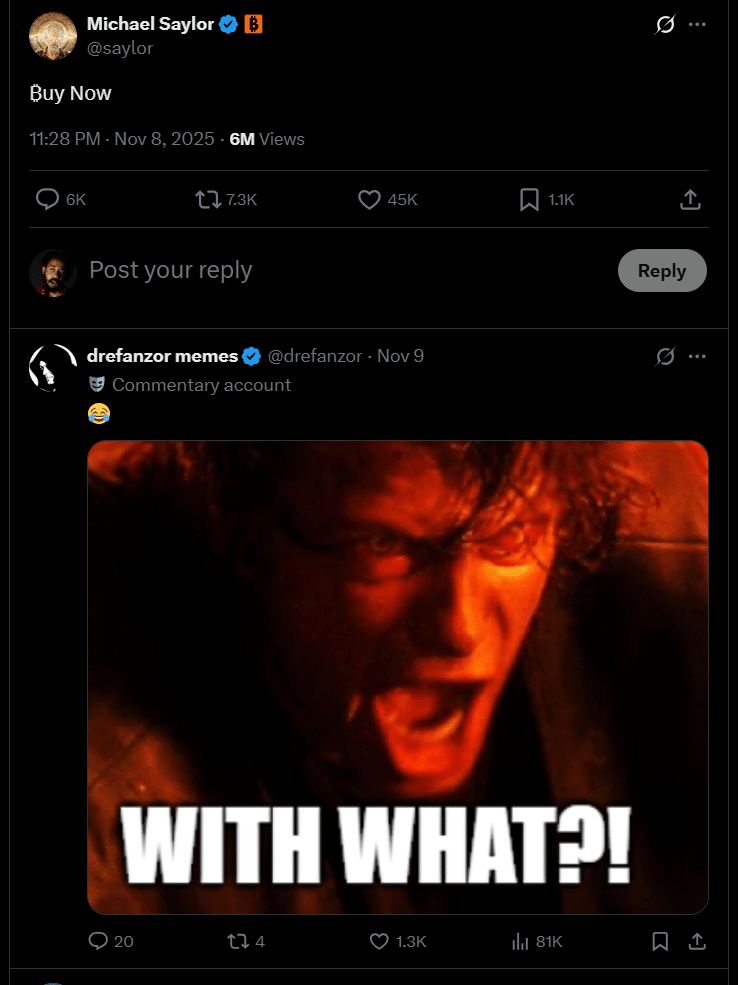

Think about considering that altering the title from Microstrategy inventory to Technique was a good suggestion. Anf now Michael Saylor simply floated a message on X that mentioned “Purchase Now,” which comes precisely three years after FTX begged individuals to purchase FTT.

What do you say lads, ought to we assist him?

We had no retail this cycle, which suggests no altcoin bull market, and most working-class individuals consider the price of Bitcoin is just too excessive.

Institutional treasuries are the retail traders this time round, shopping for enormous baggage at 90k whereas the remainder of the crypto house, which really purchased earlier, cheers on Michael Saylor as some sort of genius, shopping for at greater costs than anybody. Nicely, we’re about to see who nonetheless believes on the best way down, undoubtedly not companies and their board of administrators

So what’s subsequent for Michael Saylor and Technique?

DISCOVER: Top 20 Crypto to Buy in 2025

If MicroStrategy Inventory Falls, Will BTC USD Fall to $50k?

MicroStrategy’s inventory has slipped beneath the worth of its personal Bitcoin holdings, which is a uncommon break within the firm’s long-running premium. With BTC stabilizing round $102,000 earlier within the week – and now slipping towards $96,000! – Wall Avenue has briefly determined the underlying cash are value greater than the fairness wrapped round them.

The transfer comes days after famed short-seller Jim Chanos, who referred to as the Enron collapse, closed his MSTR place, dismissing the agency’s excessive Bitcoin leverage as “ridiculous.”

Folks have been paying @saylor like 3x NAV on the peak, proper?

LET THAT SINK IN! $mstr goes to be studied for the following 100 years… in some way

Finest recommendation: if somebody is screaming so that you can promote your own home and purchase, possibly don't? https://t.co/2l0tWynrRY

— @jason (@Jason) November 13, 2025

This adverse premium is freaking traders out and nurturing a rising warning towards the world’s largest corporate Bitcoin holder. Buyers seemed to be pricing within the agency’s dilution threat and heavy leverage, somewhat than Bitcoin’s short-term value strikes.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Is The Market Rethinking the “Company Bitcoin Proxy” Commerce?

MicroStrategy’s inventory normally trades at a premium to its internet Bitcoin holdings, reflecting optimism round Michael Saylor’s long-term BTC thesis. However as the corporate continues to lift capital via new fairness and most well-liked share choices, some institutional traders are pulling again.

“There’ll all the time be skeptics who don’t admire Bitcoin, digital capital, or digital credit score. The market is evolving,” mentioned Saylor

In line with Glassnode, institutional Bitcoin flows have stabilized since late October, whereas CoinGlass data reveals complete BTC held in company treasuries now tops $104.55 Bn. But, Technique’s widening volatility in comparison with Bitcoin means that merchants are more and more desire direct publicity over company intermediaries.

Perhaps Saylor is over his skis on this one?

In the meantime, Crypto Concern & Greed Index readings stay caught within the “excessive concern” zone at 16, signaling warning regardless of Bitcoin’s comparatively secure value motion round $96,000. Regulate this one, we could also be taking a look at a brand new FTX if MSTR inventory retains collapsing.

EXPLORE: Will The Illuvium ILV Crypto Devastation Continue? Staking V3 To Go Live

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Think about considering that altering the title from Microstrategy inventory to Technique was a good suggestion. And now Michael Saylor is in peril.

- Regulate this one, we could also be taking a look at a brand new FTX if MSTR inventory retains collapsing.

The publish MicroStrategy Stock Death Spiral: MSTR Stock Slips Below Its Bitcoin Value as Traders Favor Pure BTC Exposure appeared first on 99Bitcoins.