China reportedly minimize its U.S. Treasury holdings for a ninth straight month, pushing publicity to the bottom stage since 2008. Bitcoin held agency close to current highs as gold surged towards $4,200, exhibiting how markets react when religion in U.S. debt slips. This transfer suits a wider pattern: central banks are slowly stepping away from the greenback.

For on a regular basis traders, this isn’t summary geopolitics. When large international locations promote U.S. debt, it adjustments how cash flows throughout shares, bonds, gold, and Bitcoin. That ripple can attain your portfolio quicker than you assume.

This Evaluation issues as a result of Bitcoin usually feeds off macro uncertainty. When belief in conventional methods wobbles, individuals seek for alternate options.

DISCOVER: Top Ethereum Meme Coins to Buy in 2026

What Is Actually Taking place With China and U.S. Debt?

U.S. Treasuries are authorities IOUs. Nations purchase them as a result of they’re liquid and traditionally secure. China as soon as held over $1.3 trillion, however that quantity has slid for 15 years.

Now, China has offered Treasuries for 9 months in a row. This puts China at its lowest publicity for the reason that world monetary disaster. So what? When a significant purchaser steps again, it alerts much less confidence in U.S. debt because the world’s default protected asset. That opens the door for alternate options.

Why Bitcoin Retains Displaying Up in This Dialog

BREAKING: The US Greenback now represents ~40% of worldwide foreign money reserves, the bottom in no less than 20 years.

This share has declined -18 share factors during the last 10 years.

Over the identical interval, gold’s share has elevated +12 factors, to twenty-eight%, the best for the reason that… pic.twitter.com/M0BqI09iQ4

— The Kobeissi Letter (@KobeissiLetter) January 9, 2026

International greenback reserves now sit close to 57–58%, the bottom for the reason that Nineties. On the similar time, central financial institution gold holdings have doubled since 2014. Bitcoin enters the chat as a digital various to gold. Consider it as a worldwide financial savings account that no nation controls. That story will get louder when belief in authorities debt fades.

This doesn’t imply that Bitcoin will substitute the greenback tomorrow. It means Bitcoin advantages from the identical worry that pushes gold increased.

DISCOVER: Top 20 Crypto to Buy in 2026

Who Wins and Who Feels the Strain?

(Supply: GOLD Worth / TradingView)

Gold has already responded, rising to $4,200 per ounce in late 2025 as central banks diversified. Bitcoin tends to lag, then catch up, as retail traders course of the identical story.

On the opposite aspect, the U.S. faces increased stress to draw patrons for its debt. Even Japan hinted its $1.1 trillion Treasury stack may turn into a commerce negotiation instrument.

For inexperienced persons, this explains why Bitcoin typically rises when conventional markets really feel uneasy. It trades on belief, not money circulation.

The Threat Examine Most Headlines Skip

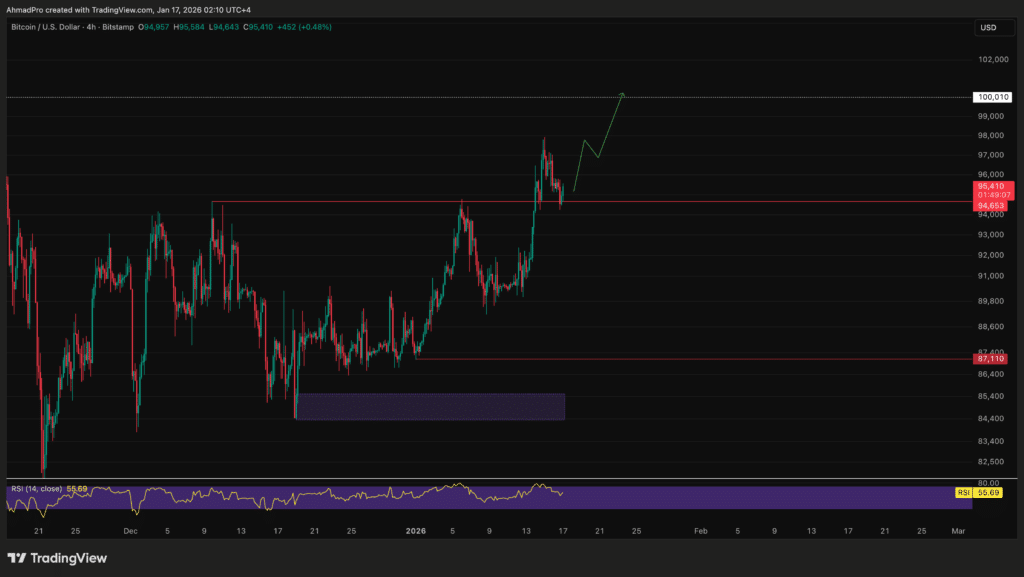

(Supply: BTCUSD / TradingView)

Bitcoin is unstable. A macro narrative can increase curiosity, however value nonetheless swings onerous. Quick-term drops can occur even throughout long-term adoption tales.

Additionally, central banks usually are not shopping for Bitcoin immediately. They nonetheless favor gold and native foreign money methods. Bitcoin beneficial properties consideration primarily from traders, not governments.

Translation: it is a tailwind, not a assure. By no means deal with macro tales as a inexperienced gentle to guess lease cash.

As de-dollarization continues, Bitcoin stays within the highlight as a hedge narrative. Watch how gold and Treasury demand transfer subsequent, as a result of Bitcoin normally listens.

DISCOVER: Top Solana Meme Coins to Buy in 2026

Observe 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Every day Skilled Market Evaluation

The put up China Dumps U.S. Treasuries: Here’s Why Bitcoin Cares appeared first on 99Bitcoins.