Michael Saylor is again on the Bitcoin buffet, and this time he introduced an even bigger plate. Strategy Inc. has expanded its most well-liked fairness increase from $500 million to $2 billion, doubling down (or ought to we are saying quadrupling down) on its BTC ▼-0.24% accumulation marketing campaign.

The Collection A Perpetual Stretch Most well-liked Shares are set to cost at $90 with a 9% dividend, in line with Bloomberg.

“The corporate is poised to cost the shares at $90 every, the underside of a marketed vary,” – Unnamed supply, Bloomberg

The transfer displays each persistent demand for Bitcoin-linked exposure and Saylor’s ongoing conviction that BTC belongs on the core of recent treasury technique.

Michael Saylor: ‘Why This Issues for Bitcoin and Institutional Traders’

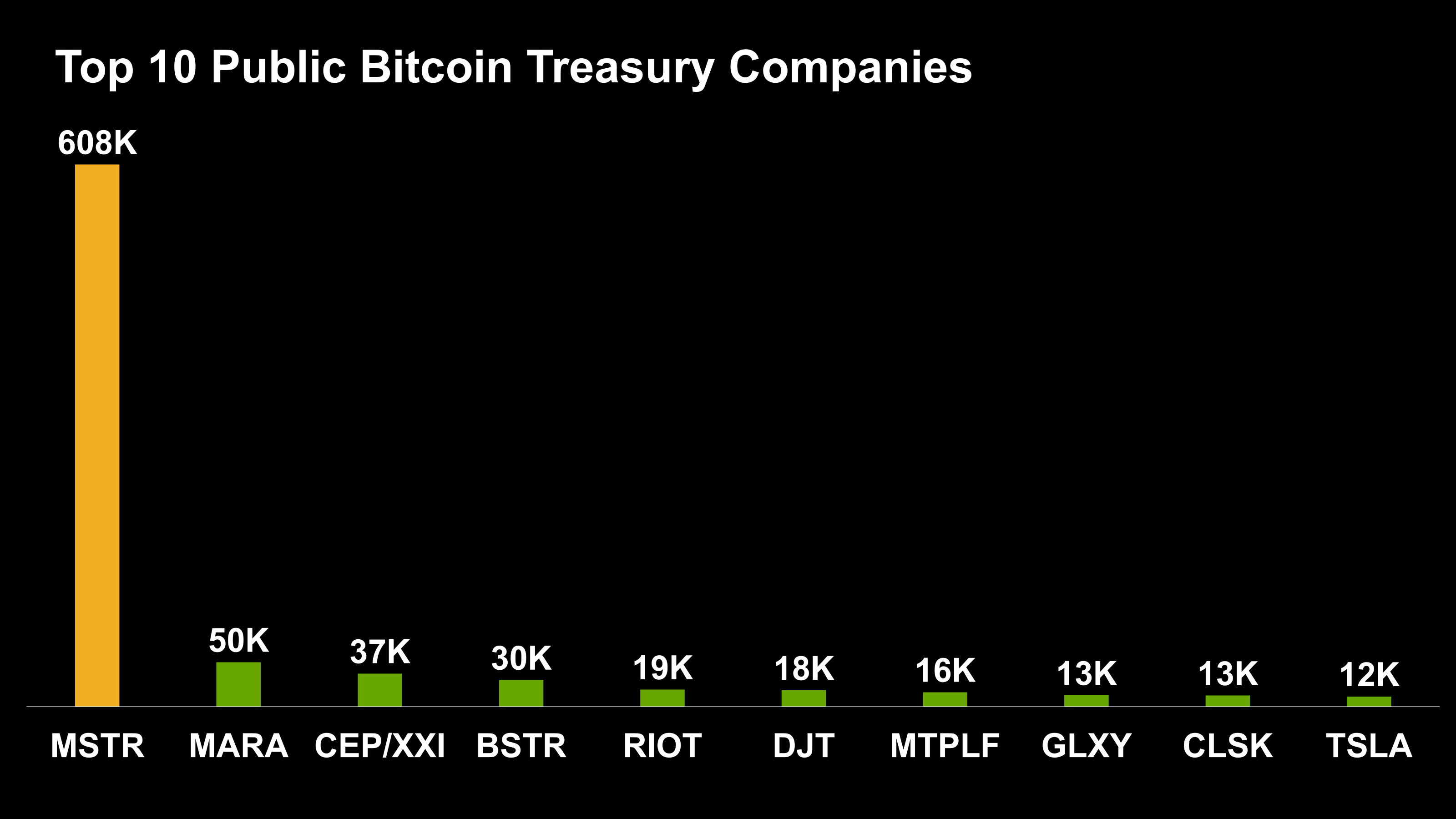

Technique already holds 607,770 BTC, valued at roughly $72.4 billion, which represents over 3% of Bitcoin’s complete circulating provide. The contemporary $2 billion in most well-liked fairness might push that quantity even increased.

The providing is being led by Morgan Stanley, Barclays, Moelis & Co., and TD Securities and consists of 5 million shares that rank senior to most of Technique’s current most well-liked and customary shares, however stay junior to its convertible debt and “Strife” most well-liked class.

Michael Saylor has described Technique’s fundraising mechanism as a “quadratically reflexive, engineered instrument” that enables the corporate to purchase Bitcoin at favorable costs utilizing capital raised at excessive valuations.

The concept is easy: increase funds by most well-liked inventory or bonds when Technique inventory is driving excessive, then deploy that capital to build up Bitcoin, which can enhance the corporate’s valuation even additional. Rinse, repeat. Saylor is a mad lad.

BTC Market Response and Outlook

On the time of writing, Bitcoin (BTC) trades close to $115,300, down barely on the day. Shares of Technique hovered close to even throughout Thursday’s session however slipped 0.44% in after-hours buying and selling. Regardless of the dip, momentum stays robust, and institutional sentiment continues to lean bullish.

Whether or not this strategy continues to reward buyers relies upon largely on one variable: the value of Bitcoin. However on the earth of crypto maximalism, Saylor is primed to develop into the following Warren Buffett.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

DISCOVER: Best Meme Coin ICOs to Invest in Today

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Strategy Inc. has expanded its most well-liked fairness increase from $500 million to $2 billion, doubling down on its BTC gamble.

- Bitcoin (BTC) trades close to $115,300, down barely on the day. Shares of Technique hovered close to even throughout Thursday’s session however slipped 0.44%.

The publish Michael Saylor’s Strategy Secures $2 Billion to Fuel Bitcoin Accumulation appeared first on 99Bitcoins.