In August, Ethereum crypto is up an enormous 40%. This surge is unprecedented. At this tempo, ETH USD is just not solely inches from break above 2021 highs however ETH crypto can simply soar to as excessive as $5,000 in Q3 2025. Contemplating all bullish occasions round ETHUSDT, it got here as a shock that knowledge exhibits large unstaking of beforehand locked ETH throughout totally different liquid staking platforms, together with Lido.

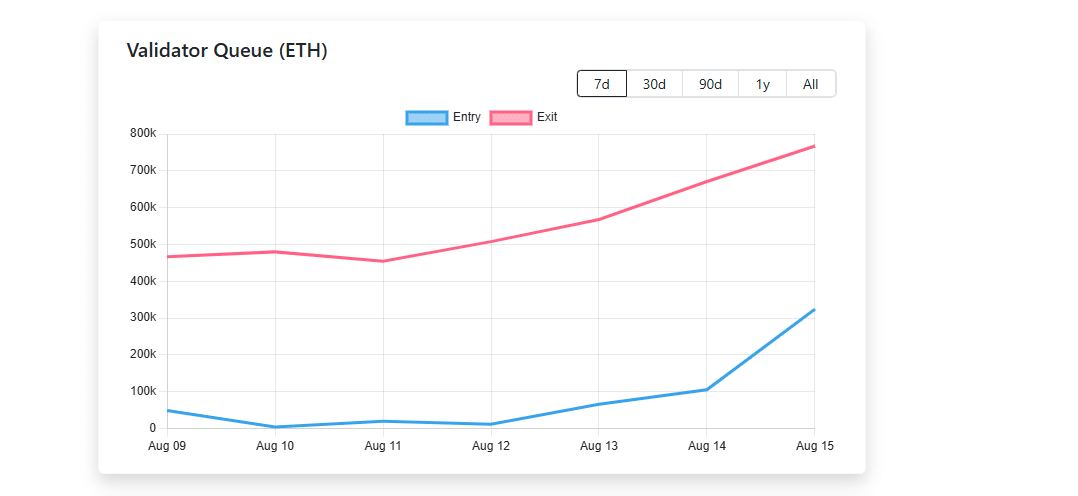

Newest stories shared on X present {that a} document 761,000 ETH price north of $3.6 billion at spot charges has flooded the unstaking queue. Curiously, the urgency to unstake ETH coincides with the pullback in costs, impacting a number of the top Solana meme coins.

1/ File variety of $ETH is within the unstaking queue:

671k $ETH = $3.2B USD

What's extra, queue wait time reached document of ~12 days.

Why is it taking place? A couple of causes: pic.twitter.com/W2dAXXxome

— Ignas | DeFi (@DefiIgnas) August 14, 2025

ETH USD Falls From $4,750

From the ETH USD each day chart, costs fell from round $4,750 to beneath $4,500.

Coinciding with this drop is a spike in buying and selling quantity, pointing to attainable sellers standing their place, capping positive aspects. Technically, a detailed above $4,800 is exactly what’s wanted for ETH ▲3.39% crypto to spike to as excessive as $5,000, printing a contemporary all-time excessive.

Nonetheless, ought to sellers take over at the moment, a detailed beneath $4,440 may even see ETH reverse positive aspects, with the following cease being $4,000. It’s a psychological assist, marking earlier resistance that capped ETH bulls in July 2025.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Race to Unstake Ethereum, What’s Going On?

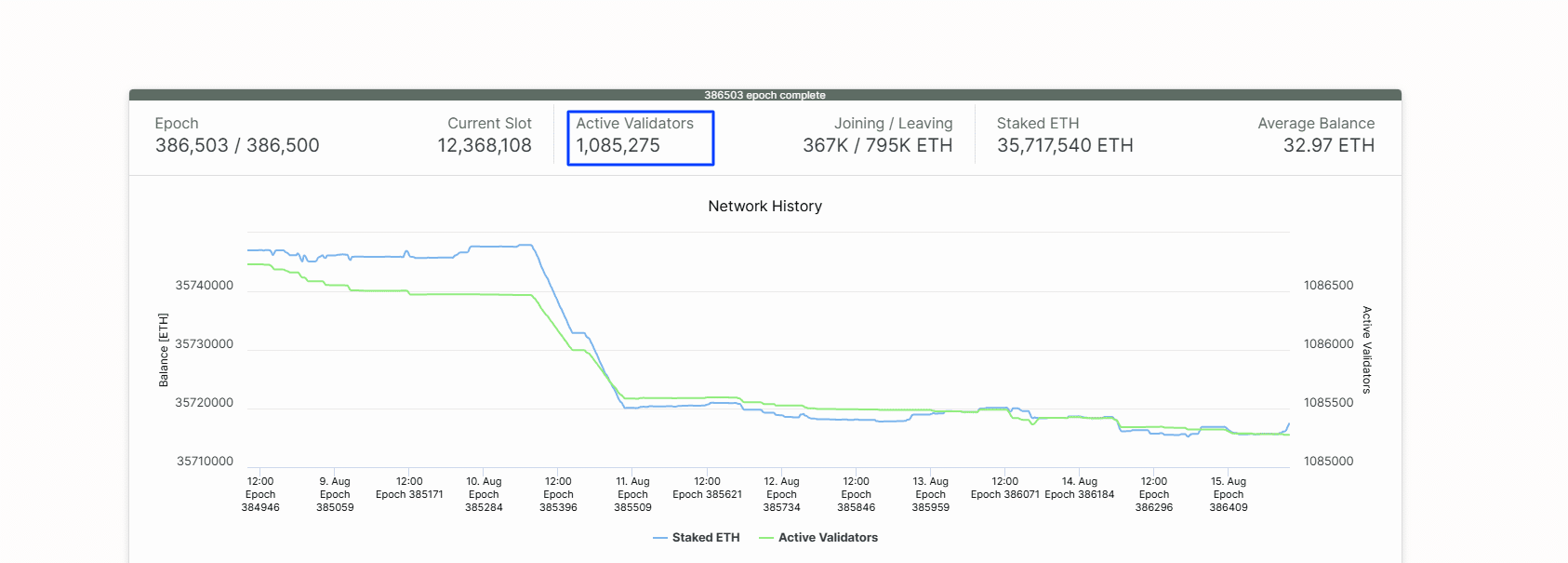

Contemplating the state of ETHUSDT value motion, the transfer by unstake may speed up the sell-off. Being a proof-of-stake community, Ethereum depends on validators. There are over 1 million validators who’ve, on common, locked over 32 ETH, serving to safe Ethereum and in return, earn block rewards and charges.

(Supply: Beachocha.in)

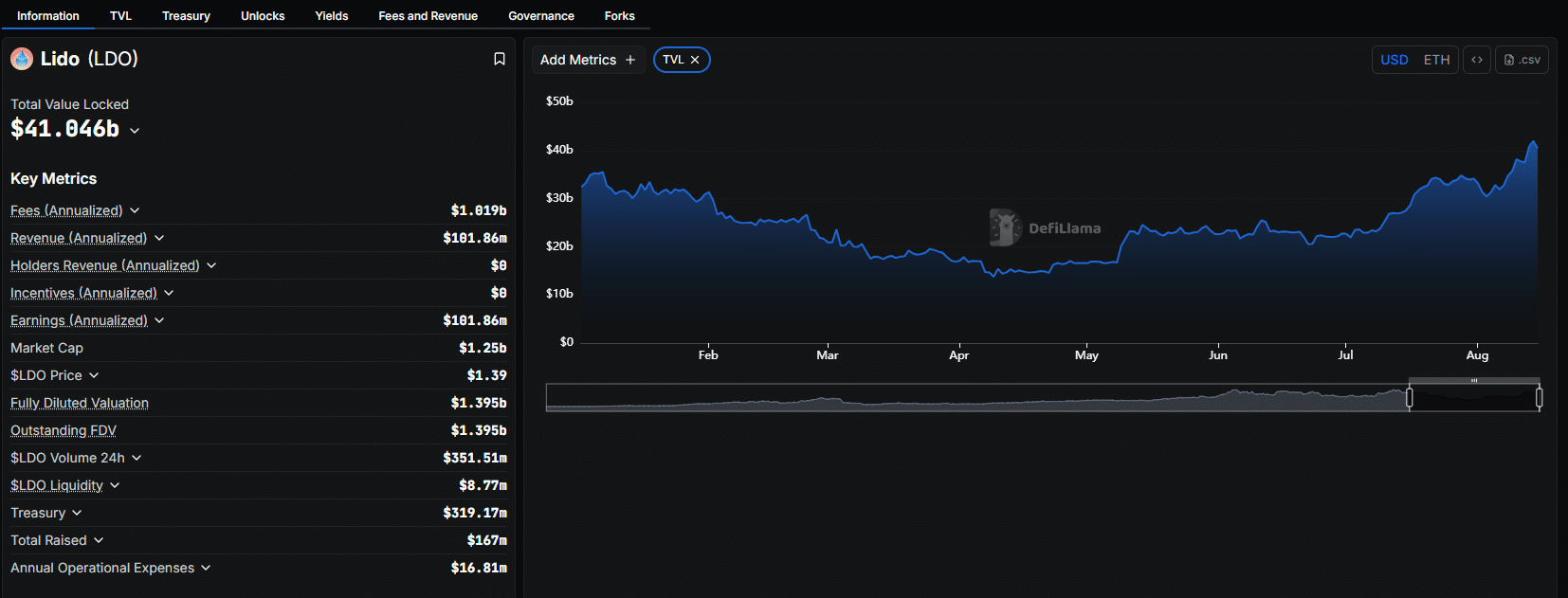

Although not less than 32 ETH is required to run a validator node in Ethereum, there are different suppliers, together with Lido Finance and Rocket Pool, that pool ETH from holders and stake them on the community earlier than distributing rewards.

As of August 15, Lido Finance, one of many liquid staking platform, is among the many largest DeFi protocol. In line with DefiLlama, the protocol manages over $41 billion of belongings, principally ETH.

(Supply: DefiLlama)

It’s now rising that there’s an urgency amongst ETH holders to unlock their cash from the community, principally by way of liquid staking platforms, together with Lido Finance.

In a matter of days, the exit queue has elevated from lower than 2,000 ETH to over 760,000 ETH. On account of this explosion, Ethereum’s exit mechanism, which limits validator exits per epoch.

(Supply: Validator Queue)

Earlier than this spike, it took roughly 6.4 minutes for a withdrawal to be processed. It now takes over 12 minutes, demonstrating the pressure Ethereum is going through that dangers destabilizing the community.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

Are Holders Taking Income?

Naturally, the query is: What’s all the push to withdraw? Contemplating this wave, trade consultants are satisfied that ETH holders are eager on taking income and cashing in on the rally.

ETH has, for month, underperformed versus Bitcoin and different best cryptos to buy, together with Solana and Cardano in earlier bull cycles.

With ETH USD costs booming, those that HODL ETH see this as an opportunity to lock in income. Offered costs stay above $4,000, there’s a sturdy incentive to understand positive aspects.

DISCOVER: 20+ Next Crypto to Explode in 2025

Blame Aave?

There’s additionally one other chance that DeFi traders, particularly on lending protocols like Aave, are deleveraging.

Galaxy Digital notes that from mid-July, ETH borrow charges on decentralized cash markets, principally Aave, rose from lower than 3% to over 18% in matter of days.

Because of this, customers who wished to borrow ETH and restake them had no financial incentive to take action as a result of the borrow charge was excessive but ETH mainnet yields have been decrease.

As a result of this loophole was sealed, it triggered a cascade of ETH place unwinds, impacting even Justin Solar who needed to withdraw $600 million price of ETH from Aave.

For now, Aave ETH borrow charges have stabilized beneath 3% however it hasn’t stopped validators from unstaking.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Ethereum Validators Unstake Over $3 Billion, ETH USD Falls

- Ethereum holders scrambling to unstake

- ETH USD drops from $4,750

- Urgency to unstake may very well be because of revenue taking

- Specialists additionally level to attainable DeFi deleveraging

The put up Ethereum Validators Unstake Over $3.6 Billion, ETH USD Falls: What’s Going On? appeared first on 99Bitcoins.