One of many largest sources of confusion within the query of blockchain safety is the exact impact of the block time. If one blockchain has a block time of 10 minutes, and the opposite has an estimated block time of 17 seconds, then what precisely does that imply? What’s the equal of six confirmations on the 10-minute blockchain on the 17-second blockchain? Is blockchain safety merely a matter of time, is it a matter of blocks, or a mixture of each? What safety properties do extra advanced schemes have?

Observe: this text won’t go into depth on the centralization dangers related to quick block instances; centralization dangers are a serious concern, and are the first motive to not push block instances all the best way right down to 1 second regardless of the advantages, and are mentioned at far more size in this previous article; the aim of this text is to elucidate why quick block instances are fascinating in any respect.

The reply the truth is relies upon crucially on the safety mannequin that we’re utilizing; that’s, what are the properties of the attackers that we’re assuming exist? Are they rational, byzantine, economically bounded, computationally bounded, in a position to bribe bizarre customers or not? On the whole, blockchain safety evaluation makes use of one in all three totally different safety fashions:

- Regular-case mannequin: there aren’t any attackers. Both everyone seems to be altruistic, or everyone seems to be rational however acts in an uncoordinated manner.

- Byzantine fault tolerance mannequin: a sure proportion of all miners are attackers, and the remaining are trustworthy altruistic individuals.

- Financial mannequin: there may be an attacker with a funds of $X which the attacker can spend to both buy their very own {hardware} or bribe different customers, who’re rational.

Actuality is a mixture between the three; nevertheless, we will glean many insights by analyzing the three fashions individually and seeing what occurs in every one.

The Regular Case

Allow us to first begin off by wanting on the regular case. Right here, there aren’t any attackers, and all miners merely need to fortunately sing collectively and get alongside whereas they proceed progressively extending the blockchain. Now, the query we need to reply is that this: suppose that somebody despatched a transaction, and okay seconds have elapsed. Then, this particular person sends a double-spend transaction making an attempt to revert their unique transaction (eg. if the unique transaction despatched $50000 to you, the double-spend spends the identical $50000 however directs it into one other account owned by the attacker). What’s the likelihood that the unique transaction, and never the double-spend, will find yourself within the last blockchain?

Observe that, if all miners are genuinely good and altruistic, they won’t settle for any double-spends that come after the unique transaction, and so the likelihood ought to method 100% after a number of seconds, no matter block time. One approach to chill out the mannequin is to imagine a small proportion of attackers; if the block time is extraordinarily lengthy, then the likelihood {that a} transaction shall be finalized can by no means exceed 1-x, the place x is the proportion of attackers, earlier than a block will get created. We’ll cowl this within the subsequent part. One other method is to chill out the altruism assumption and as an alternative talk about uncoordinated rationality; on this case, an attacker making an attempt to double-spend can bribe miners to incorporate their double-spend transaction by inserting a better payment on it (that is primarily Peter Todd’s replace-by-fee). Therefore, as soon as the attacker broadcasts their double-spend, it is going to be accepted in any newly created block, apart from blocks in chains the place the unique transaction was already included.

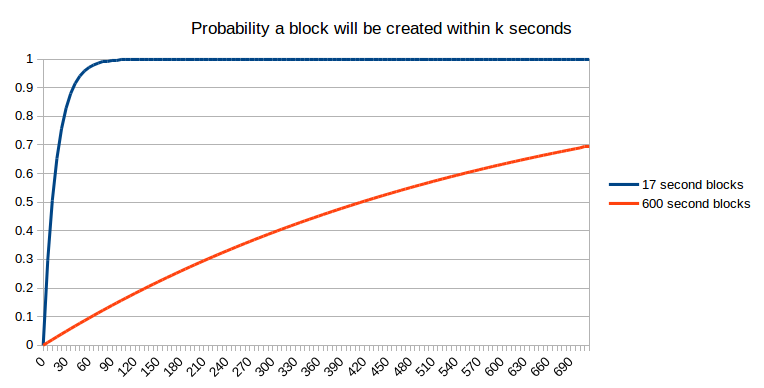

We are able to incorporate this assumption into our query by making it barely extra advanced: what’s the likelihood that the unique transaction has been positioned in a block that may find yourself as a part of the ultimate blockchain? Step one to attending to that state is getting included in a block within the first place. The likelihood that it will happen after okay seconds is fairly nicely established:

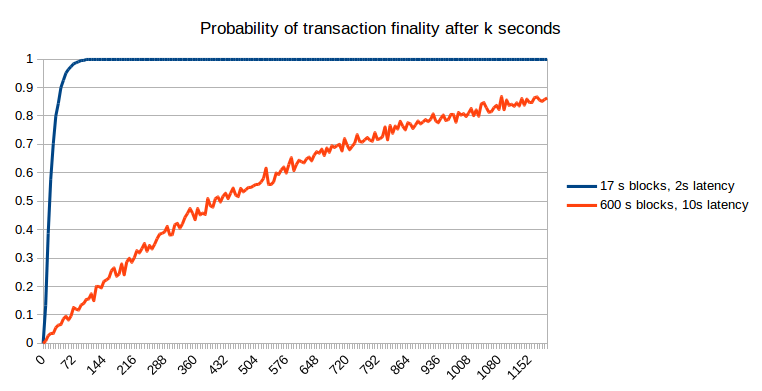

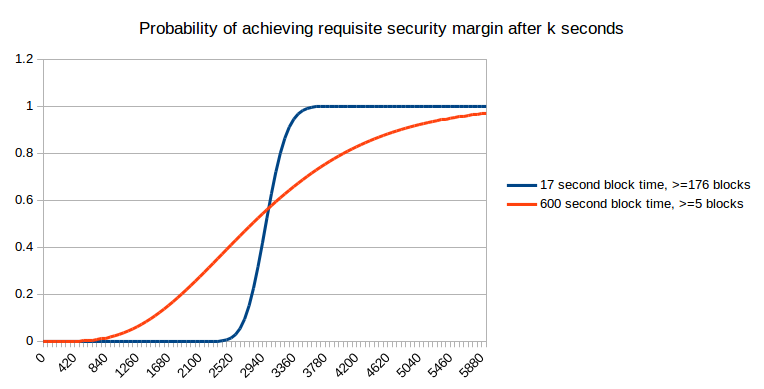

Sadly, stepping into one block shouldn’t be the top of the story. Maybe, when that block is created, one other block is created on the similar time (or, extra exactly, inside community latency); at that time, we will assume as a primary approximation that it’s a 50:50 probability which of these two blocks the following block shall be constructed on, and that block will finally “win” – or, maybe, two blocks shall be created as soon as once more on the similar time, and the competition will repeat itself. Even after two blocks have been created, it is potential that some miner has not but seen each blocks, and that miner will get fortunate and created three blocks one after the opposite. The probabilities are possible mathematically intractable, so we’ll simply take the lazy shortcut and simulate them:

The outcomes could be understood mathematically. At 17 seconds (ie. 100% of the block time), the quicker blockchain provides a likelihood of ~0.56: barely smaller than the matheatically predicted 1-1/e ~= 0.632 due to the opportunity of two blocks being created on the similar time and one being discarded; at 600 seconds, the slower blockchain provides a likelihood of 0.629, solely barely smaller than the anticipated 0.632 as a result of with 10-minute blocks the likelihood of two blocks being created on the similar time may be very small. Therefore, we will see that quicker blockchains do have a slight drawback due to the upper affect of community latency, but when we do a good comparability (ie. ready a specific variety of seconds), the likelihood of non-reversion of the unique transaction on the quicker blockchain is way higher.

Attackers

Now, let’s add some attackers into the image. Suppose that portion X of the community is taken up by attackers, and the remaining 1-X is made up of both altruistic or egocentric however uncoordinated (barring egocentric mining issues, as much as X it truly doesn’t matter which) miners. The best mathematical mannequin to make use of to approximate that is the weighted random stroll. We begin off assuming {that a} transaction has been confirmed for okay blocks, and that the attacker, who can also be a miner, now tries to begin a fork of the blockchain. From there, we signify the scenario with a rating of okay, which means that the attacker’s blockchain is okay blocks behind the unique chain, and at each step make the remark that there’s a likelihood of X that the attacker will make the following block, altering the rating to k-1 and a likelihood of 1-X that trustworthy miners mining on the unique chain will make the following block, altering the rating to okay+1. If we get to okay = 0, that implies that the unique chain and the attacker’s chain have the identical size, and so the attacker wins.

Mathematically, we all know that the likelihood of the attacker successful such a recreation (assuming x as in any other case the attacker can overwhelm the community it doesn’t matter what the blockchain parameters are) is:

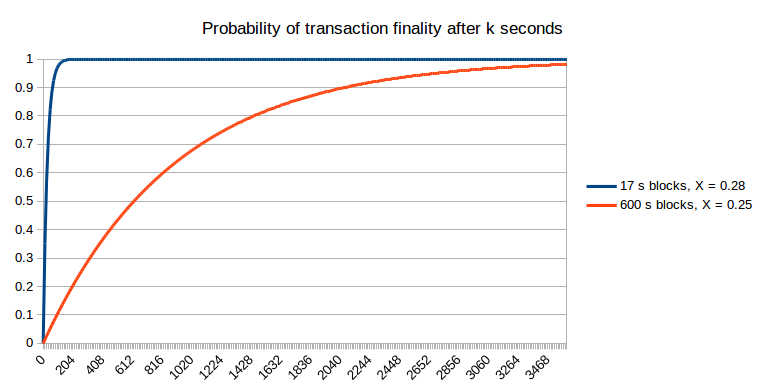

We are able to mix this with a likelihood estimate for okay (utilizing the Poisson distribution) and get the online likelihood of the attacker successful after a given variety of seconds:

Observe that for quick block instances, we do should make an adjustment as a result of the stale charges are greater, and we do that within the above graph: we set X = 0.25 for the 600s blockchain and X = 0.28 for the 17s blockchain. Therefore, the quicker blockchain does enable the likelihood of non-reversion to achieve 1 a lot quicker. One different argument that could be raised is that the diminished value of attacking a blockchain for a brief period of time over an extended period of time implies that assaults towards quick blockchains could occur extra continuously; nevertheless, this solely barely mitigates quick blockchains’ benefit. For instance, if assaults occur 10x extra typically, then which means that we must be comfy with, for instance, a 99.99% likelihood of non-reversion, if earlier than we had been comfy with a 99.9% likelihood of non-reversion. Nonetheless, the likelihood of non-reversion approaches 1 exponentially, and so solely a small variety of further confirmations (to be exact, round two to 5) on the quicker chain is required to bridge the hole; therefore, the 17-second blockchain will possible require ten confirmations (~three minutes) to attain the same diploma of safety beneath this probabilistic mannequin to 6 confirmations (~one hour) on the ten-minute blockchain.

Economically Bounded Attackers

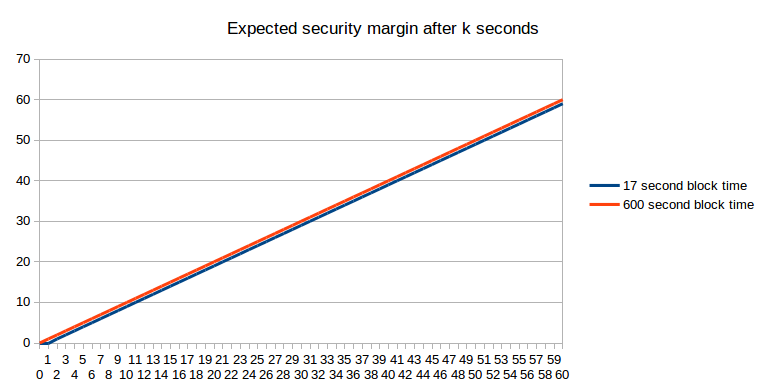

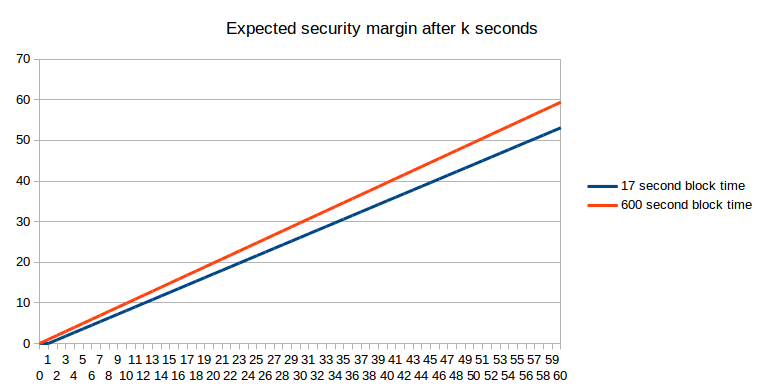

We are able to additionally method the topic of attackers from the opposite facet: the attacker has $X to spend, and may spend it on bribes, near-infinite instantaneous hashpower, or anything. How excessive is the requisite X to revert a transaction after okay seconds? Basically, this query is equal to “how a lot financial expenditure does it take to revert the variety of blocks that may have been produced on prime of a transaction after okay seconds”. From an expected-value standpoint, the reply is easy (assuming a block reward of 1 coin per second in each instances):

If we bear in mind stale charges, the image truly turns barely in favor of the longer block time:

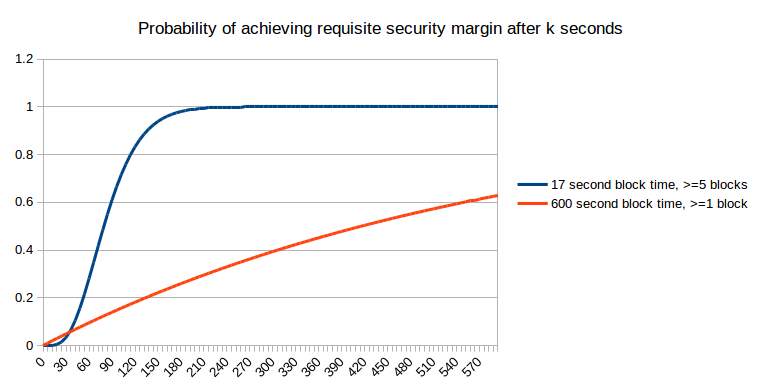

However “what’s the anticipated financial safety margin after okay seconds” (utilizing “anticipated” right here within the formal probability-theoretic sense the place it roughly means “common”) is definitely not the query that most individuals are asking. As an alternative, the issue that considerations bizarre customers is arguably one in all them desirous to get “sufficient” safety margin, and desirous to get there as rapidly as potential. For instance, if I’m utilizing the blockchain to buy a $2 espresso, then a safety margin of $0.03 (the present bitcoin transaction payment, which an attacker would want to outbid in a replace-by-fee mannequin) is clearly not sufficient, however a safety margin of $5 is clearly sufficient (ie. only a few assaults would occur that spend $5 to steal $2 from you), and a safety margin of $50000 shouldn’t be a lot better. Now, allow us to take this strict binary sufficient/not-enough mannequin and apply it to a case the place the fee is so small that one block reward on the quicker blockchain is bigger than the fee. The likelihood that we are going to have “sufficient” safety margin after a given variety of seconds is strictly equal to a chart that we already noticed earlier:

Now, allow us to suppose that the specified safety margin is price between 4 and 5 instances the smaller block reward; right here, on the smaller chain we have to compute the likelihood that after okay seconds at the least 5 blocks may have been produced, which we will do by way of the Poisson distribution:

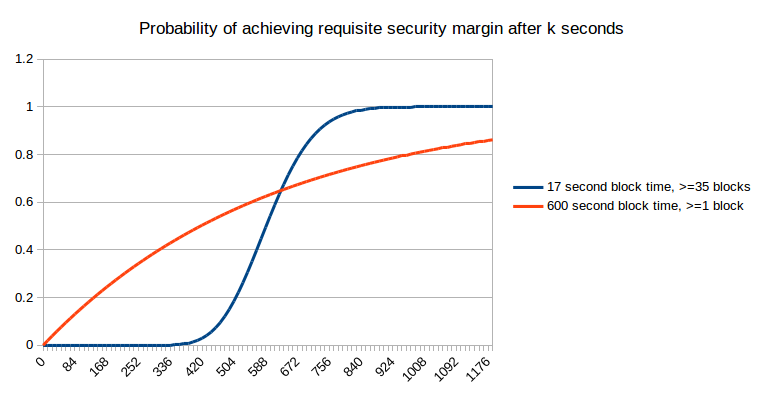

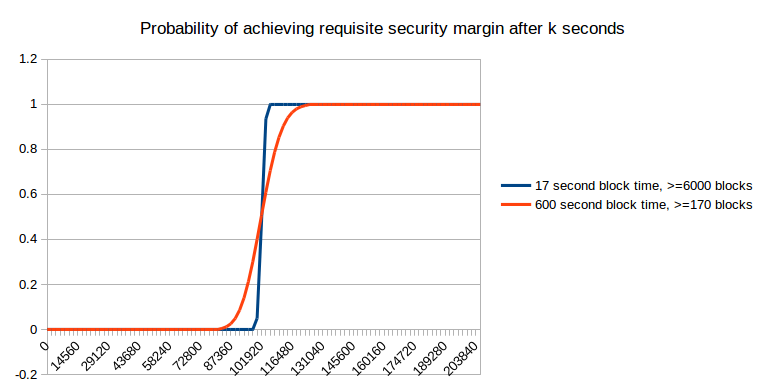

Now, allow us to suppose that the specified safety margin is price as a lot because the bigger block reward:

Right here, we will see that quick blocks not present an unambiguous profit; within the brief time period they really damage your probabilities of getting extra safety, although that’s compensated by higher efficiency in the long run. Nonetheless, what they do present is extra predictability; reasonably than an extended exponential curve of potential instances at which you’re going to get sufficient safety, with quick blocks it’s just about sure that you’re going to get what you want inside 7 to 14 minutes. Now, allow us to maintain growing the specified safety margin additional:

As you may see, as the specified safety margin will get very excessive, it not actually issues that a lot. Nonetheless, at these ranges, it’s a must to wait a day for the specified safety margin to be achieved in any case, and that may be a size of time that the majority blockchain customers in apply don’t find yourself ready; therefore, we will conclude that both (i) the financial mannequin of safety shouldn’t be the one that’s dominant, at the least on the margin, or (ii) most transactions are small to medium sized, and so truly do profit from the higher predictability of small block instances.

We must also point out the opportunity of reverts on account of unexpected exigencies; for instance, a blockchain fork. Nonetheless, in these instances too, the “six confirmations” utilized by most websites shouldn’t be sufficient, and ready a day is required with a purpose to be actually secure.

The conclusion of all that is easy: quicker block instances are good as a result of they supply extra granularity of knowledge. Within the BFT safety fashions, this granularity ensures that the system can extra rapidly converge on the “right” fork over an incorrect fork, and in an financial safety mannequin which means that the system can extra rapidly give notification to customers of when an appropriate safety margin has been reached.

After all, quicker block instances do have their prices; stale charges are maybe the biggest, and it’s after all essential to stability the 2 – a stability which would require ongoing analysis, and maybe even novel approaches to fixing centralization issues arising from networking lag. Some builders could have the opinion that the person comfort supplied by quicker block instances shouldn’t be well worth the dangers to centralization, and the purpose at which this turns into an issue differs for various individuals, and could be pushed nearer towards zero by introducing novel mechanisms. What I’m hoping to disprove right here is just the declare, repeated by some, that quick block instances present no profit in any way as a result of if every block is fifty instances quicker then every block is fifty instances much less safe.

Appendix: Eyal and Sirer’s Bitcoin NG

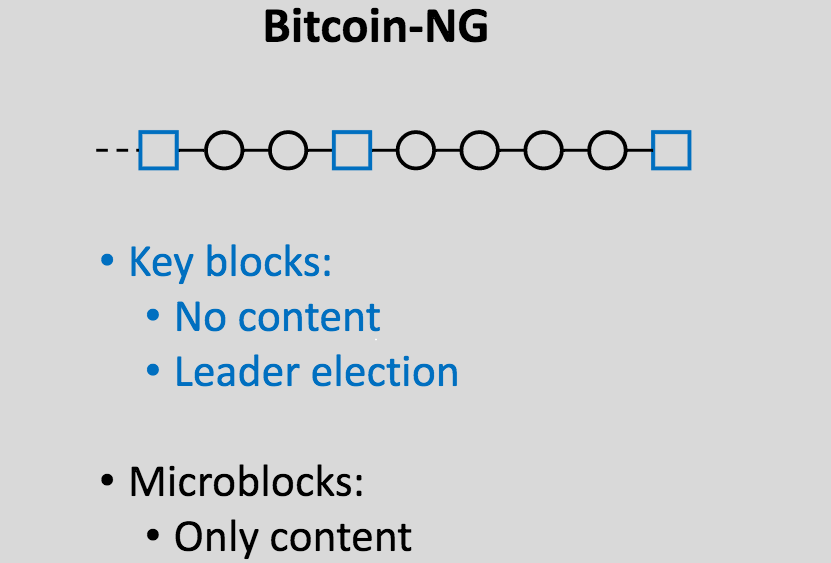

A latest fascinating proposal offered on the Scaling Bitcoin convention in Montreal is the thought of splitting blocks into two varieties: (i) rare (eg. 10 minute heartbeat) “key blocks” which choose the “chief” that creates the following blocks that comprise transactions, and (ii) frequent (eg. 10 second heartbeat) “microblocks” which comprise transactions:

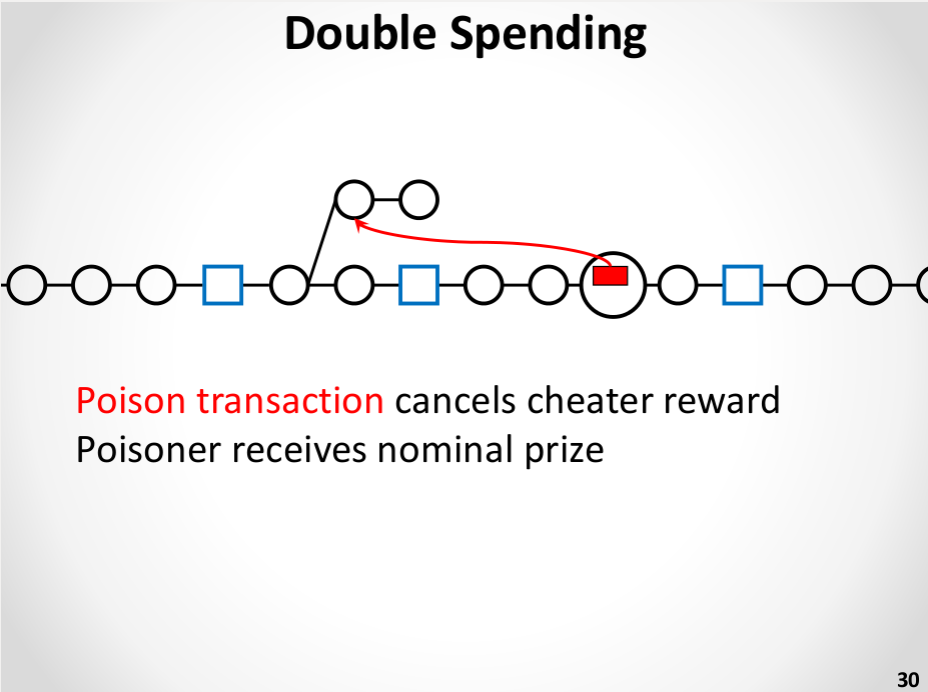

The speculation is that we will get very quick blocks with out the centralization risks by primarily electing a dictator solely as soon as each (on common) ten minutes, for these ten minutes, and permitting the dictator to provide blocks in a short time. A dictator “ought to” produce blocks as soon as each ten seconds, and within the case that the dictator makes an attempt to double-spend their very own blocks and create an extended new set of microblocks, a Slasher-style algorithm is used the place the dictator could be punished in the event that they get caught:

That is definitely an enchancment over plain outdated ten-minute blocks. Nonetheless, it isn’t practically as efficient as merely having common blocks come as soon as each ten seconds. The reasoning is easy. Below the economically-bounded attacker mannequin, it truly does provide the identical chances of assurances because the ten-second mannequin. Below the BFT mannequin, nevertheless, it fails: if an attacker has 10% hashpower then the likelihood {that a} transaction shall be last can’t exceed 90% till at the least two key blocks are created. In actuality, which could be modeled as a hybrid between the financial and BFT situations, we will say that regardless that 10-second microblocks and 10-second actual blocks have the identical safety margin, within the 10-second microblock case “collusion” is less complicated as throughout the 10-minute margin just one celebration must take part within the assault. One potential enchancment to the algorithm could also be to have microblock creators rotate throughout every inter-key-block section, taking from the creators of the final 100 key blocks, however taking this method to its logical conclusion will possible result in reinventing full-on Slasher-style proof of stake, albeit with a proof of labor issuance mannequin connected.

Nonetheless, the overall method of segregating chief election and transaction processing does have one main profit: it reduces centralization dangers on account of gradual block propagation (as key block propagation time doesn’t depend upon the dimensions of the content-carrying block), and thus considerably will increase the utmost secure transaction throughput (even past the margin supplied by Ethereum-esque uncle mechanisms), and because of this additional analysis on such schemes ought to definitely be executed.