In DeFi, Hyperliquid stands out because of its innovation. Coingecko knowledge exhibits that HYPE, its governance token, is essentially the most precious DEX coin, with a market cap more than twice that of Uniswap (UNI). Presently, Hyperliquid has a market cap of $13.4 billion, and HYPE buying and selling generated over $244 million in quantity up to now 24 hours. Whereas quantity fluctuates, curiosity within the HYPE token means that Hyperliquid is carefully monitored and will turn out to be one of many next cryptos to explode if it continues gaining market share.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

Hyperliquid Generates File Income

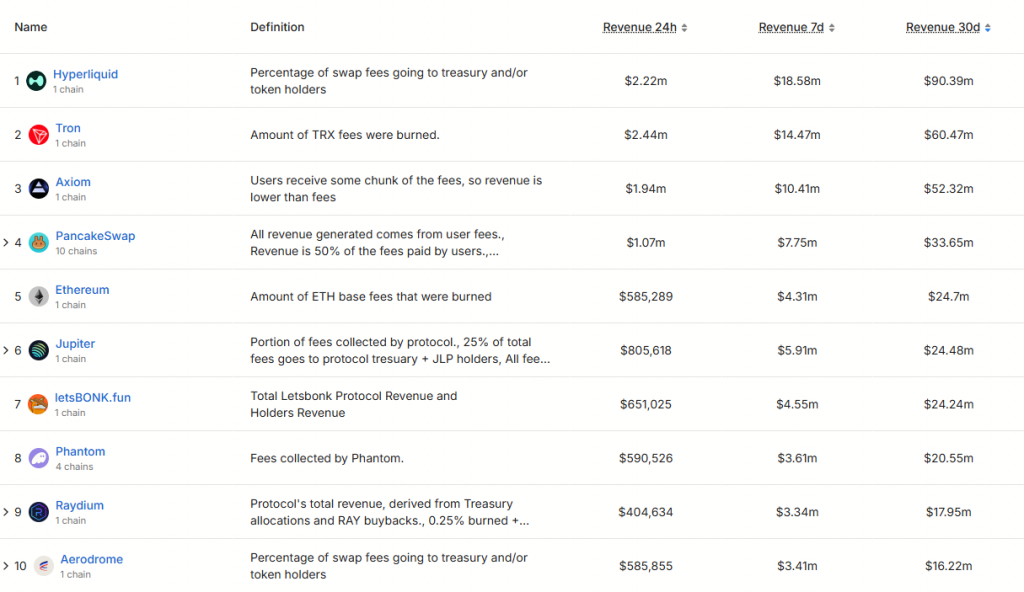

On X, one analyst notes that Hyperliquid, the decentralized perpetual crypto trade, might be one among crypto’s most compelling tales. Up to now month alone, the analyst observes that Hyperliquid generated over $90 million in charge income.

(Supply: Holosas on X)

At this degree, Hyperliquid outperformed Ethereum, Pump.enjoyable, Ethena, Base, Ondo, and even Solana, which collectively generated simply $88 million up to now month. For that reason, the analyst is satisfied that HYPE is probably going grossly undervalued on the present $13.4 billion market cap.

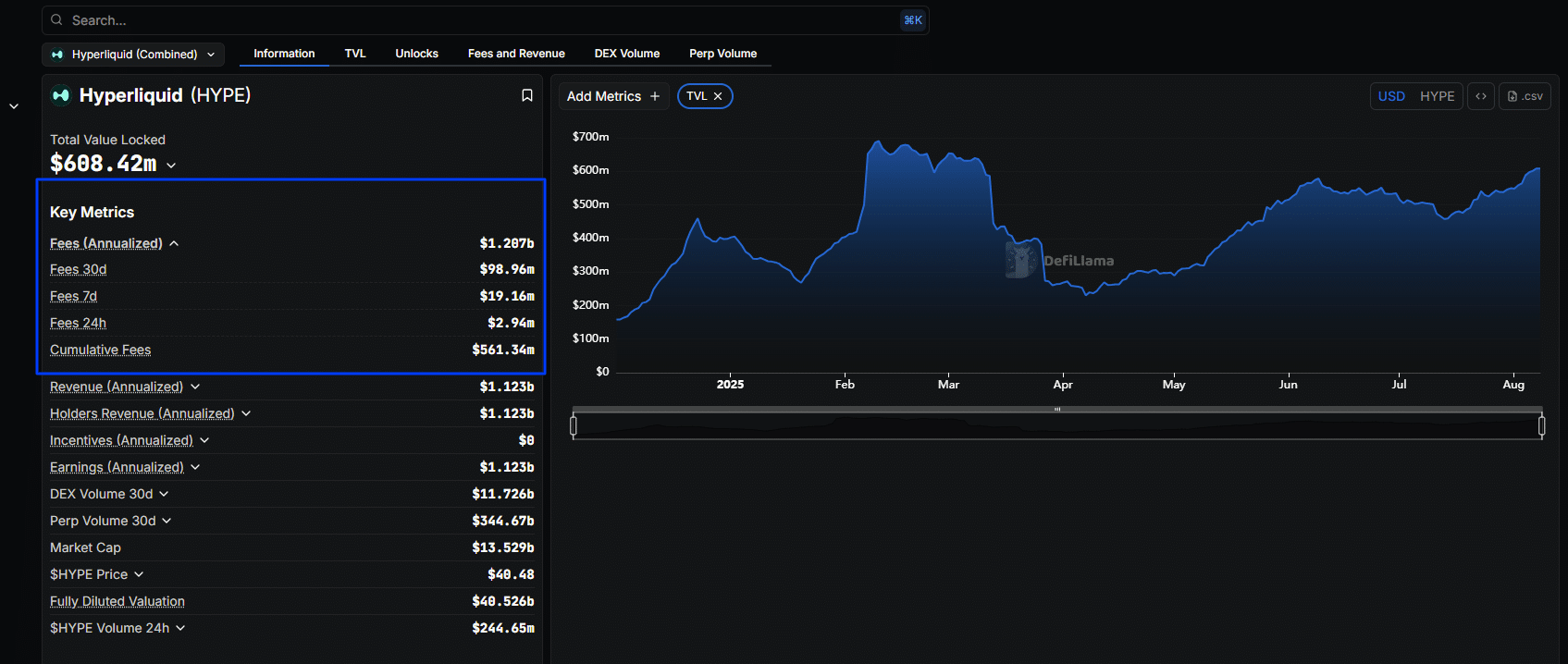

If extrapolated, and the present charge income stays, Hyperliquid might simply generate over $1 billion in charges yearly, positioning it as a pacesetter amongst DeFi protocols. In response to DeFiLlama, Hyperliquid generated over $19 million in charges up to now week. Cumulatively, the protocol has generated over $561 million in charges.

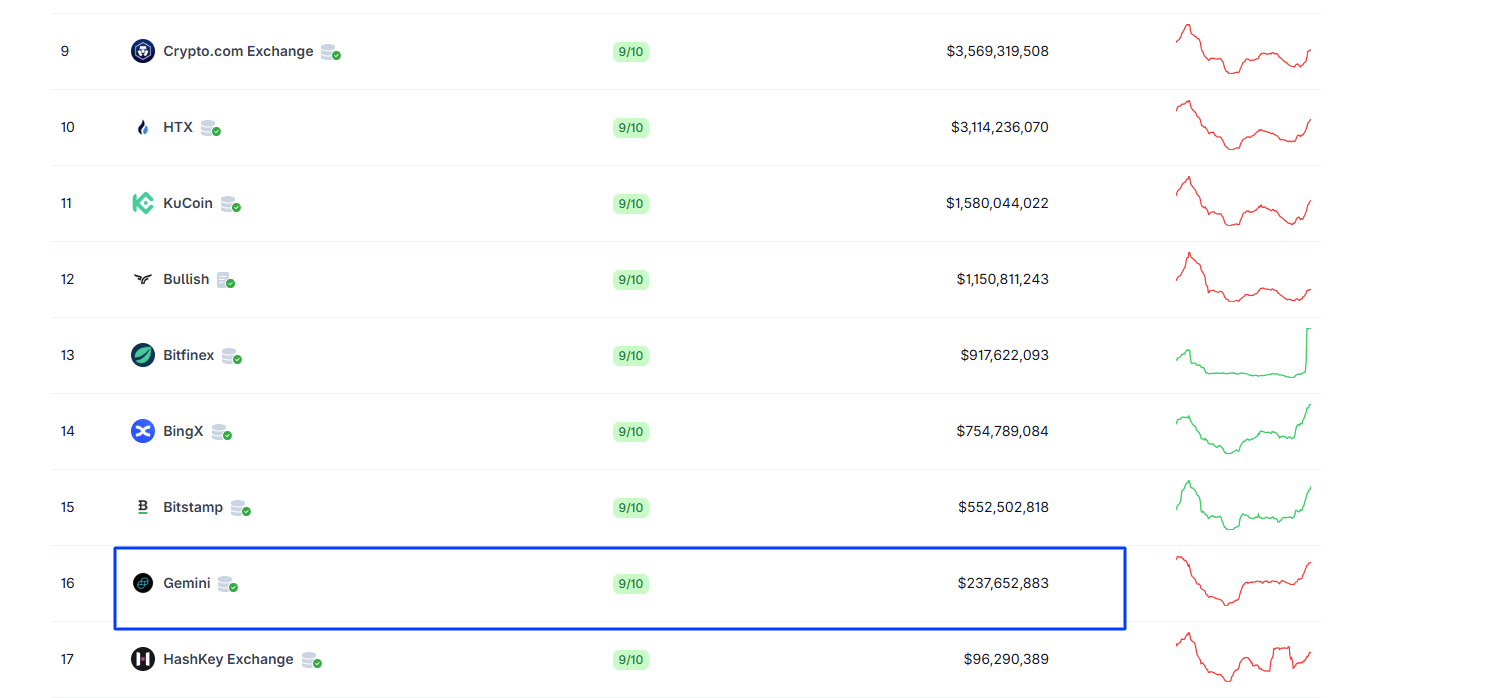

When it comes to buying and selling quantity, the decentralized perpetual trade processed over $11.7 billion up to now 30 days, $2.1 billion within the final week, and over $296 million up to now day. At this degree, Hyperliquid posted greater than Gemini, which recorded almost $237 million up to now day.

This stellar efficiency by Hyperliquid is outstanding. It explains why HYPE, within the eyes of optimistic analysts, is simply starting its ascent. At spot charges, is sort of 18% under its all-time excessive of round $50.

Regardless of the drop in late July, the uptrend stays intact. HYPE crypto has discovered assist at round $36. If consumers break above $40, there may be potential for extra development, constructing on beneficial properties from a lot of 2025. Since itemizing on main exchanges in late 2024, HYPE has soared from lows of round $8 to all-time highs of $50, earlier than cooling to roughly $40.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Is HYPE Crypto Undervalued?

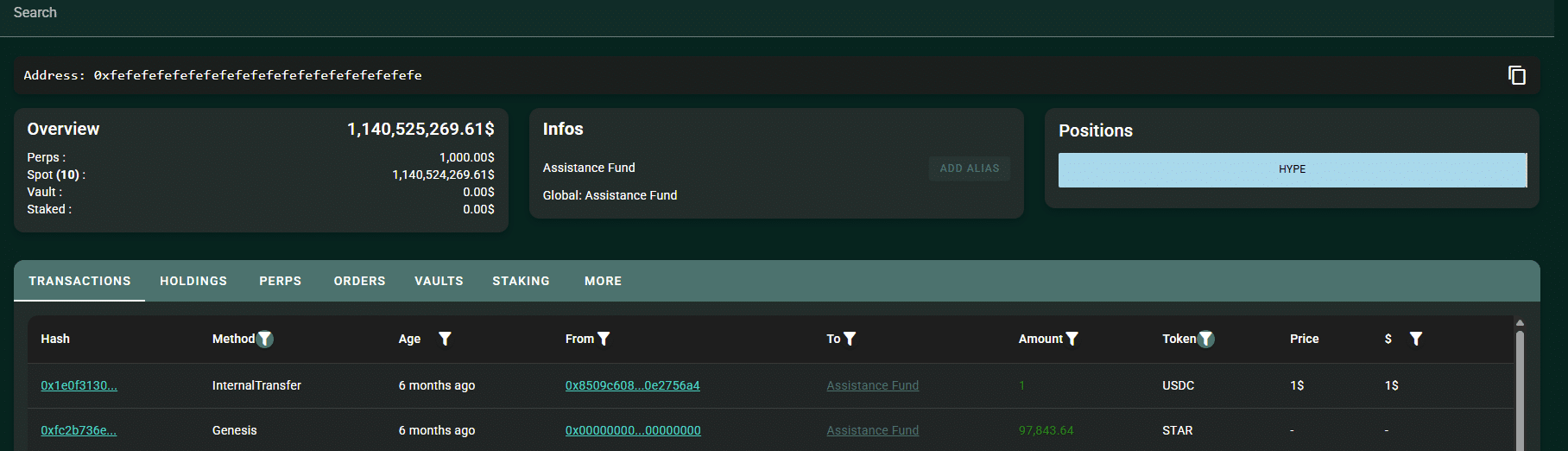

Merchants anticipate a provide shock in HYPE. Hyperliquid makes use of 97% of its income to purchase again HYPE from the secondary market. At an annualized charge of $1.1 billion, the decentralized perpetual DEX will use over $950 million to accumulate extra HYPE, decreasing the circulating provide and creating sustained upward strain.

Presently, the Hyperliquid Help Fund has amassed over $1.1 billion value of HYPE by buybacks alone.

On the present buyback charge, one analyst tasks that this aggressive mechanism might see the DEX buy back its entire circulating supply inside 4 years.

This aggressive buyback mechanism is unprecedented and much surpasses that of Binance, which goals to finally reduce its circulating provide from 200 million to 100 million BNB.

DISCOVER: Top Solana Meme Coins to Buy in 2025

Ought to Hyperliquid additional develop its person base and improve its perpetual DEX market share, the trade could purchase again HYPE quicker than retailers count on. In response to Artemis, Hyperliquid managed over 75% of all perpetual DEX buying and selling quantity as of July 2025. Throughout that point, regardless of Bitcoin reaching new all-time highs in mid-July, HYPE posted strong beneficial properties, including over 50% in comparison with Bitcoin’s 13%.

Analysts say the sturdy efficiency, report income, and buyback program align with the pursuits of merchants and liquidity suppliers. Collectively, they create a sustainable and resilient mannequin in comparison with conventional rivals like Robinhood, making it enticing for traders.

In comparison with public crypto firms comparable to Robinhood or Coinbase, Hyperliquid is lean. The workforce’s token allocation, per Messari, is lower than 25% of the full provide. These tokens are locked till 2027–2028, with solely 34% of the full provide of 1 billion in circulation. Messari analysts say this construction offers Hyperliquid an “infinite” absolutely diluted valuation (FDV), not like public firms serving comparable shoppers.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

Is Hyperliquid HYPE Crypto Undervalued? DEX Producing File Income

- HYPE crypto might be undervalued

- Hyperliquid generated over $90 million in income up to now 90 days

- HYPE crypto costs could soar above $50

- Analysts level to the aggressive buyback plan as a purpose to remain bullish

The put up Is Hyperliquid HYPE Crypto Undervalued? DEX Generates Record Revenue appeared first on 99Bitcoins.