Fedi, the Bitcoin firm constructing on prime of the open supply Fedimint protocol — a privacy-centric bitcoin funds technique utilizing Chaumian e-cash — is rising from a interval of quiet growth to announce a brand new groundbreaking function. Set for launch as we speak, this new functionality throughout the Fedi app goals to make the creation of multi-signature e-cash mints simple, non-public, and safe for communities worldwide with just some clicks, aligning with cypherpunk rules of decentralization and person sovereignty.

Constructed into their more and more common Android and iOS apps, the brand new launch permits customers to simply create a brand new Fedimint federation with the assistance of G-bot, a pleasant chatbot interface. Mint founders have to pay a fundamental service payment, add some fundamental info in minutes for the mint, and wait a number of hours.

The G-bot then finds trusted nameless Guardians to assist kind the person’s mint federation. This course of decentralizes the custody of the mint’s bitcoin reserves — wanted to function an e-cash mint. It additionally helps stop collusion as mint operators are nameless from one another and would wish to disclose themselves publicly to have the ability to discover different key holders to collude.

This Fedimint protocol is essentially constructed on privateness, a cornerstone of Bitcoin and the cypherpunk movement. “The primary line of the Cypherpunk Manifesto is that privateness is important for an open society within the digital age. It’s not good to have. It’s not handy. It’s obligatory.” Obi Nwosu, CEO of Fedi, instructed Bitcoin Journal in an unique interview. He added a cautionary warning concerning the future, which the world can be sensible to keep away from: “Bitcoin with out privateness is our worst nightmare. It’s 1984 coin, it’s the panopticoin.”

Founded in 2022, Fedi has been quietly working to ship the guarantees of personal digital money to the world, primarily based on probably the most promising applied sciences designed for that objective, David Chaum’s 1982 Chaumian e-cash. This type of digital cash virtually made it into each copy of Windows 1995, proof of its scalability and effectivity, however paradoxically failed attributable to its centralization, as Chaum and Gates reportedly couldn’t attain a last settlement on the deal.

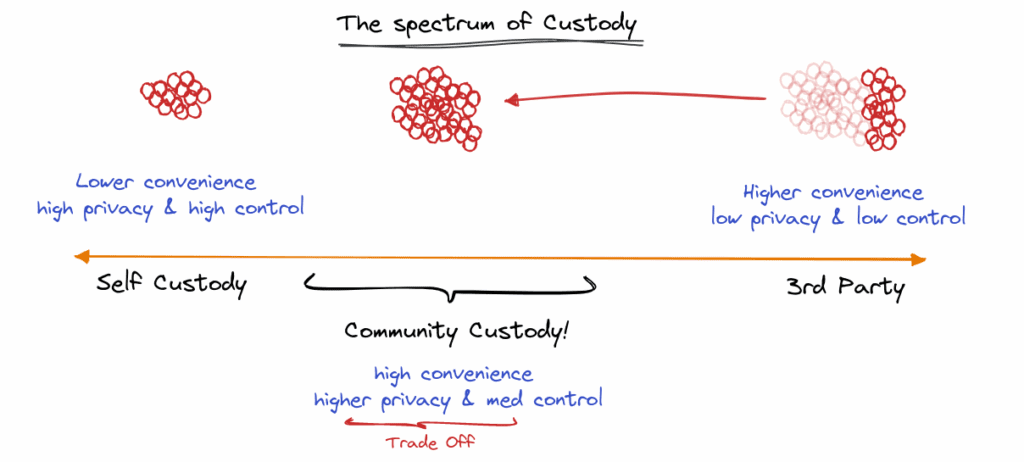

Quick ahead 30 years, and the Bitcoin neighborhood has taken on the problem of bringing non-public digital money to the world, leveraging new prospects unlocked by the Bitcoin community, which can resolve the basic trade-off of Chaumian e-cash, the necessity to belief a single counterparty mint that points and redeems the e-cash payments for the underlying foreign money.

It’s fascinating to notice that Bitcoin was designed as an answer to the basic trade-offs of e-cash. Whereas e-cash depends on a trusted server to approve transactions which can be correctly funded, it might probably achieve this with out realizing any private person info, for the reason that system is essentially constructed on cryptography and never identification. It nonetheless requires a trusted server, which may in concept emit extra e-cash payments than it has reserves for, a type of the ‘double spending downside’ Satoshi Nakamoto sought to handle in his Bitcoin white paper.

Centralized e-cash mints can be extra simply harassed by hostile governments, because the pre-Bitcoin historical past of digital money exhibits. Bitcoin decentralized the mint by distributing the accounting course of the mint does with the invention of the Bitcoin node, anybody that runs a node has a duplicate of all bitcoin transactions and might independently confirm the accounting integrity of the system, thus fixing the ‘double spending downside’.

The draw back of Bitcoin’s method is that it leaves a public document of all transactions, which isn’t nice for privateness, and has onerous theoretical limits when it comes to what number of transactions it might probably course of per second — it isn’t very scalable — two limits which the e-cash methods should not have.

The downsides of centralized cryptocurrency platforms are one thing that Nwosu has deep skilled expertise with; he was the founder and CEO of Coinfloor, a centralized cryptocurrency trade based in 2014. The trade was the “First ‘Publicly Auditable’ Bitcoin Change” in keeping with a 2014 Coindesk, via an modern auditing course of known as proof of reserves. Recalling again on his expertise with the matter, Nwosu stated, “Being solvent is a really huge factor for me in addition to with the ability to show that cryptographically, if attainable”. That have and his concern over a future with out non-public digital money are clear motivations for why he co-founded Fedi.

Creating scalable, decentralized, non-public digital money, nevertheless, isn’t simple, neither technically nor politically. To unravel this basic downside of finance and laptop science, many within the Bitcoin neighborhood have been in search of methods to mix the advantages of Bitcoin and Chaumian e-cash with a view to resolve — or not less than mitigate — the downsides of each methods. The Fedimint protocol’s most vital innovation on this area is the event of federated e-cash mints, leveraging the safety of Bitcoin’s native sensible contract capabilities, particularly multi-signature transactions.

Bitcoin’s multi-signature script permits one thing new in finance, a transaction that may solely be executed if a couple of celebration agrees to signal. Banks might have shared accounts throughout a number of events, however these are guidelines enforced by legal professionals, who have to adjust to native legal guidelines, in the end giving last say to the native authorities. Bitcoin, in contrast, defends the integrity of a multi-signature with the complete weight of its worldwide proof of labor community, making these agreements pretty much as good as gold and unlocking a brand new form of federated monetary establishment. The Liquid Community, in addition to Bitcoin’s Lightning Community, exists solely because of this multi-signature know-how.

Fedimint takes multi-signature to the following stage, making the members unknown to one another via the G-bot, defending customers of that mint from the collusion of the guardians whereas additionally including redundancy to the custody of mint bitcoin reserves, which makes hacks tougher. Fedimint additionally protects Guardians from unintended lack of keys, as a threshold of Guardians can restore the soundness of a federation, say 3 out of 4 signers, in case one loses their keys or will get compromised, on the subject Nwosu stated “the larger danger isn’t collusion however customers forgetting passwords, which federations mitigate for the reason that system continues if one guardian fails.”

Finally, Nwosu expects there to be “tens of 1000’s, if not lots of of 1000’s, of federations, every with a special set of customers utilizing it.” These mints join to one another utilizing the Bitcoin customary and its numerous fee rails corresponding to onchain Bitcoin and the Lightning Community “providing cryptographic privateness inside every federation. Even when sending between federations by way of Lightning, privateness stays excessive as a result of customers are interchangeable inside swimming pools. No single level of belief or failure.”

One frequent critique of e-cash methods, even submit Bitcoin, is relating to self-custody. Critics argue that e-cash, even in a federated community, is nonetheless a custodial trusted system of cash, and on this subject, Nwosu had a very highly effective perception: “You probably have self-custody and no privateness, you don’t have self-sovereignty as a result of somebody is aware of precisely what you’re doing and might confiscate your cash at any level.” As a result of e-cash doesn’t depart an on-chain footprint, it may be essentially extra non-public than any blockchain.