Bitcoin artwork and Bitcoin firms don’t appear to combine. However for many years — certainly centuries — corporations have collected artwork to precise their position in society. As early because the fifteenth century, the Banca Monte dei Paschi di Siena (1472) established one of many first company artwork collections. What started merely as ornamental embellishment rapidly advanced into a standing image and an indication of wealth, success and cultural duty. Can Bitcoin-native corporations acquire strategic benefits via digital artwork? And what position does Bitcoin artwork play as a brand new asset class and cultural anchor?

Why Do Firms Gather Artwork?

Work, sculptures and installations now dangle in company headquarters worldwide, not simply to beautify partitions however as statements: Artwork alerts cultural capital and underscores a agency’s id and values. With the rise of the digital financial system, particularly Bitcoin, the query arises how this custom can proceed within the twenty first century.

Company artwork collections at the moment are a hard and fast a part of company tradition. By the mid-2010s there have been already greater than 2,000 main company collections in North America and past, collectively price billions. The motivations are numerous: Surprisingly, rapid financial gain is just not the principle driver; the tax deduction isn’t what’s motivating companies. Somewhat, artwork engagement helps corporations advance strategic targets, attain new shopper teams, strengthen worker loyalty and enrich the standard of life across the firm. In different phrases, artwork in enterprise creates cultural capital — the worth that French sociologist Pierre Bourdieu outlined because the sum of cultural information and status.

Firms that gather artwork due to this fact pursue picture constructing and cultural promotion concurrently. Traditionally, a transparent sample emerges: Within the affluent Fifties, many U.S. firms started gathering artwork to make cultural statements on their newly constructed campuses and to assist the neighborhood. The motion peaked within the Nineteen Eighties, then cooled when different types of company philanthropy (schooling, social causes) got here to the fore. But corporations that stored shopping for artwork did so below stricter standards and with a transparent goal.

Strategic Leveraging of Artwork: Cultural Capital and Model Id

Company artwork collections fulfill a number of roles without delay. Internally, they create inspiring environments that foster creativity and identification; externally, they function reputational instruments: Artwork alerts schooling, stability and neighborhood spirit, and artwork collections have lengthy since develop into a part of model id.

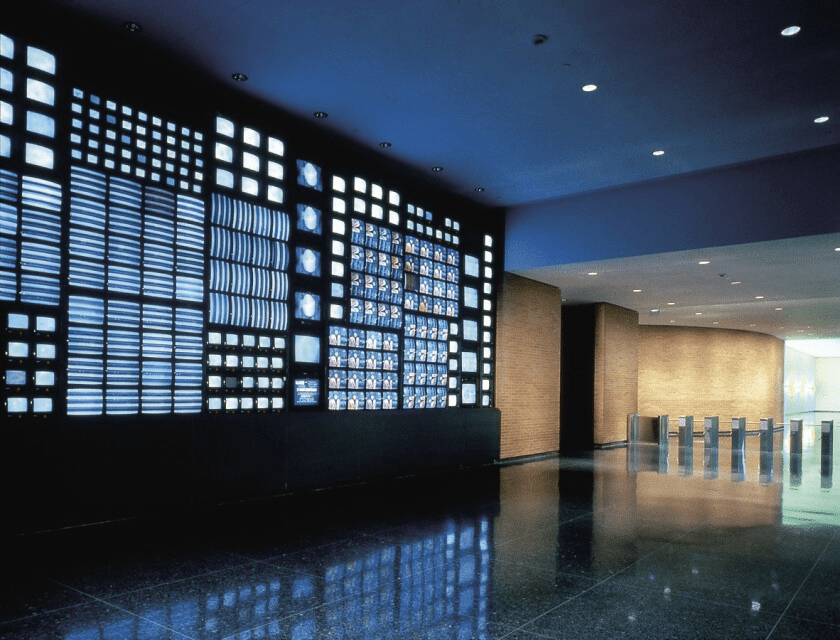

One of the best examples present that the purpose is just not ostentation however social worth: Deutsche Financial institution, as an illustration, based its assortment in 1980 expressly to assist rising German artists. Right now, it holds tens of 1000’s of works of worldwide artwork and even operates its personal museum in Berlin (the PalaisPopulaire) to stage public exhibitions. Right here, artwork builds bridges between the corporate and society. JPMorgan Chase has pursued an identical idea for many years: Its “Artwork at Work” program, initiated in 1959 by David Rockefeller, targeted intentionally on rising and missed artists worldwide — an uncommon method however one that actually fosters artwork. Such collections are proactively constructed and make artwork central to company DNA reasonably than utilizing it merely as ornament.

A strategically managed assortment turns into a lever for cultural capital. By selecting artwork (together with Bitcoin artwork) that matches the corporate’s philosophy, a agency can subtly talk its values: innovation, internationality or reverence for custom. UBS started constructing its company assortment within the early Nineteen Seventies as a part of a dedication to cultural engagement, focusing from the outset on each established and rising artists from throughout the globe. The UBS assortment, for instance, displays the financial institution’s world attain by buying artwork from each area the place it operates, together with new markets reminiscent of Thailand or Korea. Guided by impartial curators and a global advisory board, UBS has created a group that represents the range of its communities whereas spotlighting younger, rising artists.

Economists see such investments as akin to different intangible belongings: They elevate model worth via cultural legitimacy and recognition. Companies are the brand new patrons: Financial institution collections, as an illustration, have gone past their authentic advertising and marketing perform and now act as “new Medici”-patrons, on par with Renaissance households who as soon as supported the humanities. Particularly as public cultural budgets shrink, this personal patronage is extra vital than ever. Correctly managed, company collections thus serve not solely the agency however society at massive, filling gaps left by underfunded public museums. They’re, appropriately used, a cultural asset for the general public.

Change within the Final Ten Years: From Modern Artwork to Bitcoin Artwork

Not too long ago, company collections have advanced primarily in content material. Modern works — portray, sculpture, images — nonetheless dominate, however digital artwork varieties are more and more gaining floor. Digital artwork has existed for the reason that Sixties (from early computer-plotter drawings to video artwork), and collections like JPMorgan’s built-in video and media artwork a long time in the past. Within the 2010s, nonetheless, blockchain know-how sparked a revolution: NFTs (non-fungible tokens) made it potential to connect proof of possession to digital artworks and commerce them. Progressive corporations, particularly in tech, started to incorporate digital works of their collections and even construct their very own NFT portfolios to underscore an modern picture.

The event, nonetheless, was not linear. The NFT growth of 2021 — fueled by spectacular auctions reminiscent of Beeple’s “Everydays” for USD 69 million — led to exuberance; many collectors, together with firms, purchased digital artwork at peak hype. Disillusion quickly adopted: Since its 2021 peak, the NFT artwork market has collapsed by over 90 %, from USD 2.9 billion annual turnover in 2021 to roughly USD 24 million within the first quarter of 2025. This drastic correction is mirrored within the warning of established collectors. In keeping with an Art Basel/UBS survey, the share of digital artwork in high-net-worth collections fell in parallel. In brief, after the hype got here the fact examine, and corporations that jumped too rapidly onto the NFT bandwagon hit the brakes because the speculative bubbles burst.

This must be considered not as an finish, however as maturation. What stays is a core of great actors and establishments that imagine within the long-term potential of digital artwork and now gather extra selectively. For company collections, this implies digital artwork can now be built-in with better prudence — not as a short-term PR stunt however as a substantive addition. Companies ought to deal with digital artwork of clear creative high quality and historic context reasonably than chasing each fashionable NFT. New presentation codecs, reminiscent of firm galleries or on-line platforms, are being examined. The previous decade has thus seen artwork and tech converge, with company collections steadily studying to view digital artwork as a part of their ideas.

Digital Artwork From a Bitcoin Perspective: Standing Quo and Future in Collections

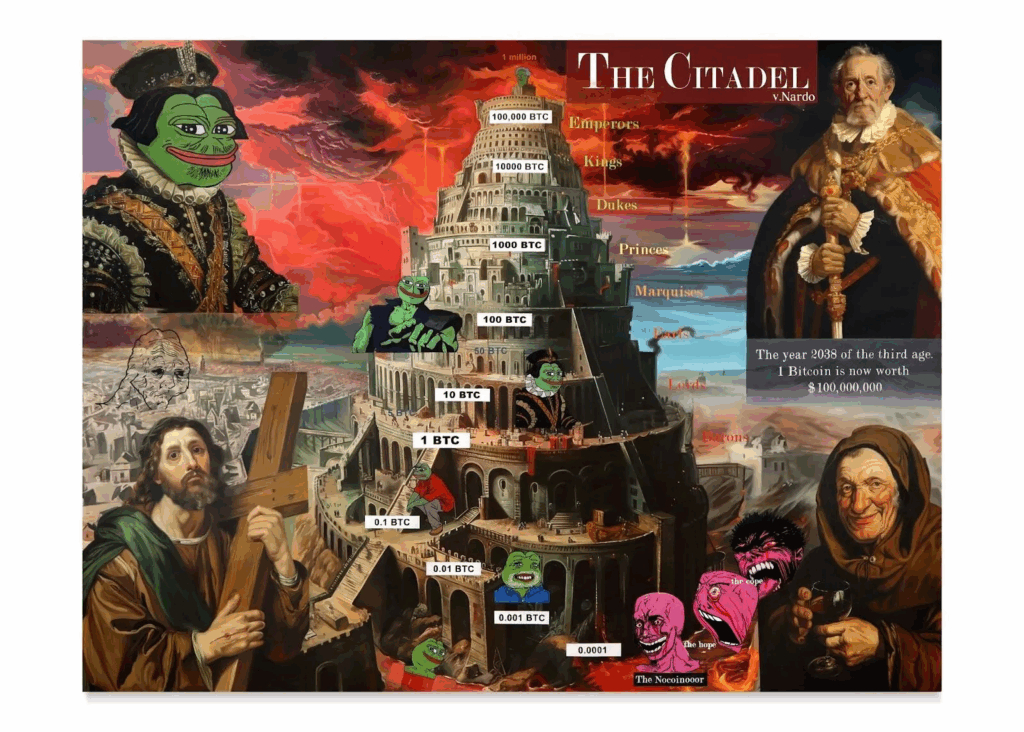

Inside Bitcoin, digital artwork opens a particular chapter. For years, the NFT market performed out primarily on Ethereum and different smart-contract platforms, whereas Bitcoin — conceived mainly as a financial system — was culturally represented extra by bodily objects (Casascius cash, sculptures or work with Bitcoin themes) and meme tradition (e.g., Pepe). But Bitcoin-centric artwork initiatives really predate the NFT hype: Experimental works started showing on the Bitcoin-fork Namecoin as early as 2012, and the Colored Coins initiative in 2013 provided one other approach to encode and switch digital belongings on-chain. The launch of the Counterparty protocol (2014) accelerated issues, with the primary Counterparty-minted artworks rising; most well-known are the Uncommon Pepe buying and selling playing cards (2016), now considered pioneers of crypto-art. Native experiments straight on Bitcoin Layer 1 additionally surfaced round 2015, however Bitcoin solely captured broad public consideration as a medium for digital artwork after the 2023 Ordinals growth. For company collections, this alerts that Bitcoin-based digital artwork has deep historic roots, is clearly on the rise, and might hardly be ignored by anybody wishing to remain present.

From a Bitcoin-only perspective, digital artwork is considered not merely as an asset however as a cultural expression of the ecosystem. Typically described as a socioeconomic motion, Bitcoin carries its personal aesthetics and beliefs (decentralization, censorship resistance, HODL mentality, and so forth.). These values are mirrored in artworks — from blockchain knowledge visualisations to portraits of Satoshi Nakamoto to meme-infused creations. Such Bitcoin-native works might develop into iconic cultural items, similar to company artwork of earlier eras — suppose industrial work of the nineteenth century or propaganda artwork of the early trendy age that accompanied financial upheavals. For present collections this implies adopting Bitcoin artwork now isn’t just buying any digital artwork however a chunk of economic and tech historical past. The 2020s are writing the creative narrative of cryptocurrency corporations. By gathering rising and historic Bitcoin artwork, they’ll develop into a part of that narrative and assist form it.

Why Bitcoin-Native Companies Ought to Gather Artwork and Bitcoin Artwork

Given these developments, why ought to Bitcoin corporations gather artwork now? The reply mixes fame, id and duty. A set can definitely burnish the picture of Bitcoin corporations, displaying openness to tradition and lowering perceptions that they’re mere tech or finance nerds. Extra vital is their energetic contribution to cultural formation inside the Bitcoin ecosystem. Bitcoin is greater than a protocol; it’s a social motion with its personal conferences, memes and a world neighborhood. Tradition is the glue that holds such actions collectively. If corporations like Nakamoto, Technique or Metaplanet construct collections, they create id anchors for the Bitcoin neighborhood. A curated Bitcoin artwork assortment can visualise the motion’s values and tales — performing like a visible manifesto.

On the similar time, the businesses develop into protagonists of this tradition. Simply as main banks grew to become “new Medici” via their collections, Bitcoin corporations might set up themselves as digital patrons who nurture and form an rising artwork scene. This goes past sponsorship: It means taking long-term duty for cultural heritage. Within the competitors for prime expertise and prospects, that may be decisive. I imply, who wouldn’t want to work for or put money into an organization that helps form tradition and historical past reasonably than merely chase revenue? A well-communicated artwork initiative can spark loyalty and pleasure that no price range might purchase, each contained in the agency.

There’s additionally an financial community impact: A vibrant cultural surroundings round Bitcoin will increase your entire ecosystem’s attraction. The extra artwork, music, literature and discourse exist about Bitcoin, the extra firmly it turns into anchored in society. That may not directly enhance demand (folks encounter Bitcoin via artwork), foster innovation (artists experiment with the know-how) and enhance public acceptance (it isn’t simply “quantity go up” however a world cultural phenomenon), finally elevating community worth. Firms gathering and supporting artwork now put money into Bitcoin’s future viability, yielding long-term business advantages. Technique, as the biggest bitcoin treasury company, has an inherent curiosity in strengthening Bitcoin culturally in addition to financially to safeguard the longevity of its holdings. Artwork can develop into a soft-power instrument, creating narrative legitimacy for Bitcoin within the broader public.

Measures: Constructing Museums, Scholarships, Prizes and Archives

What concrete artwork initiatives might Bitcoin corporations pursue? Historic precedents abound.

Some banks and firms have based their very own museums or artwork halls (Deutsche Financial institution’s PalaisPopulaire, Samsung’s Leeum Museum in Seoul). A Bitcoin firm might equally set up a Bitcoin Artwork Museum to exhibit excellent works: digital projections, interactive items, classical work or sculptures with Bitcoin themes. First initiatives already level on this course. The Bitcoin Museum in Nashville, for instance, is a noteworthy early try to inform the story of Bitcoin via a mixture of artefacts, memorabilia and artworks, to showcase the journey from Cypherpunk beginnings via the Mt. Gox period to the current. Such a museum serves as a cultural assembly level for the neighborhood and the general public.

My concept for corporations builds on this: to assemble collections that transcend modern Bitcoin artists, tracing the mental historical past of Bitcoin in artwork for the reason that 1910s. Professionally managed, these collections can be rooted in historic context, adaptable for thematic exhibitions and accessible for loans to strengthen each the educational recognition and the cultural presence of Bitcoin-related artwork.

Scholarships and prizes are highly effective levers. A agency may provide an annual “Bitcoin Artwork Scholarship” to assist gifted younger artists partaking with Bitcoin, or a prize for Bitcoin-based digital artwork (e.g., for essentially the most modern Ordinals venture of the 12 months). Such awards would create on the spot resonance within the artwork and crypto scenes, granting recipients better visibility — consider the Arab Financial institution Switzerland Digital Artwork Prize.

Like main collections of the previous that intentionally purchased works from then unknown artists, Bitcoin corporations ought to now search tomorrow’s hidden champions reasonably than merely chasing quantity with out cultural worth. Supporting the avant-garde of Bitcoin artwork at present might later show each culturally and financially rewarding: Analysts have remarked that blockchain-based digital artwork might develop into the following trillion-dollar asset class, interesting to world collectors and new investor teams.

A ceaselessly missed however important element is constructing archives and documentation buildings. Artwork is barely as helpful as its historical past is traceable — particularly within the digital realm. Firms might due to this fact put money into archival infrastructure, for instance, a database of all identified Bitcoin-related artworks, with particulars on artists, descriptions, on-chain transaction histories and extra.

Skilled Assist: Artwork Historians, Curators and Museum Apply

Bold and worthwhile as these plans are, corporations want experience. Accumulating artwork and particularly digital artwork, is just not one thing to be dealt with casually by just a few economists or IT specialists. Bitcoin corporations wishing to put money into tradition ought to contain artworld professionals from the beginning. This has custom: the UBS assortment, as an illustration, has been managed by curatorial specialists for many years and suggested by a global board. These specialists know how one can construct a group with a coherent narrative, assess high quality and guarantee correct conservation and presentation.

Digital artwork brings further challenges, from questions of digital stock to modes of show. Right here, tapping museum expertise pays off: An organization may collaborate with media-art specialists who’ve already curated digital exhibitions. Artwork historians can bridge “new Bitcoin artwork” and artwork historical past, putting the gathering in context. Whether or not avant-garde artwork, protest artwork or digital artwork for the reason that Sixties, such perspective deepens understanding and helps determine artists more likely to stay related. Steady documentation and analysis additional improve cultural worth.

Moral and authorized recommendation is one other facet. On this area, the place sources of wealth are scrutinized, transparency and accountable conduct are important. Artwork historians and curators guarantee collections usually are not staged merely as PR however stay credible and respectful towards the artwork neighborhood. Classical company collections often commit to purchasing artwork on the first market straight from artists or galleries, thereby supporting dwelling artists as an alternative of chasing public sale trophies. This angle, away from fast flipping towards sustainable patronage, is advisable for Bitcoin corporations. Hiring or consulting curators to design and take care of the gathering mirrors finest apply in firms that systematically keep their collections.

Lastly, artwork and tradition as investments require long-term pondering. Classical artwork investments have traditionally yielded reasonable returns of about 6% per 12 months, and specialists advise shopping for artwork primarily from ardour, not for returns alone. The identical seemingly holds for Bitcoin artwork: Its intangible positive aspects (social affect and cultural heritage) are paramount, although monetary appreciation might comply with. Skilled recommendation helps steadiness creative and monetary worth. When each align, artwork collections develop into exactly the strategic asset that doesn’t seem as a quantity on the steadiness sheet but exerts huge affect inside and past the corporate.

Conclusion: A Brilliant Future for the Arts

In an period the place the excellence between the digital and bodily worlds is changing into more and more blurred, company artwork collections are on the verge of getting into a brand new period. Bitcoin represents not solely an financial but additionally a cultural paradigm shift. Company artwork collections within the age of Bitcoin are greater than a continuation of an previous custom with new instruments; they’re a chance to form an rising cultural cosmos. Traditionally, corporations collected artwork to current their face to society, encourage staff and make their values tangible.

Right now, Bitcoin corporations can undertake these motives and infuse them with new life: By gathering digital artworks on-chain, they create cultural capital in a language that matches their enterprise DNA. They will leverage this capital strategically to generate community results. Every supported artist and every donated paintings strengthens the narrative of Bitcoin as not merely know-how or funding however a cultural motion.

The subsequent steps for me are clear: artwork scholarships for rising Bitcoin artists; devoted exhibition areas on-line and offline; partnerships with museums and artwork academies; maybe even a company museum. Firms ought to method the duty with humility and search skilled experience. Simply as a CFO is consulted for funding technique, a curator must be consulted for artwork technique. Outfitted on this method, Bitcoin-focused corporations might develop into real cultural actors, incomes future recognition akin to at present’s collections of UBS, Deutsche Financial institution, or JPMorgan.

The younger Bitcoin artwork scene at present presents a historic alternative: Its tradition continues to be malleable, the “canvas” largely unpainted. Firms that act now can write cultural historical past. They’ll personal not solely digital masterpieces but additionally contribute to the id of a decentralized future. Bitcoin is poised to open a brand new chapter; artwork gives the language to inform it. Company collections might help form the canon. That is strategic leveraging in its noblest sense: uniting capital and tradition to create one thing of lasting worth for the corporate, for the neighborhood and for the longer term.