On-chain information exhibits New Whales on the Bitcoin community have been realizing losses lately, whereas Previous Whales have remained on the sidelines.

Bitcoin Has Confronted Loss Promoting From The Beginner Whales

In a brand new post on X, CryptoQuant group analyst Maartunn has talked in regards to the newest pattern within the revenue/loss realization conduct of the Bitcoin whales. “Whales” broadly check with the BTC buyers that maintain at the least 1,000 tokens of their steadiness.

On the present trade charge, the cutoff for the cohort is equal to $91.6 million, which is kind of vital. As such, this group represents the big-money arms of the market, who can carry a point of affect.

Whales will be divided into two subgroups based mostly on holding time. Traders of this dimension who bought their cash throughout the previous 155 days are often called the short-term holder (STH) or New Whales. Equally, whales with an extended holding time are known as the long-term holder (LTH) or Previous Whales.

Now, right here is the chart shared by Maartunn that exhibits the pattern within the web quantity of revenue/loss that these Bitcoin whale teams have been realizing via their promoting over the previous few months:

As displayed within the above graph, the Bitcoin New Whales have proven some loss realization spikes lately. This underwater promoting from the cohort has come because the cryptocurrency’s worth has gone via a decline.

The New Whales embrace the inexperienced arms of the market who have a tendency to simply panic within the face of volatility. It could seem that this high quality of the group has held via the most recent crash as effectively.

The Previous Whales, however, are thought-about to signify the resolute aspect of the community. From the chart, it’s seen that there was some loss promoting from these giant dormant entities lately, however its scale has been small in comparison with the New Whale capitulation.

The truth that the presence of the Previous Whales has been comparatively muted via the bearish shift, in addition to the rebound that has adopted, might be a sign price maintaining a tally of.

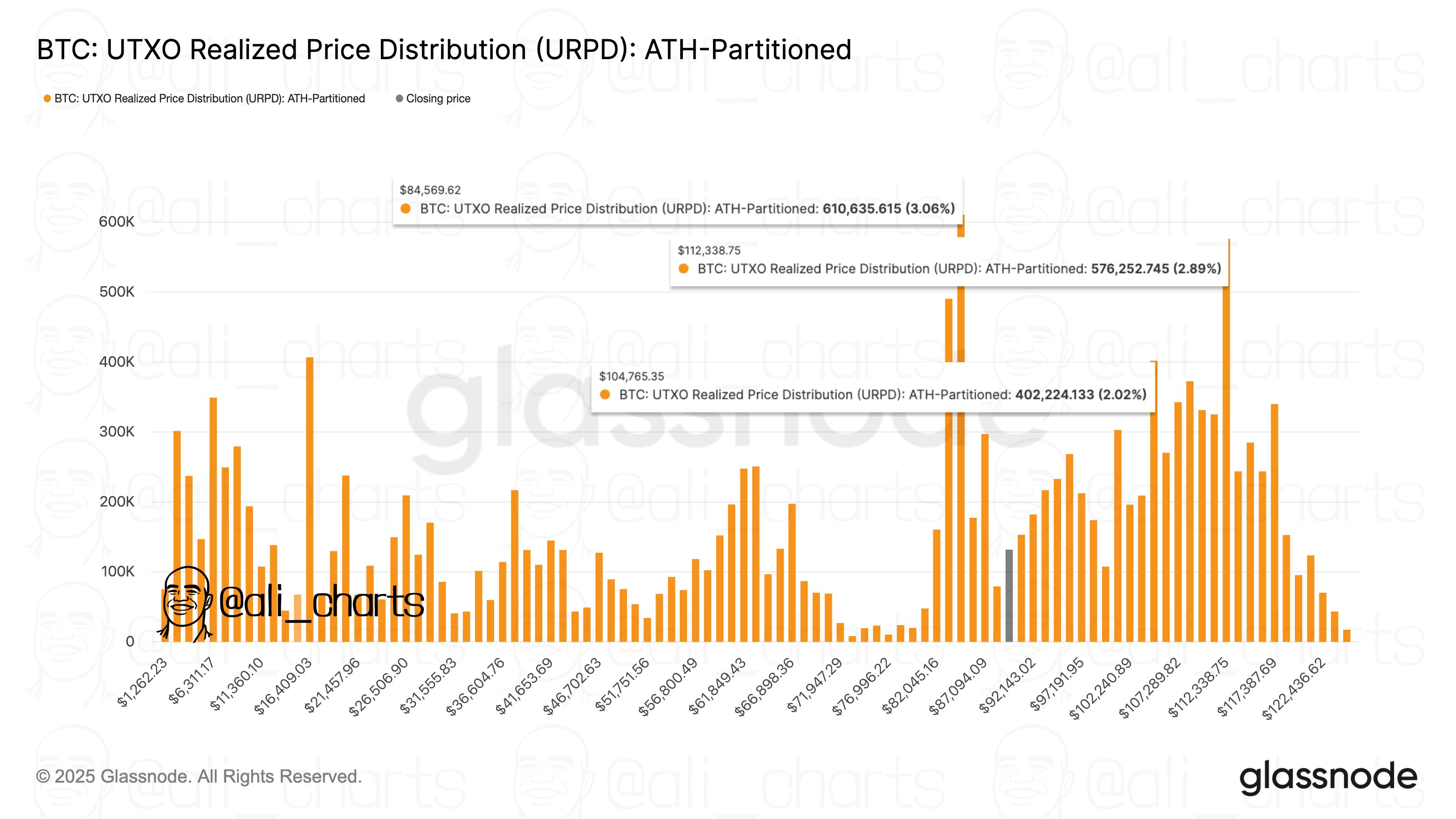

Talking of the restoration, the Bitcoin rally has meant that its worth has climbed again above a serious on-chain price foundation degree. As analyst Ali Martinez has shared in an X post, the Bitcoin UTXO Realized Worth Distribution (URPD) suggests a robust quantity of shopping for final occurred at $84,500.

In on-chain evaluation, sturdy demand zones under the spot worth are thought-about factors of potential assist for Bitcoin. Equally, ranges above are assumed to be sources of resistance as an alternative. One such main degree is current at $112,300.

BTC Worth

Bitcoin’s restoration has furthered throughout the previous day as its worth has returned to $92,300.