Is BlackRock set to grow to be Ethereum’s Greatest Validator? ETH USD is on the verge of its subsequent leg up after reclaiming $4,300 for the fourth time in 48 hours. A breakout from right here seemingly takes the quantity two digital asset to a brand new all-time excessive, surpassing its November 2021 excessive of $4,878.

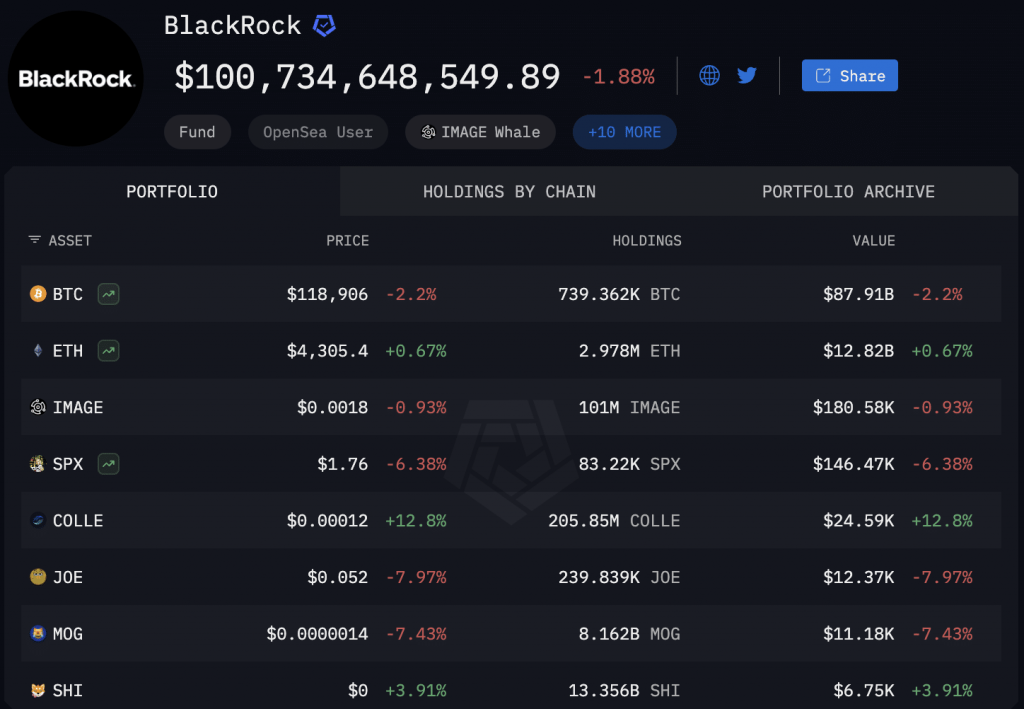

This current value motion for Ethereum coincides with BlackRock making considered one of its most vital ETH purchases because it started accumulating, securing 150,584.76 $ETH for $639 million, taking the asset supervisor’s crypto holdings over $100 billion for the primary time, per Arkham.

(ARKHAM)

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

BlackRock Now Holds $12 Billion in ETH USD – What Do They Know?

With its newest nine-figure ETH USD buy, BlackRock now holds over $12.8 billion in Ethereum, its second-largest holding behind Bitcoin ($87.91 billion).

BlackRock is the world’s largest asset supervisor, with over $4.74 trillion in property below administration (AUM). Per HedgeFollow, its prime holding is Apple inventory (AAPL), at $253.27 billion. Now, its crypto holdings have exceeded $100 billion, making it the fifth-largest holding, overtaking Meta (META), through which it holds $95.89 billion value of inventory.

It isn’t talked about almost sufficient how vital it’s that the world’s largest asset supervisor has made crypto its fifth-largest holding. And its mass accumulation of ETH, whereas it’s nonetheless greater than 11% away from its all-time excessive stage, is telling.

For context, BTC is round 90% up from its November 2021 excessive of $67,617. It at the moment trades for $118,600 and appears prepared for an additional leg up. BlackRock has seemingly noticed Ethereum’s undervalued place. Ethereum is the second-largest digital asset by market cap and has not but made a brand new all-time excessive for the previous 4 years.

With its present ETH holdings making BlackRock the biggest company holder of Ethereum, it highlights the demand and success of its spot Ethereum ETF product. Per CoinGlass information, yesterday, $1.02 billion in constructive inflows for all Ethereum ETFs have been seen, with over $639 million of that coming from BlackRock’s ETHA ETF.

BlackRock is now in search of approval from the SEC to permit staking of its ETH holdings. If handed, this might see the asset supervisor incomes over 209 ETH in yield on its Ethereum holdings per day, which equates to round $867,000 in day by day ETH USD rewards, a staggering quantity for BlackRock and its ETHA traders.

Blackrock purchased $12,065,478,744 $ETH.

You would possibly wish to test how a lot Ethereum you’re holding.

Don’t be left underexposed. pic.twitter.com/pkM7EYcStS

— Ted (@TedPillows) August 11, 2025

DISCOVER: Top Solana Meme Coins to Buy in August

Might BlackRock and Ethereum Treasury Companies Be the Catalyst to Ship Ethereum to $15k?

Not solely is BlackRock shopping for ETH in big portions, however publicly traded corporations are additionally taking the Michael Saylor/Technique method and pivoting to Ethereum Treasury corporations.

Sharplink Gaming (SBET), headed by Ethereum co-founder Joe Lubin, and Bitmine (BMNR), a former Bitcoin mining agency led by Tom Lee, are the 2 most outstanding. Each corporations now maintain a mixed 1.67 million ETH and are nonetheless shopping for.

The distinction between a Bitcoin Treasury technique and an Ethereum one is the yield on supply with ETH staking. The present APR is round 2.6% on common, which means these corporations can earn sizeable curiosity only for staking Ethereum.

This opens up the likelihood for it being a extra profitable enterprise than the identical technique with Bitcoin as a result of yield on supply. And with ETH USD nonetheless being below its 2021 all-time excessive, the continual shopping for of Ethereum from behemoths resembling BlackRock and the opposite asset managers, and likewise the ETH Treasury corporations resembling Sharplink and Bitmine, make the potential of Ethereum hitting $10,000+ this cycle an actual chance.

Retail traders can now put money into Ethereum with no need to navigate crypto exchanges, their awkward UIs, and unforgiving processes. By merely investing in BlackRock’s ETHA fund or shopping for SBET/BMNR inventory, traders can acquire publicity to the Ethereum upside extra simply than ever.

Then, in the event you add in to the combo that the possibility of a 25bps price lower in September on the Federal Reserve FOMC conferences is sitting at a 73% probability of ‘YES’ on prediction platform, Polymarket, issues are shaping up for ETH USD to skyrocket to five-figures in 2025.

EXPLORE: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The publish Is BlackRock Set To Become Ethereum’s Biggest Validator? Here’s How ETH USD Can Hit $15K appeared first on 99Bitcoins.