On-chain knowledge exhibits over half of the Ethereum provide is held by simply 10 addresses. Right here’s how different ETH-based tokens like Shiba Inu stack up.

Shiba Inu, Uniswap, & Ethereum Are Amongst The Most Centralized ETH Tokens

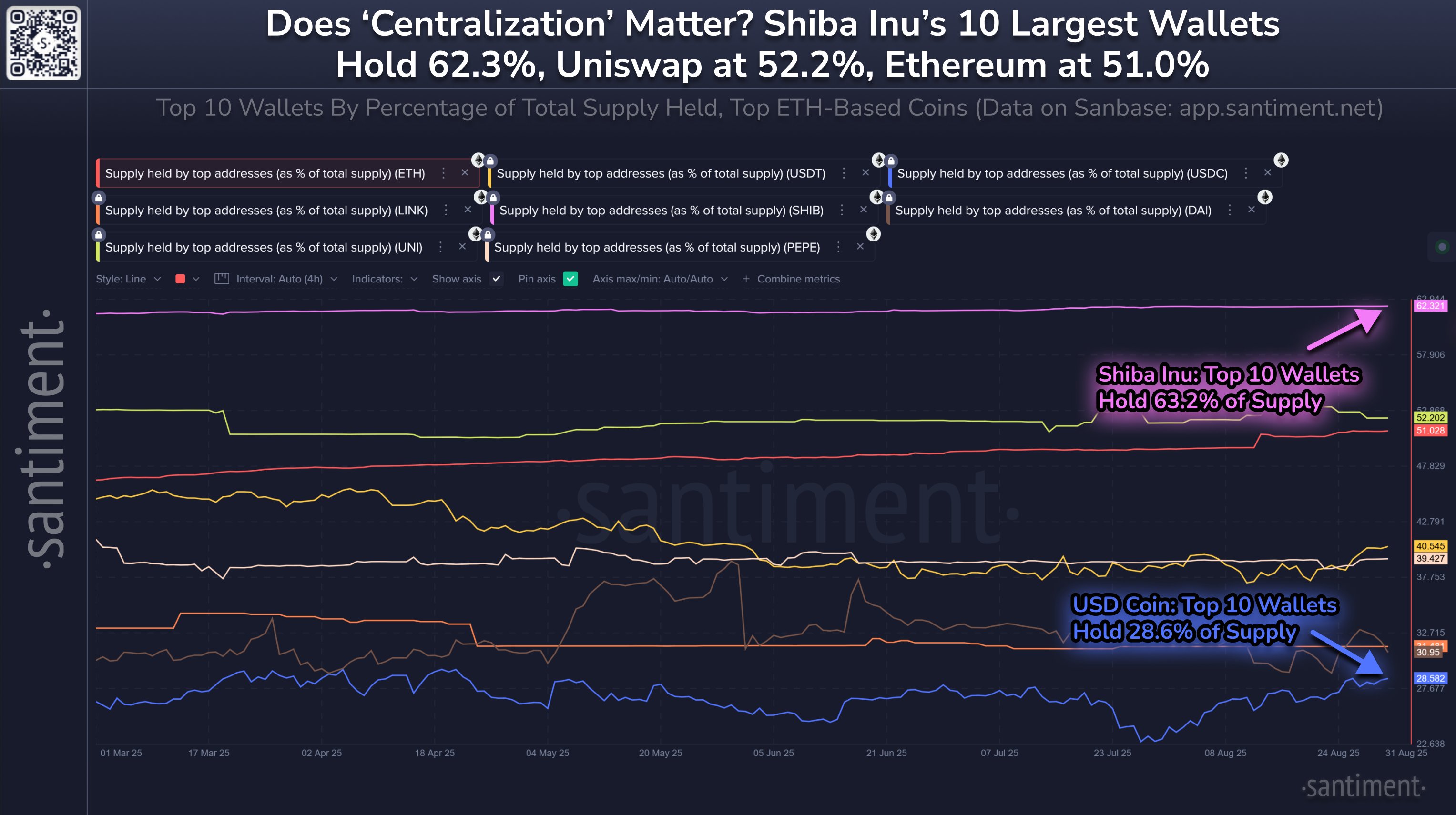

In a brand new post on X, on-chain analytics agency Santiment has talked about how the totally different belongings within the Ethereum ecosystem line up towards one another by way of the quantity of provide that’s targeting the highest 10 wallets.

Under is the chart shared by Santiment that exhibits the pattern on this metric for eight cryptocurrencies over the previous few months.

Seems like SHIB is on the prime of the record in the meanwhile | Supply: Santiment on X

From the graph, it’s seen that 51% of the Ethereum provide is owned by the ten largest wallets on the community. That is greater than many of the different ETH-based tokens on the record.

The 2 cash which are forward on this metric are Shiba Inu (SHIB) and Uniswap (UNI). The latter is barely marginally forward of ETH with a price of 52.2%, however the former is considerably forward at 62.3%.

Typically, a cryptocurrency’s provide being closely targeting only a few palms doesn’t are typically a constructive sign, because it means just a few gamers are wanted to maneuver the market.

Past market dynamics, provide centralization has one other disadvantage: it probably weakens the community safety. Chains like Ethereum’s run on a consensus mechanism referred to as the Proof-of-Stake (PoS). Underneath this technique, validators referred to as stakers need to lock up a stake in an effort to obtain an opportunity at including the following block to the chain.

The upper is a validator’s stake, the upper is the possibility that they get picked. If a single staker crosses the 51% provide threshold, they’ll, in concept, acquire complete management over the blockchain.

Any such assault doesn’t exist on Bitcoin, the place the Proof-of-Work (PoW) consensus mechanism is employed as a substitute. In PoW networks, miners compete towards one another utilizing computing energy. Right here, too, nonetheless, if a validator features management over 51% of the community computing assets, they’ll mould BTC to their will.

Contemplating that Ethereum has simply 10 holders controlling 51% of the provision, an assault on the community is feasible if these entities come collectively. The possibilities of it occurring, although, are fairly slim.

Nonetheless, the very fact the likes of ETH, SHIB, and UNI are notably centralized on only a few holders might be one thing to look at for. In distinction, another tokens within the ecosystem like USDC (28.6%), DAI (31%), and Chainlink (31.5%) are in a more healthy zone by way of this metric.

ETH Value

Ethereum has seen a surge of virtually 4% over the past 24 hours that has taken its worth to the $4,380 mark.

The worth of the coin appears to have shot up over the previous day | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, Santiment.web, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.