tokenization of real-world belongings, and elevated curiosity from massive monetary teams.

Associated Studying

Stablecoin Exercise On Ethereum

Primarily based on studies, the whole stablecoin market stands at about $308 billion now and will develop to $500 billion by the tip of subsequent 12 months, an increase of roughly 62%.

Over half of all stablecoin exercise — about 54% — occurs on Ethereum. That math issues: extra stablecoin flows on Ethereum tends to carry the protocol’s TVL as a result of lots of these {dollars} sit in sensible contracts for swaps, lending, and liquidity swimming pools.

Sharplink Gaming holds 797,704 Ether, price roughly $2.30 billion on the time of publication, a sign that some public treasuries are already staking massive bets on the community.

Tokenized Belongings Achieve Traction

Chalom additionally expects tokenized real-world belongings to increase quickly, forecasting a $300 billion marketplace for RWAs in 2026 and saying tokenized belongings will 10X in AUM subsequent 12 months as funds, shares, and bonds get wrapped onchain.

In 2026, I imagine Ethereum’s Whole Worth Locked (TVL) will enhance 10X. Why and the way? 🧵

Views ≠ funding recommendation.

— Joseph Chalom (@joechalom) December 26, 2025

He factors to rising curiosity from mainstream companies like JPMorgan, Franklin Templeton, and BlackRock. Studies be aware that sovereign wealth funds might enhance their Ethereum publicity by five- to tenfold, which may carry giant, affected person capital into tokenization tasks and protocol deposits.

Ethereum Worth Motion

Ethereum was buying and selling close to $2,921 on December 25, 2025, giving the community a market worth of about $352 billion, whereas 24-hour buying and selling quantity got here in at roughly $11.47 billion.

Over the course of 2025, ETH moved by a full market swing. It opened the 12 months round $3,298, climbed to about $4,390 in August, and stayed under its report excessive of $4,942, earlier than sliding again to the $2,921 space by year-end.

Worth swings have been heavy, with annual volatility near 140%. Technical readings present combined momentum. The weekly RSI sits at 41.7, putting Ethereum in a neutral-to-bearish zone, whereas the each day MACD histogram stays detrimental at -0.15. Worth motion has additionally been boxed right into a slim band between $2,774 and $3,038.

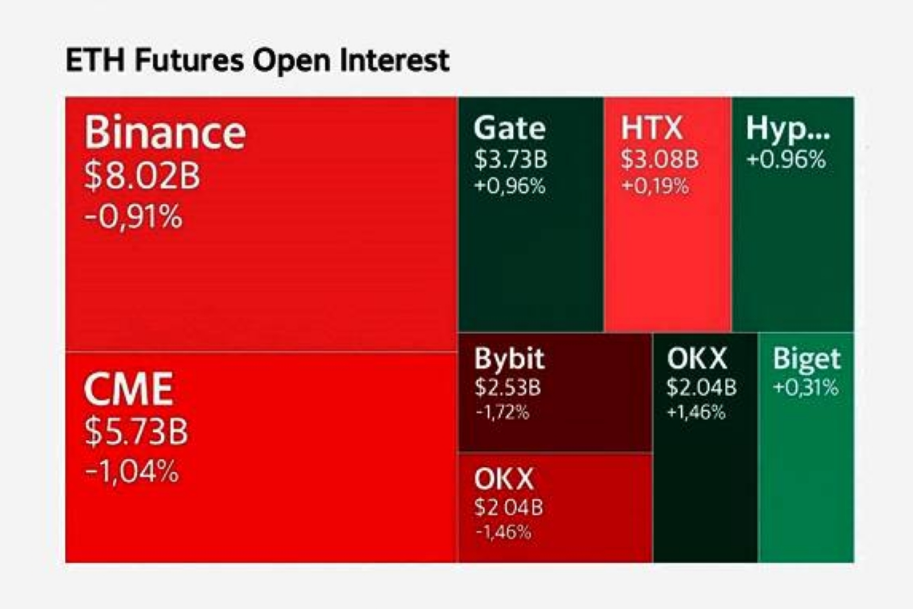

Futures knowledge provides to the cautious tone. Whole open interest stands close to $37 billion, down 0.62% over the previous 24 hours, pointing to decreased publicity from merchants. Liquidation knowledge exhibits greater than $100 million in potential lengthy liquidations clustered between $2,880 and $2,910, an space now seen as a key strain level.

Associated Studying

Market Alerts And Dangers

Not everybody agrees that token flows will translate into fast worth positive factors. In keeping with crypto analyst Benjamin Cowen, Ether is unlikely to hit new highs subsequent 12 months given present Bitcoin circumstances.

That warning traces up with technicals that time to range-bound buying and selling and with the truth that open curiosity has eased barely. The liquidation cluster close to $2,880–$2,910 exhibits the place leveraged positions may very well be pressured out, and that type of stress can push worth strikes sooner than fundamentals.

Featured picture from Gemini, chart from TradingView