Epoch, a enterprise agency specializing in Bitcoin infrastructure, issued its second annual ecosystem report on January 21, 2026, forecasting sturdy progress for the asset regardless of a subdued 2025 efficiency.

The 186-page document analyzes Bitcoin’s worth dynamics, adoption developments, regulatory outlook, and technological dangers, positioning the cryptocurrency as a maturing financial system. Key highlights embody a prediction that Bitcoin will attain no less than $150,000 USD by year-end, pushed by institutional inflows and decoupling from equities. The report additionally anticipates the Readability Act failing to go, although its substance on asset taxonomy and regulatory authority might advance via SEC steering. Further forecasts cowl gold rotations boosting Bitcoin by 50 p.c, main asset managers allocating 2 p.c to mannequin portfolios, and Bitcoin Core sustaining implementation dominance.

Eric Yakes, CFA charterholder and managing associate at Epoch Ventures, brings over a decade of finance experience to the Bitcoin house, having began his profession in company finance and restructuring at FTI Consulting earlier than advancing to personal fairness at Lion Fairness Companions, the place he targeted on buyouts. He left conventional finance lately to immerse himself in Bitcoin, authoring the influential e book “The seventh Property: Bitcoin and the Financial Revolution,” which explores Bitcoin’s position as a transformative financial asset, and has since written extensively on its applied sciences and ecosystem. Yakes holds a double main in finance and economics from Creighton College, positioning him as a key voice in Bitcoin enterprise capital via Epoch, a agency devoted to funding Bitcoin infrastructure.

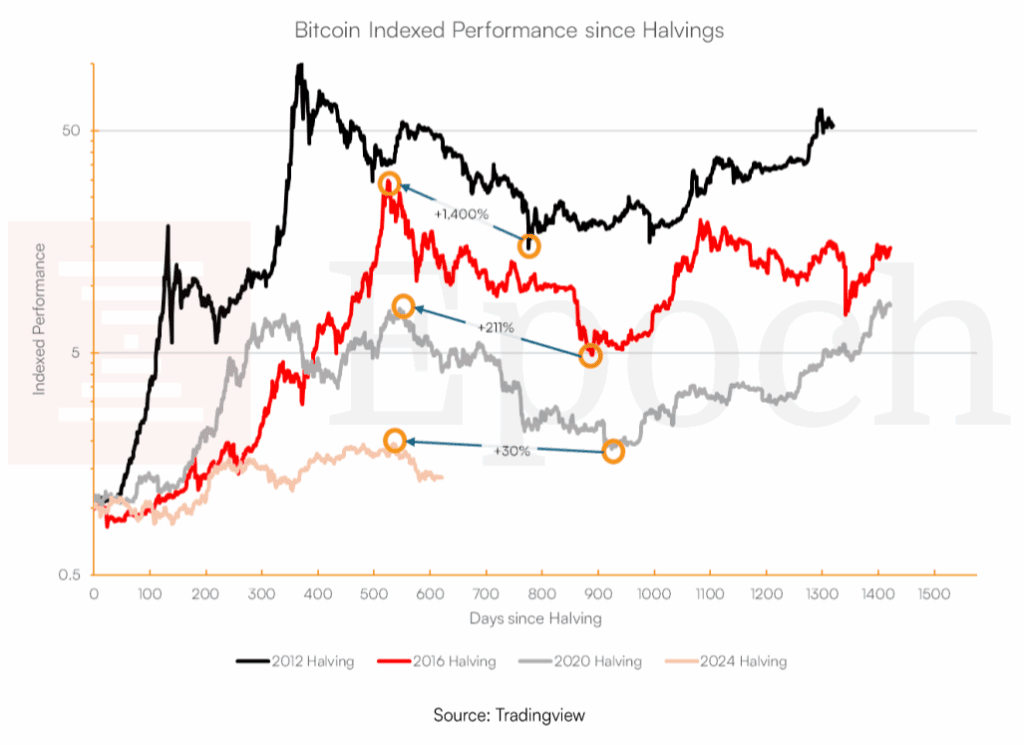

The Dying of the 4-Yr Cycle

Bitcoin closed 2025 at $87,500, marking a 6 p.c annual decline however an 84 p.c four-year achieve that ranks within the backside 3 p.c traditionally. The report states the dying of the 4-year cycle in no unsure phrases: “We consider cycle principle is a relic of the previous, and the cycles themselves in all probability by no means existed. The very fact is that Bitcoin is boring and rising regularly now. We make the case for why gradual progress is exactly what’s going to drive a ‘regularly, then abruptly’ second.”

The report goes on to debate cycle principle in depth, presenting a view of the long run that’s changing into the brand new market expectation: much less volatility to the draw back, sluggish and regular progress to the upside.

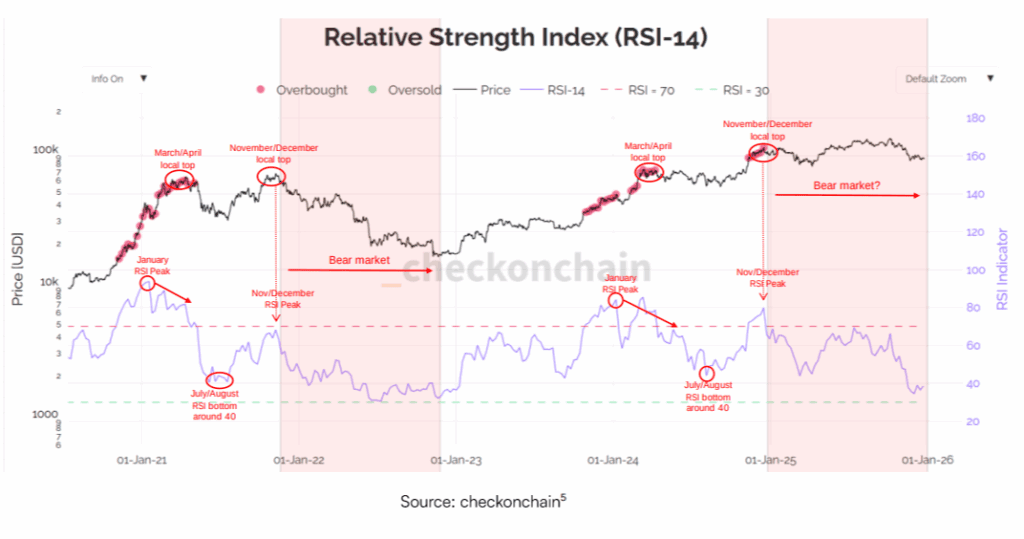

Worth motion suggests a brand new bull market commenced in 2026, with 2025’s drop from $126,000 to $81,000 probably being a self-fulfilling prophecy as a result of cycle expectations, as RSI remained beneath overbought since late 2024, suggesting bitcoin already went via a bear market and we’re commencing a brand new form of cycle.

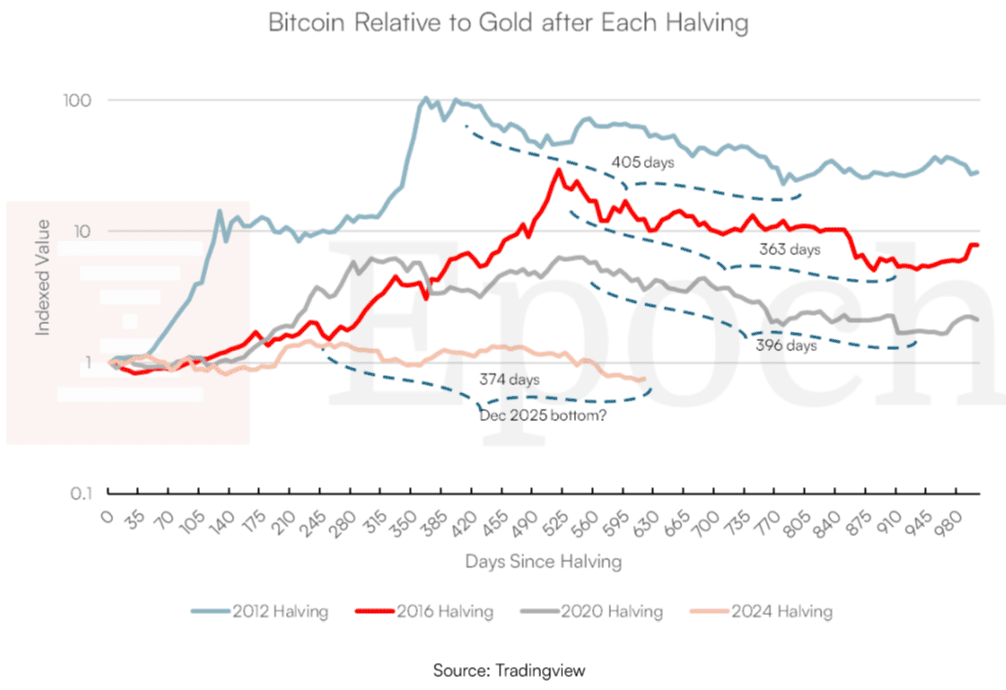

Versus gold, Bitcoin is down 49 p.c from its highs, in a bear market since December 2024. Gold’s meteoric rise presents a possible worth catalyst for bitcoin; a small rebalancing reallocation from gold of 0.5% would induce higher inflows than the U.S. ETFs; at 5.5%, it might equal bitcoin’s market capitalization. Gold’s rise makes bitcoin extra enticing on a relative foundation, and the upper gold goes, the extra possible a rotation into bitcoin. Timing evaluation, as seen within the chart beneath, which counts days from the native high, suggests Bitcoin is perhaps nearing a backside versus Gold.

By way of volatility bitcoin has aligned with mega-caps like Tesla, with 2025 averages for Nasdaq 100 leaders exceeding Bitcoin’s, suggesting a risk-asset decoupling and limiting drawdowns. Lengthy-term inventory correlations persist, however maturing credit score markets and safe-haven narratives might pivot Bitcoin towards gold-like habits.

The report goes in-depth into different potential catalysts for 2026, defending its bullish thesis, comparable to:

- Constant ETF Inflows

- Nation State Adoption

- Mega-cap Corporations Allocating to Bitcoin

- Wealth Managers Allocating Shoppers

- Inheritance Allocation

FUD, Sentiment and Media Evaluation

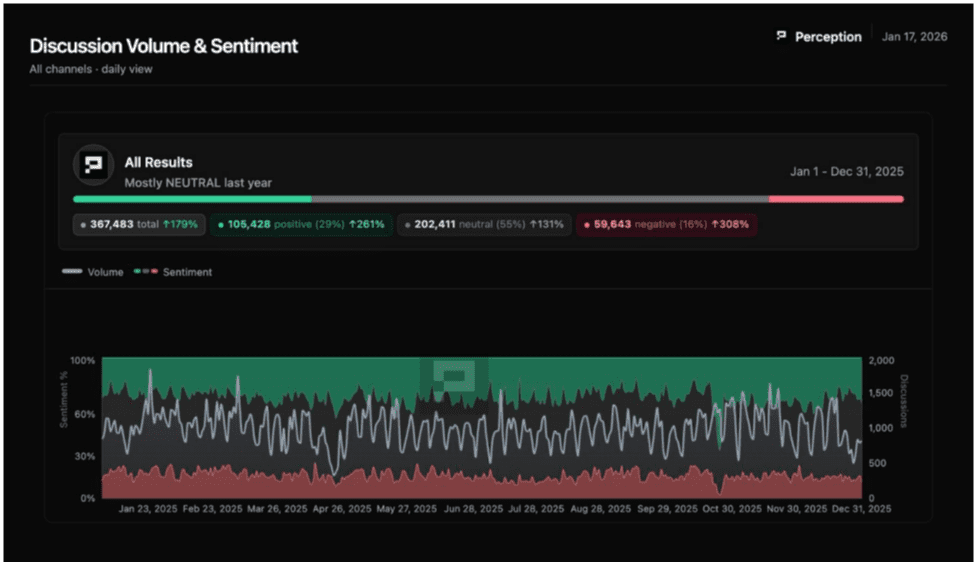

Evaluation of 356,423 datapoints from 653 sources reveals a fractured sentiment panorama, with “Bitcoin is lifeless” narratives concluded. FUD is secure at 12-18 p.c however the subjects rotate, crime and authorized themes are up 277 p.c, whereas environmental FUD is down 41 p.c.

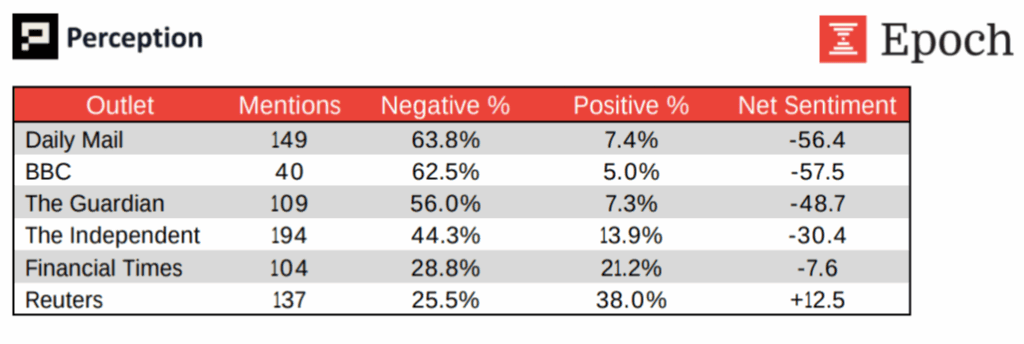

A 125-point notion hole exists between convention attendees (+90 constructive) whereas tech media is usually adverse at (-35). UK retailers present 56-64 p.c negativity, 2-3 instances worldwide averages.

The Lightning Community protection dominates podcasts at 33 p.c however garners solely 0.28 p.c mainstream protection, a 119x disparity. Layer 2 options will not be zero-sum, with Lightning at 58 p.c mentions and Ark up 154 p.c.

Media framing has prompted mining sentiment to swing 67 factors: mainstream retailers cowl the sector at 75.6 p.c constructive, whereas Bitcoin communities view it at solely 8.4 p.c constructive, underscoring the significance of narrative and viewers credibility for mining firms.

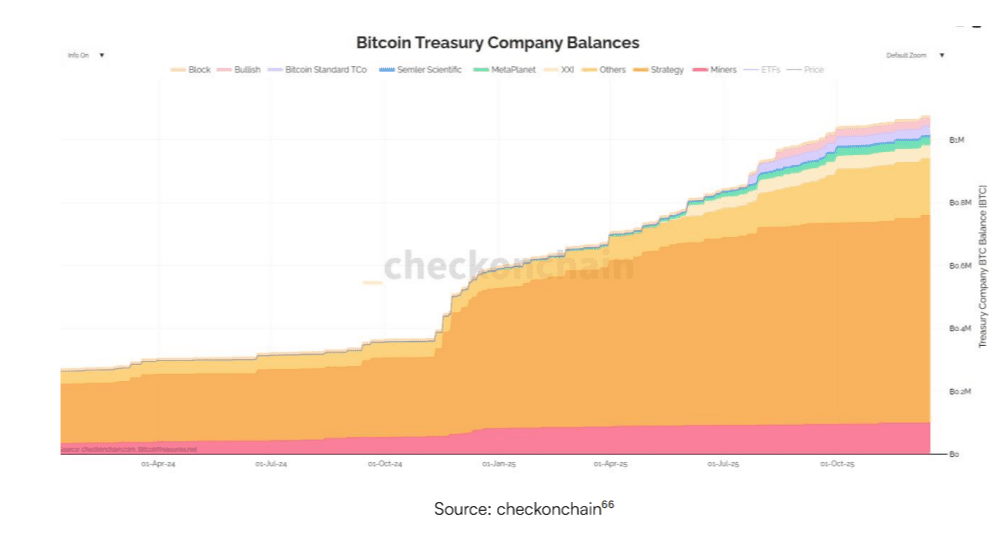

Bitcoin Treasury Corporations

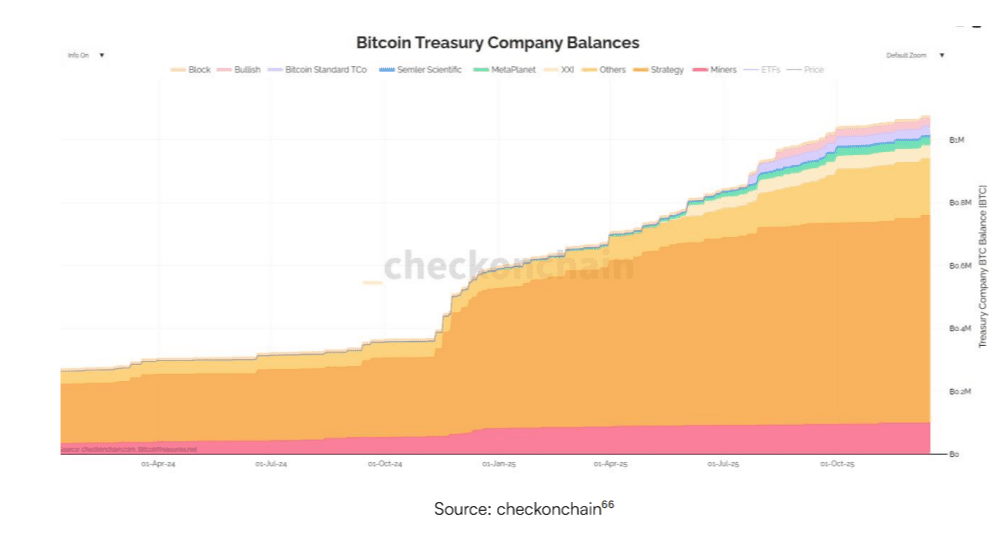

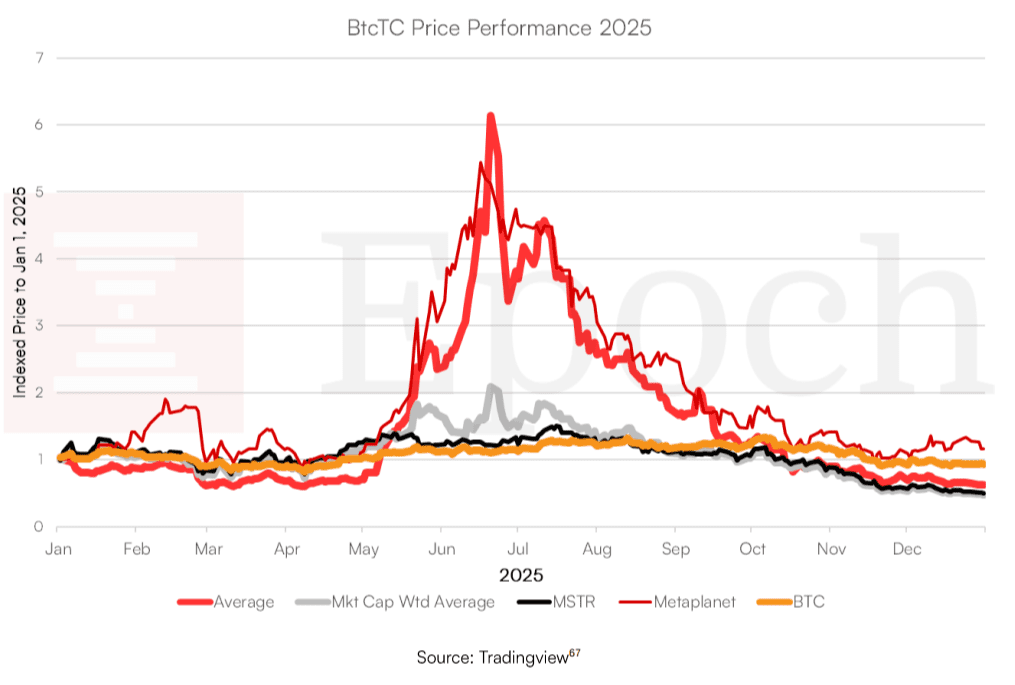

Extra firms added Bitcoin to their steadiness sheets in 2025 than in any earlier 12 months, marking a serious step in company adoption. Established companies that already held Bitcoin—often known as Bitcoin treasury firms, or BtcTCs—purchased even bigger quantities, whereas new entrants went public particularly to lift cash and buy Bitcoin. In keeping with the report, public firm bitcoin holdings elevated 82% y/y to ₿1.08 million and the variety of public firms holding bitcoin grew from 69 to over 191 all through 2025.65 Companies personal no less than 6.4% of complete Bitcoin provide – public firms 5.1% and personal firms 1.3%. This created a transparent boom-and-bust sample all year long.

Firm valuations rose sharply via mid-2025 earlier than pulling again when the broader Bitcoin worth corrected. The report explains that these public treasury firms supply buyers simpler entry via conventional brokers, the flexibility to borrow towards holdings, and even dividend funds, although with dilution dangers. In distinction, shopping for and holding Bitcoin immediately stays easier and preserves the asset’s full shortage.

Trying forward, Epoch expects Japan’s Metaplanet to publish the best a number of on internet asset worth (mNAV)—a key valuation metric—amongst all treasury firms with a market cap above $1 billion. The agency additionally predicts that an activist investor or rival firm will power the liquidation of 1 underperforming treasury agency to seize the low cost between its share worth and the precise worth of its Bitcoin holdings.

Over time, these firms will stand out by providing aggressive yields on their Bitcoin. In complete, treasury firms acquired roughly 486,000 BTC throughout 2025, equal to 2.3 p.c of your entire Bitcoin provide, drawing additional company curiosity in Bitcoin. For enterprise homeowners contemplating a Bitcoin treasury, the report highlights each the expansion potential and the dangers of public-market volatility.

The Bitcoin Treasury Corporations part of the report explores:

- The basics of a Bitcoin treasury allocation together with the potential advantages and dangers of Bitcoin treasury firm investing.

- The 2025 timeline of Bitcoin Treasury firms.

- Present valuations of BtcTCs.

- Our opinion on BtcTCs broadly, and the way we view them in comparison with proudly owning Bitcoin immediately.

- Commentary on particular BtcTCs.

- Predictions on Bitcoin treasury firms within the coming years.

Regulation Expectations for 2026

Epoch predicts the Readability Act—a proposed invoice to make clear digital asset oversight by dividing authority between the SEC and CFTC—won’t go Congress in 2026. Nonetheless, the report expects the invoice’s major concepts, together with clear definitions for asset classes and regulatory jurisdiction, to advance via SEC rulemaking or steering as a substitute. The agency additionally forecasts Republican losses within the midterm elections, which might set off new regulatory stress on crypto, almost certainly within the type of shopper safety measures aimed toward perceived business dangers. On high-profile authorized circumstances, Epoch doesn’t count on pardons for the founders of Samurai Pockets or Twister Money this 12 months, although future authorized appeals or associated proceedings might in the end help their defenses.

The report takes a vital view of current legislative efforts, arguing that payments just like the GENIUS Act (targeted on stablecoins) and the Readability Act prioritize business lobbying over the issues of on a regular basis Bitcoin customers, particularly the flexibility to carry and management belongings immediately with out third-party interference (self-custody).

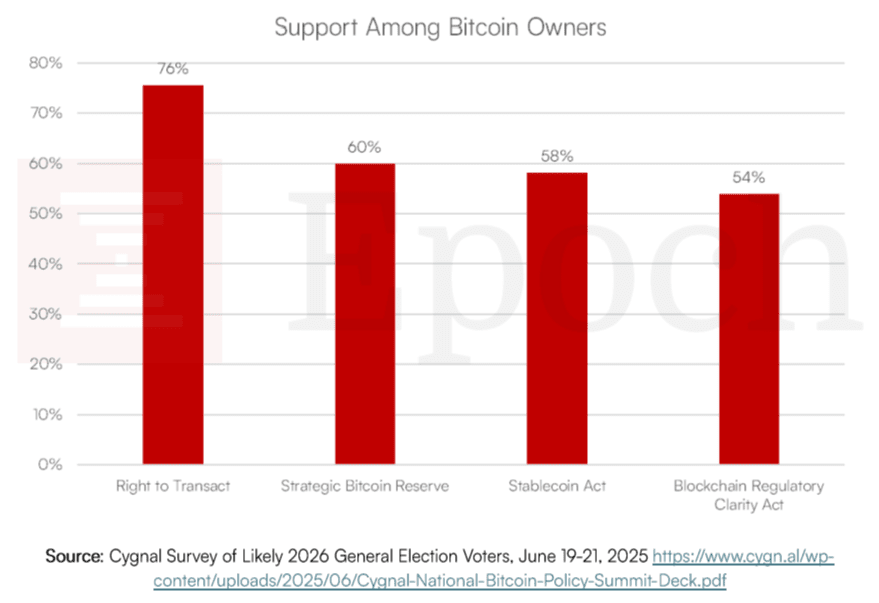

The report factors out a discrepancy between what crypto-owning voters need — a majority preferring above all, the fitting to transact. Whereas the Readability and Genius Acts concentrate on much less common particular pursuits, they only fall throughout the 50% help vary. Epoch warns that “This deviation between the desire of the voters and the desire of the most important business gamers is an early warning signal of the potential hurt from regulatory seize (intentional or in any other case)”.

The report is especially vital of the best way the GENIUS Act arrange the regulatory construction for stablecoins. The paragraph on the subject is so poignant that it deserves being printed in its entirety:

“Meet the brand new boss, similar because the outdated boss:

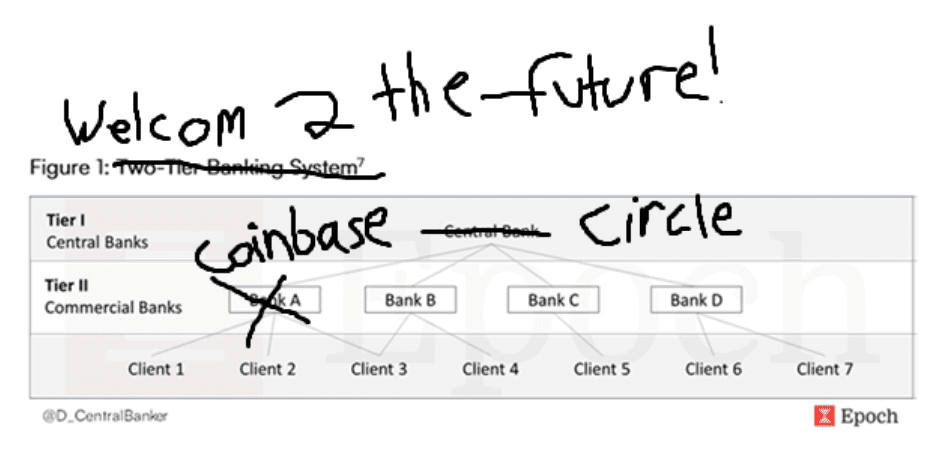

Final 12 months, in our Bitcoin Banking Report, we mentioned the construction of the 2-tier banking system within the US (see determine beneath). On this system, the Central Financial institution pays a yield on the deposits it receives from the Tier II Business banks, who then go on to share a portion of that yield with their depositors. Sound acquainted?

The compromise construction within the GENIUS Act basically creates a parallel banking system the place stablecoin issuers play the position of Tier I Central Banks and the crypto exchanges play the position of Tier II Business Banks.

To make issues worse, stablecoin issuers are required to maintain their reserves with regulated Tier II banks and are unlikely to have entry to Fed Grasp accounts. The upshot of all that is that the GENIUS act converts a peer-to-peer cost mechanism right into a closely intermediated cost community that sits on high of one other closely intermediate cost community.”

The report goes into additional depth on subjects of regulation and regulatory seize danger, closing the subject with an evaluation of how the CLARITY Act would possibly and, of their opinion, ought to take form.

Quantum Computing Threat

Considerations about quantum computing probably breaking Bitcoin’s cryptography surfaced prominently in late 2025, partly contributing to institutional sell-offs as buyers reacted to headlines about fast advances within the subject. The Epoch report attributes a lot of this response to behavioral biases, together with loss aversion—the place folks concern losses greater than they worth equal good points—and herd mentality, by which market members comply with the gang with out impartial evaluation. The authors describe the perceived risk as considerably overhyped, noting that claims of exponential progress in quantum capabilities, usually tied to “Neven’s Regulation,” lack strong observational proof so far.

“Neven’s regulation states that the computational energy of quantum computer systems will increase at a double exponential fee of classical computer systems. If true, the timeline to interrupt Bitcoin’s cryptography may very well be as quick as 5 years.

Nonetheless, Moore’s regulation was an commentary. Neven’s regulation will not be an commentary as a result of logical qubits will not be rising at such a fee.

Neven’s regulation is an expectation of specialists. Based mostly on our understanding of knowledgeable opinion within the fields we’re educated about, we’re extremely skeptical of knowledgeable projections,” the Epoch report defined.

They add that present quantum computer systems haven’t succeeded in factoring numbers bigger than 15, and error charges improve exponentially with scale, making dependable large-scale computation removed from sensible. The report argues that progress in bodily qubits has not but translated into the logical qubits or error-corrected programs wanted for factorization of the big numbers underpinning Bitcoin’s safety.

Implementing quantum-resistant signatures prematurely — which do exist — would introduce inefficiencies, consuming extra block house on the community, whereas rising schemes stay untested in real-world circumstances. Till significant advances in factorization happen, Epoch concludes the quantum risk doesn’t warrant quick precedence or community adjustments.

Mining Expectations

The report forecasts that no firm among the many high ten public Bitcoin miners will generate greater than 30 p.c of its income from AI computing providers through the 2026 fiscal 12 months. This consequence stems from important delays within the improvement and deployment of the mandatory infrastructure for large-scale AI workloads, stopping miners from pivoting as shortly as some market narratives urged.

Media protection of Bitcoin mining reveals a stark divide relying on who’s framing the dialogue. Mainstream retailers are likely to painting the business positively—75.6 p.c of protection is favorable, usually emphasizing vitality innovation, job creation, or financial advantages—whereas conversations inside Bitcoin communities stay much more skeptical, with solely 8.4 p.c constructive sentiment. This 67-point swing in internet positivity highlights how framing and viewers form perceptions of the identical sector, with group credibility remaining a vital issue for mining firms looking for to take care of help amongst Bitcoin holders.

The report has much more to supply together with evaluation of layer two programs and Bitcoin adoption knowledge on a number of fronts, it may be learn on Epoch’s website free of charge.