Though not many information retailers are reporting it right now, we’re seeing a curious twist as gold costs are falling, down greater than 2% from roughly $4,390/oz to as little as underneath $4,200. On the identical time, the Bitcoin worth (BTC USD) is holding regular just below $107,000, with a 1.6% every day acquire.

Buying and selling volumes for BTC USD spiked close to $78 billion within the final day, a slight trace that cash is rotating out of conventional property and into crypto.

The thought of a wealth rotation to BTC USD is gaining traction. Bitcoin’s market cap sits round $2.13 trillion, displaying the resilience of the highest coin whilst gold pulls again.

On‑chain and ecosystem knowledge again this narrative because the stablecoin market cap is up. A month-to-month improve of 5.7% to $307 billion, per DefiLlama, with DeFi whole worth locked (TVL) stands close to $149 billion, with DEX quantity up 3.8% week‑over‑week.

(supply – Stablecoins MarketCap, Defillama)

Technically, BTC USD seems encouraging. On the every day chart, MACD has proven a bullish crossover. Circulating provide is getting tightened on each halving, which feeds the shortage narrative, considered one of

.cwp-coin-chart svg path {

stroke-width: 0.65 !vital;

}

.cwp-coin-widget-container .cwp-graph-container.optimistic svg path:nth-of-type(2) {

stroke: #008868 !vital;

}

.cwp-coin-widget-container .cwp-coin-trend.optimistic {

colour: #008868 !vital;

background-color: clear !vital;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.optimistic {

border: 1px strong #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.optimistic::earlier than {

border-bottom: 4px strong #008868 !vital;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: clear !vital;

}

.cwp-coin-widget-container .cwp-graph-container.damaging svg path:nth-of-type(2) {

stroke: #A90C0C !vital;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.damaging {

border: 1px strong #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.damaging {

colour: #A90C0C !vital;

background-color: clear !vital;

}

.cwp-coin-widget-container .cwp-coin-trend.damaging::earlier than {

border-top: 4px strong #A90C0C !vital;

}

0.12%

Bitcoin

BTC

Value

$107,356.07

0.12% /24h

Quantity in 24h

$29.50B

<!–

?

–>

Value 7d

// Make SVG responsive

jQuery(doc).prepared(perform($) {

var svg = $(‘.cwp-graph-container svg’).final();

if (svg.size) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘peak’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘peak’);

svg.css({‘width’: ‘100%’, ‘peak’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

professionals towards gold.

On high of that, the correlation knowledge between Bitcoin and gold is fascinating. Quick‑time period (30‑day) correlation has dropped into damaging territory (‑0.54), that means within the close to time period they’ve moved in reverse instructions. Nevertheless, over longer timeframes (90‑ and 365‑day), the correlation stays reasonably optimistic (0.39 and 0.60, respectively).

In plain language, gold dumping doesn’t mechanically imply Bitcoin should dump. Actually, it’s doubtless signaling the alternative. So, what’s subsequent?

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Bitcoin Value Power Constructing as Indicators Help BTC USD Upside: Sentiment, Market Positioning & the Bull Case

Sentiment is firmly within the “concern” camp. The crypto concern & greed index at present reads 23/100 in keeping with CoinCodex, which is classed as Excessive Worry. Traditionally, readings this low usually presage optimistic turns for the Bitcoin worth. As Buffet says:

Be grasping when others are fearful, and fearful when others are grasping

Crypto Worry and Greed Chart

1y

1m

1w

24h

On social media, tracked samples present extra bullish than bearish chatter. We requested GROK to gauge the sentiment from 50 bullish vs 50 bearish posts, and the AI mannequin comes with knowledge that exhibits bearish posts interact extra customers. Primarily based on this, we are able to simply say that the sentiment is at all-time low for the time being.

(supply – GROK)

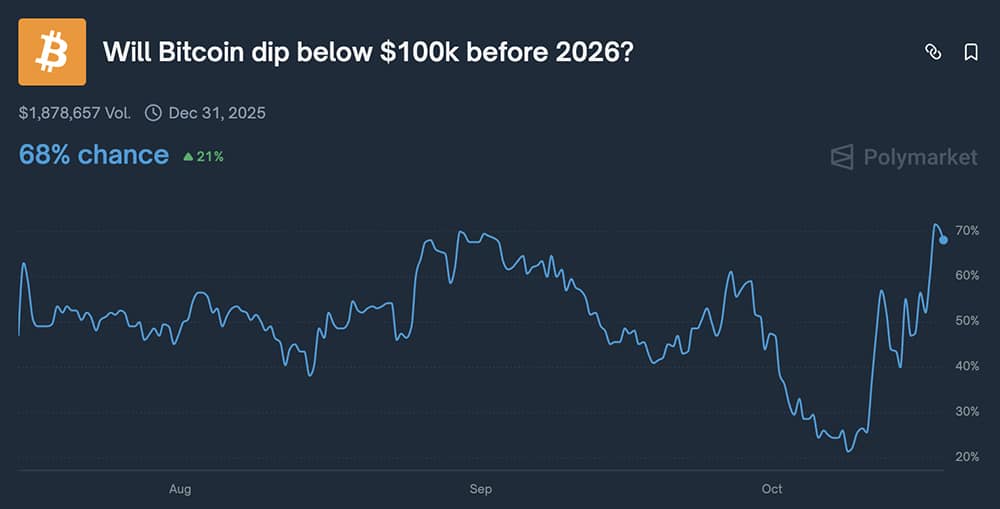

On Polymarket, bettors are leaning towards BTC USD to dip underneath $100,000 by yr‑finish with 68% likelihood. However herein lies the contrarian edge: when the gang expects stagnation or a drop, usually the market surprises to the upside by way of a squeeze of shorts or rotation of funds.

(supply – Polymarket)

Notably, Michael Saylor in latest commentary sounded cautious concerning the close to time period, but his lengthy‑time period stance stays unchanged. Some interpret this cautious tone as a setup of kinds, positioning for a transfer greater, whereas many anticipate weak point. In keeping with him, this dip is a present.

Volatility is a present to the trustworthy.

— Michael Saylor (@saylor) October 17, 2025

When gold is retreating and Bitcoin worth is firming, the potential for capital flowing into BTC USD turns into actual. With ecosystem metrics enhancing, sentiment low, provide tight, and technicals displaying promise, we might be on the early stage of a wealth rotation.

Overlook the information and the bearishness right now, Bitcoin and crypto could be establishing for his or her next move.

DISCOVER: 10+ Next Crypto to 100X In 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

COAI Crypto Drops After Sprinting 100X: Is Chain Opera AI Run Completed?

After a 100x dash, COAI, as soon as hyped as the perfect crypto to purchase now, slumps over -52% in a day as euphoria cools and on-chain scrutiny grows.

ChainOpera AI’s token, COAI, tumbled almost -52% up to now 24 hours after every week of fast features that pushed it into the multi-billion-dollar vary.

(Supply:Coingecko)

By Saturday night ET, COAI was buying and selling round $10-$11 with about $295 million in every day quantity on main exchanges.

The drop follows rising dialogue about heavy income amongst high wallets and potential coordinated promoting.

The correction got here quickly after COAI’s explosive rally from about $0.14 on Sept. 26 to an all-time excessive close to $44.90 on Oct. 12, a surge of greater than 100x in simply over two weeks.

Learn the total story here.

Tom Lee Purchased $281 Million in Ethereum Crypto: Does He Know One thing We Don’t? Will ETH Hit A New Excessive?

Tom Lee and his Ethereum guess is again within the headlines this time on reviews of a contemporary $281 million purchase that has crypto merchants asking what he sees subsequent for ETH.

Tom Lee’s BitMine Immersion reportedly purchased 72,898 ether, value about $281 million, throughout the final 24 hours.

BREAKING:

Tom Lee's Bitmine Immersion simply purchased $281 million value of Ethereum. pic.twitter.com/sdzhLhj9N5

— Ash Crypto (@Ashcryptoreal) October 18, 2025

BitMine’s Ethereum holdings have risen to three.03 million ETH, about 2.5% of the whole circulating provide, after including roughly 202,000 tokens since Oct. 6.

BitMine offered its newest holdings replace for Oct 13, 2025:

$12.9 billion in whole crypto + "moonshots":

– 3,032,188 ETH at $4,154 per ETH (Bloomberg)

– 192 Bitcoin (BTC)

– $135 million stake in Eightco Holdings (NASDAQ: ORBS) (“moonshots”) and

– unencumbered…— Bitmine (NYSE-BMNR) $ETH (@BitMNR) October 13, 2025

Analysts famous there aren’t any seen transaction hashes, pockets addresses, or regulatory filings to confirm the acquisition. BitMine has not commented publicly on the declare.

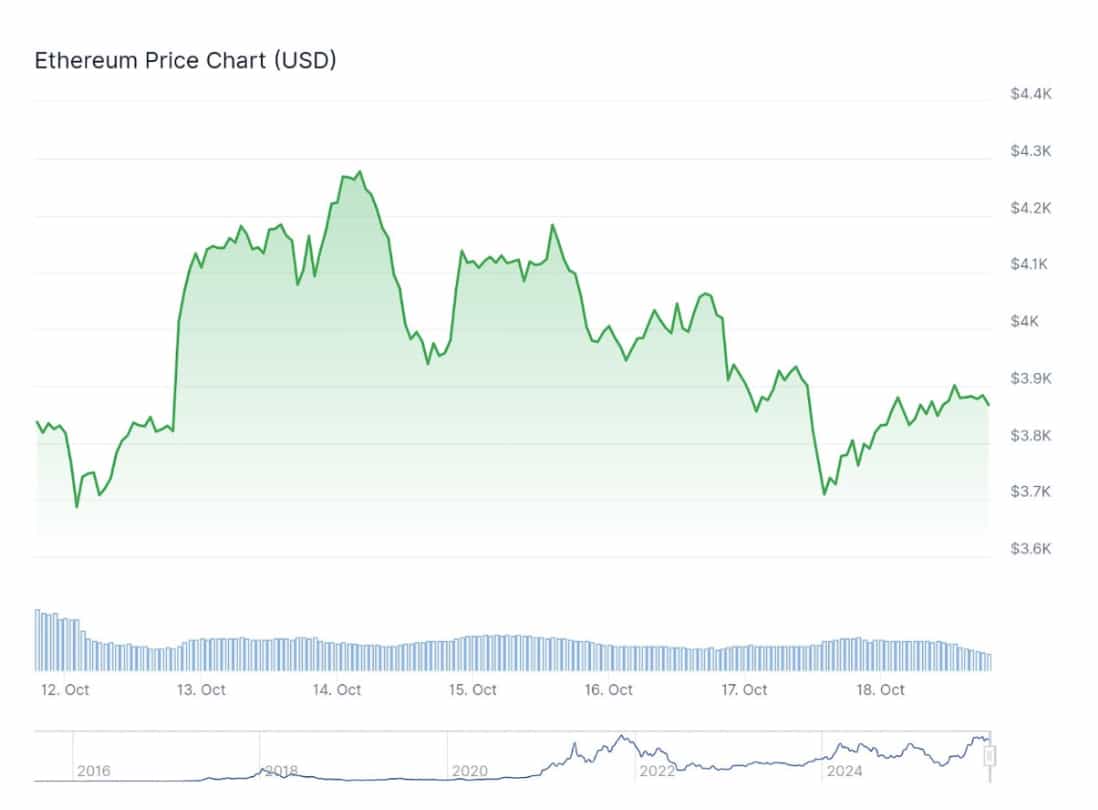

In keeping with Coingecko data, Ether traded round $3,830 to $3,870 on Friday, posting slight every day features of +0.8% but nonetheless beneath its early-October highs.

(Supply: Coingecko)

The token stays underneath stress after final week’s sharp correction, when the Oct. 10–11 liquidation wave, the biggest in crypto’s historical past, briefly pushed costs into the mid-$3,400s.

Market observers say buyers reminiscent of Lee look like accumulating throughout weak point, wagering that Ethereum’s long-term fundamentals will outweigh short-term swings.

Learn the total story here.

SLERF Skyrocketing +600% After Delisted from Binance: Finest Meme Coin to Purchase?

The crypto world’s favorite alchemy, turning dangerous information into alternative, has struck once more with SLERF and is seen as the perfect meme coin to purchase proper now. Simply after Binance introduced the delisting of SLERF’s perpetual futures contract, the coin pumped by over 600% as shorts had been squeezed and hype exploded.

This isn’t simply one other meme pump; it’s a textbook “reverse psy-op” the place a delisting serves as a catalyst. For meme merchants and FOMO-hungry speculators, SLERF crypto could be flashing a major alternative. Let’s break it down.

Learn the total story here.

The submit Crypto News Today, October 18: Gold Dumped as Bitcoin Price Reverses | Is Wealth Rotating to BTC USD? appeared first on 99Bitcoins.