Following the political and regulatory adjustments in the US that started after final yr’s presidential elections, the entities behind quite a few altcoins began to hope for the launch of spot ETFs monitoring their respective belongings’ efficiency.

Ripple’s XRP was among the many most extremely anticipated alts to have such funds on Wall Road, and the primary, Canary Capital’s XRPC, hit the US markets precisely a month in the past. Since then, 4 extra joined the listing, together with 21Shares’ TOXR, which was the latest one. Right here’s what occurred within the first 30 days.

1/ One other W for XRP.

The 21shares XRP ETF ($TOXR) is now stay, offering traders a liquid, clear, and handy strategy to acquire publicity to $XRP—a foundational asset in the way forward for world funds.

Why XRP issues:

Supported by XRP Military, one of many strongest… pic.twitter.com/3fgW2rtVB1

— 21shares US (@21shares_us) December 11, 2025

What Occurred In the course of the First Month?

As reported the day after the profitable launch of XRPC, Canary Capital’s monetary autos broke the 2025 document for buying and selling quantity throughout its debut. The amount was just below $60 million, which outpaced Bitwise’s SOL ETF launch, whereas the general inflows stood at round $243 million.

As talked about above, TOXR was the newest to see the sunshine of day. Grayscale’s GXRP was transformed into an ETF, whereas Bitwise’s XRP and Franklin Templeton’s XRPZ had been launched within the meantime.

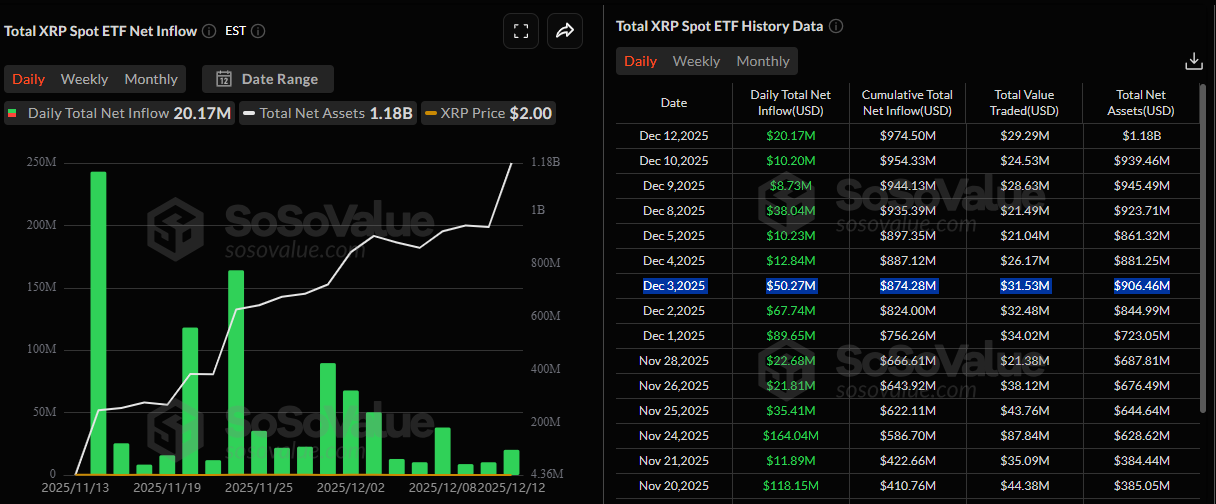

The influx streak has been fairly spectacular, as all buying and selling days because the debut of XRPC have been within the inexperienced. Whereas the preliminary day document of $243 million in web inflows can’t be reached but, the entire inflows since then proceed to climb to $974.50 million as of Friday’s shut.

The full web belongings have shot up above the $1 billion mark and stand at $1.18 billion, in response to knowledge from SoSoValue.

XRP Worth Influence

Given the truth that the spot XRP ETFs outperformed the BTC and ETH counterparts for essentially the most half since their launch, it might be logical to imagine that the affect on the underlying asset’s value must be fairly optimistic. Furthermore, the corporate behind the token has been making big moves with partnerships and regulatory approvals.

Nonetheless, the fact is totally different. Within the hours forward of XRPC’s launch, XRP traded above $2.50 and even near $2.60. Since then, it dipped under $2.00 on a number of events and even bottomed at $1.85 through the late November crash. Though it has reclaimed the $2.00 help, it nonetheless sits simply inches above it, which implies it has dropped by 20% in a month regardless of the funds attracting $974 million.

The submit First Month of XRP ETFs Analyzed: The Good, The Bad, and The Ugly appeared first on CryptoPotato.