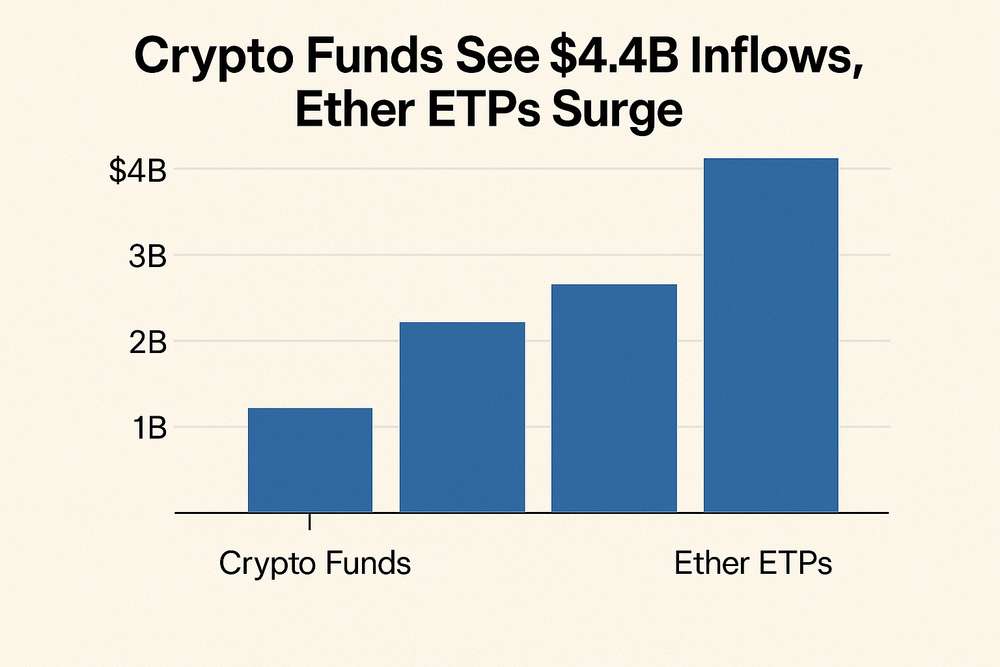

Cryptocurrency funding merchandise have recorded unprecedented capital inflows, with U.S. spot Bitcoin ETFs driving a nine-day streak totaling $4.4 billion in new investments. This surge coincides with Ethereum-based exchange-traded merchandise (ETPs) considerably outpacing Bitcoin in relative progress, marking a pivotal shift in institutional crypto adoption. In keeping with a Cointelegraph report, the inflows characterize the strongest capital motion because the launch of those funds.

BlackRock’s IBIT ETF dominated the inflows, attracting $416.35 million in a single day, whereas VanEck’s HODL added $19 million. Regardless of this bullish momentum, Grayscale’s GBTC skilled $41.22 million in outflows, with Constancy’s FBTC and Ark/21Shares’ ARKB additionally seeing minor redemptions. The web constructive stream underscores strong institutional confidence as Bitcoin trades close to all-time highs.

Cumulative inflows for spot Bitcoin ETFs now stand at $53.07 billion, with the sector drawing practically $17 billion since April alone. Deutsche Financial institution analysts establish ETF flows as 2025’s main market catalyst, noting that over $35 billion entered U.S. Bitcoin ETFs this 12 months, pushing complete belongings underneath administration towards $150 billion.

Bitcoin ETF Momentum

The nine-day influx streak represents the longest sustained capital inflow since January, with BlackRock’s IBIT now commanding $83 billion in belongings. This fund alone generated extra income than BlackRock’s flagship S&P 500 ETF final quarter, highlighting crypto’s rising institutional footprint. The next desk particulars key ETF actions through the streak’s peak day:

| Fund | Issuer | Move (Thousands and thousands) |

|---|---|---|

| IBIT | BlackRock | +$416.35 |

| HODL | VanEck | +$19.00 |

| GBTC | Grayscale | -$41.22 |

| FBTC | Constancy | -$23.00 |

Market analysts attribute this demand to macroeconomic uncertainty and rising regulatory readability. Bitcoin’s worth stability above $119,000 through the influx interval supplied essential assist, with the cryptocurrency briefly touching a brand new all-time excessive of $123,226 final week. This worth resilience occurred regardless of over $5.8 billion in Bitcoin and Ethereum choices expiring through the interval.

Ethereum ETPs Breakout

Ethereum-based funding merchandise have outperformed Bitcoin counterparts in relative progress, attracting $226 million in weekly inflows at twice Bitcoin’s tempo. This surge propelled year-to-date Ether ETP beneficial properties past 2024’s complete, signaling renewed institutional curiosity in Ethereum’s tokenization capabilities. The momentum contributed to the broader crypto market capitalization exceeding $4 trillion for the primary time.

Ethereum’s relative energy emerges because the community prepares for its Pectra improve, which goals to boost scalability and consumer expertise. Institutional inflows into Ether merchandise now complete $1.04 billion over 11 consecutive weeks, suggesting confidence in Ethereum’s utility past speculative buying and selling. This divergence from Bitcoin’s dominance marks a maturation in crypto funding methods.

Market Affect and Developments

The capital inflow coincides with MicroStrategy pausing its Bitcoin accumulation technique for the primary time in three months, regardless of holding 59,000 BTC. This short-term halt contrasts with accelerating ETF inflows, indicating diversified institutional entry factors. Deutsche Financial institution’s evaluation confirms ETF flows as 2025’s dominant worth driver, with single-day inflows reaching $1.17 billion final week.

Over 135 public corporations now maintain Bitcoin as a reserve asset, contributing to the $14.4 billion year-to-date ETF inflows. Analysts challenge sustained demand via 2025’s second half, citing regulatory readability and inflation hedging wants. The crypto choices market mirrored this exercise, with $5.8 billion in contracts expiring as Ethereum led quantity.

Grayscale’s Mini Bitcoin Belief and Bitwise’s BITB joined the influx pattern, although Ark Make investments’s ARKB noticed minor outflows. This divergence highlights investor selectivity even inside bullish circumstances. The Worldwide Financial Fund famous potential pockets reshuffling in El Salvador’s Bitcoin reserves, although this didn’t dampen broader market sentiment.

VanEck’s HODL ETF emerged as a constant performer, attracting regular inflows all through the streak. Bitwise’s BITB additionally demonstrated resilience, sustaining constructive flows regardless of sector volatility. These developments counsel buyers are diversifying past market leaders into specialised merchandise.

Constancy’s FBTC outflows marked a uncommon deviation from the agency’s usually robust efficiency, although its $23 million redemption paled in opposition to BlackRock’s $416 million consumption. This distinction underscores the aggressive dynamics evolving inside the crypto ETF panorama as merchandise differentiate via charge buildings and custody options.

Market technicians word Bitcoin’s consolidation above $119,000 establishes a brand new assist degree, probably enabling one other upward leg if ETF inflows persist. The crypto market’s $4 trillion milestone displays accelerating institutional participation past Bitcoin, with real-world asset tokenization rising as a key progress sector.

Set up Coin Push cell app to get worthwhile crypto alerts. Coin Push sends well timed notifications – so that you don’t miss any main market actions.

The file inflows sign deepening institutional dedication to cryptocurrency as an asset class, with Ethereum merchandise gaining disproportionate curiosity. This capital motion has stabilized costs throughout choices expirations and established new valuation baselines. The ETF-driven demand seems sustainable via 2025, probably reshaping crypto’s correlation with conventional markets.

- ETF (Alternate-Traded Fund)

- Funding fund traded on inventory exchanges holding belongings like shares, bonds, or cryptocurrencies. Offers diversified publicity with out direct asset possession.

- ETP (Alternate-Traded Product)

- Umbrella time period for exchange-traded devices together with ETFs, ETNs, and others. Tracks underlying belongings via derivatives or bodily holdings.

- AUM (Property Below Administration)

- Complete market worth of belongings managed by a monetary establishment. Signifies fund measurement and investor confidence in administration methods.

- Choices Expiry

- Date when by-product contracts have to be exercised or expire nugatory. Giant expirations can improve short-term market volatility close to strike costs.