A China-based leisure firm has made a significant transfer into crypto, shopping for 300 Bitcoin simply because the market trades close to $114,000.

Pop Tradition Group (NASDAQ: CPOP), headquartered in Xiamen, disclosed the $33M buy in a press release.

The corporate emphasised the start of its digital asset treasure and a part of wider plans to attach its leisure enterprise with Web3.

It shared its plan to put money into extra belongings in Bitcoin, Ethereum, and BOT to ascertain a diversified crypto fund to finance blockchain-oriented leisure initiatives.

Bitcoin Value Evaluation: How is Bitcoin Buying and selling Publish Buy?

Bitcoin is holding close to $114,400, with intraday strikes between $113,200 and $114,700. The broader market stays upbeat as merchants guess on US charge cuts after inflation knowledge met expectations.

The timing of Pop Tradition Group’s entry coincides with what analysts see as a key technical setup for Bitcoin.

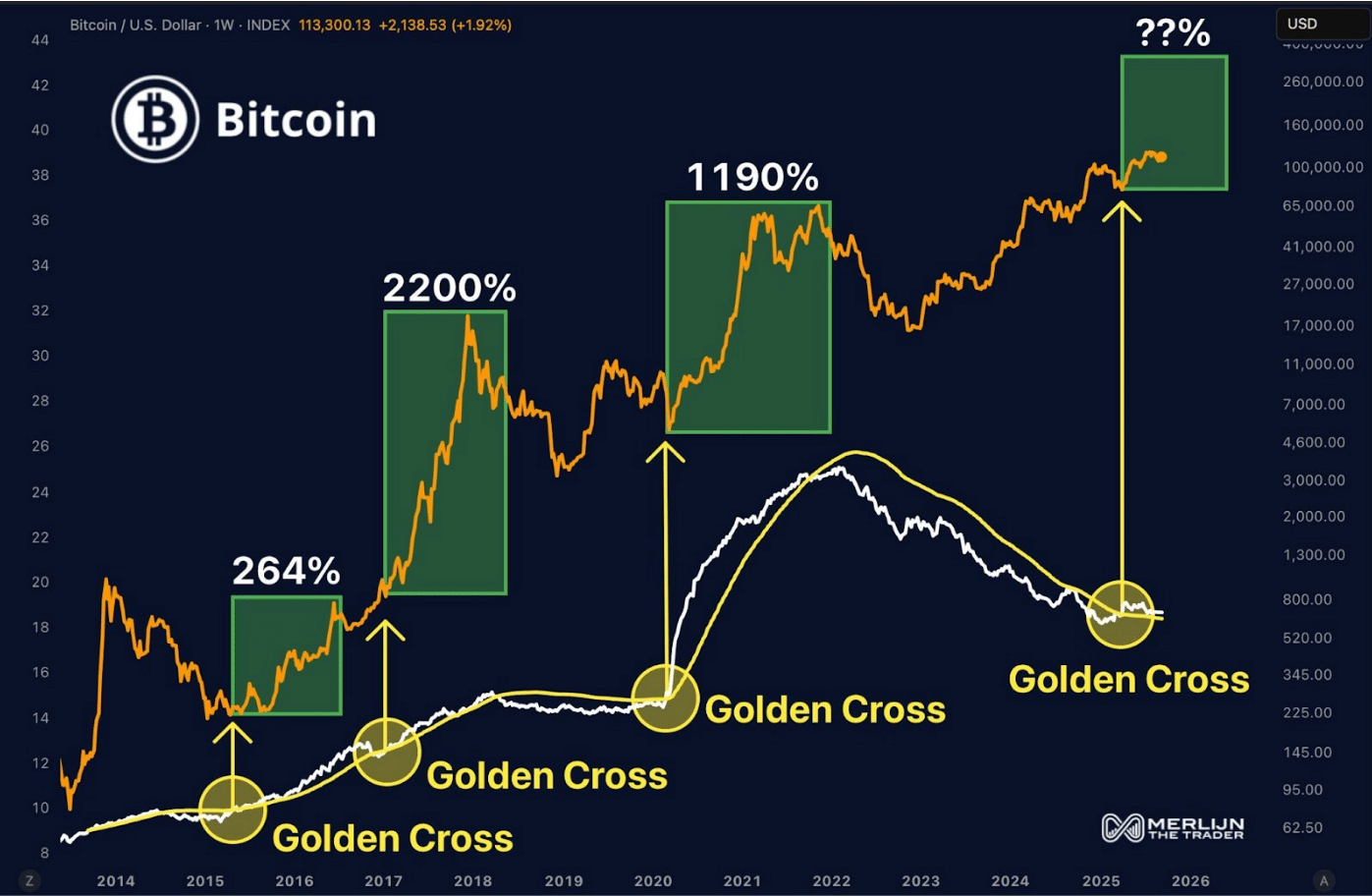

Merlijn, a crypto analyst, shared the chart on X, which exhibits Bitcoin has fashioned one other “golden cross” when the 50-week transferring common rises above the 200-week transferring common.

Bitcoin Phases Restoration | ETH Blasts $4.4K | Altcoins on Fireplace!

Watch right here:https://t.co/bCksAuGhg0 pic.twitter.com/S16RPAtZG0

— Merlijn The Dealer (@MerlijnTrader) September 11, 2025

This crossover is extensively considered as a bullish sign.

In previous cycles, golden crosses have preceded sturdy rallies. Bitcoin elevated 264% in 2015, 2,200% in 2016, and 1,190% in 2020 with the cross, sign, and file highs, respectively.

Bitcoin is buying and selling right now between $113,000 and $114,000 in a consolidation band. The development is much like earlier phases, during which the asset established a backside after which important upward actions.

Analysts observe that the long-term development is characterised by greater highs and better lows.

Golden crosses don’t predict future outcomes, however historical past signifies that they have a tendency to coincide with the start of the multi-year progress cycles.

The query that the merchants are considering now could be whether or not this newest sign will result in one other big rally or whether or not it’ll dangle in the midst of the resistance.

Bitcoin remains to be steering the market, at the same time as ETH clears $4,400 and altcoins warmth up.

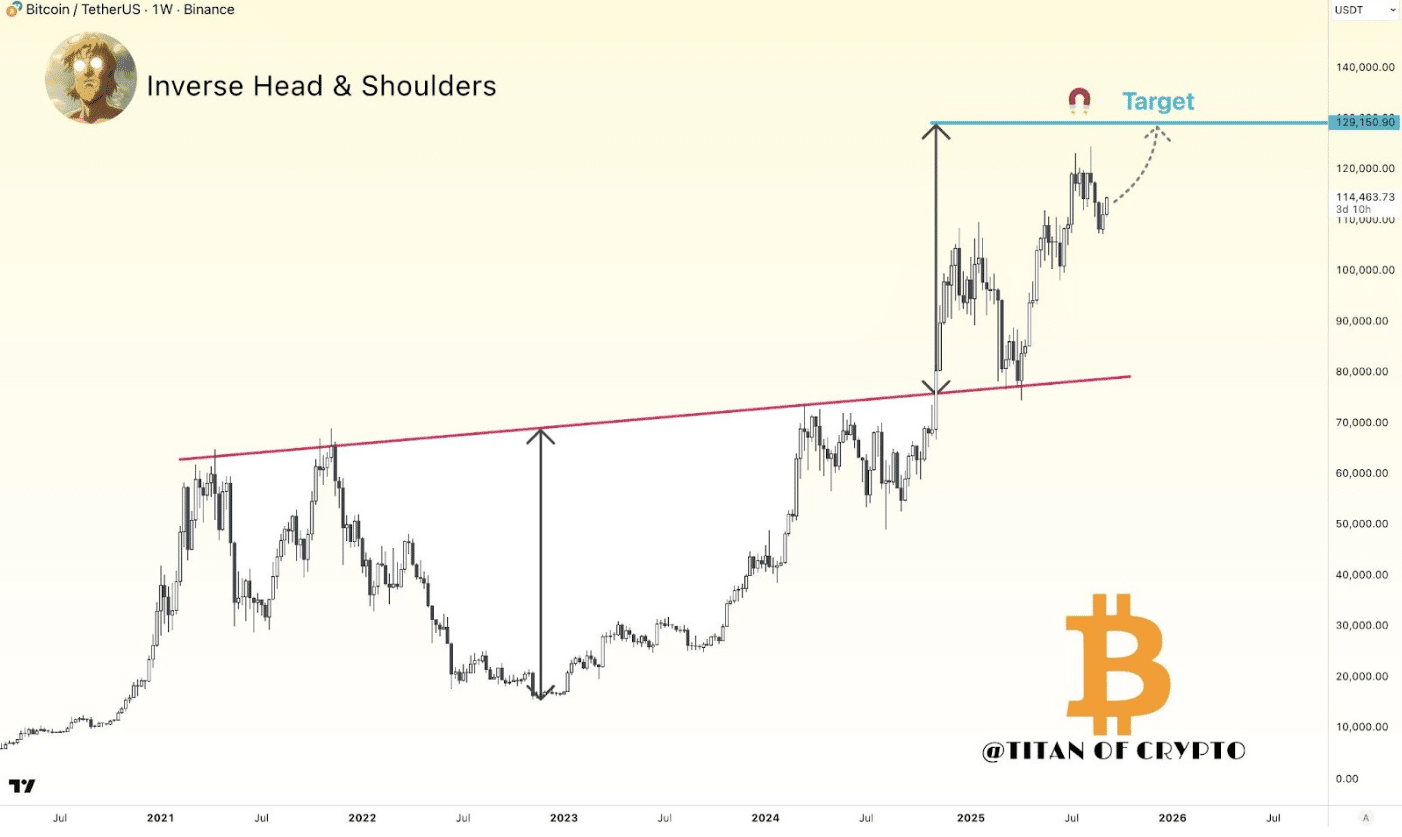

Chart analyst Titan of Crypto keeps a long-term Bitcoin goal of $129,000. The view rests on an inverse head-and-shoulders sample that has held up by current swings.

On the weekly chart, value broke decisively above the neckline, drawn in opposition to the 2021–2022 peaks.

That breakout completes the sample and factors to a measured transfer towards $129K. Bitcoin is buying and selling round $114,463 after a robust run earlier this yr.

The retest close to $80K acted as a clear assist test earlier than the transfer greater. So long as value holds above the $110K space, the bullish case stays intact. Lose that zone, and momentum might fade.

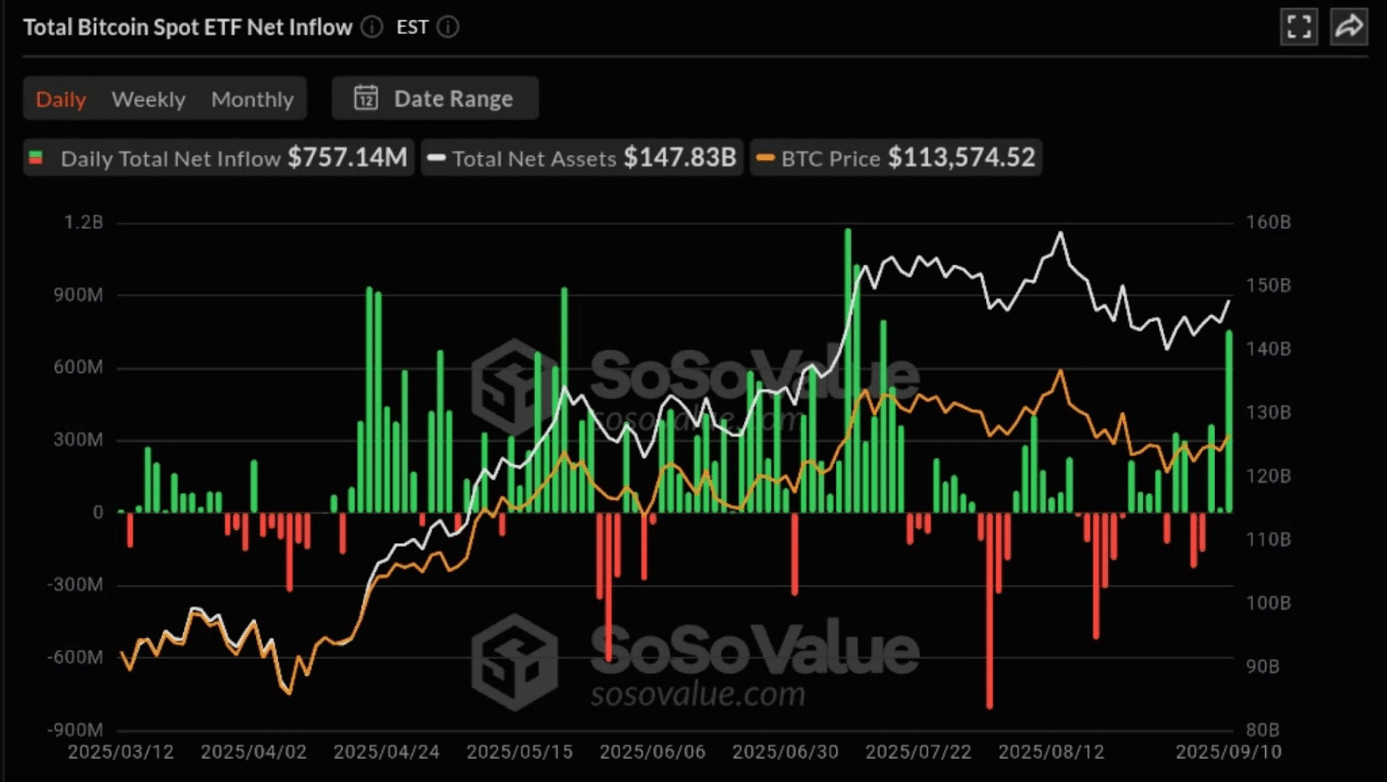

In line with SoSoValue data, internet inflows hit $757.14M as of right now, the strongest in two months.

The inexperienced bars shoot again into the constructive space following a tough interval, but a white line signifies a value that escalates over $113,500.

(Source: Total Bitcoin ETF Net Inflow, SoSo Value)

(Source: Total Bitcoin ETF Net Inflow, SoSo Value)

Beforehand witnessed outflows in July and August had been a drag on sentiment. Nevertheless, new institutional shopping for is restoring confidence. That’s essential since constant ETF bids are inclined to cushion the pullbacks and might push the value upward.

If $110K holds and inflows persist, $129K stays a sensible goal. If not, count on a slower grind and deeper exams of assist

How Are Chinese language Corporations Discovering Methods Into Crypto Regardless of Restrictions?

Markets are leaning towards a September charge reduce after US inflation knowledge matched forecasts, giving danger belongings a lift.

Bitcoin briefly crossed $114,000 as merchants priced in a 25 foundation level transfer from the Federal Reserve. CPI numbers stay central to the short-term vary.

There are nonetheless restrictions on buying and selling within the mainland, but the businesses associated to China nonetheless commerce by way of abroad itemizing and allotment of treasury shares.

The current Bitcoin acquisition by Pop Tradition Group displays a much bigger development of Asian corporations experimenting with Web3 methods despite said restrictions.

Spot ETF flows are driving a lot of the value motion, and inflows hit multi-week highs this week, aligning with Bitcoin’s push again towards resistance at $115K.

Buying and selling volumes during the last 24 hours stay sturdy, displaying extra affect from macro flows than retail churn.

Analysts see $115K as the important thing hurdle. A transparent break and maintain might attract momentum merchants chasing greater ranges. Failure to push by might lure BTC between $104K and $114K.

The put up Chinese Money Enters The Picture as Bitcoin Price Slams $114K appeared first on 99Bitcoins.