China is shifting nearer to exploring stablecoins, a change that would reshape world funds and assist push the yuan onto the world stage. Experiences say the State Council is reviewing a roadmap that may set targets for utilizing a yuan-backed stablecoin, assign roles to home regulators, and lay out guidelines to handle dangers. Senior leaders are anticipated to satisfy this month to debate yuan internationalisation and stablecoin coverage — a notable shift from the 2021 ban on crypto buying and selling and mining, and a improvement carefully watched by tasks like Conflux crypto, which place themselves as regulatory-compliant blockchains in China.

JUST IN: China pivots to stablecoins after US passes the GENIUS Act.

Beijing is now drafting a yuan-backed stablecoin roadmap, with pilots set offshore in

Hong Kong.

This marks a significant shift: as soon as centered solely on the e-CNY CBDC (home use), China now sees stablecoins… pic.twitter.com/JLqSmbz5xD— Jessica Gonzales (@lil_disruptor) August 28, 2025

Beijing has lengthy aspired for the yuan to rival the U.S. greenback and euro in world funds. But, regardless of China’s huge commerce surpluses, strict capital controls have capped its worldwide affect.

Stablecoins are digital tokens pegged to fiat currencies and supply immediate, low-cost, borderless transfers. For a rustic that has lengthy enforced strict capital controls, stablecoins current each a possibility and a problem: they may make cross-border yuan flows simpler, however regulators will want safeguards to stop capital flight and monetary instability.

The yuan’s share of worldwide funds not too long ago fell to about 2.88%, underscoring why Beijing is concerned about instruments to spice up worldwide use of the foreign money.

EXPLORE: The 12+ Hottest Crypto Presales to Buy Right Now

Beijing’s Stablecoin Roadmap Might Redefine Yuan Internationalisation, Problem U.S. Greenback Dominance, and Spark a New Period for China-Compliant Blockchains Like Conflux Crypto

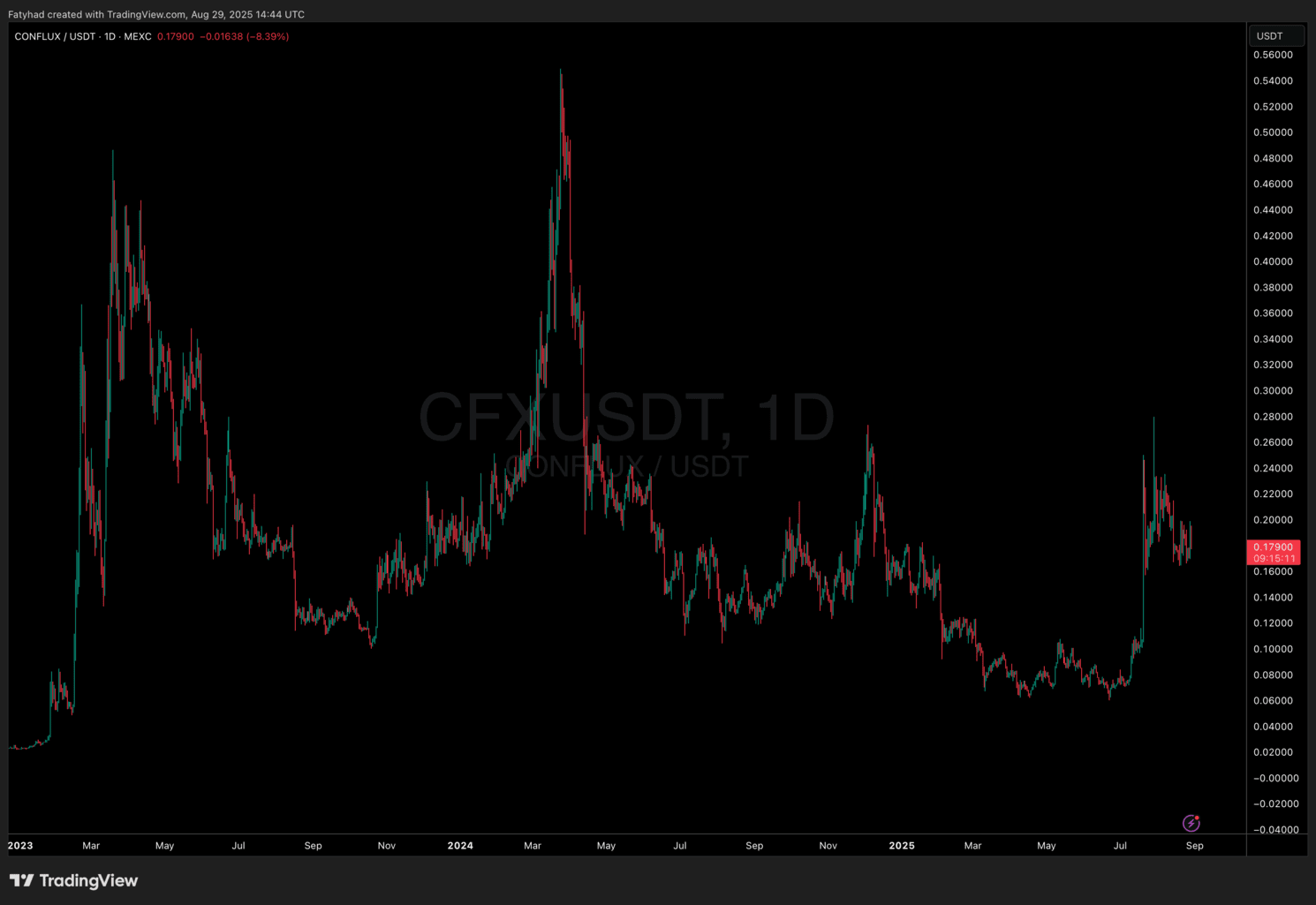

Following this transformation of coronary heart, Conflux (CFX) crypto has exploded greater. Since July, CFX has climbed sharply after two headlines: a plan for an offshore yuan-pegged stablecoin constructed with fintech companions, and the rollout of Conflux 3.0, which guarantees a lot sooner throughput (as much as 15,000 TPS) and higher cross-border settlement help.

Buying and selling quantity jumped from underneath $60 million to greater than $1.7 billion in a few days, briefly pushing CFX market cap above $1 billion.

(Supply: CFXUSDT)

Conflux can be making ready a crucial community improve (v3.0.1). The laborious fork is scheduled for August 31 (08:00 UTC+8); Binance has stated it would droop CFX deposits and withdrawals beginning September 1 as a precaution throughout the improve — an ordinary follow to assist guarantee a easy transition.

PetroChina’s Stablecoin Experiment Highlights Company Adoption and Hong Kong’s Regulatory Function

In the meantime, PetroChina is finding out whether or not stablecoins can be utilized for cross-border settlement and funds, citing Hong Kong’s new stablecoin guidelines (efficient August 1) and shut monitoring of the HKMA.

China Nationwide Petroleum Company, one of many world's largest power firms, disclosed at its half-year outcomes convention that the corporate is carefully following the newest developments of the Hong Kong Financial Authority relating to stablecoin issuer licenses, and can…

— Wu Blockchain (@WuBlockchain) August 29, 2025

If power majors like PetroChina start settling transactions in yuan-pegged tokens, the potential affect on world commerce corridors might be large. For China, it might imply a direct utility of stablecoin know-how to develop yuan-denominated settlement, lowering reliance on the U.S. greenback in oil and commodity markets.

Might Conflux crypto develop into a significant participant on this sector? The reply will rely on regulatory outcomes in Beijing and Hong Kong, how easily Conflux’s improve runs, and whether or not main corporations truly transfer to settle in yuan-pegged stablecoins. For now, Conflux sits on the middle of a narrative that mixes coverage, infrastructure upgrades, and company pilots — and that mix is why merchants can’t assist however watch carefully.

Key Takeaways

- China’s State Council is reviewing a roadmap for yuan-backed stablecoins. This alerts a significant coverage shift.

- Conflux crypto positive factors momentum with its 3.0 improve and compliance edge, aligning with China’s blockchain ambitions.

- PetroChina explores stablecoin settlements underneath Hong Kong’s new framework, highlighting broader adoption in conventional industries.

The publish China is Moving on Chinese Stablecoin: Is Conflux Crypto Pump Evidence of Smart Money Accumulation? appeared first on 99Bitcoins.