What’s good in the present day? Effectively, nothing moreover it’s Christmas. Belief Pockets customers drained following a giant Chrome browser hack as Bitcoin struggles in worth regardless of Gold and Silver hitting all-time highs.

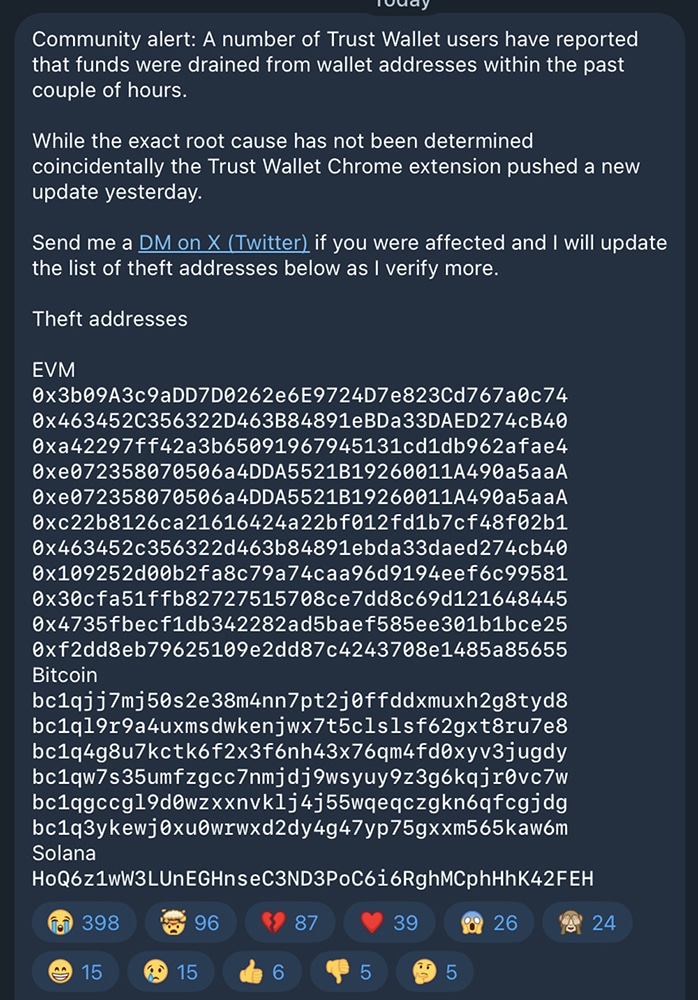

This Christmas Day, Belief Pockets customers have confronted a giant hit as their wallets have been drained in a phishing hack. The hacker focused the Chrome extension model 2.68, and so they used a supply-chain exploit to steal non-public keys from wallets. Bitcoin, Ethereum, Solana, and a few EVM chains like BNB are affected, and in whole, the hack drained round $7 million from over 600 Belief Pockets customers.

ZachXBT of X, an on-chain sleuth, was one of many first to identify the problem and alert the group. Binance’s CEO, Changpeng Zhao, confirmed the $7 million loss and promised full reimbursements for everybody affected. Belief Pockets launched a repair with model 2.69, which stopped any additional thefts.

(supply – ZachXBT Telegram)

However for the victims, the blow is surprising, and the injury is completed. One in every of Belief Pockets customers, who has been in crypto since 2018, mentioned she adopted all one of the best practices, and her funds had been nonetheless stolen throughout the hack. Nonetheless, CZ assured customers that the stolen funds could be lined, saying, “Person funds are SAFU.”

To this point, $7m affected by this hack. @TrustWallet will cowl. Person funds are SAFU. Respect your understanding for any inconveniences precipitated.

The crew remains to be investigating how hackers had been capable of submit a brand new model. https://t.co/xdPGwwDU8b

— CZ

BNB (@cz_binance) December 26, 2025

Should you’re utilizing Belief Pockets, be sure to replace proper now. It’s a very good reminder that no pockets is 100% foolproof.

Past Belief Pockets Hack: Bitcoin Worth within the Purple, What’s Going On This December?

Moreover the Belief Pockets hack, the larger footage comply with the Bitcoin worth, which has been struggling this December. We’re seeing a well-recognized sample of dips out there, similar to we’ve seen in previous Decembers.

The massive query on our thoughts is:

Will this purple month result in a inexperienced January?

POV: coming down for Christmas Dinner

.

“There’s our little crypto man… come inform us about your cash” pic.twitter.com/Skqz49wvY0— CRYPTO 101 Podcast (@CRYPTO101Pod) December 25, 2025

Regardless of the struggles of Bitcoin and its worth fluctuations, there are some vibrant spots. The stablecoin market cap has hit an all-time excessive of $310 billion, marking a 70% improve in only a 12 months, and crypto adoption remains to be rising. Plus, the full crypto market cap remains to be on the rise if we evaluate it 12 months to 12 months. However, the expiration of Bitcoin and Ethereum choices in the present day might create some volatility, hopefully with an upside, and the bulls to take over.

(supply – CoinGecko)

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

What’s Subsequent for Bitcoin in 2026? Is a Bull Run Coming?

For 2026, opinions are in every single place. Peter Schiff is warning of an financial collapse that might finally drag Bitcoin down with it. Then again, CZ Binance remains to be fairly bullish, predicting that 2026 may very well be the beginning of a “supercycle” for crypto, particularly with mainstream adoption and higher tech.

When bitcoin was ATH, have you ever ever thought, “I want I purchased bitcoins early”?

Guess what, those that purchased early didn’t purchase at ATH, they purchased when there have been worry, uncertainty and doubt.

Merry Christmas

— CZ

BNB (@cz_binance) December 25, 2025

Bitcoin’s long-term fundamentals nonetheless look robust. Whereas we’re seeing some short-term struggles, issues like the expansion within the stablecoin market and the continued curiosity from institutional traders present that crypto is right here to remain. Plus, we’ve seen prior to now that Bitcoin tends to bounce again in February after a troublesome December and January.

So, whereas the following few months is likely to be a bit bumpy, a stable restoration in 2026 may very well be in play. In any case, crypto has been by means of its fair proportion of ups and downs, and it’s bounced again each time. Keep in mind, Bitcoin is a million-dollar asset, and nothing can change it eternally, or simply but.

DISCOVER: 10+ Next Coin to 100X In 2025

Follow 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Each day Knowledgeable Market Evaluation.

Uniswap Passes Historic “UNIFICation” Proposal to Burn 100M UNI

The change has flipped quick on Uniswap. With UNIfication accredited, Uniswap stopped pretending it was only a DeFi plumbing software and is pivoting to one thing extra.

The protocol is now hard-wiring value seize into its core, turning years of passive quantity into an specific new change in Uniswap’s economics. Uniswap’s vote, which closed on December 25, handed with overwhelming help.

Greater than 125 million UNI tokens had been forged in favor, with fewer than 1,000 votes in opposition to. Quorum was exceeded by a large margin, triggering a brief governance timelock earlier than execution begins on-chain.

Learn the complete story here.

SEC Cracks Down On 7 In $14M Rip-off Amid File Wave Of Bitcoin Filings

Is the Bitcoin worth at risk heading into 2026? The US Securities and Alternate Fee has charged three crypto buying and selling platforms and 4 affiliated funding golf equipment for allegedly defrauding American retail traders out of roughly $14 Mn.

This crackdown is touchdown simply as Washington is lastly constructing a clearer regulatory perimeter round digital assets.

BULLISH:

SEC Chair Paul Atkins says crypto market construction laws will quickly cross in Congress.

This may drop market manipulation by 70%-80%. pic.twitter.com/lllPXrgH4I

— Max Crypto (@MaxCrypto) December 24, 2025

Based on the SEC, Morocoin Tech Corp., Berge Blockchain Expertise Co. Ltd., and Cirkor Inc. labored in tandem with AI Wealth Inc., Lane Wealth Inc., AI Funding Training Basis Ltd., and Zenith Asset Tech Basis to run what regulators describe as an “funding confidence rip-off.” The targets had been on a regular basis traders pulled in by means of WhatsApp groups, social media advertisements, and guarantees of AI-powered buying and selling insights.

Laura D’Allaird, Chief of the SEC’s Cyber and Rising Applied sciences Unit, was blunt:

“This matter highlights an all-too-common type of funding rip-off getting used to focus on US retail traders with devastating penalties.”

$154 Billion in Crypto Liquidations: Find out how to Keep away from It and What to Do

2025 has been a brutal 12 months for us in crypto, with $154 billion worn out simply from this 12 months’s whole liquidations alone. This large lack of course got here from these utilizing approach an excessive amount of leverage, overleveraged. There have been some huge triggers, just like the October tenth flash crash that noticed greater than $19 billion liquidated.

If we’re to remain in crypto, we have to know easy methods to keep away from this sort of loss sooner or later.

Whole crypto market cap: $3 trillion

Whole liquidations in 2025 alone: $150 billionEarlier than playing on futures once more, ask urself:

Do you actually need to donate your hard-earned cash to grasping, extractive trade and MM pockets?

Futures are the most important most cancers of this trade. pic.twitter.com/VBdye7nUcp

— 𝗰𝘆𝗰𝗹𝗼𝗽 (@nobrainflip) December 25, 2025

Learn the complete story here.

The submit Crypto Market News Today, December 26: Trust Wallet Hack Steals $7 Million Amid Bitcoin’s Red December appeared first on 99Bitcoins.