Grayscale has simply paid out Ethereum staking rewards to U.S. ETF holders for the primary time, remodeling its ETHE fund right into a yield-generating crypto product. The fund distributed $0.083178 per share from This autumn 2025 staking revenue.

This matches a much bigger shift the place crypto ETFs are now not simply “worth trackers” however begin to behave extra like revenue merchandise for mainstream traders.

DISCOVER: Best Meme Coin ICOs to Invest in 2026

What Does Grayscale’s ETH Staking Payout Truly Imply for Learners?

First, fast translation. “Staking” is like incomes curiosity at a financial institution, however for crypto. You lock your ETH to assist safe the community and, in return, you earn rewards paid out in ETH. Personally, I take pleasure in staking.

Till now, U.S. traders who purchased Ethereum ETFs acquired worth publicity solely. No yield. On October 6, 2025, Grayscale added staking to its Ethereum merchandise, and ETHE has now handed these rewards by means of to traders for the primary time, as reported by Connor Sephton.

That $0.083178 per share would possibly look small, however the true story is entry: you earn staking rewards with out operating your individual validator or touching a DeFi protocol. If I hated the crypto ecosystem however cherished the positive aspects, I would love it.

Right this moment, Grayscale Ethereum Staking ETF (Ticker: $ETHE) grew to become the primary U.S. Ethereum ETP to distribute staking rewards again to traders.

Be aware: $ETHE is buying and selling ex-dividend in the present day as of the open.

Learn the press launch: https://t.co/oDOSk9B2pG

— Grayscale (@Grayscale) January 5, 2026

Grayscale manages billions in ETH publicity and virtually half of all U.S. Ethereum ETP property. So when Grayscale adjustments the way it treats staking, it doesn’t simply tweak one product. It nudges the entire market towards yield-paying Ethereum publicity that feels extra acquainted to inventory and bond traders.

If you need extra big-picture Ethereum context, we just lately lined document on-chain exercise in our piece on Ethereum stablecoin transfers. While you mix rising utilization with quick access to staking yield, you get a clearer story for why many long-term traders care about ETH past short-term worth strikes.

DISCOVER: Top Ethereum Meme Coins to Buy in 2026

How Might ETH Staking ETFs Change Crypto Investing?

Consider an everyday spot ETF as a glass window. You possibly can see the asset worth, however you by no means contact the underlying factor. A staking ETF turns that window right into a window plus a small dividend stream. You continue to don’t custody ETH your self, however now your shares mirror a number of the yield that on-chain stakers earn.

Competitors is heating up quick. REX‑Osprey’s ESK ETF affords ETH plus staking with month-to-month distributions, and Bitwise already launched a yield-focused altcoin product with its Solana ETF.

When issuers compete on yield and costs, traders usually get higher merchandise, however danger additionally spreads to a wider viewers who might not totally perceive what “staking danger” means.

ETH staking exit queue is mainly empty

Nobody needs to promote their staked ETH

However all analytics are quiet pic.twitter.com/TzTzpEemKO

— rostyk.eth (@rostyketh) January 5, 2026

For ETH itself, these merchandise can quietly improve demand. Massive funds and advisors who won’t ever run a staking setup at house now have a compliance-friendly solution to earn yield from ETH. That matches a pattern we already see in institutional Ethereum curiosity, like rising institutional ETH accumulation.

Extra locked ETH and extra long-term holders normally imply much less promote strain in calm markets.

For you as a newbie, the sensible shift is easy: “Ethereum in my brokerage account” now not has to imply “no yield.” Now you can purchase a ticker like ETHE and get each worth publicity and a trickle of staking revenue, much like holding a dividend inventory or a bond ETF.

What Are the Dangers Behind “Protected” Staking ETFs?

This all appears like free cash, however it isn’t. When a fund stakes ETH, it takes on additional dangers past simply holding ETH in chilly storage. Slashing (penalties if validators misbehave), sensible contract bugs in third‑social gathering staking providers, and authorized adjustments round staking rewards all matter, even when you by no means see the technical particulars.

There may be one other commerce‑off. Many staking ETFs cost greater charges to handle the staking course of and maintain a part of the rewards. So whilst you earn yield, you normally earn lower than somebody who stakes ETH straight. You pay with a decrease return in trade for simplicity and regulation.

Additionally, keep in mind: the ETF wrapper doesn’t defend you from ETH worth swings. If ETH drops 40%, a couple of {dollars} of staking revenue won’t save your portfolio. Deal with staking yield as a bonus on high of a really unstable asset, not as a alternative for an emergency fund or a financial savings account.

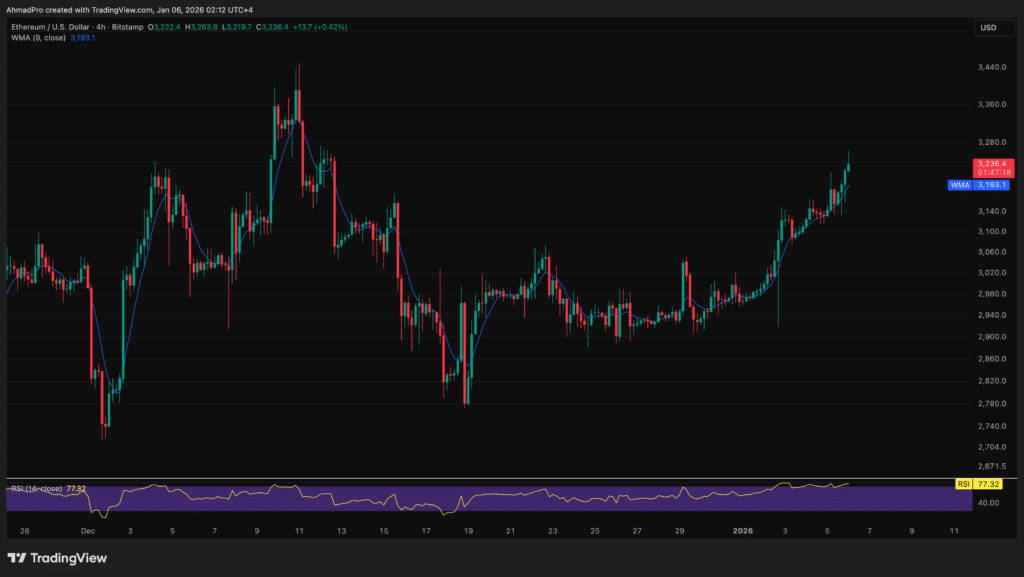

(Supply: ETHUSD / TradingView)

So how do you act on this? In the event you already needed ETH publicity in an everyday brokerage account and also you perceive the worth danger, then a staking ETF generally is a smarter model of what you deliberate to purchase anyway. In the event you really feel tempted to purchase simply due to the phrase “yield,” step again, evaluate our protection of broader Ethereum market dynamics, and by no means transfer cash you want for lease or debt funds into ETH or any staking product.

As extra issuers roll out yield-bearing crypto ETFs, anticipate a gentle race so as to add staking to extra cash and extra funds; your edge will come from understanding that yield at all times rides on high of actual danger, not as a substitute of it.

DISCOVER: Top Solana Meme Coins to Buy in 2026

Comply with 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Day by day Professional Market Evaluation

The publish Grayscale Starts ETH Staking Payouts, Pushing ETFs Into Yield Era appeared first on 99Bitcoins.