What to Know:

- Technique’s new ‘Bitcoin Ranking’ reveals its $BTC stack covers convertible debt by about 5.9x at its common entry and would keep close to 2x even in a deep crash, underlining how levered it’s to long-term $BTC upside.

- Regardless of that cushion, establishments are bailing on the inventory and transferring into spot Bitcoin ETFs as an alternative, leaving Technique out of the S&P 500 and buying and selling under the worth of its personal $BTC holdings.

- Bitcoin Hyper’s presale is constructing an SVM-based Bitcoin Layer 2 with near-instant, low-fee good contracts and DeFi that settles again to Bitcoin, giving $BTC holders a scaling and yield angle as an alternative of simply spot publicity.

- PEPENODE’s presale pushes a mine-to-earn meme mannequin the place you purchase digital nodes, construct a digital mining rig, and earn $PEPENODE plus different meme cash, with node upgrades and token burns tying demand to in-game exercise.

Company Bitcoin technique hits in another way when it’s backed by laborious numbers as an alternative of doompost threads.

A 5.9x asset‑to‑debt ratio on the common $BTC value foundation, and even 2x protection if Bitcoin nukes to $25K, is precisely the form of steadiness‑sheet resilience large cash cares about.

When the highest asset on company books nonetheless comfortably covers obligations after a deep crash, the sign isn’t ‘threat off’ – it’s that Bitcoin has matured into collateral that establishments really belief.

That belief doesn’t simply sit in chilly wallets; it turns into the backdrop for the subsequent wave of threat‑on bets.

Traditionally, when the market accepts Bitcoin as sound collateral, the subsequent transfer is often into excessive‑beta performs that may journey the identical lengthy‑time period conviction with far bigger upside.

That’s the place presales, aggressive Layer 2s, and excessive‑throughput chains are inclined to explode, turning $BTC power into altcoin momentum.

Under are three initiatives positioned to learn from this setting – led by Bitcoin Hyper ($HYPER), a Bitcoin Layer 2 attempting to do for $BTC what excessive‑efficiency chains did for DeFi elsewhere, alongside Solana‑type execution and Tron’s stablecoin machine.

1. Bitcoin Hyper ($HYPER): SVM Pace On A Bitcoin Layer 2

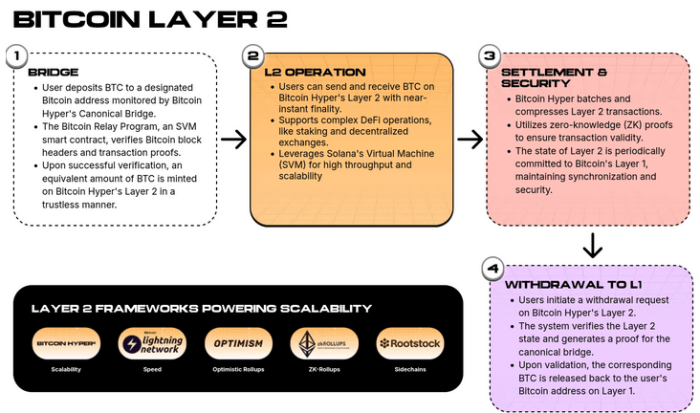

Bitcoin Hyper pitches itself as ‘the quickest Bitcoin Layer 2 Chain’ with built-in Solana Digital Machine (SVM), aiming to ship sooner efficiency than Solana itself whereas anchoring to Bitcoin for settlement.

The concept is straightforward: hold Bitcoin as the bottom layer of belief, outsource velocity and programmability to a objective‑constructed Layer 2.

Beneath the hood, Bitcoin Hyper makes use of a modular design: Bitcoin L1 for settlement and an actual‑time SVM Layer 2 for top‑throughput execution.

A single trusted sequencer batches transactions and periodically anchors state again to Bitcoin, enabling sub‑second affirmation at low value as an alternative of ready for sluggish on‑chain $BTC finality and paying full L1 charges.

This structure assaults Bitcoin’s three core limitations directly: sluggish transactions, excessive charges, and lack of native good contracts.

On Bitcoin Hyper, you get extraordinarily low‑latency processing, SVM‑primarily based good contracts, and SPL‑suitable tokens tailored for the L2.

That opens the door to wrapped $BTC funds, AMMs, lending markets, staking protocols, NFTs, and gaming dApps inbuilt Rust with SDKs and APIs builders already know.

The presale has raised $28.58M, with tokens at $0.013335, and staking is ready at 40%, so there are long-term positive factors to be made alongside worth appreciation.

Join the $HYPER presale today.

2. PEPENODE ($PEPENODE): Mine-To-Earn Meme With Node Economics

If Bitcoin Hyper is the infrastructure guess, PEPENODE ($PEPENODE) is the speculative meme play wrapped in a pseudo‑mining financial system.

Branded because the world’s first mine-to-earn memecoin, it swaps hash charge and ASICs for a digital mining system the place customers deploy ‘nodes’ by a gamified dashboard to earn token emissions.

As an alternative of proof‑of‑work, PEPENODE makes use of tiered node rewards to simulate miner economics. Increased‑tier nodes are designed to seize bigger slices of emissions, encouraging early participation and laddering up by the system.

Finally, you’ll be capable of obtain rewards on popular meme coins like Fartcoin and Pepe.

It’s a well-recognized sample from DeFi node initiatives, however re‑skinned for meme merchants who need one thing extra interactive than merely shopping for and ready.

Regardless of the playful branding, there’s actual capital flowing in. The PEPENODE presale has raised $2.2M with tokens at $0.0011685, placing it firmly in micro‑cap territory the place order‑e book depth will matter however upside may be violent if the narrative catches a bid.

Staking isn’t specified but, so yield for now’s targeted on the digital mining mechanics and node tiers.

In a market the place Bitcoin is proving itself as a sturdy treasury asset, memes like PEPENODE sit on the reverse finish of the chance curve: pure beta with a gamified wrapper.

In case you’re searching for publicity that may transfer multiples sooner than $BTC on narrative alone, the mine‑to‑earn angle goals immediately at that demand.

Join the PEPENODE presale now.

3. Tron (TRX): Stablecoin Workhorse With Large USDT Flows

Tron (TRX) stays one of many purest expressions of ‘blockchain as funds rail’ available in the market.

It’s a excessive‑throughput community designed for quick, low‑value transactions and dApp deployment, however its actual edge right this moment is stablecoins: Tron has grow to be a serious hub for $USDT transfers throughout exchanges and cost platforms.

With excessive TPS and tiny charges, Tron quietly become the default settlement layer for a giant chunk of crypto’s greenback liquidity.

Lately, it even surpassed Ethereum in whole circulating $USDT, reaching about $73.8B, underscoring how a lot actual transactional circulate now prefers Tron’s value construction over costlier chains for day‑to‑day motion.

That stablecoin gravity feeds right into a rising DeFi and cross‑chain ecosystem, the place customers can faucet lending, swaps, and yield methods with out abandoning the cost rails they already use.

In a market the place Bitcoin is the collateral anchor, Tron gives publicity to the transactional layer of crypto {dollars}.

And the token is showing signs of recovery from the current market dump, with a 1% enhance within the final day.

You can get Tron from Binance.

Recap: When company treasuries present Bitcoin reserves nonetheless comfortably overlaying debt even in a deep crash, it units the stage for top‑beta performs. Bitcoin Hyper ($HYPER) and PEPENODE ($PEPENODE) stand out as probably the most direct bets within the present market.

This content material is for academic and informational functions solely and doesn’t represent monetary, funding, or buying and selling recommendation.

Authored by Aaron Walker, NewsBTC – https://www.newsbtc.com/next-crypto-to-explode-strategy-proves-bitcoin-reserve-covers-debts