Everybody stated Ethereum value was locked in on $10,000 this bull run, however now prime analysts from a number one mining agency say not till 2030.

Ethereum is now seen as a turnaround story, a setup some analysts assume may work to its profit.

Ethereum is at the moment present process a unique part: a sluggish restoration following a protracted interval of weak sentiment. Matt Hougan, chief funding officer at Bitwise, says this rebuilding interval may give buyers a helpful entry level.

To grasp this view, it helps to look at what has dragged the community down and what could also be bettering.

Is Ethereum Nonetheless Overpriced or Are Critics Lacking the Greater Image?

A crypto analyst means that Ethereum could also be due for a pointy re-rating over the following 12 months.

He expects the asset to “meet up with the M2 cash provide” by the fourth quarter, which he believes helps a good worth between $8,000 and $10,000 by early 2026.

$ETH will meet up with the M2 provide in This autumn.

The honest worth of Ethereum is $8,000-$10,000 by Q1 2026.

With institutional bidding and staking approval, I feel ETH will rally exhausting. pic.twitter.com/GWhdqetubr

— Ted (@TedPillows) October 13, 2025

He additionally factors to rising curiosity from massive buyers. In his view, constant shopping for and the possibility of recent staking approvals may assist push costs larger.

The message is straightforward: if demand builds and coverage stays supportive, ETH could have room to run.

Earlier this 12 months, even long-time supporters nervous the ecosystem had misplaced vitality as a collection of setbacks piled up.

On-chain exercise slowed, and critics argued that the push to scale by layer-2 networks had backfired.

There as soon as was a cow named "$ETH" who was being milked dry by its 'caretakers'. When bystanders stated "hey that's not good for $ETH", the 'caretakers' bought actually upset on the bystanders, utterly ignoring the irony that they have been those killing the cow for private enrichment. pic.twitter.com/WBMtspGqqh

— Quinn Thompson (@qthomp) March 30, 2025

They stated the method weakened token economics and shifted worth away from the primary chain. Some even claimed Ethereum was now overpriced and now not interesting to buyers.

Hougan, nonetheless, notes that Ethereum nonetheless holds a core benefit that many overlook: its central place inside the stablecoin ecosystem.

“All funds will probably be on stablecoins,” he stated. At present, most stablecoins function on Ethereum.

USDT and USDC, which collectively account for greater than two-thirds of the worldwide stablecoin provide, are issued primarily on Ethereum.

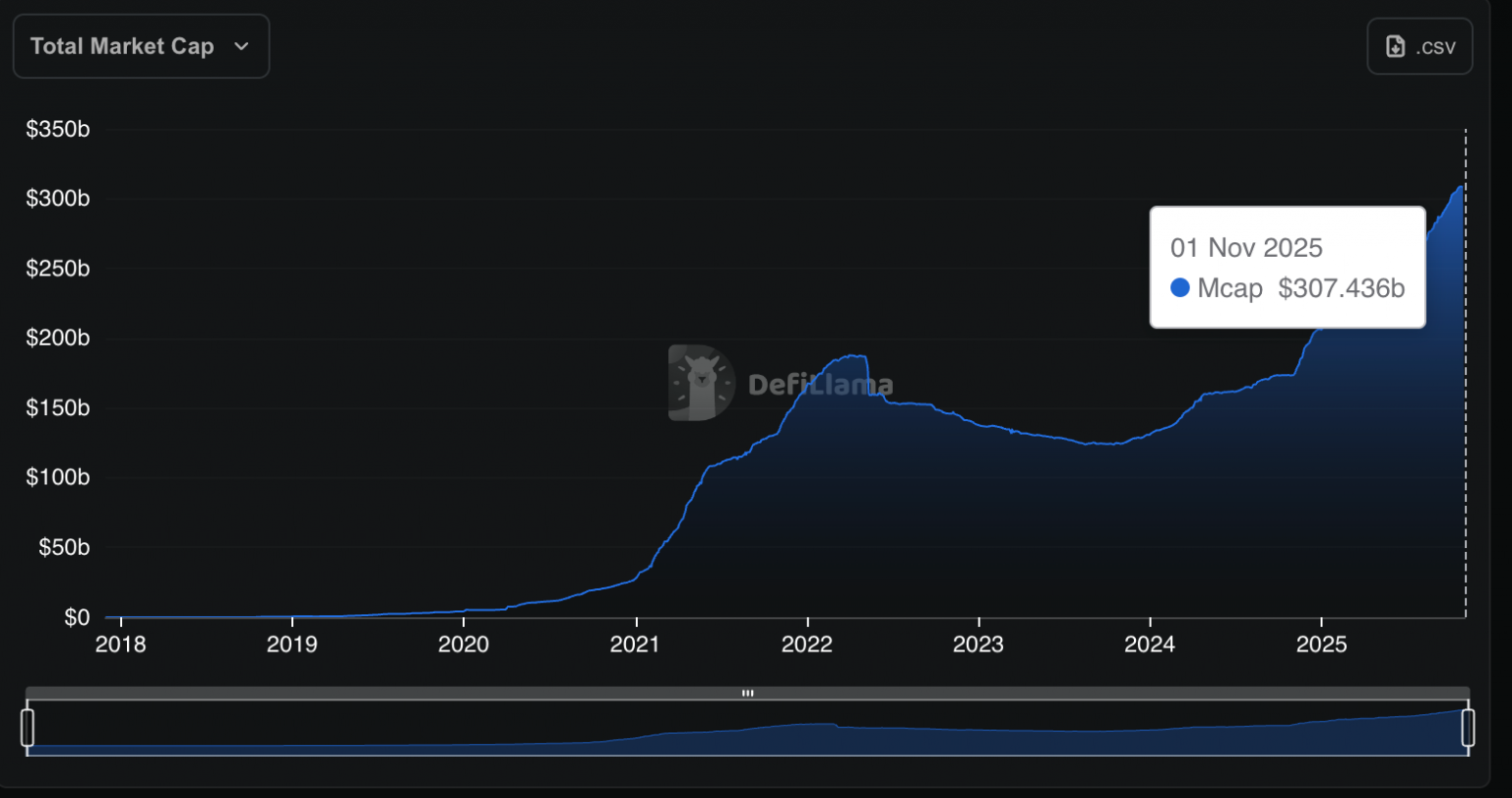

Knowledge from DefiLlama signifies that over 53% of the sector’s $307Bn market operates on Ethereum. Solana, by comparability, holds simply over 4%.

As banks and cost corporations undertake stablecoins for settlements, funds, and treasury work, Ethereum may stay the primary community supporting that exercise.

Massive establishments are already transferring in. JPMorgan, for instance, has began accepting crypto as collateral.

JPMorgan to permit its institutional purchasers to make use of bitcoin and ether as collateral for loans as crypto continues to get absorbed into Wall Road's plumbing. Good scoop from @emilyjnicolle and one more instance of Life Strikes Fairly Quick pic.twitter.com/ej68sOHm9J

— Eric Balchunas (@EricBalchunas) October 24, 2025

Ripple plans to place $1Bn into increasing stablecoin use in company treasuries. On the identical time, BlackRock’s tokenized treasury fund has reached about $2.5Bn.

Each strikes direct extra exercise towards Ethereum, which earns charges when stablecoins are transferred throughout the community.

Tom Lee, a widely known strategist who helps run one of many greatest Ethereum-focused treasury corporations, known as stablecoins the “ChatGPT of crypto” in a June 30 interview on CNBC, citing their quick adoption.

Ethereum Value Prediction: Will ETH Reclaim Market Share If The 12–13% Zone Holds?

In keeping with Mister Crypto, Ethereum’s share of the market could also be near a bounce.

The chart reveals ETH dominance sliding towards an upward trendline that has held since April 2025.

Every time the value touched this line prior to now, marked by inexperienced arrows, the market noticed a contemporary transfer larger.

The most recent candle is sitting simply above that trendline, suggesting consumers are nonetheless defending the 12–13% space.

That assist has acted as a ground earlier than, and merchants are watching to see if it does the identical once more.

Value motion nonetheless factors to an uptrend, although issues have cooled.

Ethereum dominance pulled again from above 16% in late summer time however continues to type larger lows, which suggests the general construction is holding.

The stochastic oscillator has slipped into oversold territory for the primary time since early 2025. That setup appears just like moments that got here earlier than robust rebounds.

If this assist stage holds, Ethereum could begin to acquire market share once more as merchants shift towards main altcoins. But when the trendline breaks, it will sign fading power and will push any restoration additional out.

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

The submit Ethereum Price To $10,000? Analysts Say Not This Cycle appeared first on 99Bitcoins.