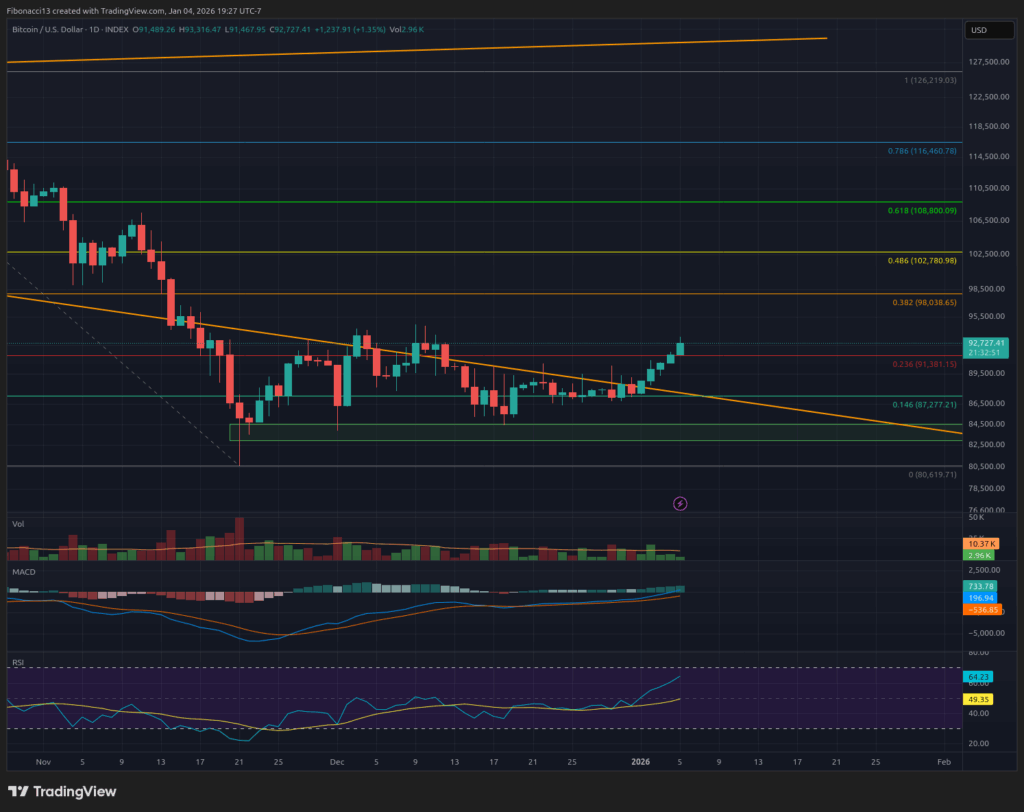

After remaining comparatively sideways via the Christmas and New 12 months’s weeks, the bitcoin worth made a small transfer increased over this previous weekend. Bitcoin worth closed the week at $91,489, simply above the short-term resistance stage at $91,400. If bulls can maintain above this stage, they need to take one other run on the $94,000 resistance stage this week, which has saved a lid on the value since mid-November. $98,000 is inside attain this week as nicely.

Key Assist and Resistance Ranges Now

Bulls will attempt to carry some momentum into the New 12 months right here and take out the $94,000 resistance stage. Above $94,000, we’ve $98,000, the place resistance actually begins to select up, and stretches from there all the way in which as much as $103,500. This space is poised nicely to reject the value if it could actually climb above $94,000. $109,000 supplies a possible closing ceiling for the value that will probably be extraordinarily powerful to overcome. If the value will get above $109,000, we are able to begin speaking about doubtlessly seeing new highs.

The bulls will wish to maintain assist at $87,000 if the bears can handle to drive the value down there. $84,000 remains to be sturdy assist beneath there, however it should weaken with additional touches. If $84,000 assist fails, we’ll look right down to the $72,000 to $68,000 assist zone as a robust stage to supply a bounce.

Outlook For This Week

Sleepy bears have let up a bit of over the previous few weeks. This week, the bulls will seemingly attempt to make the most of this by persevering with to push the value increased into the following resistance stage, so search for the bulls to make one other try at $94,000. $98,000 ought to hold a lid on issues this week if bulls can handle to push previous $94,000. If bulls fail to carry the $91,400 stage this week, search for them to defend the $87,000 stage to present themselves one other try at getting above it and taking over $94,000 as soon as once more.

Market temper: Impartial – Bulls have managed to carry assist ranges over the previous few weeks and have a little bit of upward momentum this week. The bearish temper has softened to a extra impartial stage.

The following few weeks

The weekly chart has been sandwiched between the decrease development line of the broadening wedge above and the weekly 100 SMA beneath for a number of weeks now. One in all them needed to break, and for now, it’s the development line resistance that has eroded away to present the bulls an opportunity to push increased. Lengthy-term bias remains to be bearish, nonetheless, so search for any bullish transfer to discover a prime over the approaching weeks and are available again down to check assist at $87,000 to $84,000. Closing any weeks beneath $84,000 at this level will set bears as much as drop the value right down to the following assist stage within the low $70,000 vary. On the upside, the bulls might want to maintain weekly closes above $100,000 to attempt to flip the long-term development round.

Terminology Information:

Bulls/Bullish: Consumers or buyers anticipating the value to go increased.

Bears/Bearish: Sellers or buyers anticipating the value to go decrease.

Assist or assist stage: A stage at which the value ought to maintain for the asset, at the very least initially. The extra touches on assist, the weaker it will get and the extra seemingly it’s to fail to carry the value.

Resistance or resistance stage: Reverse of assist. The extent that’s prone to reject the value, at the very least initially. The extra touches at resistance, the weaker it will get and the extra seemingly it’s to fail to carry again the value.

SMA: Easy Transferring Common. Common worth primarily based on closing costs over the required interval. Within the case of RSI, it’s the common energy index worth over the required interval.

Broadening Wedge: A chart sample consisting of an higher development line appearing as resistance and a decrease development line appearing as assist. These development traces should diverge away from one another with a purpose to validate the sample. This sample is a results of increasing worth volatility, usually leading to increased highs and decrease lows.

Fibonacci Retracements and Extensions: Ratios primarily based on what is named the golden ratio, a common ratio pertaining to progress and decay cycles in nature. The golden ratio is predicated on the constants Phi (1.618) and phi (0.618).