Bitcoin is undergoing a structural transformation, and institutional traders are steadily tightening their grip on the cryptocurrency. As of mid-2025, institutional traders are becoming a dominant force in Bitcoin possession and are steadily capturing a big portion of its circulating provide.

Institutional Bitcoin Holdings Barrel Towards 20% Of Provide

Current information exhibits that establishments, starting from ETFs to public firms, now management an unprecedented share of Bitcoin, price a whole bunch of billions of {dollars}. Estimates place institutional possession anyplace between 17 and almost 31 p.c of complete provide when additionally factoring the quantity managed by governments.

Associated Studying

In keeping with data from Bitbo, entities akin to ETFs, private and non-private firms, governments, and DeFi protocols collectively maintain greater than 3.642 million BTC, equal to about 17.344% of the whole provide. At at present’s costs, that represents roughly $428 billion price of Bitcoin locked away in institutional treasuries.

ETFs are the biggest contributors, with over 1.49 million BTC, whereas public firms akin to Technique, Tesla, and others account for 935,498 BTC. Technique’s position is particularly noteworthy, because the agency’s relentless accumulation strategy in recent times has seen it amass 628,946 BTC, or about three p.c of your entire circulating provide.

Bitbo information exhibits personal firms maintain 426,237, price $50.17 billion, and about 2.03% of the whole circulating provide. BTC mining firms personal 109,808 BTC (0.523% of the whole circulating provide), whereas DeFi protocols personal 267,236 BTC (1.273% of the whole circulating provide).

Bitcoin holdings by class. Supply: Bitbo

Different reviews, together with a joint study by Gemini and Glassnode, recommend the numbers may very well be even increased. Their findings level to centralized treasuries composed of governments, ETFs, companies, and exchanges controlling as much as 30.9% of circulating Bitcoin, which equates to over 6.1 million BTC. This enhance represents a 924% surge in institutional management of Bitcoin in comparison with a decade in the past.

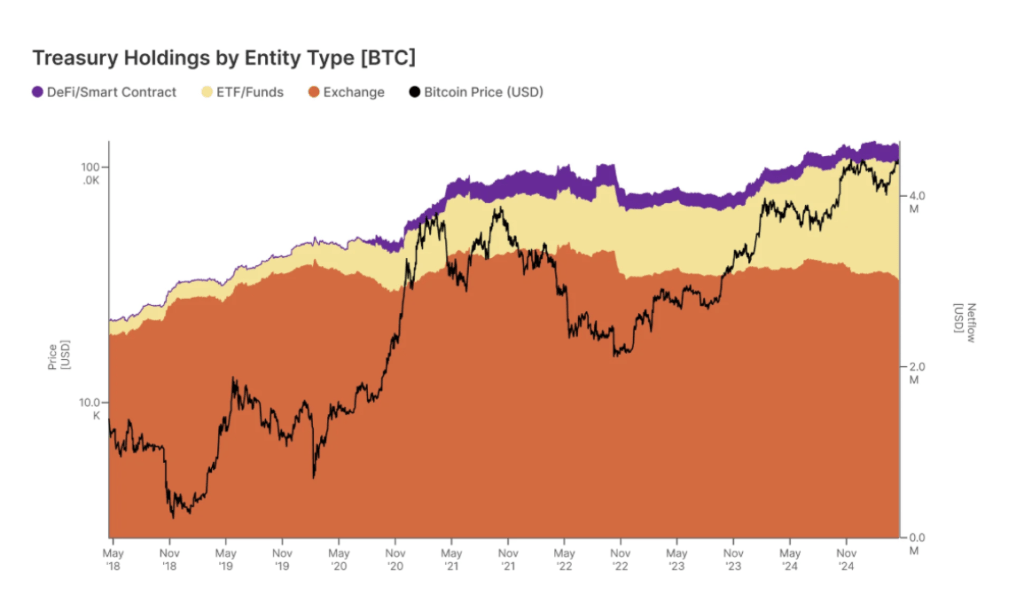

Chart Picture From Gemini: Bitcoin treasury holdings by entity kind

Is Bitcoin The New Wall Road Playground?

Bitcoin’s rise in its early years was primarily based on a mixture of enthusiasm from retail traders and long-term conviction from early adopters, however the market’s stability of energy is shifting. In keeping with the holding information, Bitcoin is more and more turning into a lot much less reasonably priced for retail merchants and is now turning into a playground for big Wall Road establishments.

Institutional demand for Bitcoin has not been confined to companies and ETFs alone. Governments are starting to make their presence felt, and the US took probably the most notable step earlier this yr. In March 2025, the US authorities established a Strategic Bitcoin Reserve crammed with seized and forfeited digital belongings. Different governments like El Salvador and Bhutan are also accumulating Bitcoin via intentional, ongoing purchases, additional tightening the provision in circulation

Associated Studying

Some analysts consider this might cut back Bitcoin’s value volatility and support its price growth over the long run. Then again, the focus of Bitcoin amongst a comparatively small variety of entities might undermine its decentralization and the pure development of its value. Both method, the info exhibits that Bitcoin is now becoming Wall Street’s newest playground.

On the time of writing, Bitcoin was buying and selling at $117,460.

Featured picture from Unsplash, chart from TradingView